This version of the form is not currently in use and is provided for reference only. Download this version of

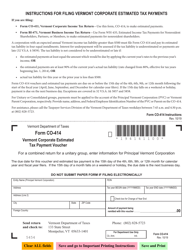

Instructions for Form CORP-ES

for the current year.

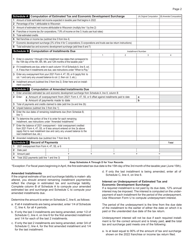

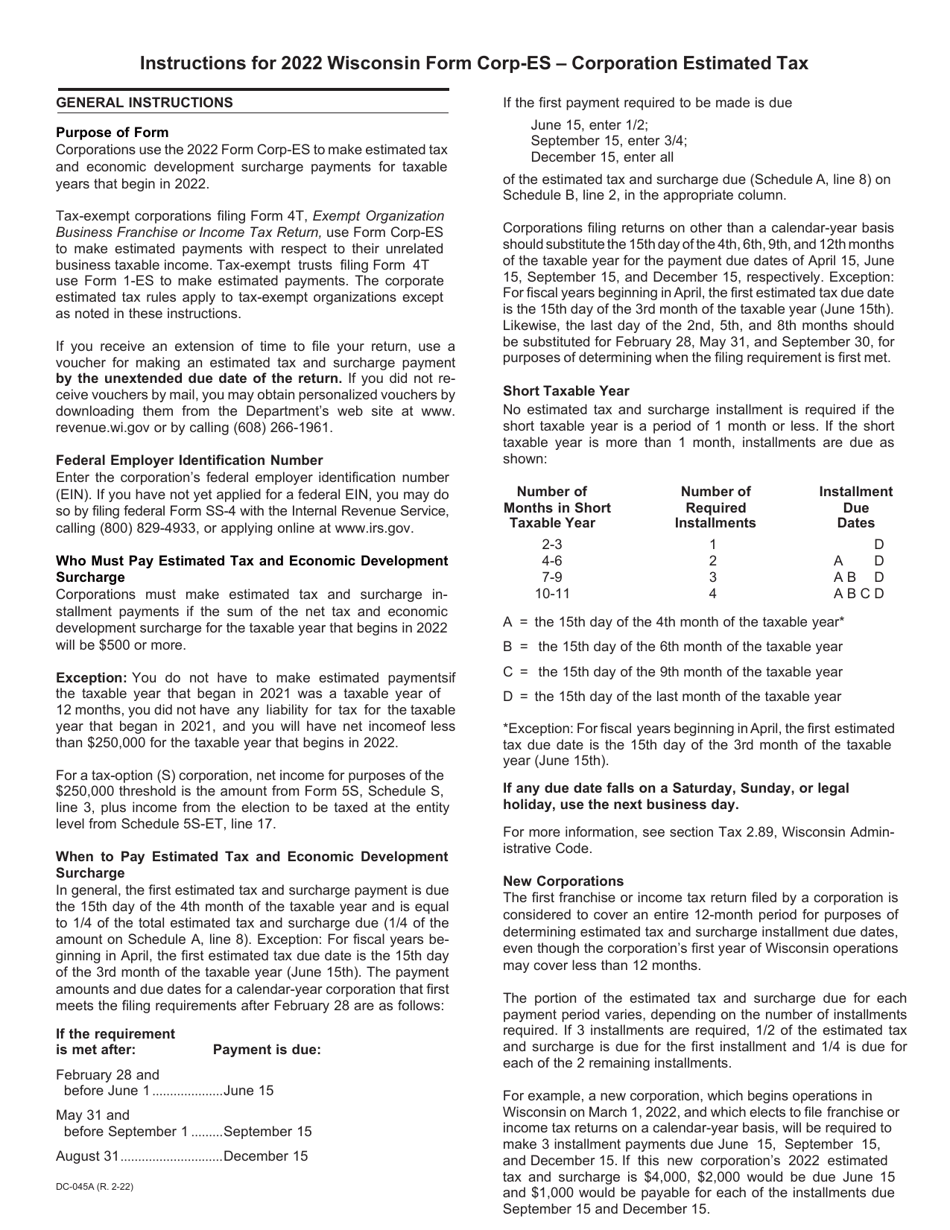

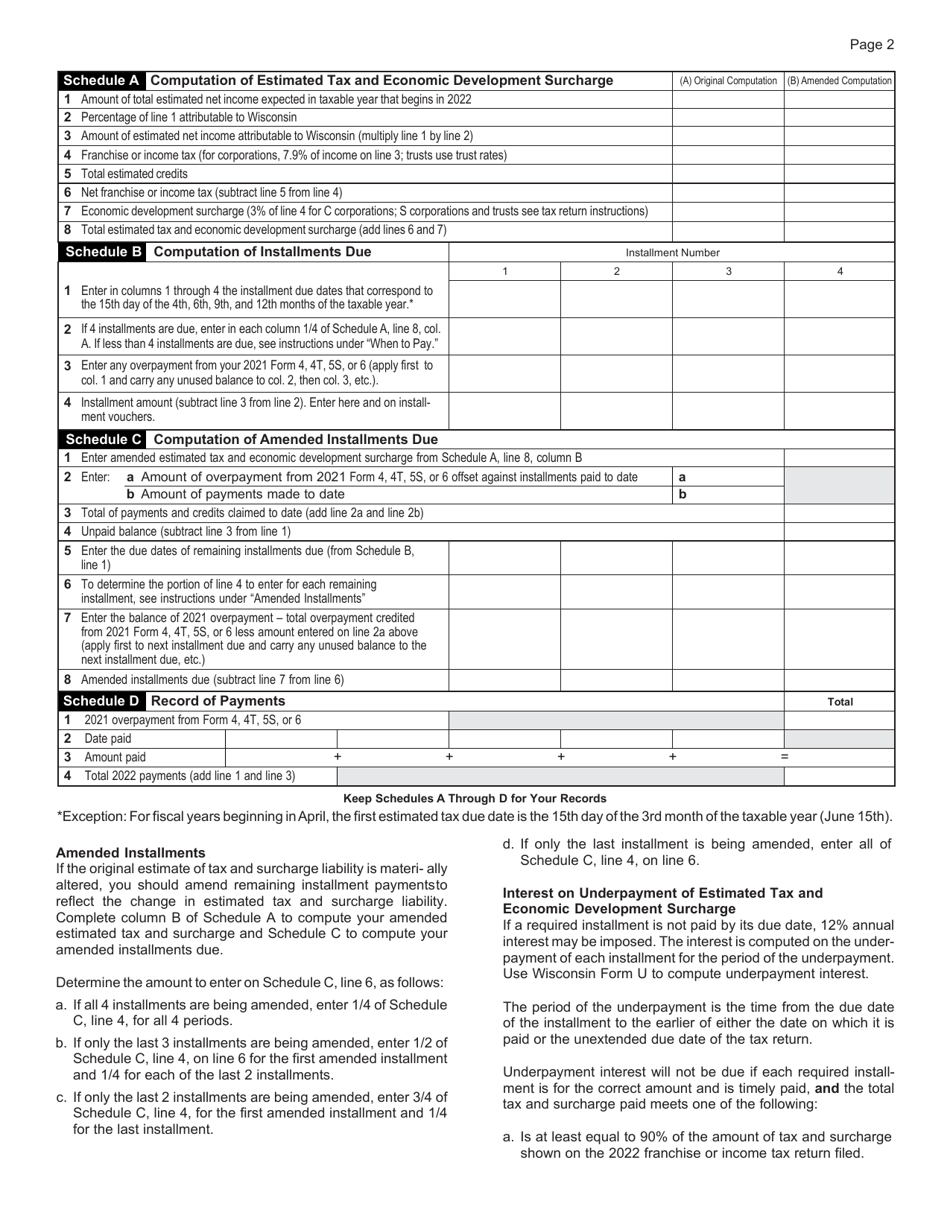

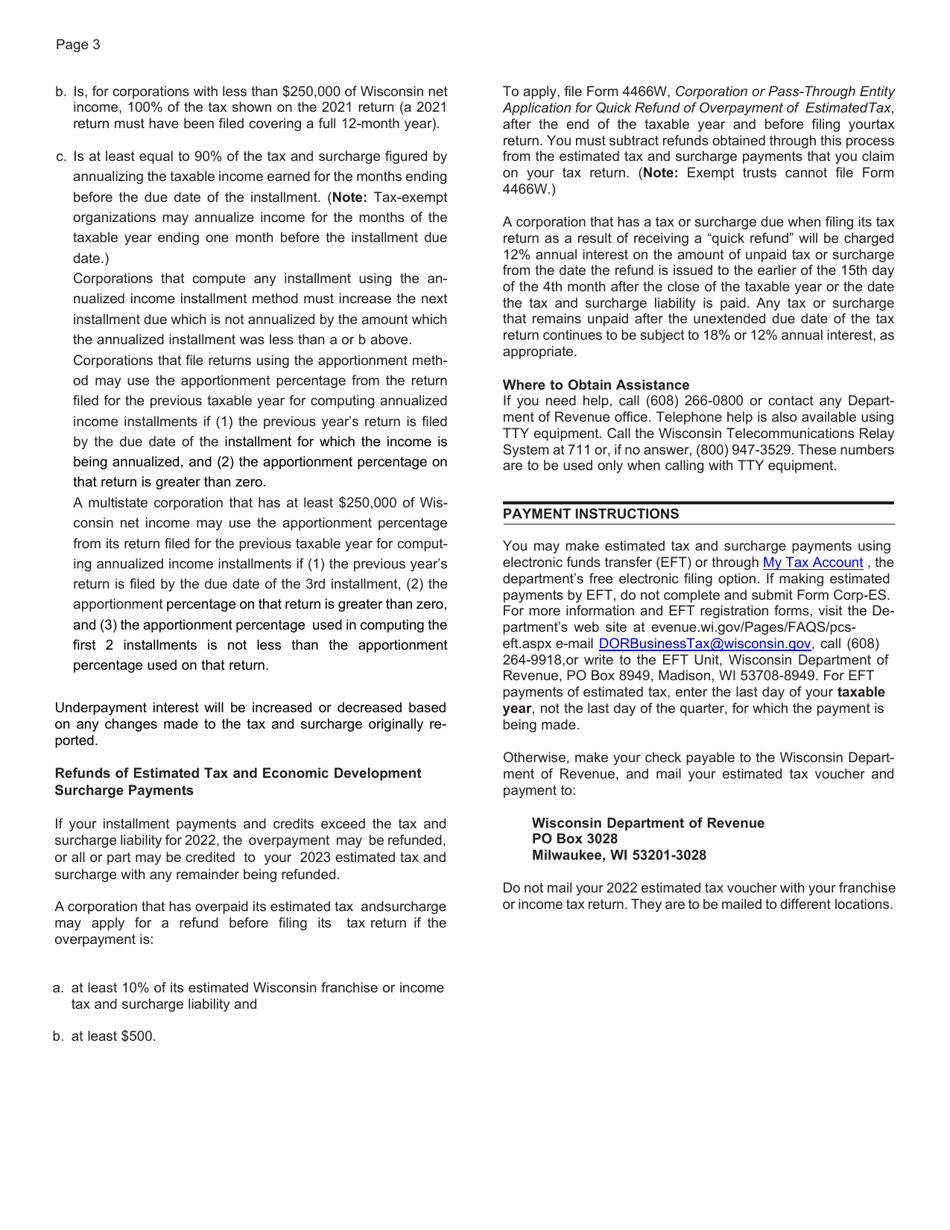

Instructions for Form CORP-ES Wisconsin Corporation Estimated Tax Voucher - Wisconsin

This document contains official instructions for Form CORP-ES , Wisconsin Corporation Estimated Tax Voucher - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form CORP-ES?

A: Form CORP-ES is the Wisconsin Corporation Estimated Tax Voucher.

Q: Who needs to use Form CORP-ES?

A: Wisconsin corporations need to use Form CORP-ES to make estimated tax payments.

Q: What is the purpose of Form CORP-ES?

A: Form CORP-ES is used to report and pay estimated taxes on a quarterly basis.

Q: How often should Form CORP-ES be filed?

A: Form CORP-ES should be filed on a quarterly basis: April 15, June 15, September 15, and December 15.

Q: What information is required on Form CORP-ES?

A: Form CORP-ES requires the corporation's name, address, federal employer identification number (FEIN), estimated tax amount, and payment details.

Q: Is there a penalty for not filing Form CORP-ES?

A: Yes, there may be penalties for failure to file or underpayment of estimated taxes using Form CORP-ES.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.