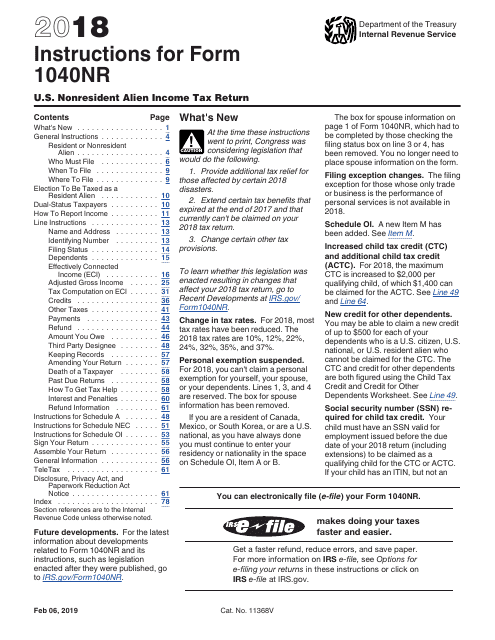

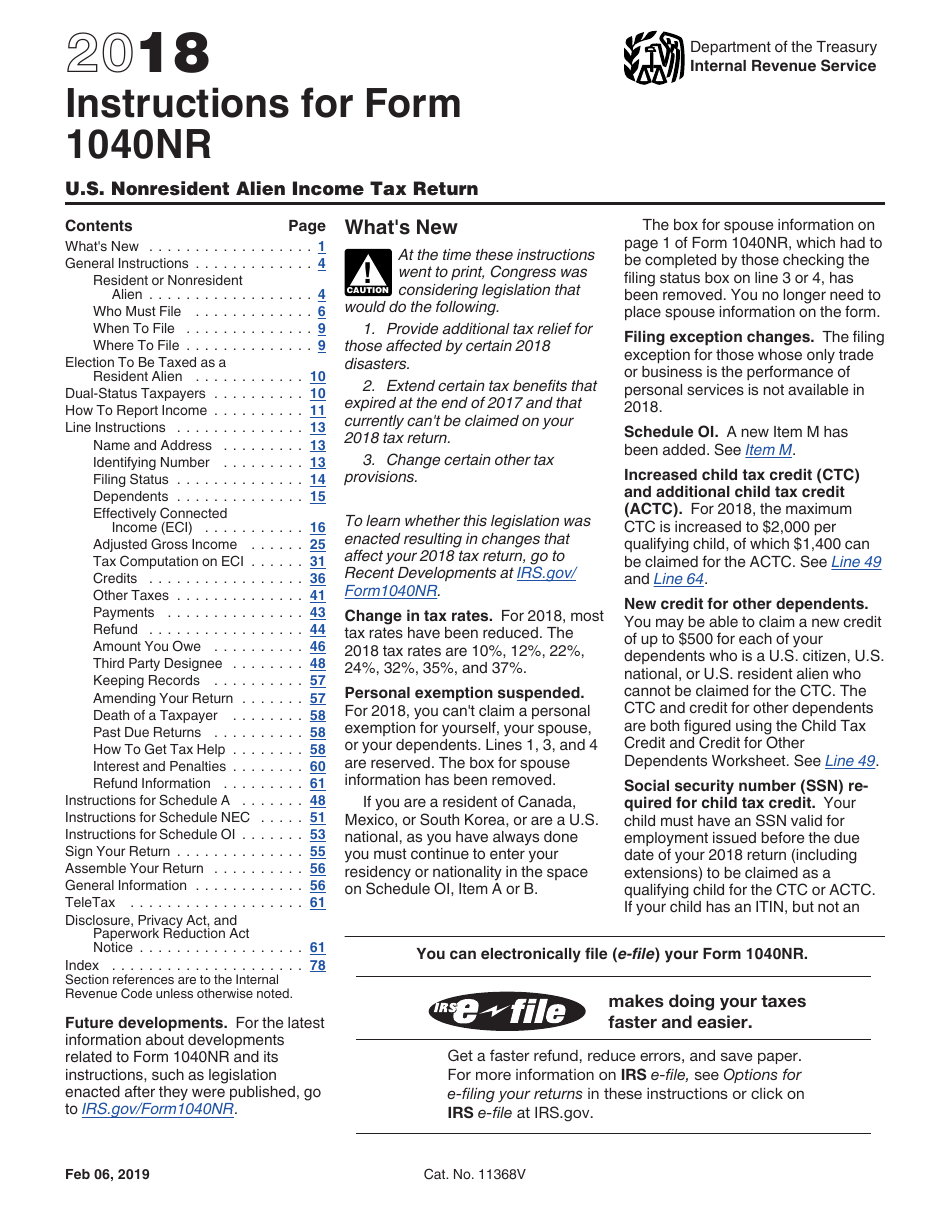

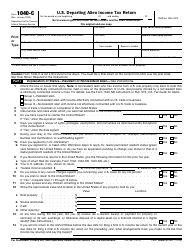

Instructions for IRS Form 1040NR U.S. Nonresident Alien Income Tax Return

This document contains official instructions for IRS Form 1040NR , U.S. Nonresident Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040NR is available for download through this link.

FAQ

Q: What is IRS Form 1040NR?

A: IRS Form 1040NR is the U.S. Nonresident Alien Income Tax Return.

Q: Who needs to file IRS Form 1040NR?

A: Nonresident aliens who have earned income from U.S. sources need to file IRS Form 1040NR.

Q: What is considered U.S. source income?

A: U.S. source income includes wages, salaries, tips, dividends, rental income, and other types of income earned in the U.S.

Q: Can nonresident aliens claim deductions on Form 1040NR?

A: Nonresident aliens can claim certain deductions and exemptions on Form 1040NR, such as the standard deduction or itemized deductions.

Q: What is the deadline for filing Form 1040NR?

A: The deadline for filing Form 1040NR is generally April 15th, but it may be extended in certain circumstances.

Q: Can nonresident aliens file their taxes electronically?

A: Nonresident aliens cannot file their taxes electronically. They must file a paper return.

Q: What happens if a nonresident alien fails to file Form 1040NR?

A: If a nonresident alien fails to file Form 1040NR when required, they may face penalties and interest on unpaid taxes.

Q: Is a Social Security Number required to file Form 1040NR?

A: Nonresident aliens who do not have a Social Security Number can apply for an Individual Taxpayer Identification Number (ITIN) to use on Form 1040NR.

Q: Are nonresident aliens subject to U.S. self-employment tax?

A: Nonresident aliens are generally not subject to U.S. self-employment tax, but there may be exceptions depending on the individual's circumstances.

Instruction Details:

- This 79-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.