Instructions for Arizona Form 332, 332-P - Arizona

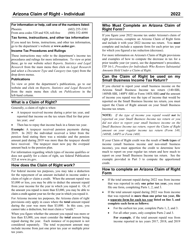

This document contains official instructions for Arizona Form 332 , and Arizona Form 332-P . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Arizona Form 332?

A: Arizona Form 332 is a form used for submitting tax payments or requesting refunds of overpaid taxes in Arizona.

Q: What is Arizona Form 332-P?

A: Arizona Form 332-P is a payment voucher used to accompany payments made with Form 332.

Q: What information is required on Arizona Form 332?

A: The form requires information such as your name, address, Social Security number, employer information, and details about your tax payments or refund request.

Q: When is the deadline for filing Arizona Form 332?

A: The deadline for filing Arizona Form 332 depends on your specific tax situation. It is typically due by April 15th, but it may vary for certain individuals or businesses.

Q: Can I e-file Arizona Form 332?

A: Yes, you can e-file Arizona Form 332 if you are using approved tax software or working with a certified tax professional.

Q: What if I cannot pay the full amount owed on Arizona Form 332?

A: If you cannot pay the full amount owed, it is still important to file the form by the deadline and pay as much as you can. You may also explore options like payment plans or obtaining a loan to cover the remaining balance.

Q: How long does it take to receive a refund after submitting Arizona Form 332?

A: The processing time for refunds can vary, but it generally takes about 4-6 weeks to receive a refund after submitting Arizona Form 332.

Q: Are there any penalties for late filing or underpayment?

A: Yes, there may be penalties for late filing or underpayment of taxes. It is important to file and pay on time to avoid penalties and interest charges.

Q: Can I amend my Arizona Form 332 after it has been filed?

A: Yes, if you need to make changes or corrections to your Arizona Form 332 after it has been filed, you can do so by filing an amended return using Arizona Form 332X.

Instruction Details:

- This 11-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.