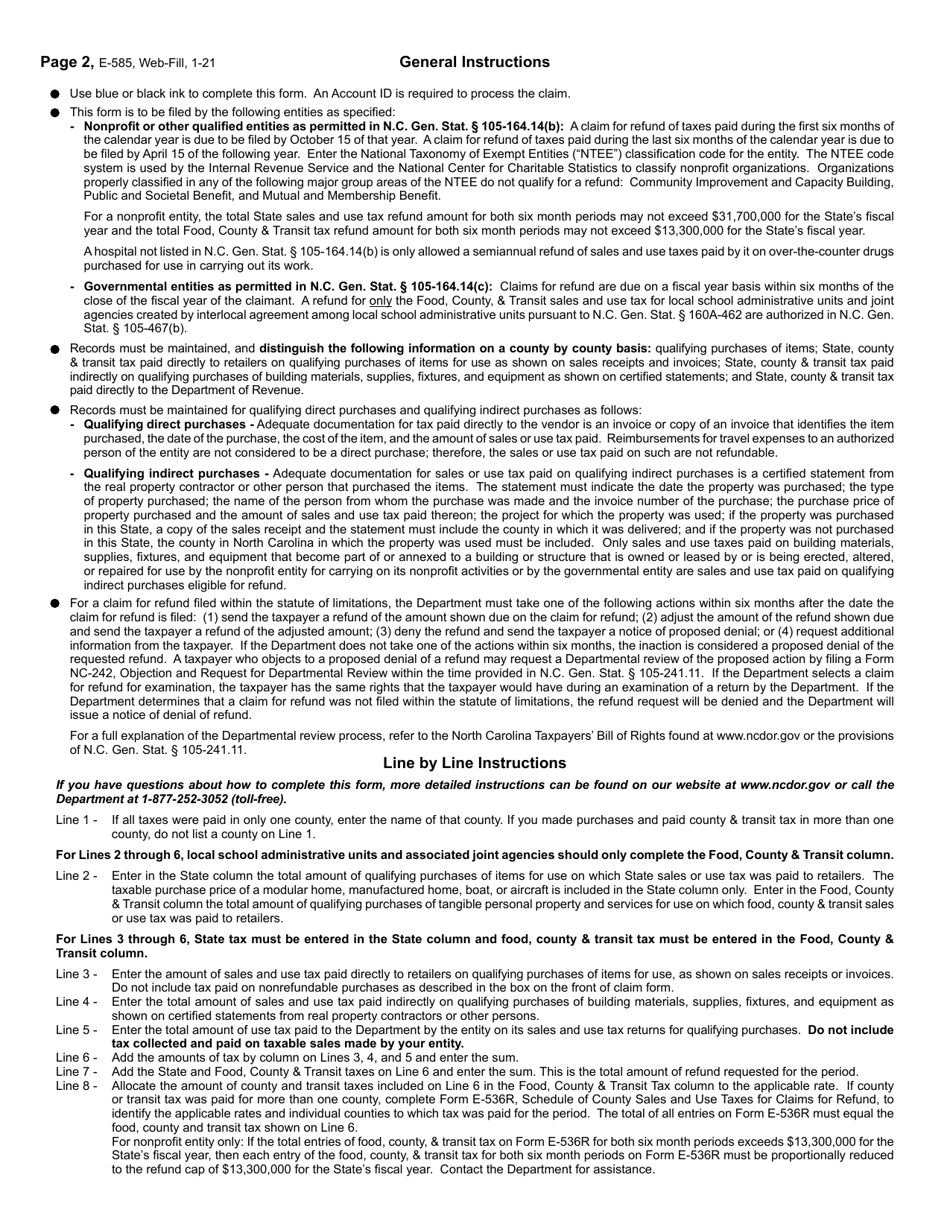

Form E-585 Nonprofit and Governmental Entity Claim for Refund State, County, and Transit Sales and Use Taxes - North Carolina

What Is Form E-585?

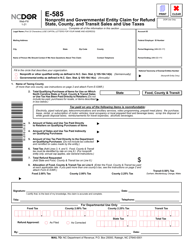

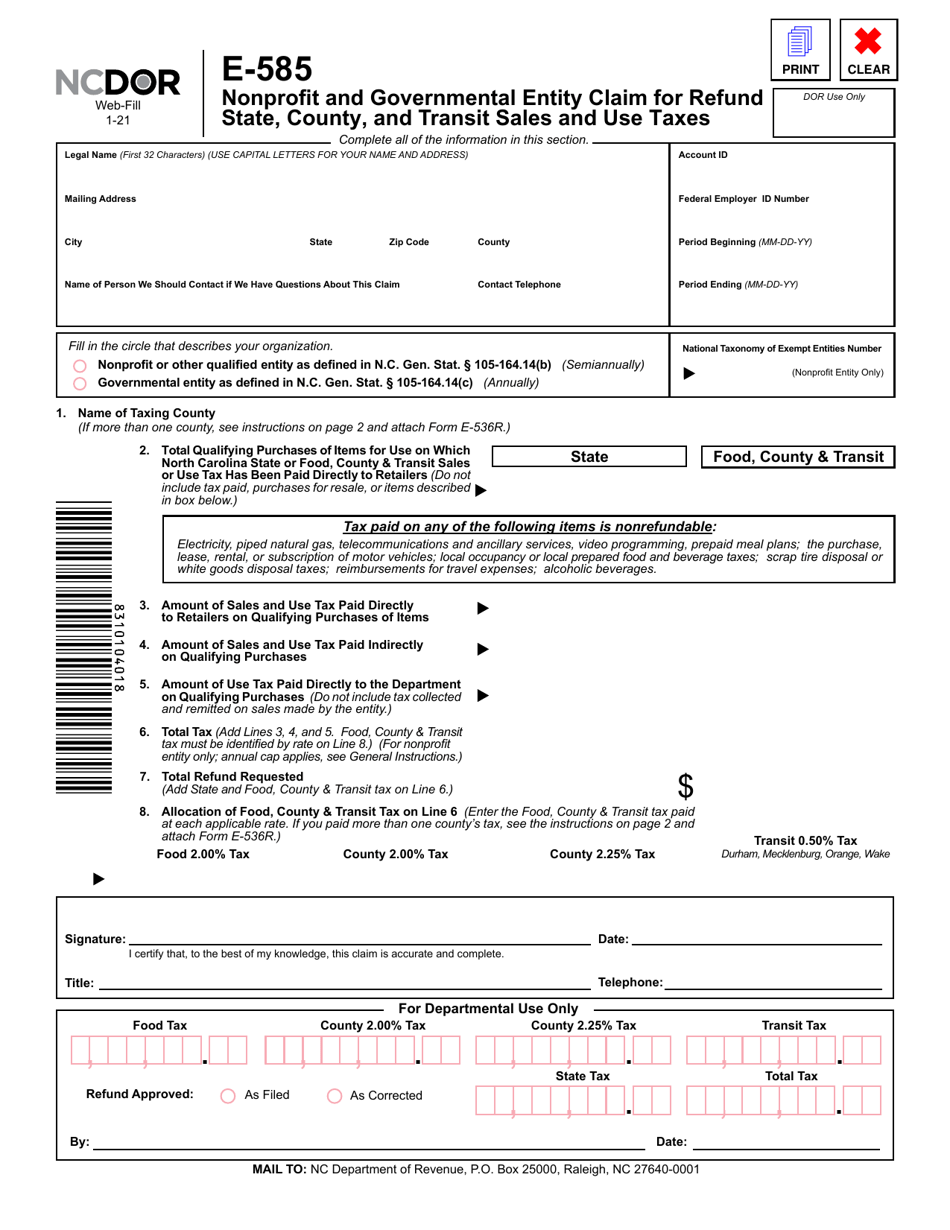

Form E-585, Nonprofit and Governmental Entity Claim for Refund State, County, and Transit Sales and Use Taxes , is a legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue. It can be completed by nonprofit and other qualified entities and governmental entities listed in the North Carolina General Statutes, Chapter 105, Taxation, § 105-164.14.

This form was released by the North Carolina Department of Revenue . The latest version of the form was issued on January 1, 2021 , with all previous editions obsolete. A fillable NC Form E-585 can be downloaded through the link below.

How to Prepare NC DOR E-585?

Form E-585 instructions are as follows:

- Enter the legal name of the entity, its mailing address and contact information of the individual to be contacted regarding the claim;

- Write down the account ID. It can be either the account ID number assigned by the Department of Revenue or the Federal Employer Identification Number (FEIN) issued by the Internal Revenue Service;

- Indicate the beginning and ending dates of the period covered by the refund claim;

- State whether you complete this form for a nonprofit or other qualified entity or governmental entity. A nonprofit entity is also required to provide the National Taxonomy of Exempt Entities (NTEE) number;

- Indicate the name of the taxing county in which the entity paid county and transit tax. If you have to identify more than one county, list them in Form E-536R, Schedule of County Sales and Use Taxes for Claims for Refund you attach to Form E-585;

- Record the total purchases of tangible personal property and services on which you have paid State sales or use tax directly to retailers. If you paid food, county, and transit sales or use tax, enter this information in the right column;

- Enter the total State sales and use tax paid directly and indirectly to retailers and record food, county, and transit sales and use tax separately;

- Record information about the use tax paid directly to the Department of Revenue;

- Add the State tax and enter its total amount. Add the food, county, and transit tax and indicate its total in the appropriate column;

- Indicate the total refund requested by adding the State and county tax;

- Enter the county tax paid at the applicable rate;

- Sign the form certifying the claim is complete and accurate. Write down the actual date, your title, and add the telephone number.

When you file a claim for the refund of taxes paid during the first six months of the calendar year, the E-585 due date is October 15 of this year. Claims for tax refunds paid during the last six months of the year are to be filed by April 15 of the following year.

Send the form to the NC Department of Revenue, PO Box 25000, Raleigh, NC 27640-0001.