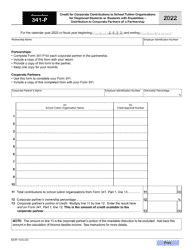

Instructions for Arizona Form 331, ADOR10537, Arizona Form 331-P, ADOR11328, Arizona Form 331-S, ADOR11329 - Arizona

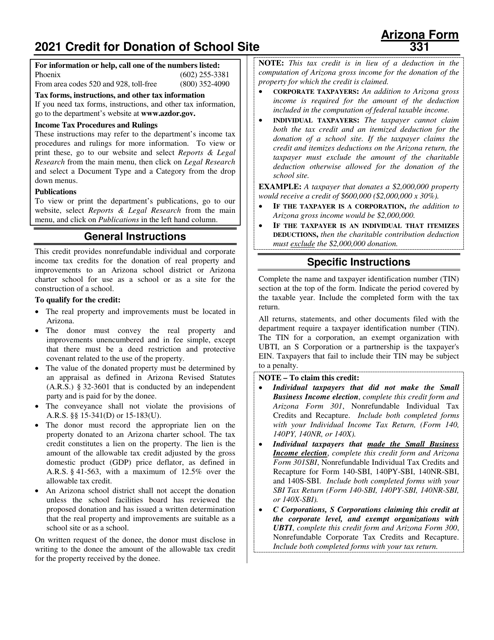

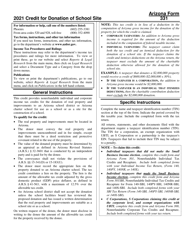

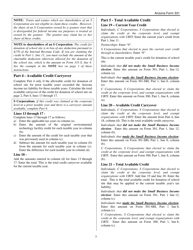

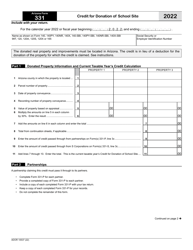

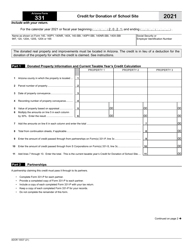

Arizona Form 331 (ADOR10537) Credit for Donation of School Site - Arizona

Arizona Form 331 (ADOR10537) Credit for Donation of School Site - Arizona

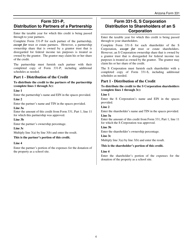

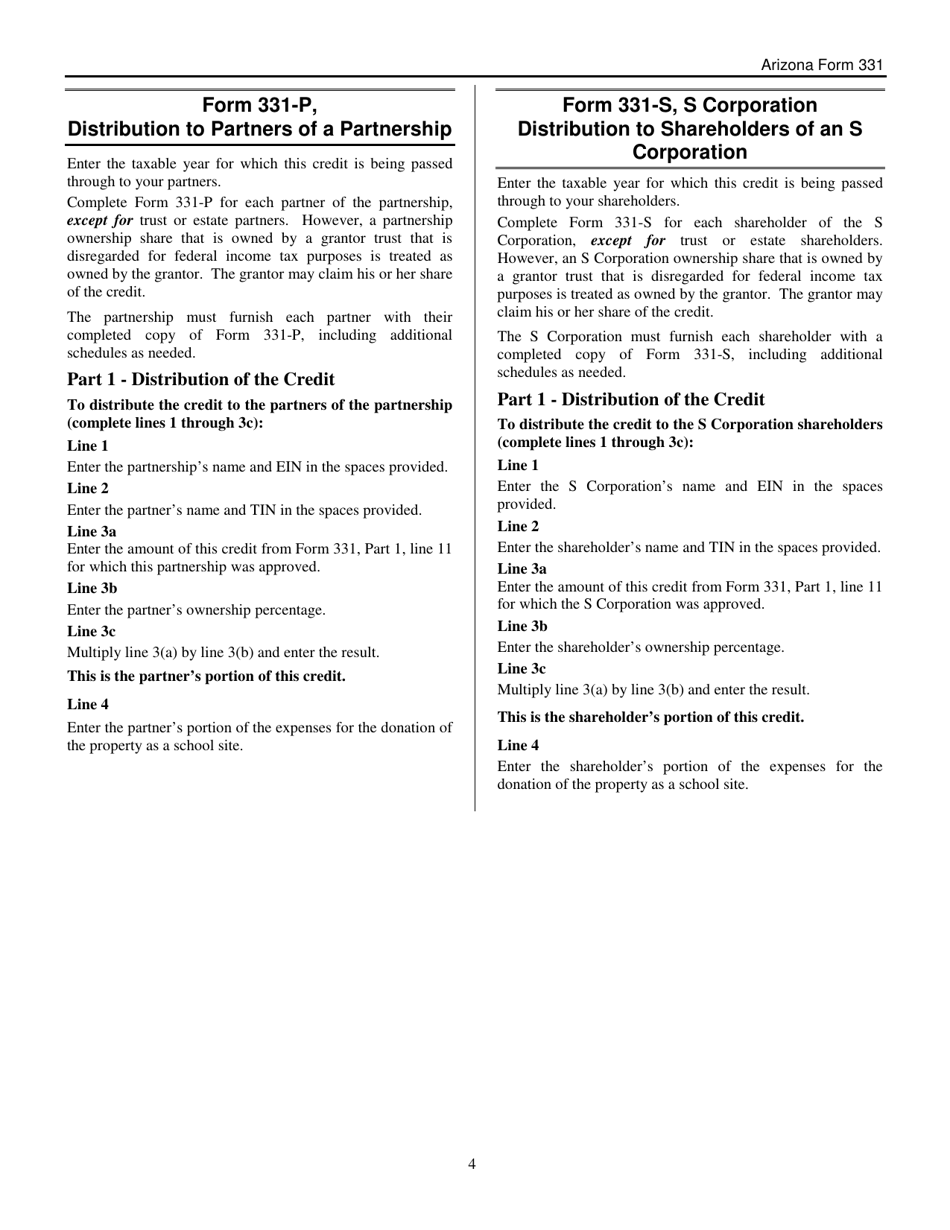

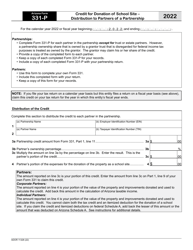

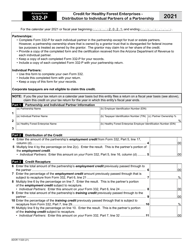

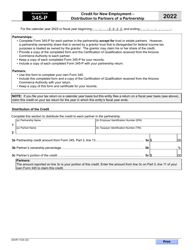

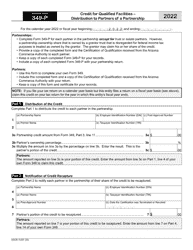

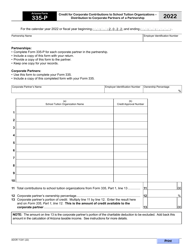

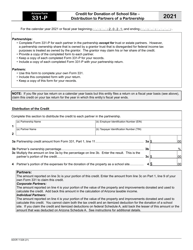

Arizona Form 331-P (ADOR11328) Credit for Donation of School Site - Distribution to Partners of a Partnership - Arizona

Arizona Form 331-P (ADOR11328) Credit for Donation of School Site - Distribution to Partners of a Partnership - Arizona

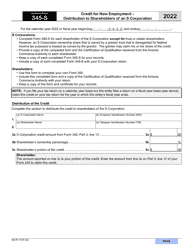

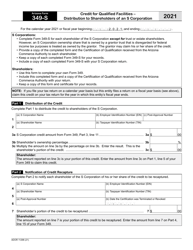

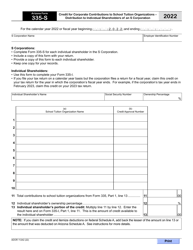

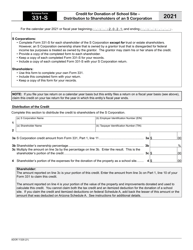

Arizona Form 331-S (ADOR11329) Credit for Donation of School Site - Distribution to Shareholders of an S Corporation - Arizona

Arizona Form 331-S (ADOR11329) Credit for Donation of School Site - Distribution to Shareholders of an S Corporation - Arizona

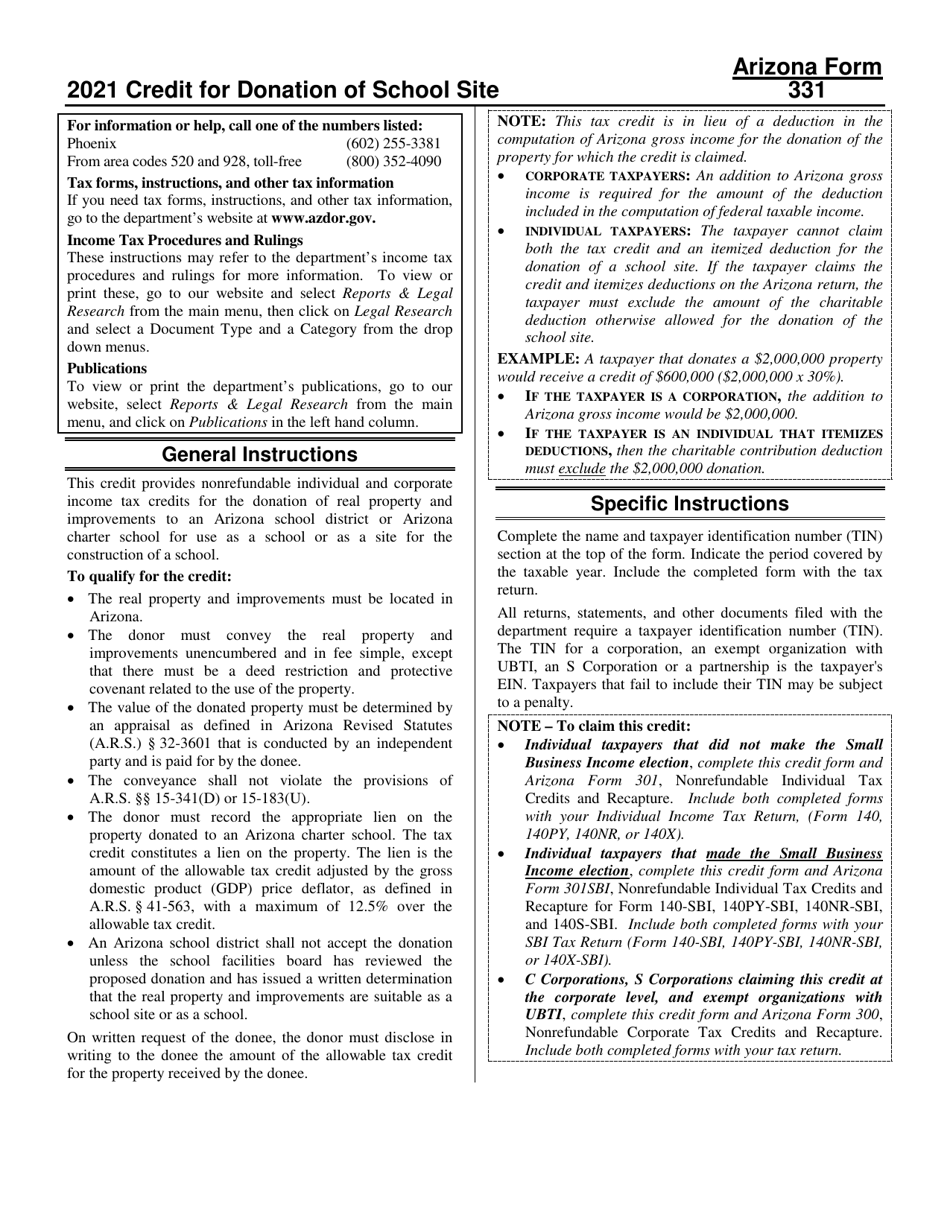

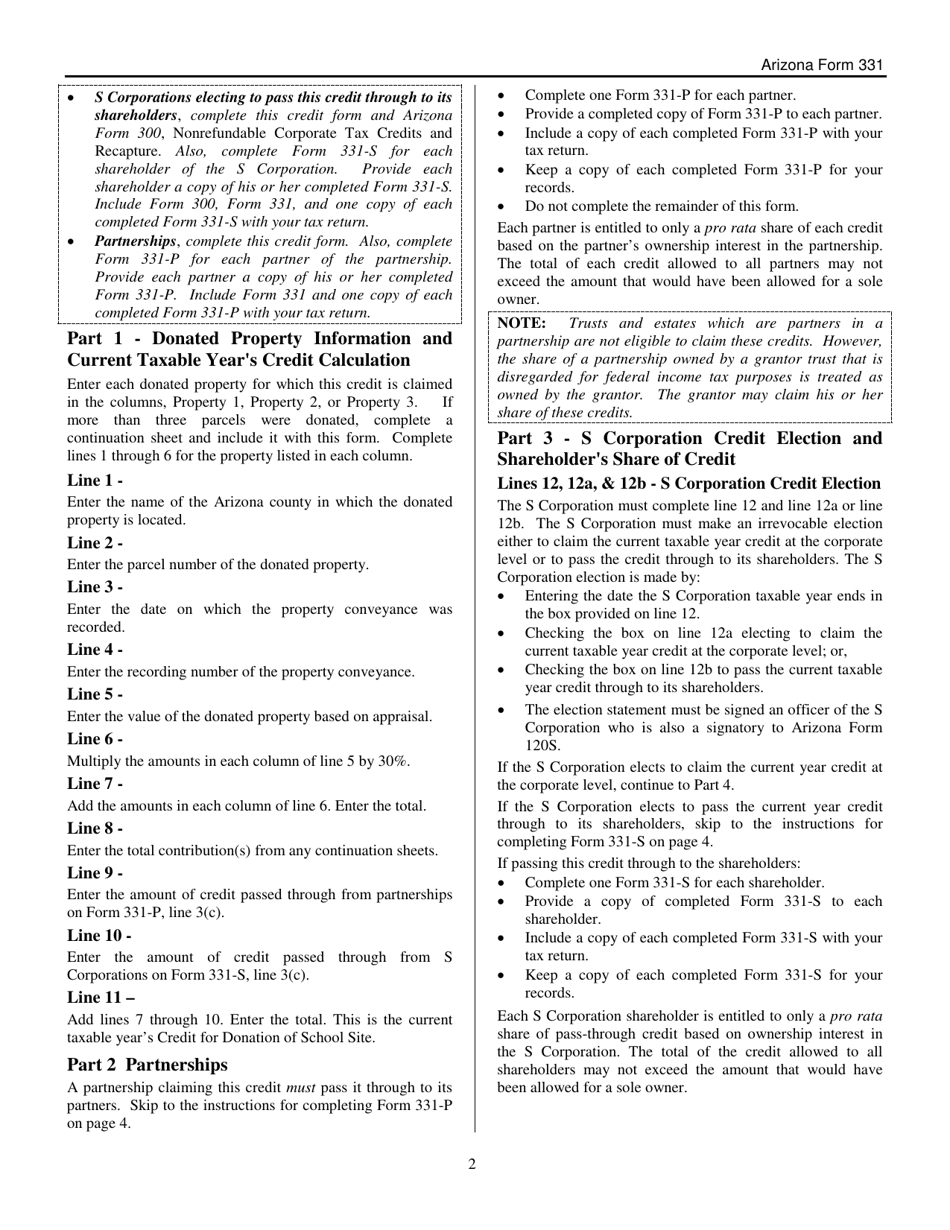

This document contains official instructions for Arizona Form 331 , Form ADOR10537 , Arizona Form 331-P , Form ADOR11328 , Arizona Form 331-S , and Form ADOR11329 . All forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 331 (ADOR10537) is available for download through this link. The latest available Arizona Form 331-P (ADOR11328) can be downloaded through this link. Arizona Form 331-S (ADOR11329) can be found here.

FAQ

Q: What is Arizona Form 331?

A: Arizona Form 331 is a tax form used in Arizona to report changes in ownership or control of an entity.

Q: What is ADOR10537?

A: ADOR10537 is the form number assigned by the Arizona Department of Revenue for Arizona Form 331.

Q: What is Arizona Form 331-P?

A: Arizona Form 331-P is used in Arizona to report changes in ownership or control of a partnership.

Q: What is ADOR11328?

A: ADOR11328 is the form number assigned by the Arizona Department of Revenue for Arizona Form 331-P.

Q: What is Arizona Form 331-S?

A: Arizona Form 331-S is used in Arizona to report changes in ownership or control of an S corporation.

Q: What is ADOR11329?

A: ADOR11329 is the form number assigned by the Arizona Department of Revenue for Arizona Form 331-S.

Q: Who needs to file Arizona Form 331?

A: Entities that have undergone changes in ownership or control during the tax year may need to file Arizona Form 331.

Q: Are there any filing fees for these forms?

A: No, there are no filing fees associated with Arizona Form 331, ADOR10537, Arizona Form 331-P, ADOR11328, Arizona Form 331-S, or ADOR11329.

Q: What is the deadline to file these forms?

A: The deadline to file these forms is generally the same as the deadline for filing the entity's annual tax return in Arizona.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.