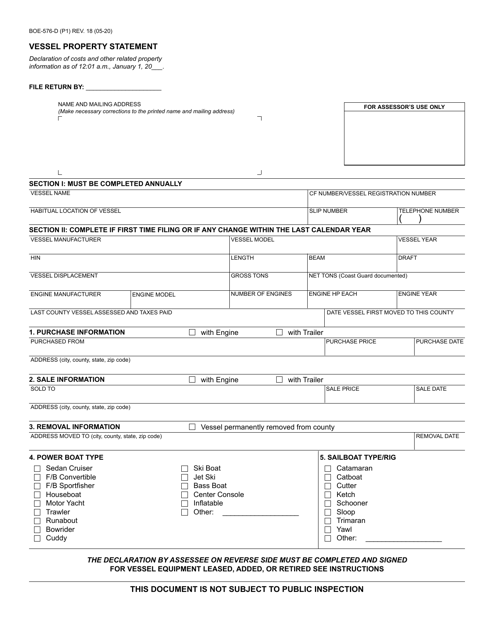

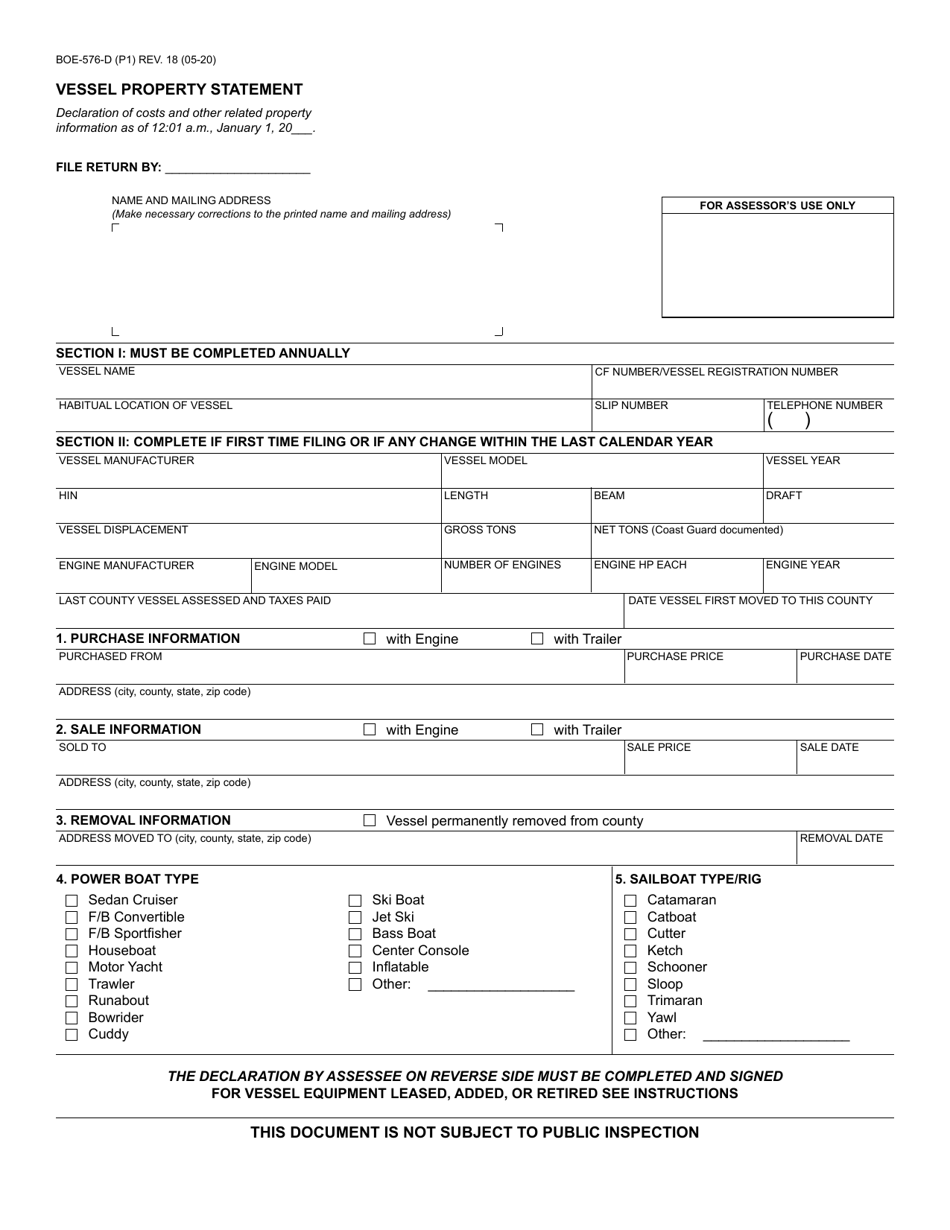

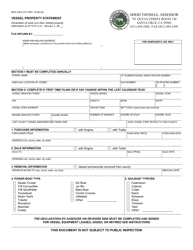

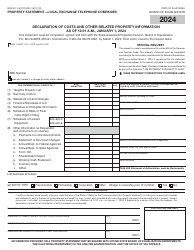

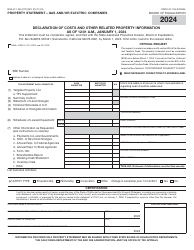

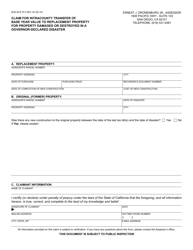

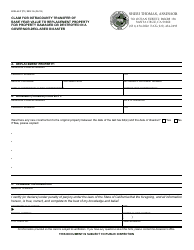

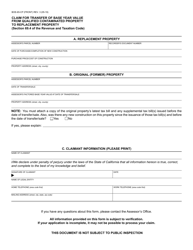

Form BOE-576-D Vessel Property Statement - California

What Is Form BOE-576-D?

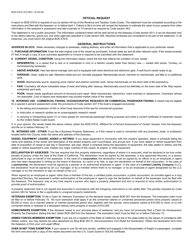

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-576-D?

A: Form BOE-576-D is the Vessel Property Statement for the state of California.

Q: Who needs to file Form BOE-576-D?

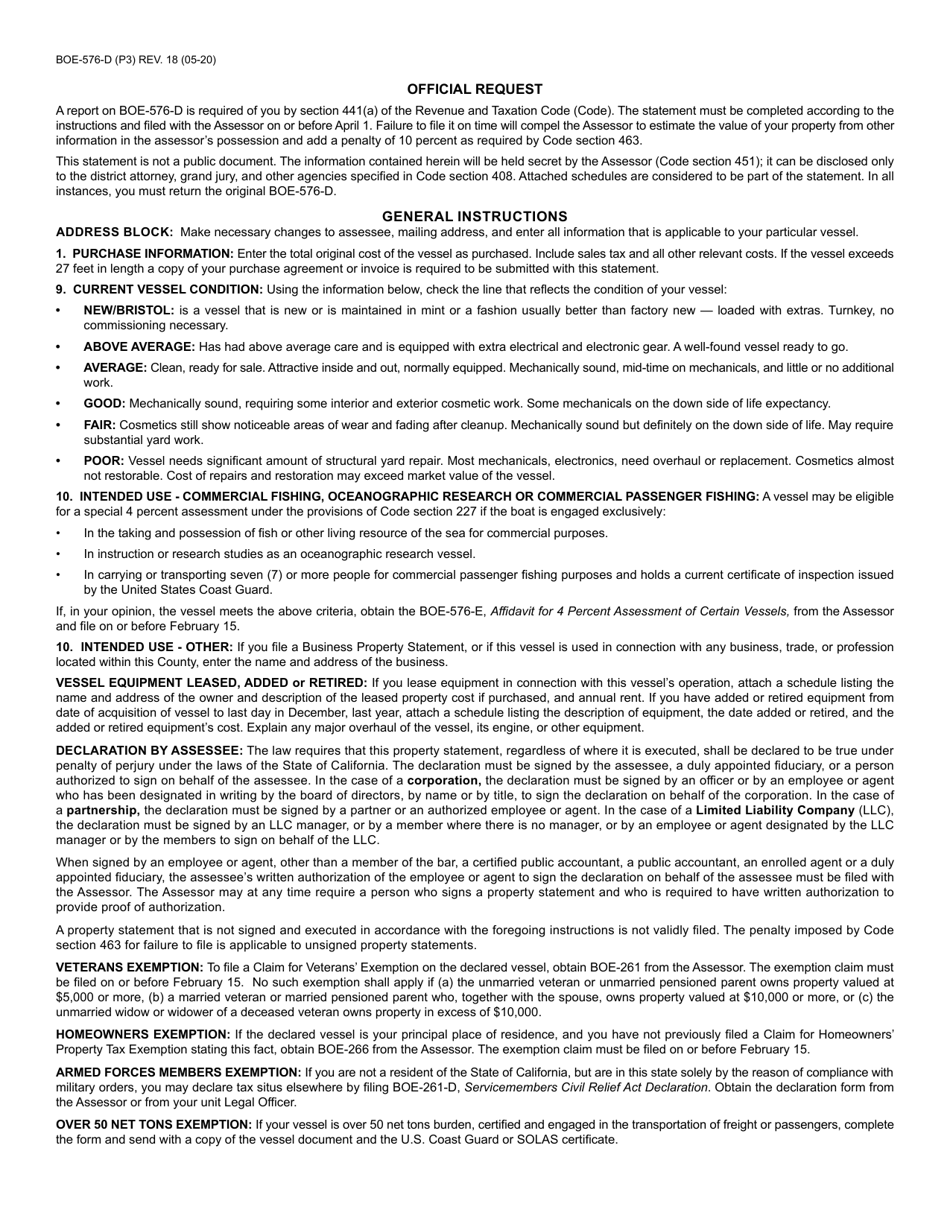

A: Owners of vessels with taxable situs in California need to file Form BOE-576-D.

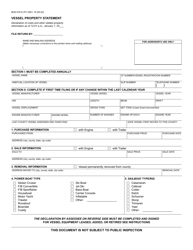

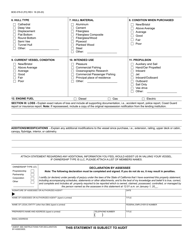

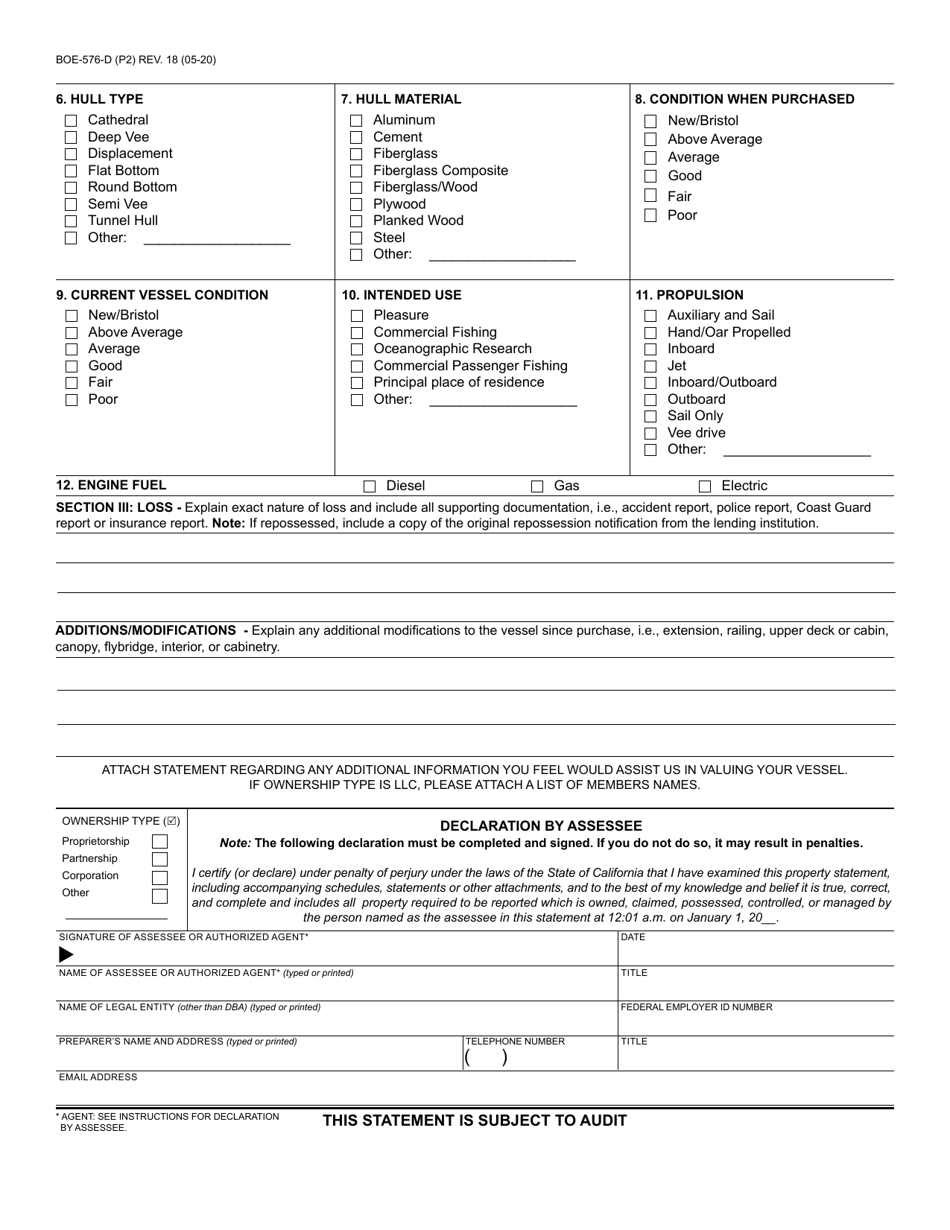

Q: What information is required in Form BOE-576-D?

A: Form BOE-576-D requires information about the vessel, such as its make, model, year, and length.

Q: When is Form BOE-576-D due?

A: Form BOE-576-D is due annually by the end of the fiscal year, which is typically June 30th.

Q: What happens if I don't file Form BOE-576-D?

A: Failure to file Form BOE-576-D may result in penalties and the assessment of taxes based on an estimated value of the vessel.

Q: Is Form BOE-576-D only for commercial vessels?

A: No, Form BOE-576-D is required for both commercial and non-commercial vessels.

Q: Do I need to file Form BOE-576-D every year?

A: Yes, owners of vessels with taxable situs in California are required to file Form BOE-576-D annually.

Q: Is Form BOE-576-D the same as Form 571-L?

A: No, Form BOE-576-D is specifically for vessels, while Form 571-L is for other types of personal property.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-576-D by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.