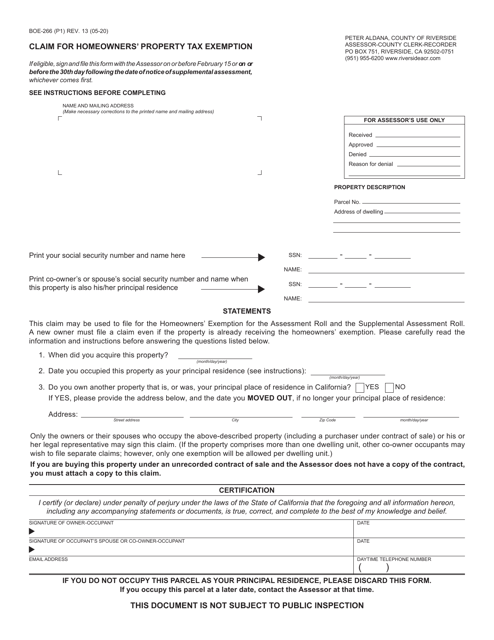

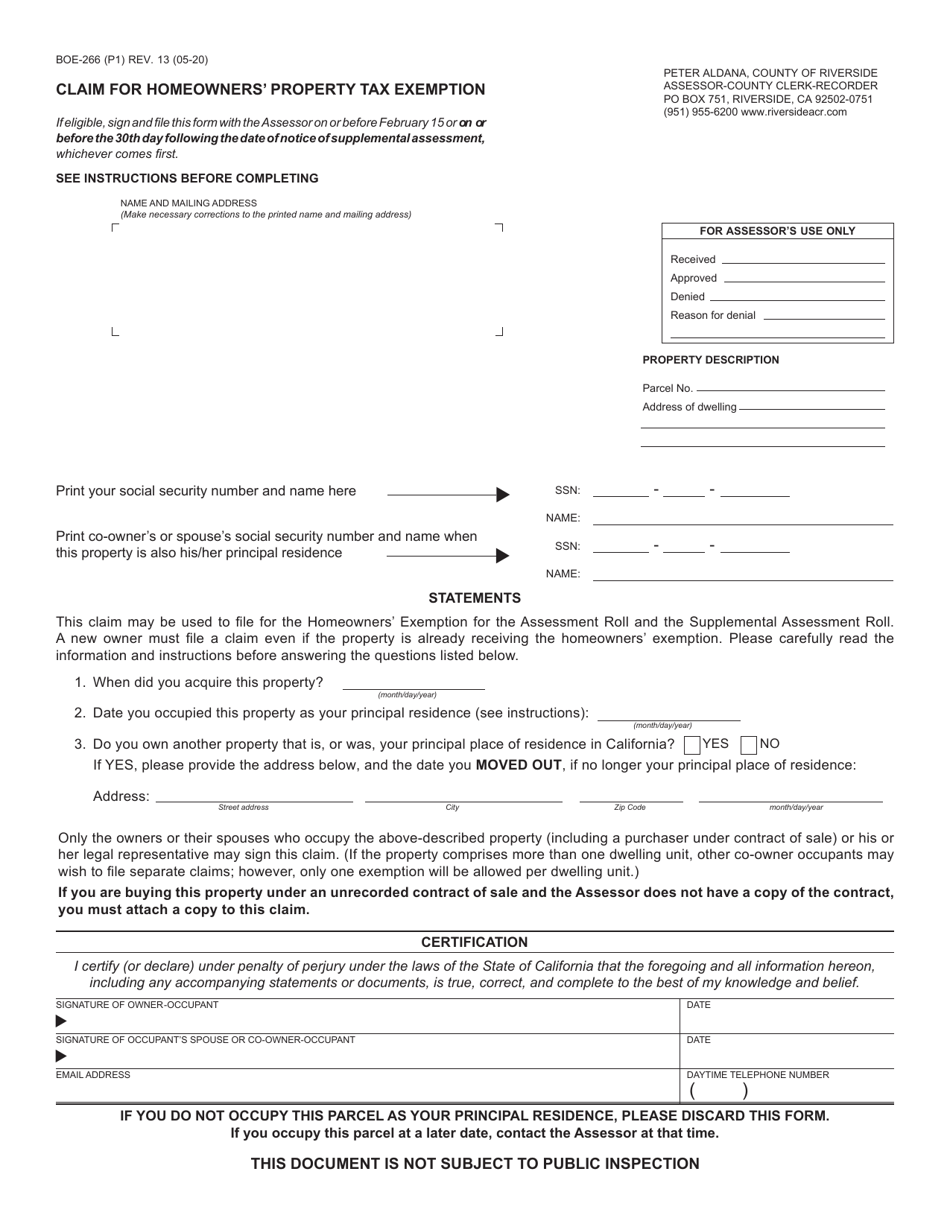

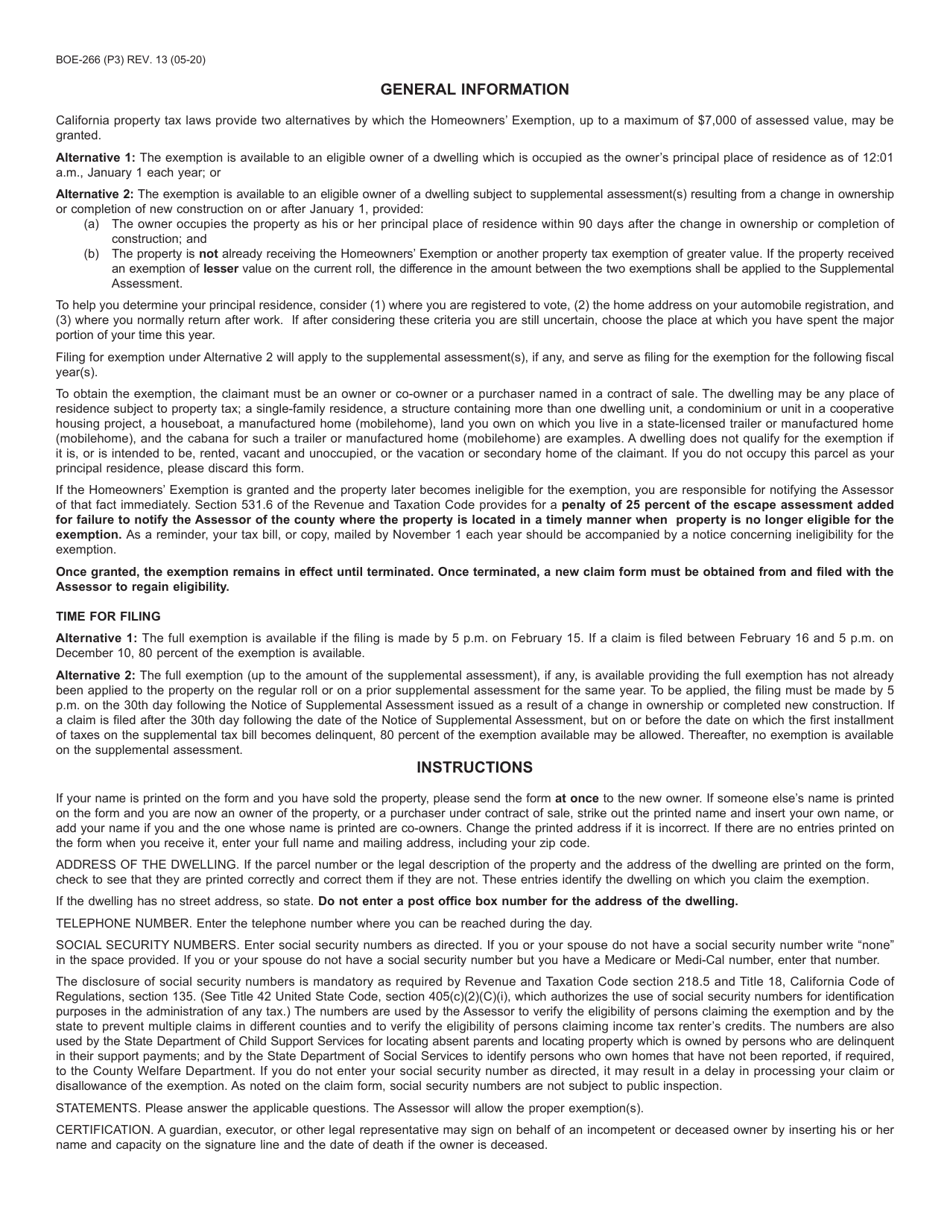

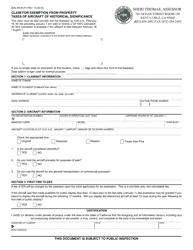

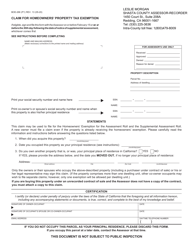

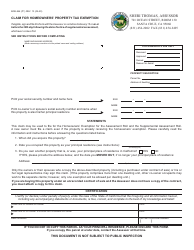

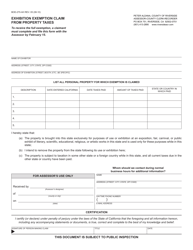

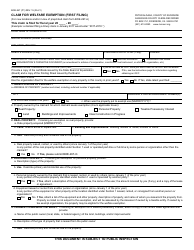

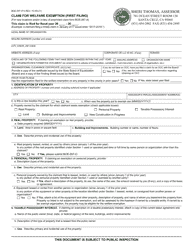

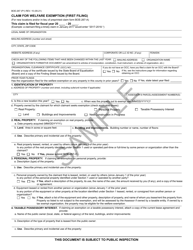

Form BOE-266 Claim for Homeowners' Property Tax Exemption - County of Riverside, California

What Is Form BOE-266?

This is a legal form that was released by the Assessor-County Clerk-Recorder - County of Riverside, California - a government authority operating within California. The form may be used strictly within County of Riverside. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

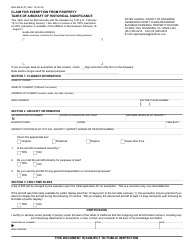

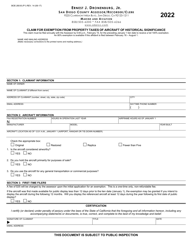

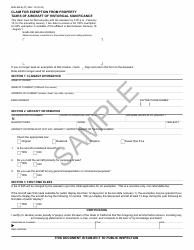

Q: What is Form BOE-266?

A: Form BOE-266 is the Claim for Homeowners' Property Tax Exemption in Riverside County, California.

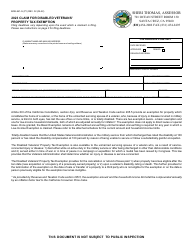

Q: What is the purpose of Form BOE-266?

A: The purpose of Form BOE-266 is to apply for a homeowners' property tax exemption in Riverside County, California.

Q: Who is eligible to file Form BOE-266?

A: Homeowners who use their property as their primary residence in Riverside County, California may be eligible to file Form BOE-266.

Q: What is a homeowners' property tax exemption?

A: A homeowners' property tax exemption is a deduction that reduces the assessed value of a homeowner's property, resulting in a lower property tax bill.

Q: When is the deadline to file Form BOE-266?

A: The deadline to file Form BOE-266 is typically February 15th of each year, but it is always recommended to check with the County of Riverside for the most current deadlines.

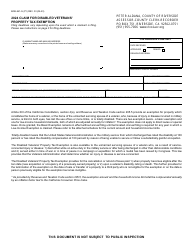

Q: Are there any fees associated with filing Form BOE-266?

A: There are no fees associated with filing Form BOE-266.

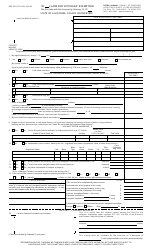

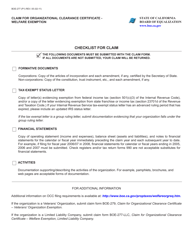

Q: What supporting documents do I need to include with Form BOE-266?

A: You may need to include documentation such as proof of ownership, proof of residency, and other supporting documents as required by the County of Riverside.

Q: Can I apply for a homeowners' property tax exemption if I rent out a portion of my property?

A: In most cases, you cannot apply for a homeowners' property tax exemption if you rent out a portion of your property. The exemption typically applies to properties used as the owner's primary residence.

Q: How long does the homeowners' property tax exemption last?

A: Once approved, the homeowners' property tax exemption generally lasts as long as you own and occupy the property as your primary residence. However, it is important to review the specific rules and requirements of the County of Riverside for any updates or changes.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Assessor-County Clerk-Recorder - County of Riverside, California;

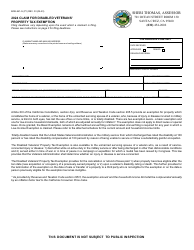

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-266 by clicking the link below or browse more documents and templates provided by the Assessor-County Clerk-Recorder - County of Riverside, California.