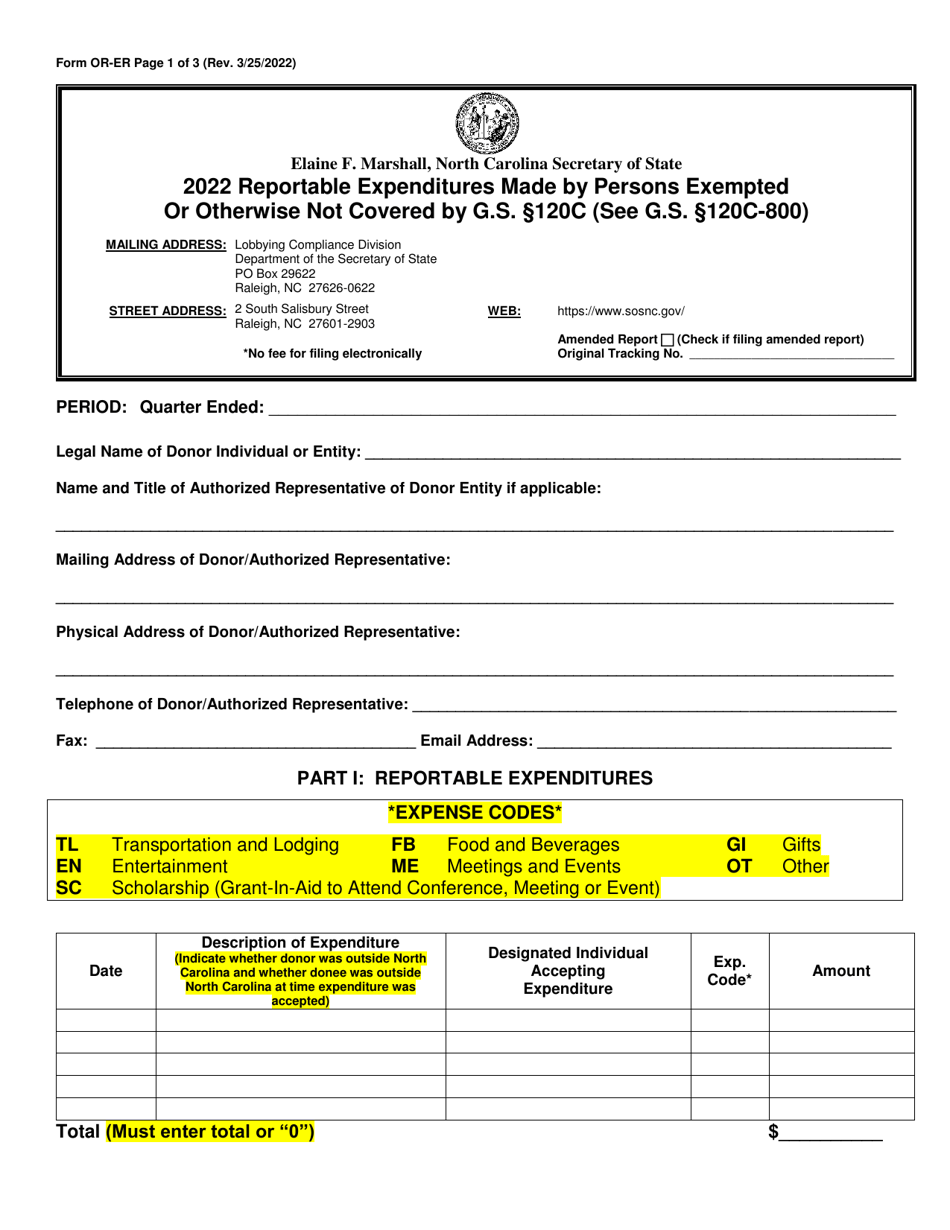

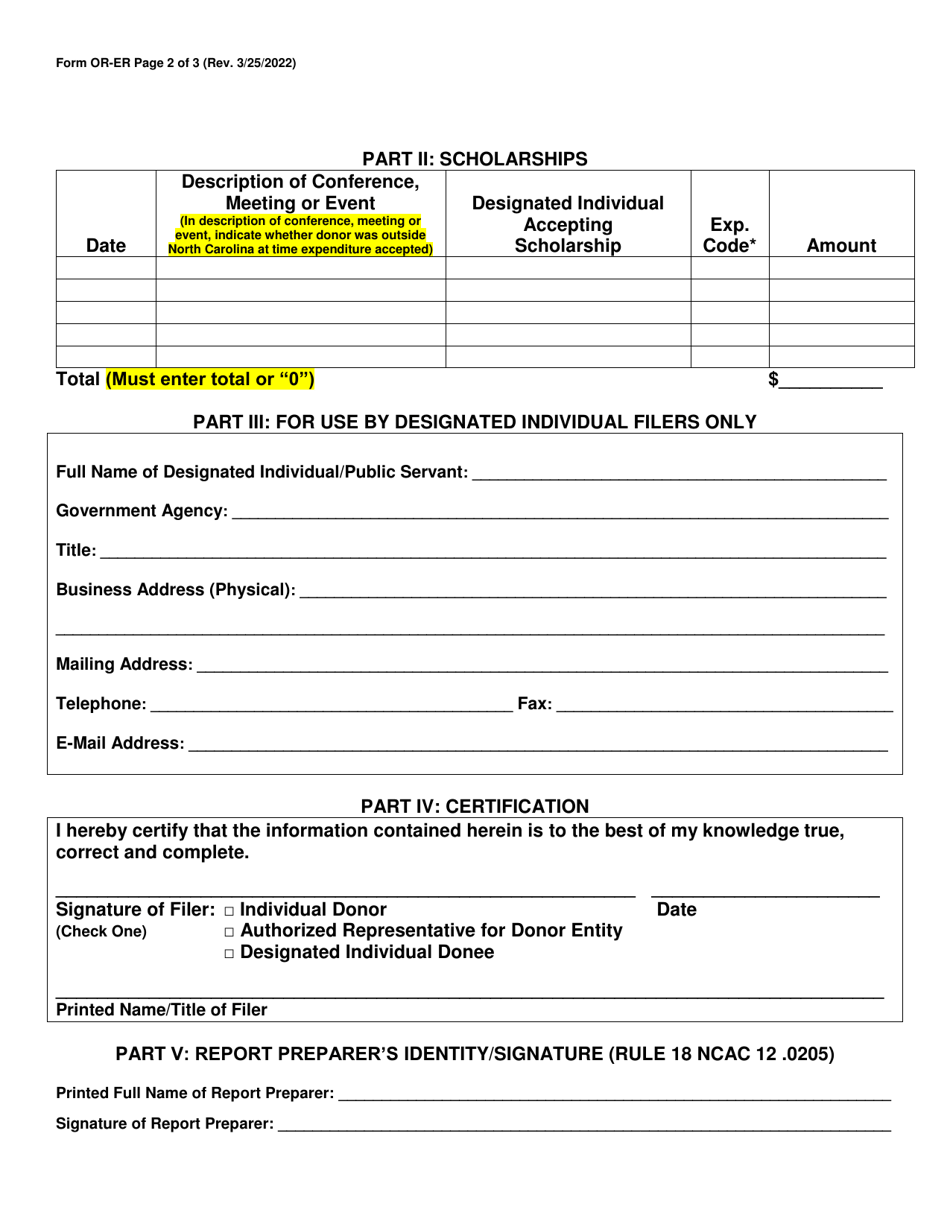

This version of the form is not currently in use and is provided for reference only. Download this version of

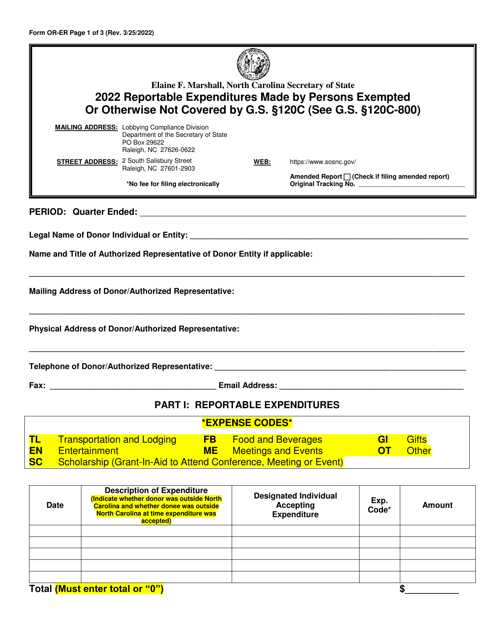

Form OR-ER

for the current year.

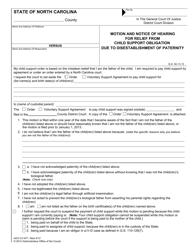

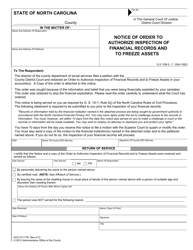

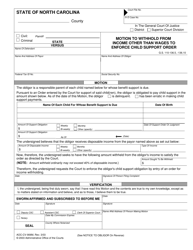

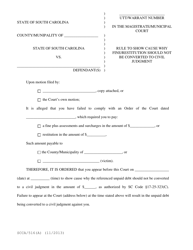

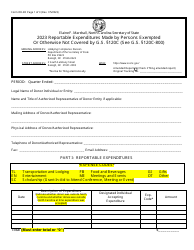

Form OR-ER Reportable Expenditures Made by Persons Exempted or Otherwise Not Covered by G.s. 120c - North Carolina

What Is Form OR-ER?

This is a legal form that was released by the North Carolina Secretary of State - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-ER?

A: Form OR-ER is a reporting form used in North Carolina.

Q: Who is required to file Form OR-ER?

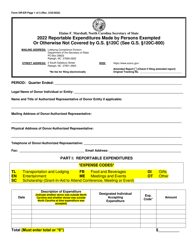

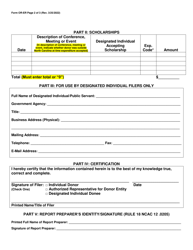

A: Persons exempted or otherwise not covered by G.s. 120c are required to file Form OR-ER.

Q: What are reportable expenditures?

A: Reportable expenditures are expenses that need to be reported on Form OR-ER.

Q: What is G.s. 120c?

A: G.s. 120c refers to a specific law or statute in North Carolina.

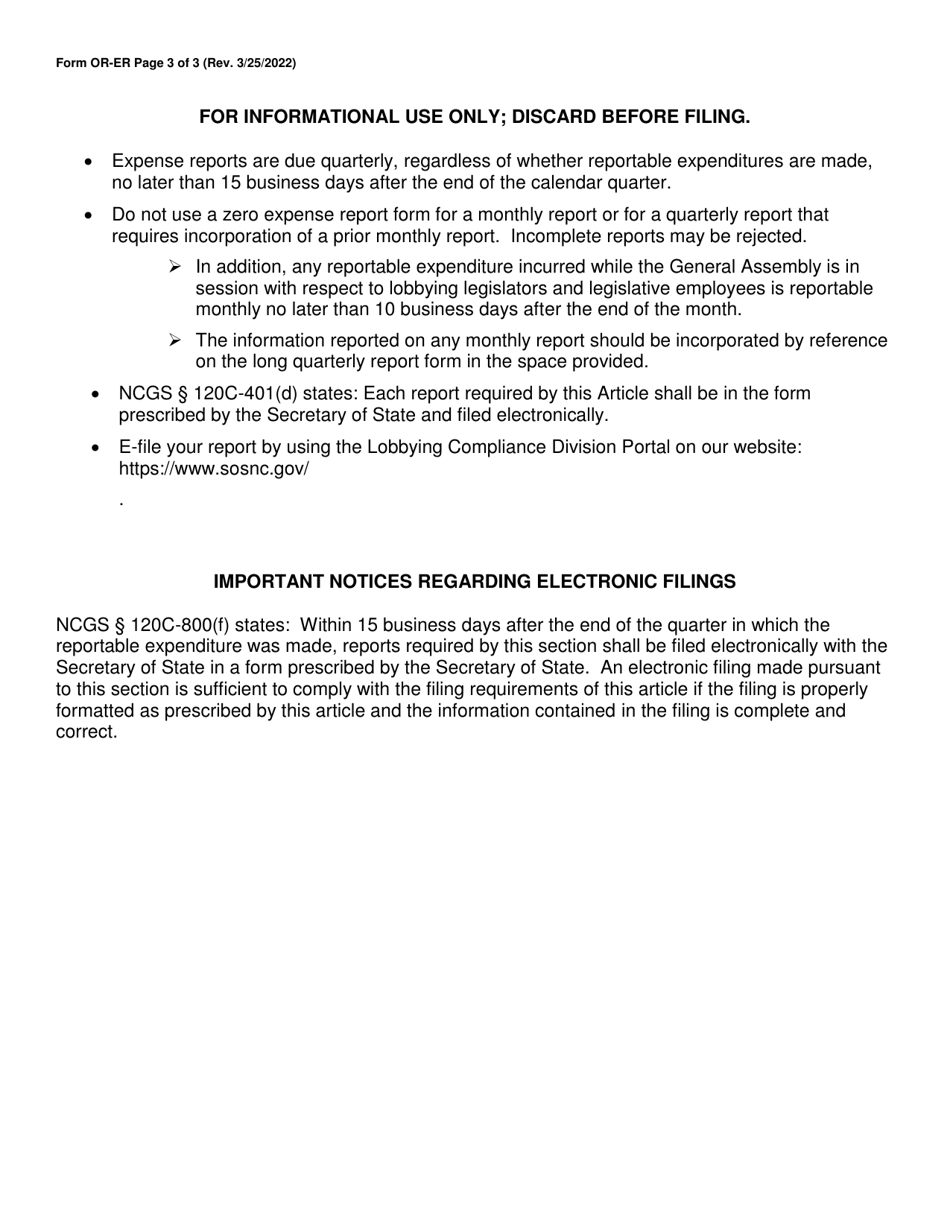

Q: When is the deadline to file Form OR-ER?

A: The deadline to file Form OR-ER may vary, and it is advisable to check the official instructions or contact the relevant authority for the specific deadline.

Q: What happens if I don't file Form OR-ER?

A: Consequences for not filing Form OR-ER may include penalties or other legal ramifications. It is essential to comply with the reporting requirements.

Q: Are there any exemptions to filing Form OR-ER?

A: Persons exempted or otherwise not covered by G.s. 120c are not required to file Form OR-ER.

Q: Can I request an extension to file Form OR-ER?

A: It is advisable to check the official instructions or contact the relevant authority to inquire about the possibility of an extension for filing Form OR-ER.

Form Details:

- Released on March 25, 2022;

- The latest edition provided by the North Carolina Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OR-ER by clicking the link below or browse more documents and templates provided by the North Carolina Secretary of State.