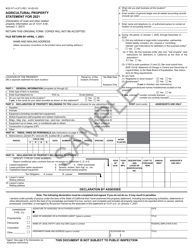

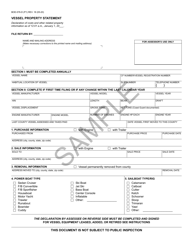

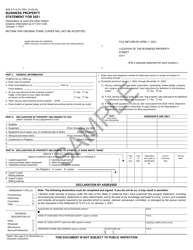

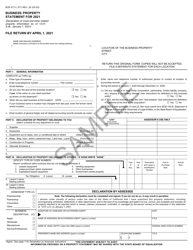

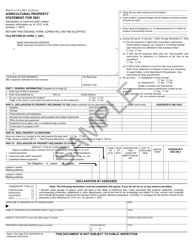

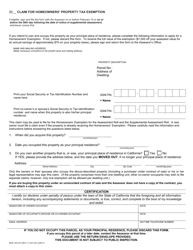

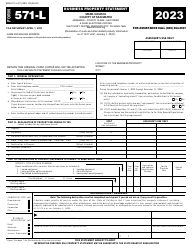

Instructions for Form BOE-571-L Business Property Statement Form - County of San Diego, California

This document contains official instructions for Form BOE-571-L , Business Property Statement Form - a form released and collected by the Assessor, Recorder, County Clerk's Office - County of San Diego, California.

FAQ

Q: What is Form BOE-571-L?

A: Form BOE-571-L is the Business Property Statement form for the County of San Diego, California.

Q: Who needs to fill out Form BOE-571-L?

A: Business owners in the County of San Diego, California need to fill out Form BOE-571-L.

Q: What is the purpose of Form BOE-571-L?

A: Form BOE-571-L is used to report business property assets for property tax assessment purposes.

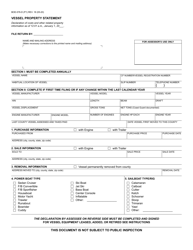

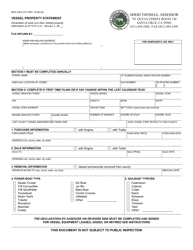

Q: What information is required on Form BOE-571-L?

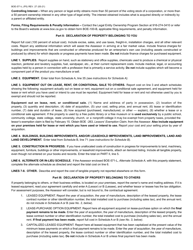

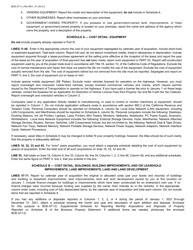

A: Form BOE-571-L requires information about the business's property assets, such as land, buildings, equipment, and supplies.

Q: When is Form BOE-571-L due?

A: Form BOE-571-L is due by April 1st of each year.

Q: Are there any penalties for filing Form BOE-571-L late?

A: Yes, late filing of Form BOE-571-L may result in penalties.

Q: Is there a fee to file Form BOE-571-L?

A: No, there is no fee to file Form BOE-571-L.

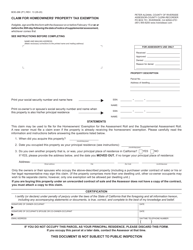

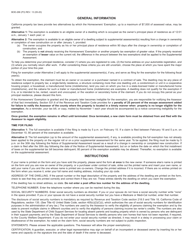

Q: Are there any exemptions or exclusions for business property on Form BOE-571-L?

A: Yes, there are certain exemptions and exclusions that may apply to business property on Form BOE-571-L. Consult the instructions on the form for more details.

Instruction Details:

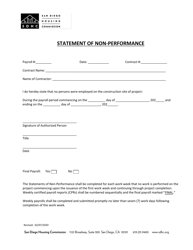

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Assessor, Recorder, County Clerk's Office - County of San Diego, California.