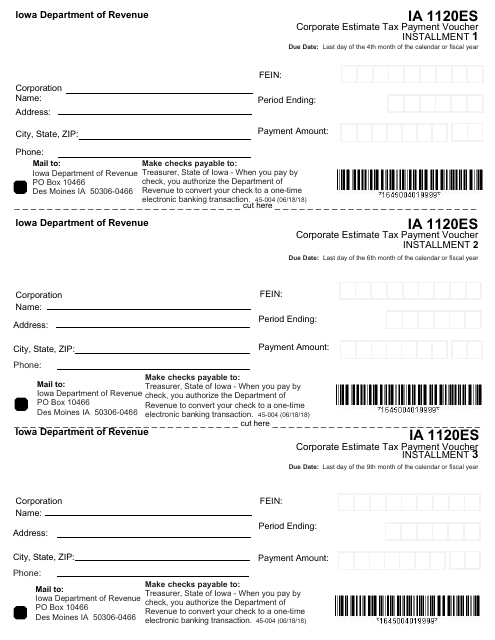

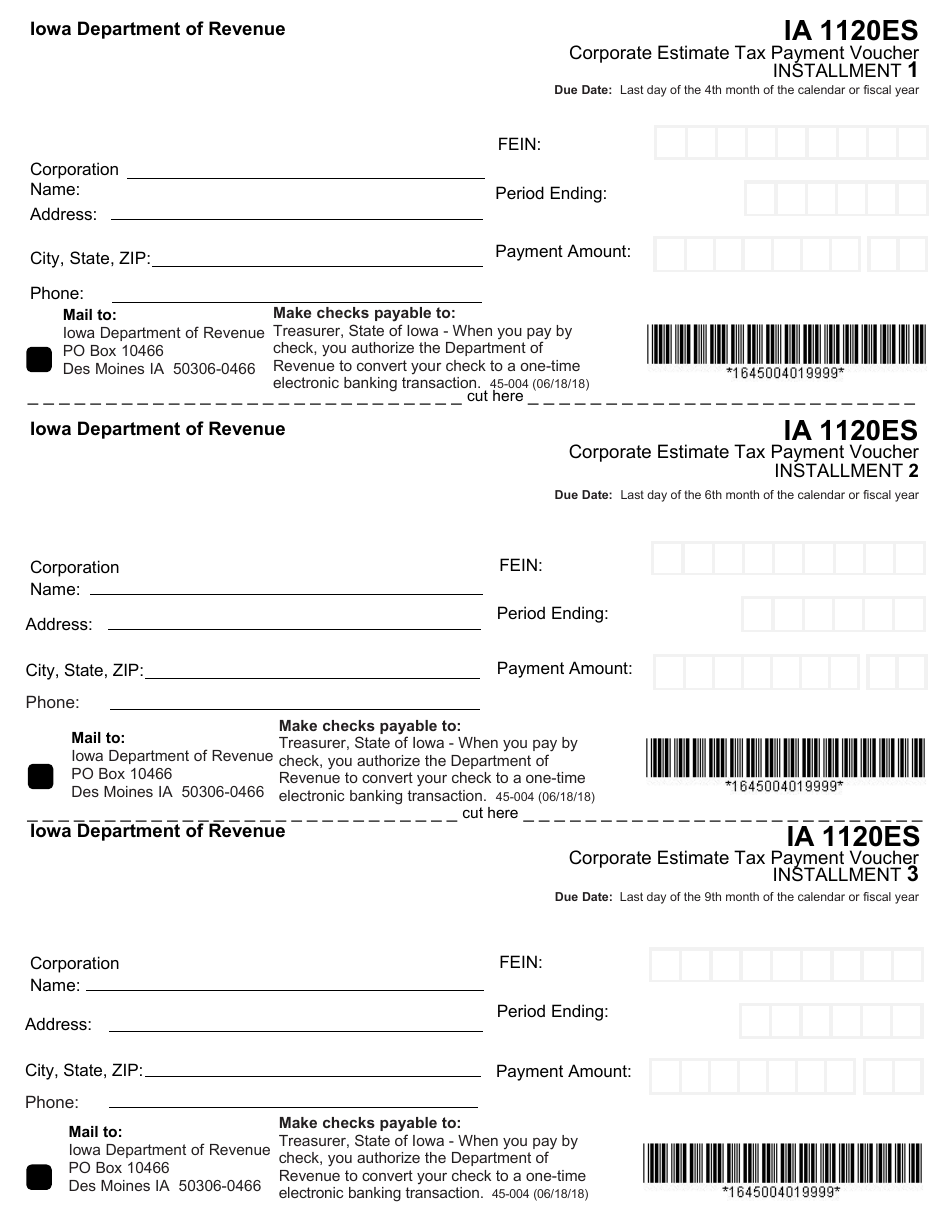

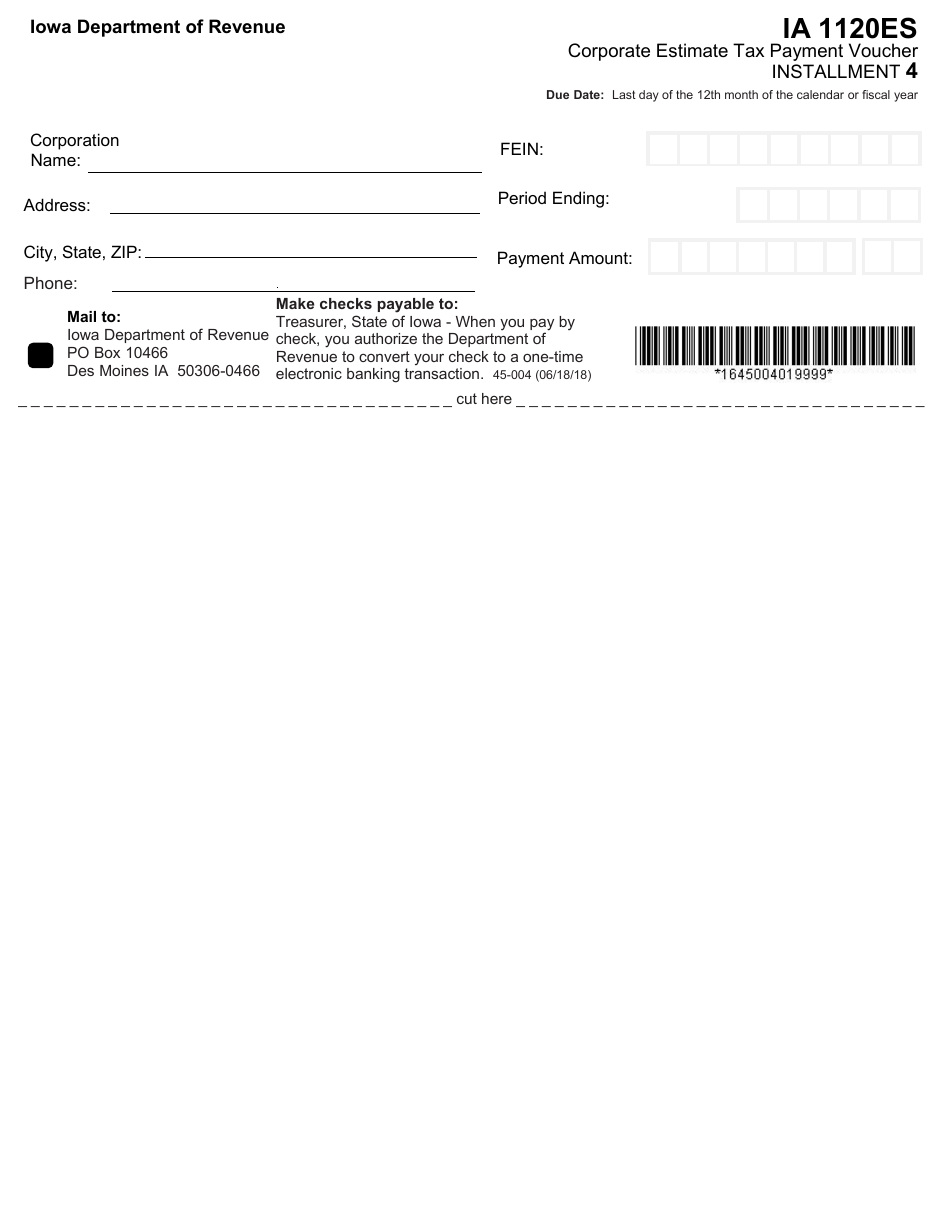

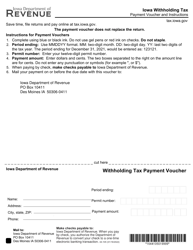

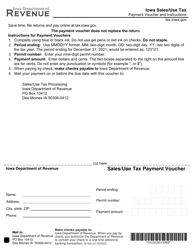

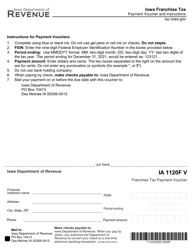

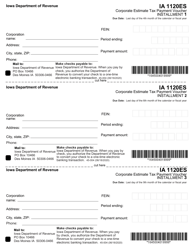

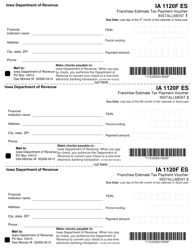

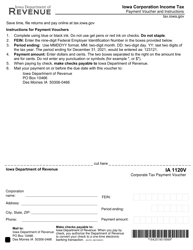

Form 45-004 (IA1120ES) Corporate Estimate Tax Payment Voucher - Iowa

What Is Form 45-004 (IA1120ES)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 45-004 (IA1120ES)?

A: Form 45-004 (IA1120ES) is the Corporate Estimate Tax Payment Voucher specifically for Iowa.

Q: Who needs to use Form 45-004 (IA1120ES)?

A: Form 45-004 (IA1120ES) is for corporations in Iowa that need to make estimated tax payments.

Q: What is the purpose of Form 45-004 (IA1120ES)?

A: The purpose of Form 45-004 (IA1120ES) is to facilitate the payment of estimated taxes by corporations in Iowa.

Q: How often should Form 45-004 (IA1120ES) be filed?

A: Form 45-004 (IA1120ES) should be filed quarterly by corporations in Iowa.

Q: What information is required on Form 45-004 (IA1120ES)?

A: Form 45-004 (IA1120ES) requires the corporation's name, address, federal employer identification number (FEIN), estimated tax amount, and other relevant information.

Q: When is the due date for Form 45-004 (IA1120ES)?

A: The due date for Form 45-004 (IA1120ES) depends on the tax year, but the first due date is generally on or before April 30th.

Q: What happens if Form 45-004 (IA1120ES) is not filed or filed late?

A: If Form 45-004 (IA1120ES) is not filed or filed late, the corporation may be subject to penalties and interest.

Q: Are there any special instructions or considerations for filling out Form 45-004 (IA1120ES)?

A: Yes, it is important to carefully follow the instructions provided with Form 45-004 (IA1120ES) to ensure accurate and timely filing.

Form Details:

- Released on June 18, 2018;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 45-004 (IA1120ES) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.