This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Arizona Form 140, ADOR10571 Schedule A

for the current year.

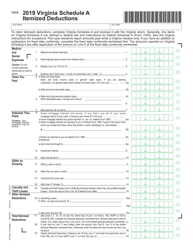

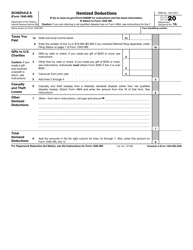

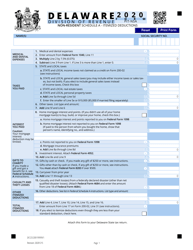

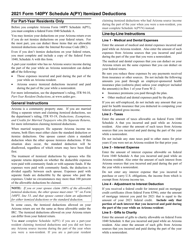

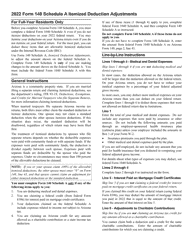

Instructions for Arizona Form 140, ADOR10571 Schedule A Itemized Deduction Adjustments - Arizona

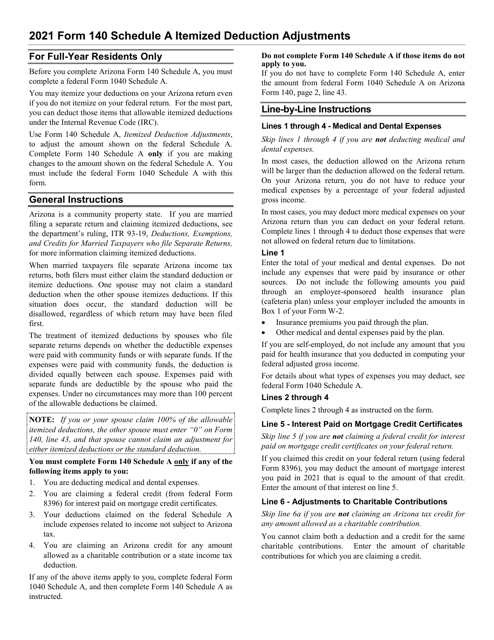

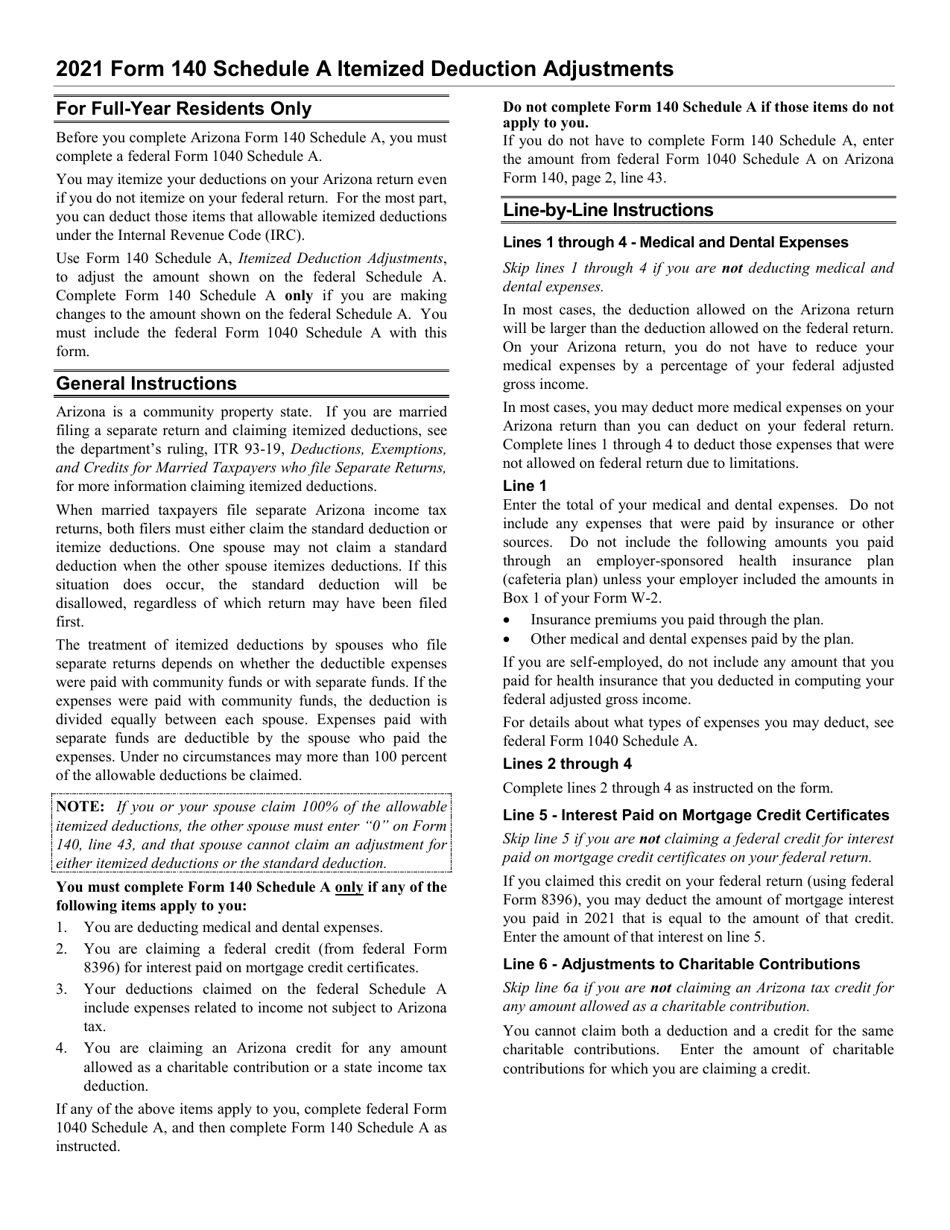

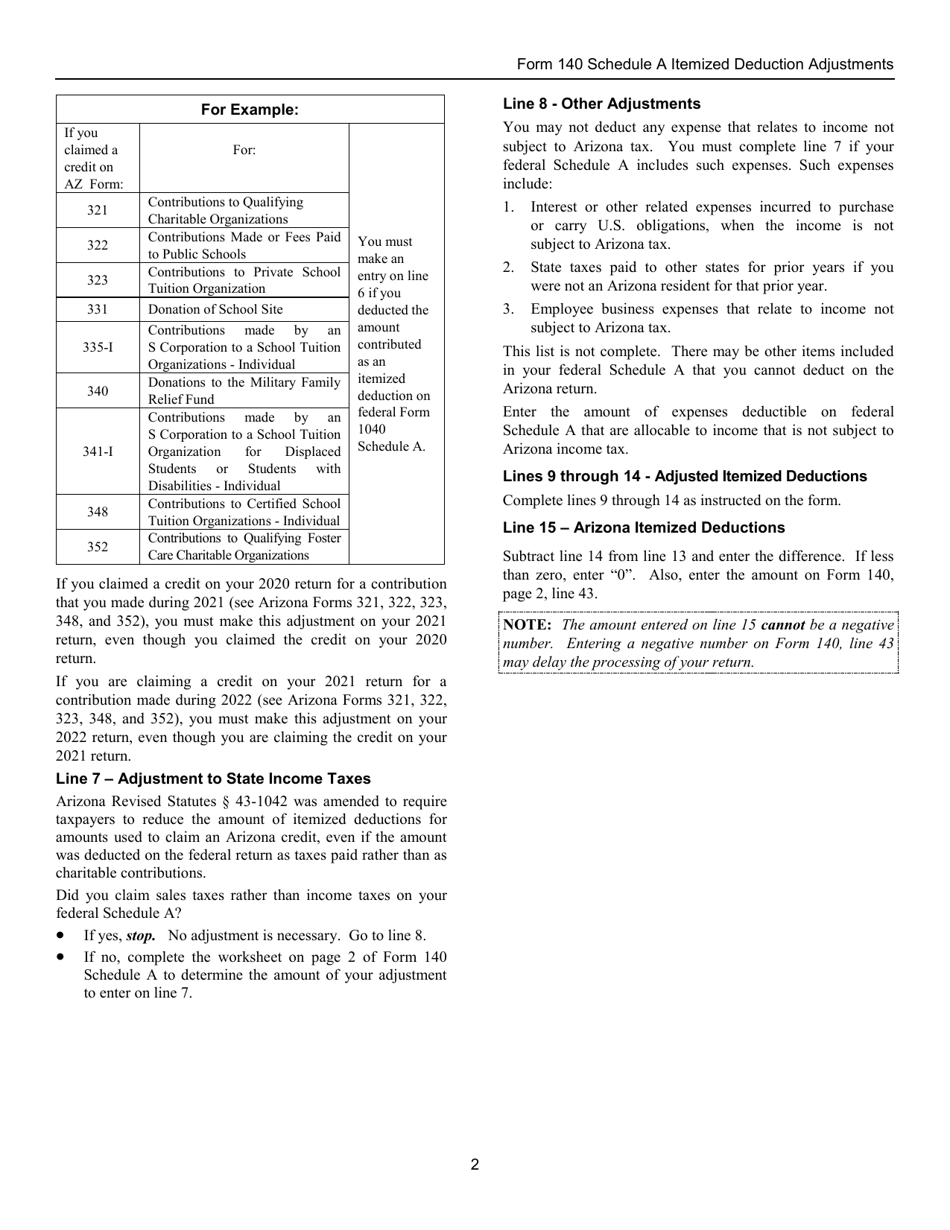

This document contains official instructions for Arizona Form 140 Schedule A and Form ADOR10571 Schedule A . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Arizona Form 140, ADOR10571?

A: Arizona Form 140, ADOR10571 is a form used in Arizona for itemized deduction adjustments.

Q: What is Schedule A?

A: Schedule A is a section on Arizona Form 140, ADOR10571 where you report your itemized deduction adjustments.

Q: What are itemized deduction adjustments?

A: Itemized deduction adjustments are specific deductions that can be made on your Arizona tax return.

Q: How do I fill out Schedule A?

A: To fill out Schedule A, you need to enter the amount of each itemized deduction adjustment that applies to you.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.