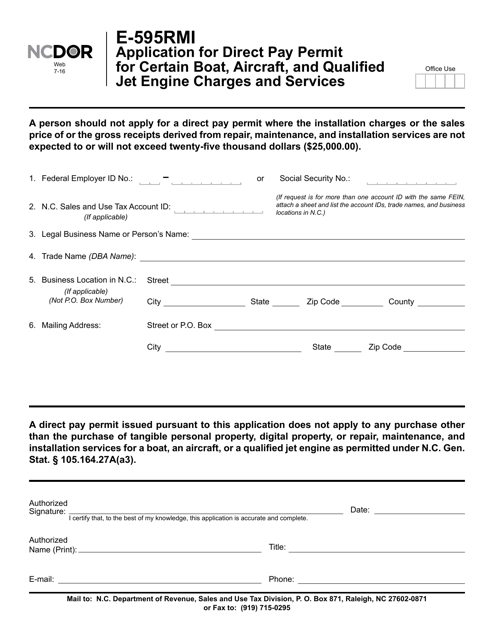

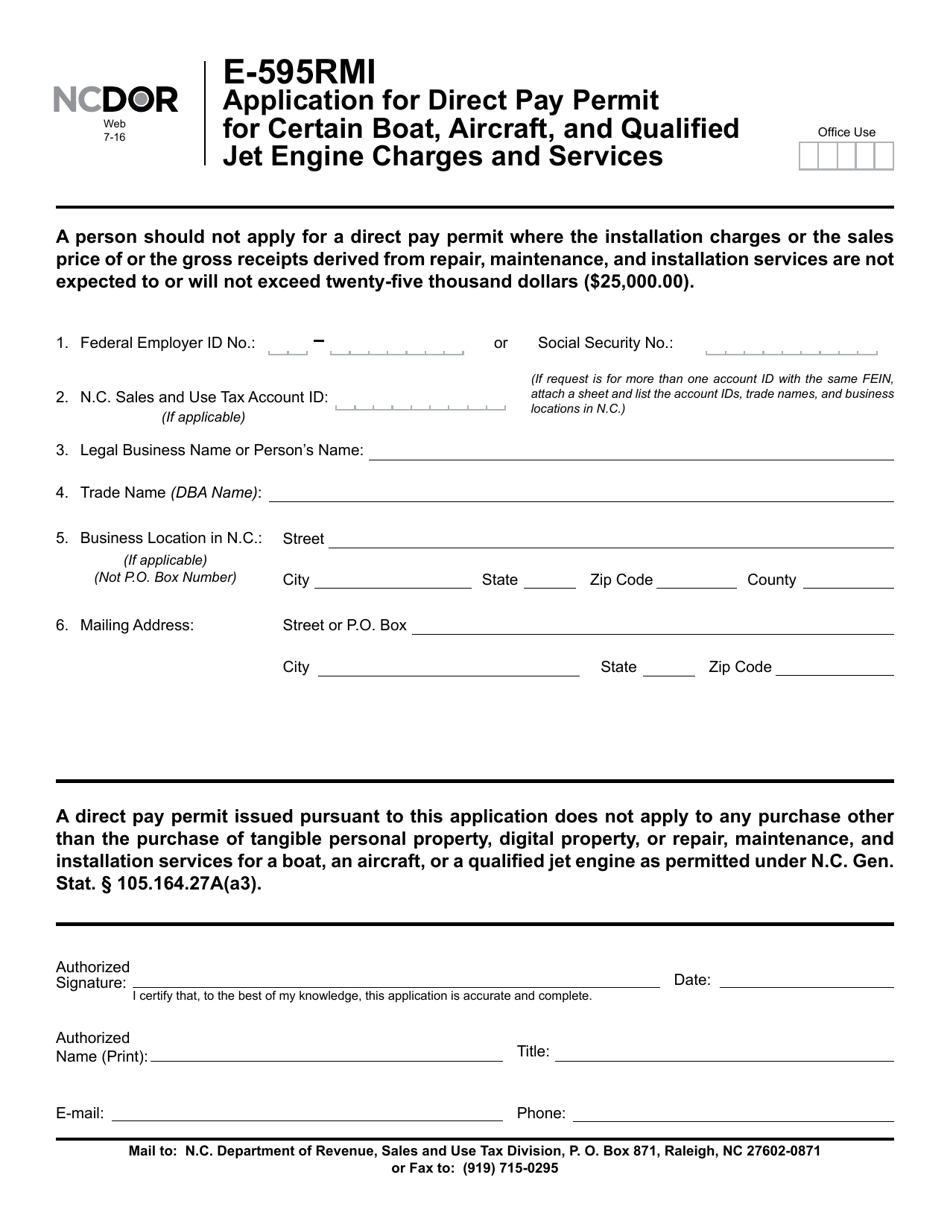

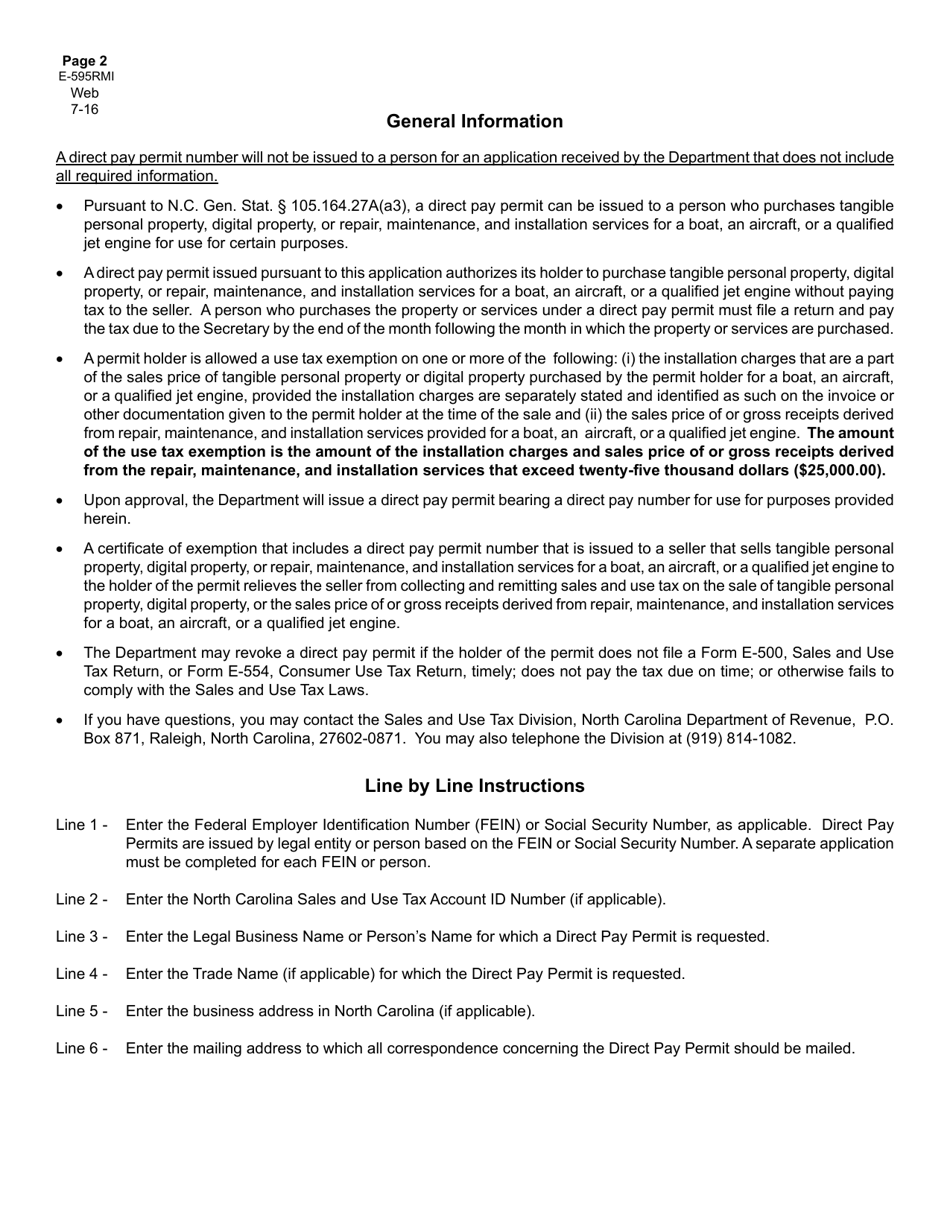

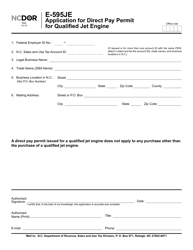

Form E-595RMI Application for Direct Pay Permit for Certain Boat, Aircraft, and Qualified Jet Engine Charges and Services - North Carolina

What Is Form E-595RMI?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-595RMI?

A: Form E-595RMI is an application for a Direct Pay Permit for certain boat, aircraft, and qualified jet engine charges and services in North Carolina.

Q: What is a Direct Pay Permit?

A: A Direct Pay Permit allows the holder to purchase tangible personal property and services without paying sales tax at the time of purchase.

Q: Who can apply for a Direct Pay Permit?

A: Businesses that frequently purchase taxable property or services for use in boat, aircraft, or qualified jet engine charges and services in North Carolina.

Q: What charges and services are covered by the Direct Pay Permit?

A: The Direct Pay Permit covers charges and services related to boats, aircraft, and qualified jet engines, such as repair, maintenance, and modification.

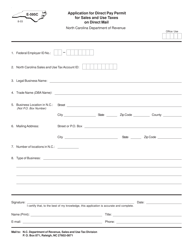

Q: How can I apply for a Direct Pay Permit?

A: You can apply for a Direct Pay Permit by completing and submitting Form E-595RMI to the North Carolina Department of Revenue.

Q: How long does it take to get a Direct Pay Permit?

A: The processing time for a Direct Pay Permit application is typically 10 business days.

Q: Is there a fee to apply for a Direct Pay Permit?

A: No, there is no fee to apply for a Direct Pay Permit.

Q: Can I use a Direct Pay Permit for non-qualifying charges and services?

A: No, a Direct Pay Permit can only be used for qualifying charges and services related to boats, aircraft, and qualified jet engines.

Q: Can I use a Direct Pay Permit in other states?

A: No, a Direct Pay Permit is specific to North Carolina and cannot be used in other states.

Q: Do I still need to file sales tax returns if I have a Direct Pay Permit?

A: Yes, you are still required to file sales tax returns, but you will not pay tax on qualifying charges and services covered by the Direct Pay Permit.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-595RMI by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.