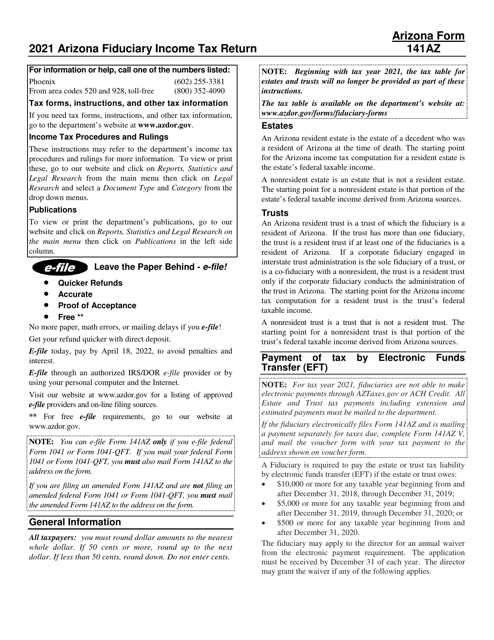

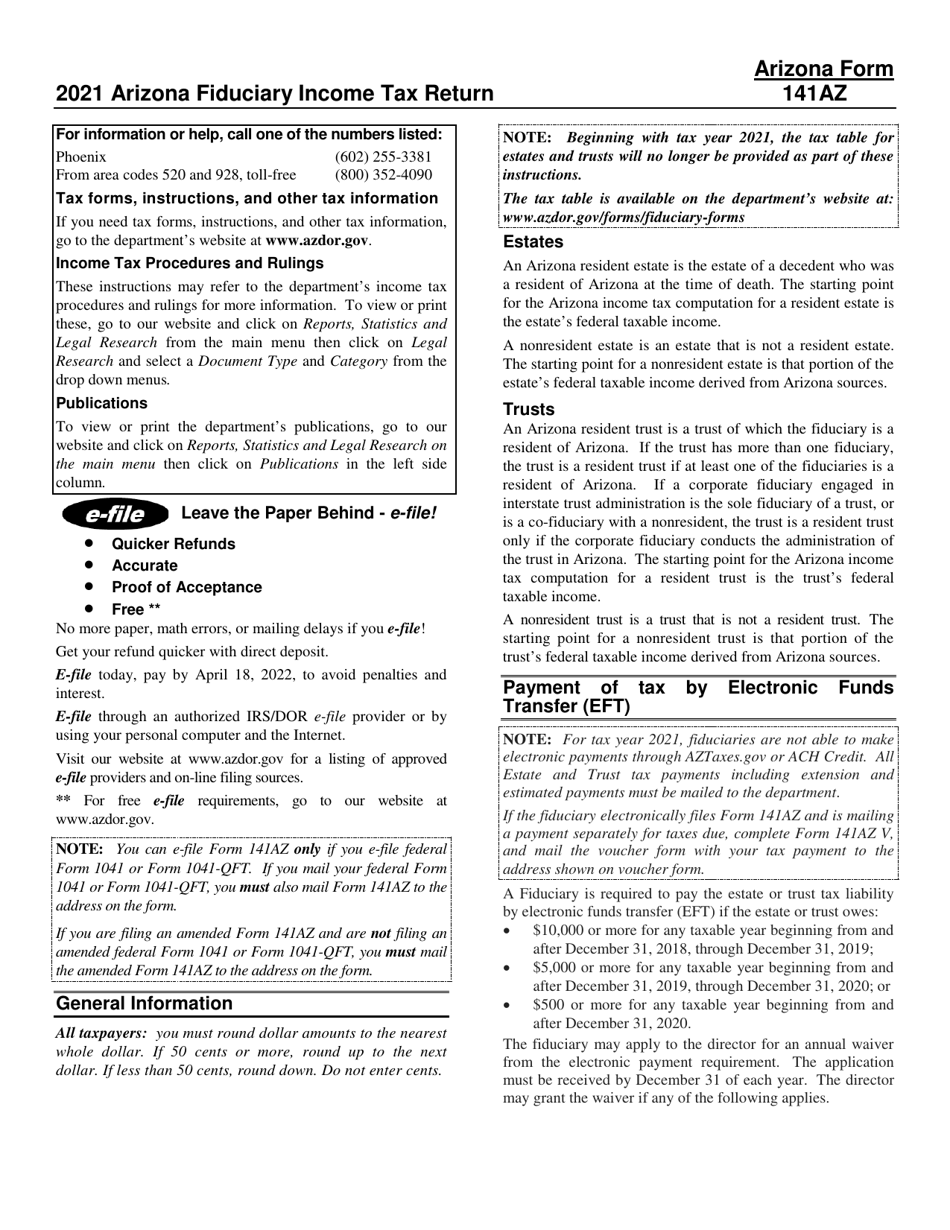

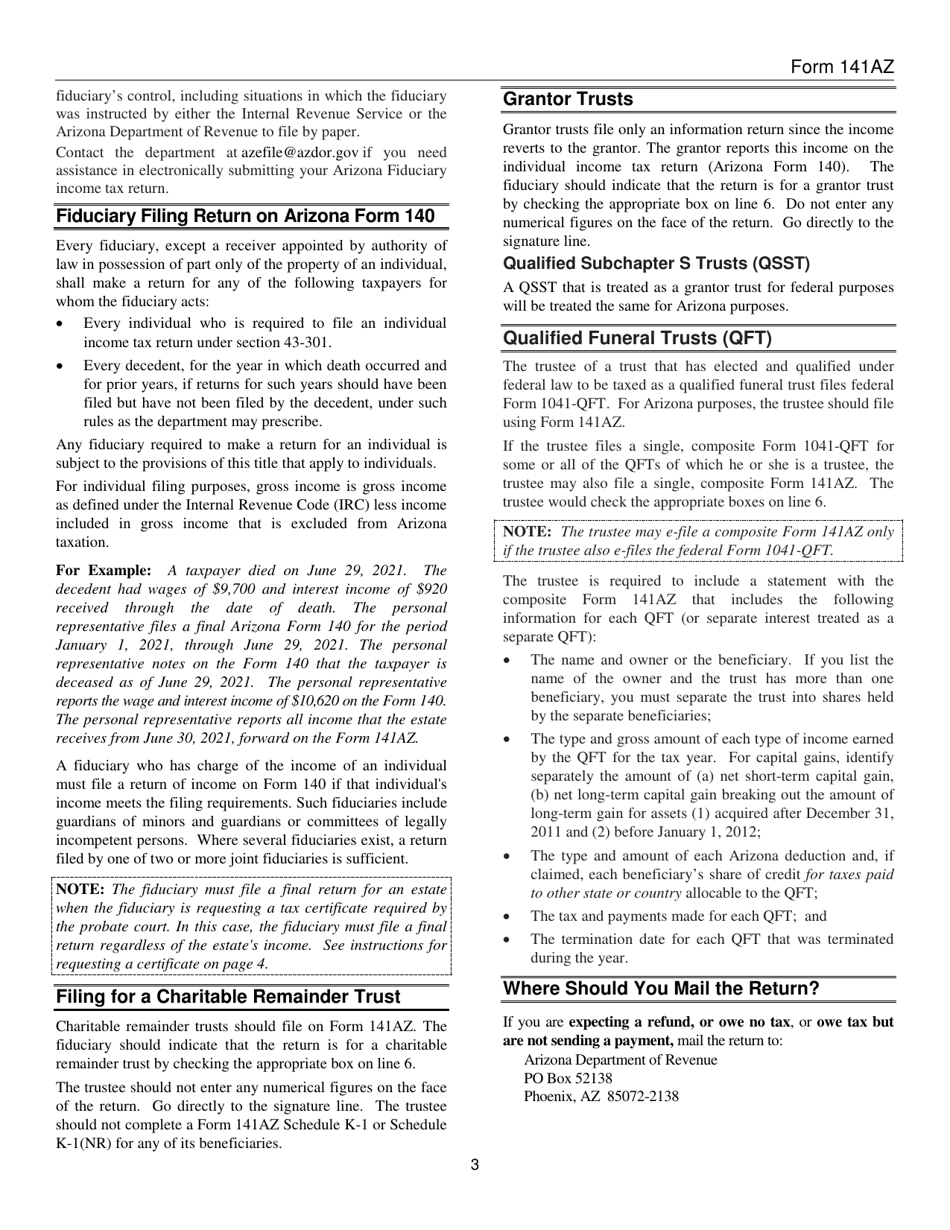

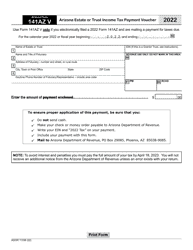

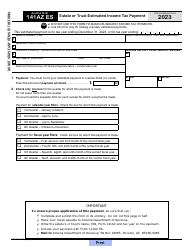

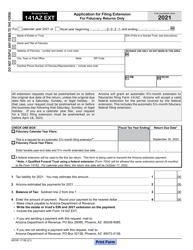

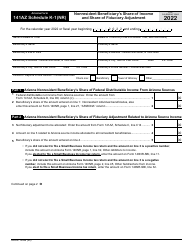

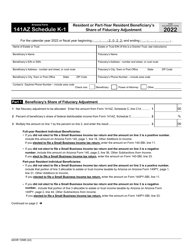

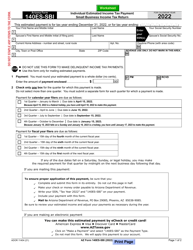

Instructions for Arizona Form 141 AZ, ADOR10584 Arizona Fiduciary Income Tax Return - Arizona

This document contains official instructions for Arizona Form 141 AZ , and Form ADOR10584 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 141 AZ (ADOR10584) is available for download through this link.

FAQ

Q: What is the Arizona Form 141 AZ?

A: The Arizona Form 141 AZ is the Arizona Fiduciary Income Tax Return.

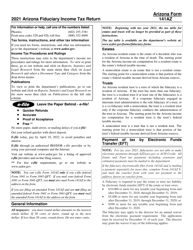

Q: Who is required to file the Arizona Form 141 AZ?

A: Any fiduciary, such as a trustee or executor, who controls and manages income on behalf of someone else must file the Arizona Form 141 AZ.

Q: What is the purpose of filing the Arizona Form 141 AZ?

A: The purpose of filing the Arizona Form 141 AZ is to report and pay taxes on the income earned by a trust or estate in Arizona.

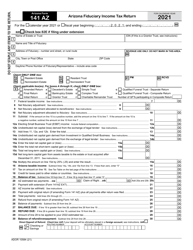

Q: What information do I need to fill out the Arizona Form 141 AZ?

A: To fill out the Arizona Form 141 AZ, you will need information about the trust or estate's income, deductions, and credits, as well as the beneficiaries' information.

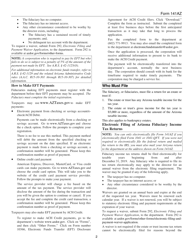

Instruction Details:

- This 19-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.