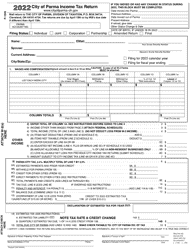

This version of the form is not currently in use and is provided for reference only. Download this version of

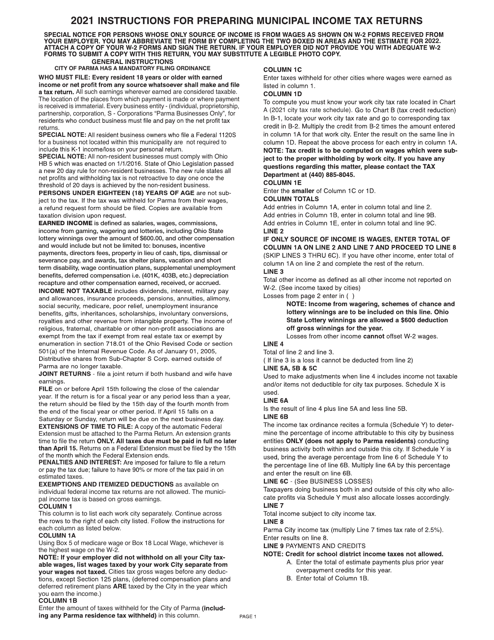

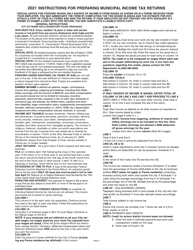

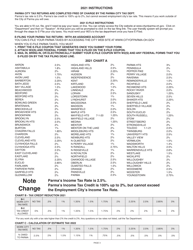

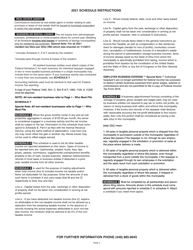

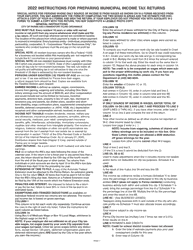

Instructions for Form P-1040

for the current year.

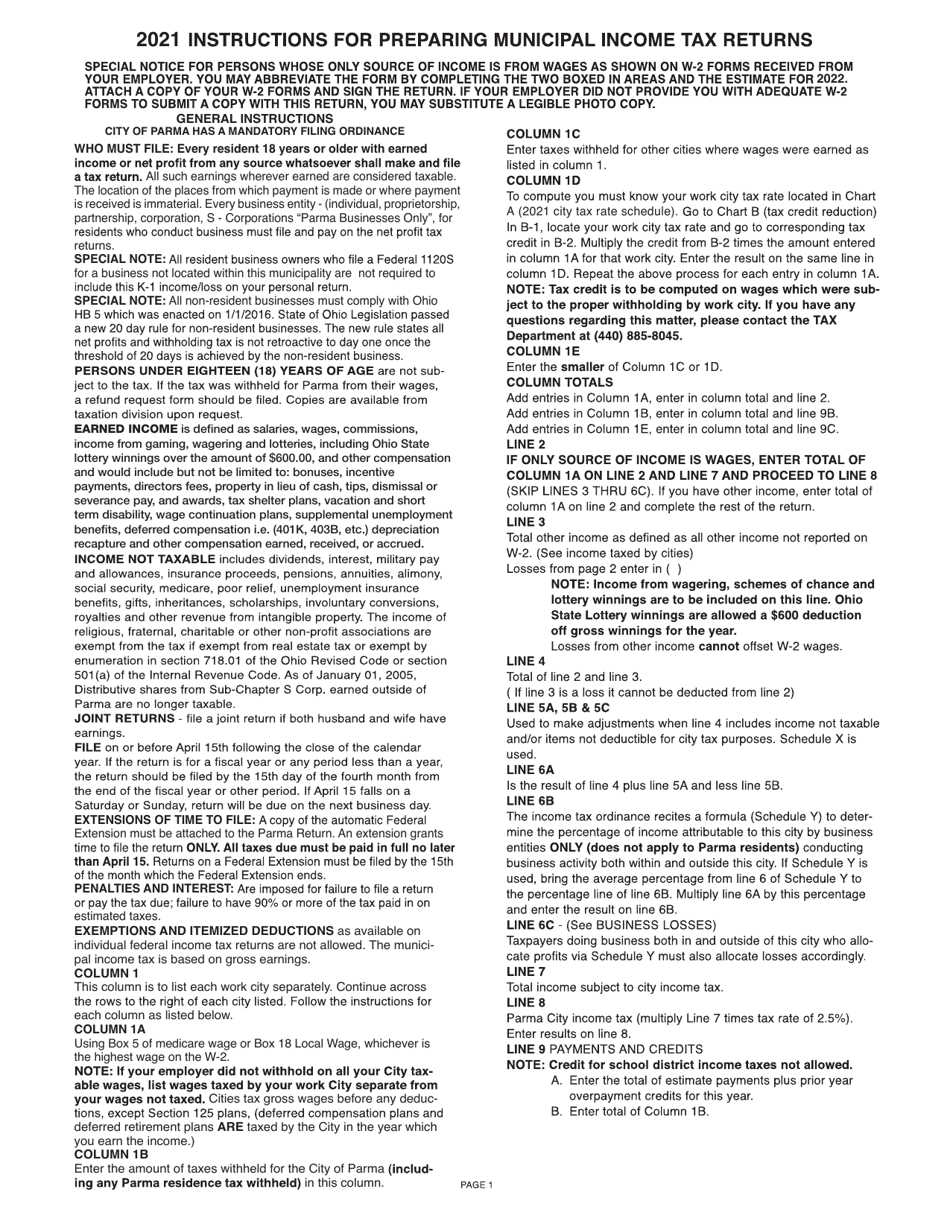

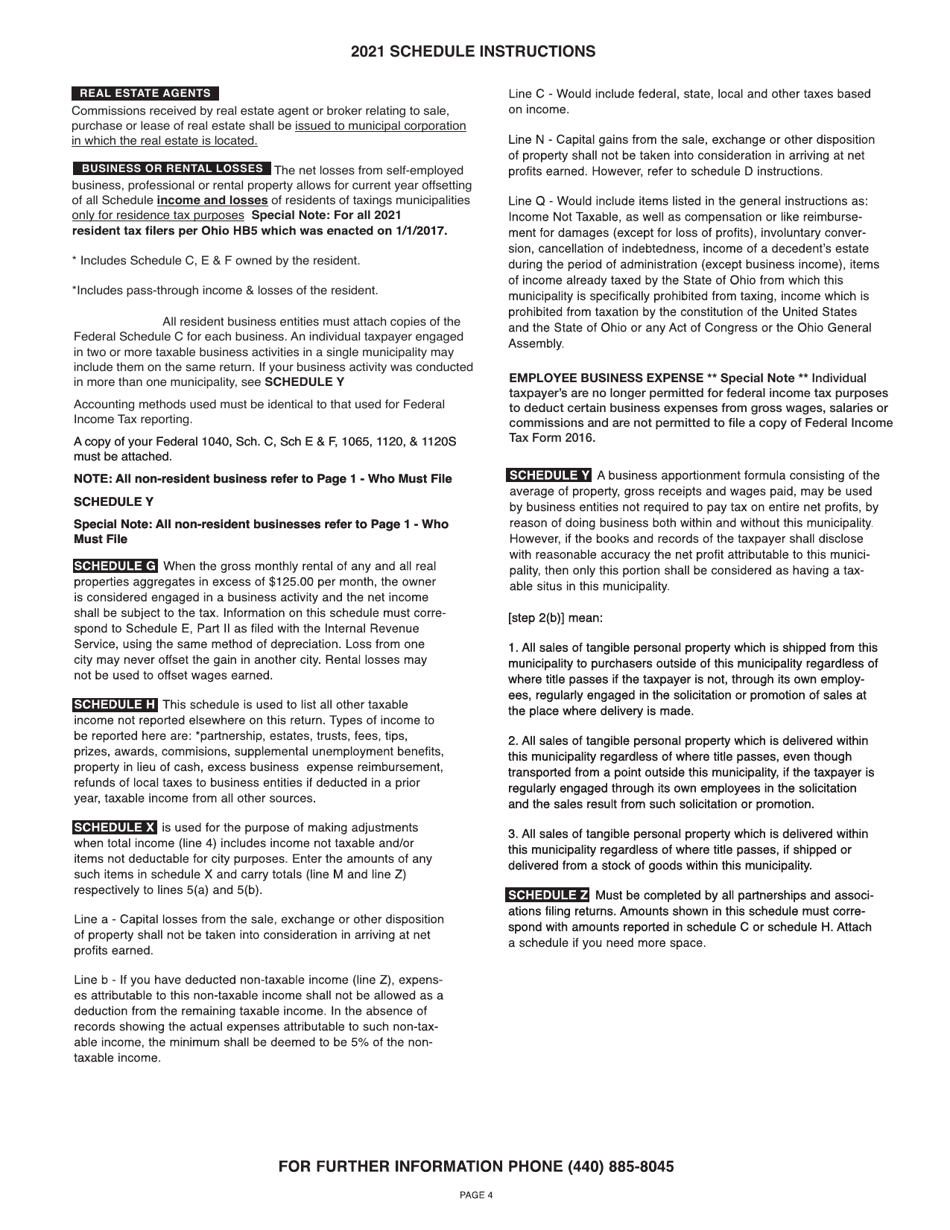

Instructions for Form P-1040 City of Parma Income Tax Return - City of Parma, Ohio

This document contains official instructions for Form P-1040 , City of Parma Income Tax Return - a form released and collected by the Division of Taxation - City of Parma, Ohio.

FAQ

Q: What is Form P-1040?

A: Form P-1040 is the City of Parma Income Tax Return.

Q: What is the purpose of Form P-1040?

A: Form P-1040 is used to report and pay income tax to the City of Parma, Ohio.

Q: Who needs to file Form P-1040?

A: Residents of the City of Parma, Ohio, who have taxable income must file Form P-1040.

Q: What if I don't live in the City of Parma?

A: If you do not live in the City of Parma, Ohio, you do not need to file Form P-1040.

Q: When is the deadline to file Form P-1040?

A: The deadline to file Form P-1040 is typically April 15th, but check the instructions for the current year's deadline.

Q: What if I can't file my tax return by the deadline?

A: If you cannot file your tax return by the deadline, you may need to request an extension or face penalties and interest.

Q: Are there any deductions or credits available on Form P-1040?

A: Yes, there may be deductions and credits available on Form P-1040. Refer to the instructions for more information.

Q: Who should I contact if I have questions about Form P-1040?

A: If you have questions about Form P-1040, you should contact the City of Parma's income tax department.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Division of Taxation - City of Parma, Ohio.