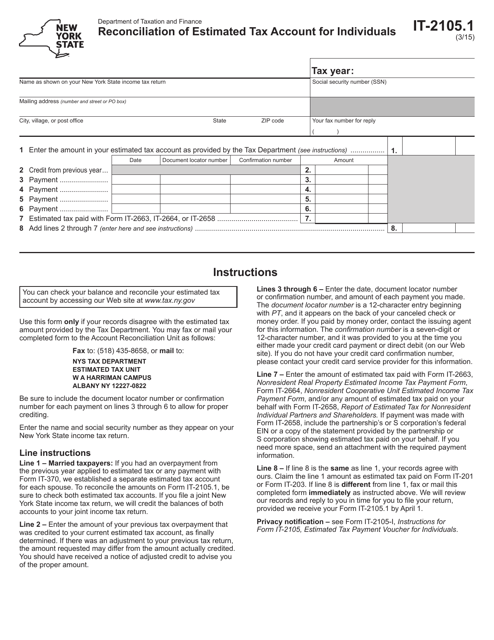

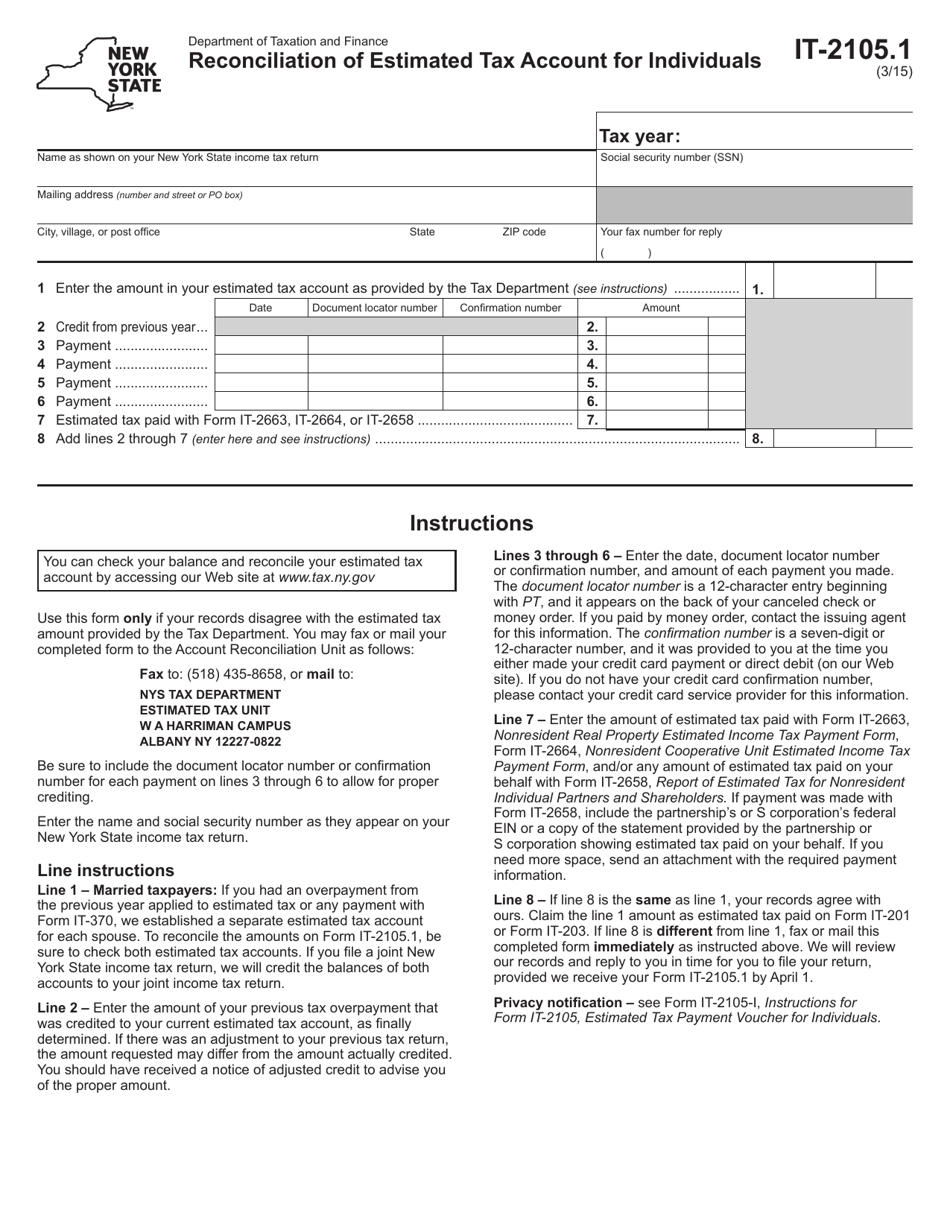

Form IT-2105.1 Reconciliation of Estimated Tax Account for Individuals - New York

What Is Form IT-2105.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2105.1?

A: Form IT-2105.1 is a tax form for individuals in New York to reconcile their estimated tax account.

Q: Who needs to file Form IT-2105.1?

A: Individuals in New York who made estimated tax payments throughout the year need to file Form IT-2105.1.

Q: What is the purpose of Form IT-2105.1?

A: The purpose of Form IT-2105.1 is to reconcile the estimated tax payments made by an individual with their actual tax liability for the year.

Q: When is Form IT-2105.1 due?

A: Form IT-2105.1 is generally due by April 15th of the following year.

Q: Are there any penalties for not filing Form IT-2105.1?

A: Yes, there may be penalties for not filing Form IT-2105.1 or for underpaying estimated taxes throughout the year. It is important to file the form to avoid penalties and accurately report your tax liability.

Q: What information do I need to complete Form IT-2105.1?

A: You will need to know your estimated tax payments made throughout the year, your total tax liability for the year, and any other relevant information about your income and deductions.

Q: Do I need to attach any documents with Form IT-2105.1?

A: In general, you do not need to attach any documents to Form IT-2105.1. However, it is always a good idea to keep records of your estimated tax payments and any supporting documentation for your tax return.

Q: Can I make changes to Form IT-2105.1 after submitting it?

A: If you need to make changes to Form IT-2105.1 after submitting it, you can file an amended form using Form IT-2105.1-X.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2105.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.