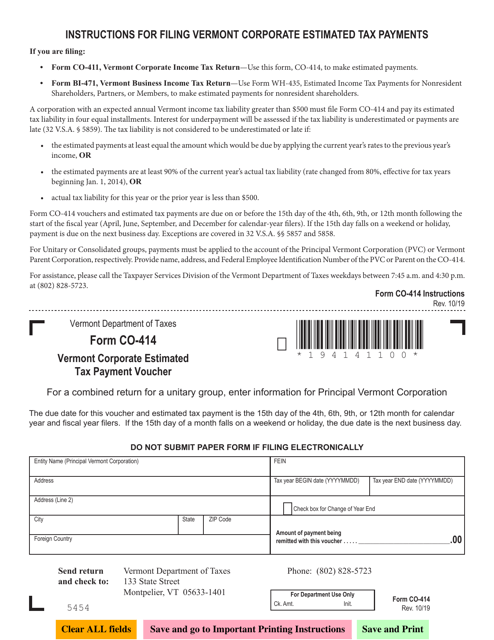

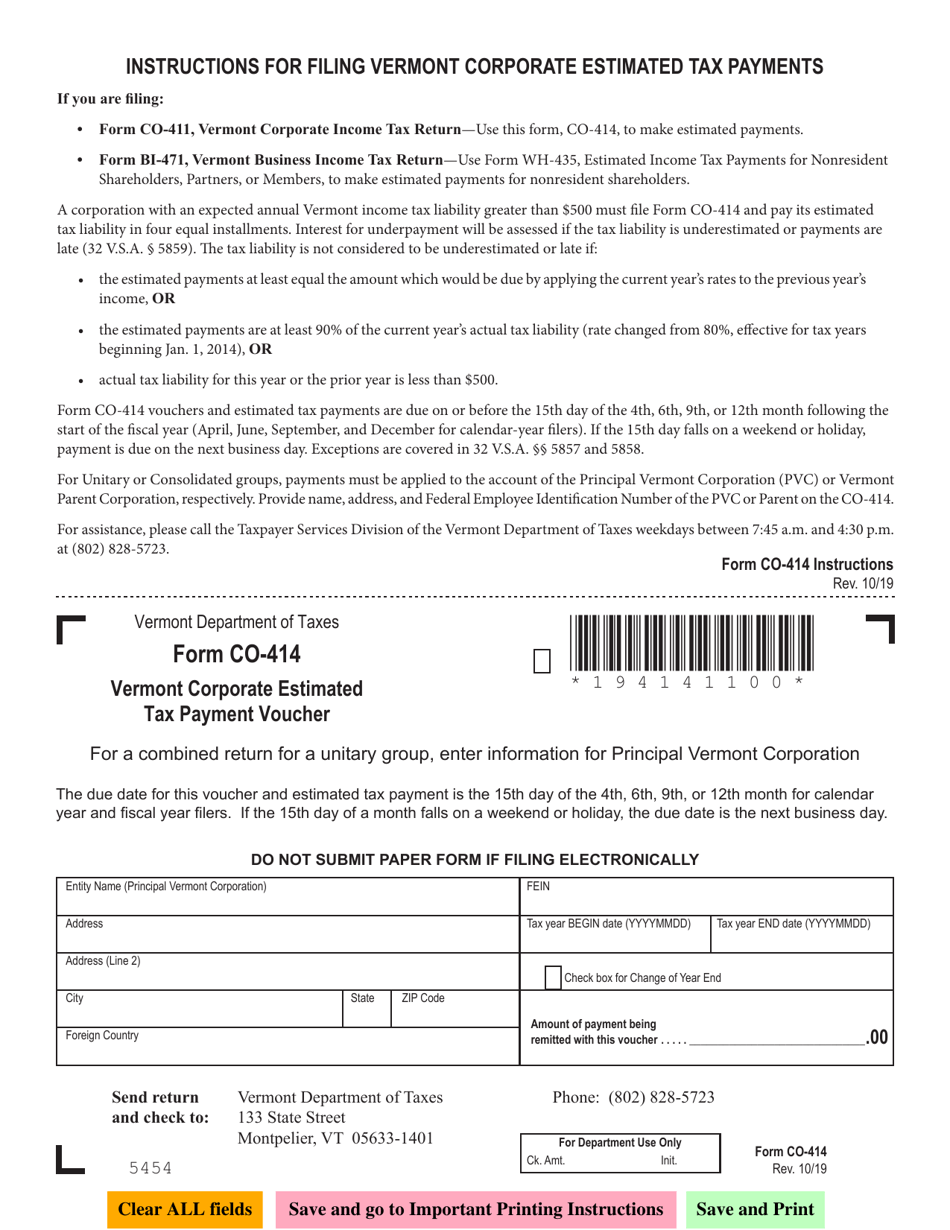

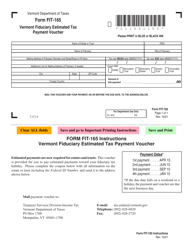

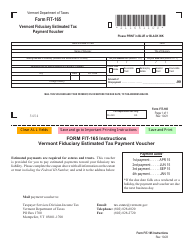

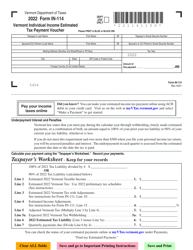

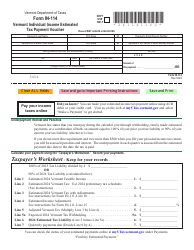

Form CO-414 Vermont Corporate Estimated Tax Payment Voucher - Vermont

What Is Form CO-414?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form CO-414?

A: Form CO-414 is the Vermont Corporate Estimated Tax Payment Voucher.

Q: Who needs to use form CO-414?

A: Vermont corporations that are required to make estimated tax payments should use form CO-414.

Q: What is the purpose of form CO-414?

A: The purpose of form CO-414 is to submit estimated tax payments for Vermont corporations.

Q: What information is required on form CO-414?

A: Form CO-414 requires information such as the corporation's name, address, federal identification number, and the estimated tax amount.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-414 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.