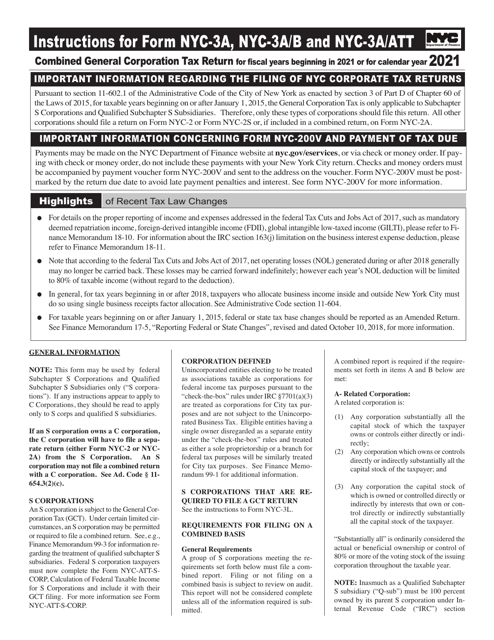

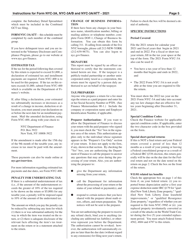

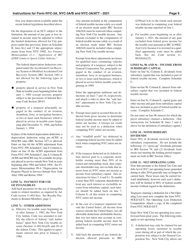

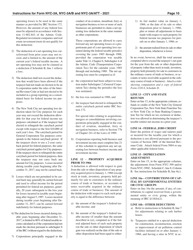

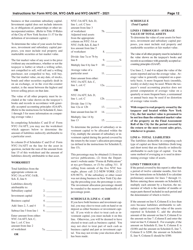

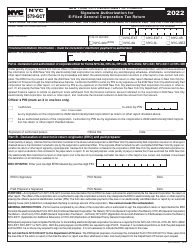

Instructions for Form NYC-3A, NYC-3A / B, NYC-3A / ATT - New York City

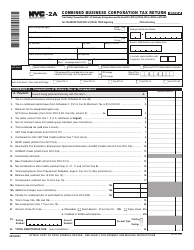

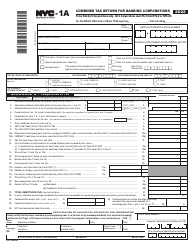

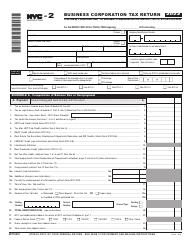

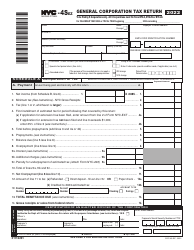

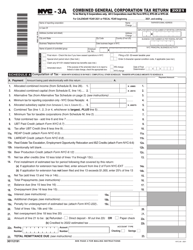

Form NYC-3A Combined General Corporation Tax Return - New York City

Form NYC-3A Combined General Corporation Tax Return - New York City

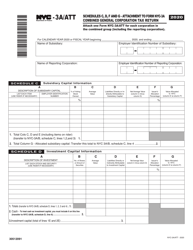

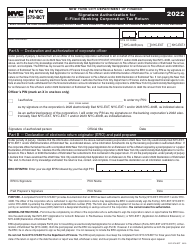

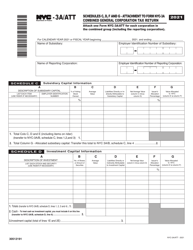

Form NYC-3A/B Subsidiary Detail Spreadsheet Attachment to Form Nyc-3a - Combined General Corporation Tax Return - New York City

Form NYC-3A/B Subsidiary Detail Spreadsheet Attachment to Form Nyc-3a - Combined General Corporation Tax Return - New York City

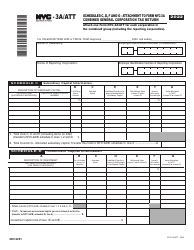

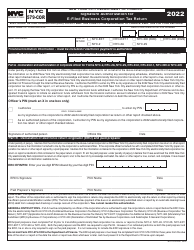

Form NYC-3A/ATT Schedule C, D, F, G Attachment to Combined General Corporation Tax Return - New York City

Form NYC-3A/ATT Schedule C, D, F, G Attachment to Combined General Corporation Tax Return - New York City

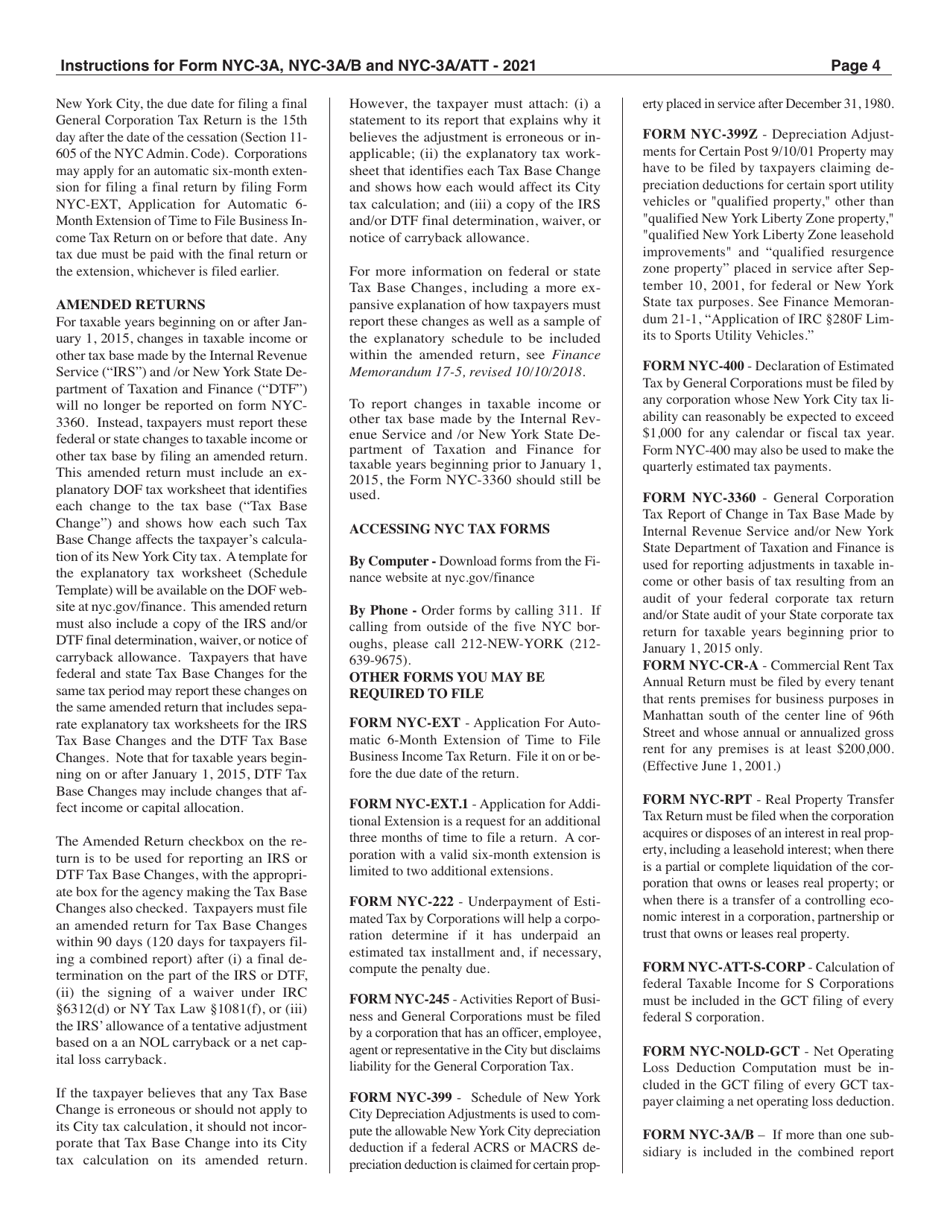

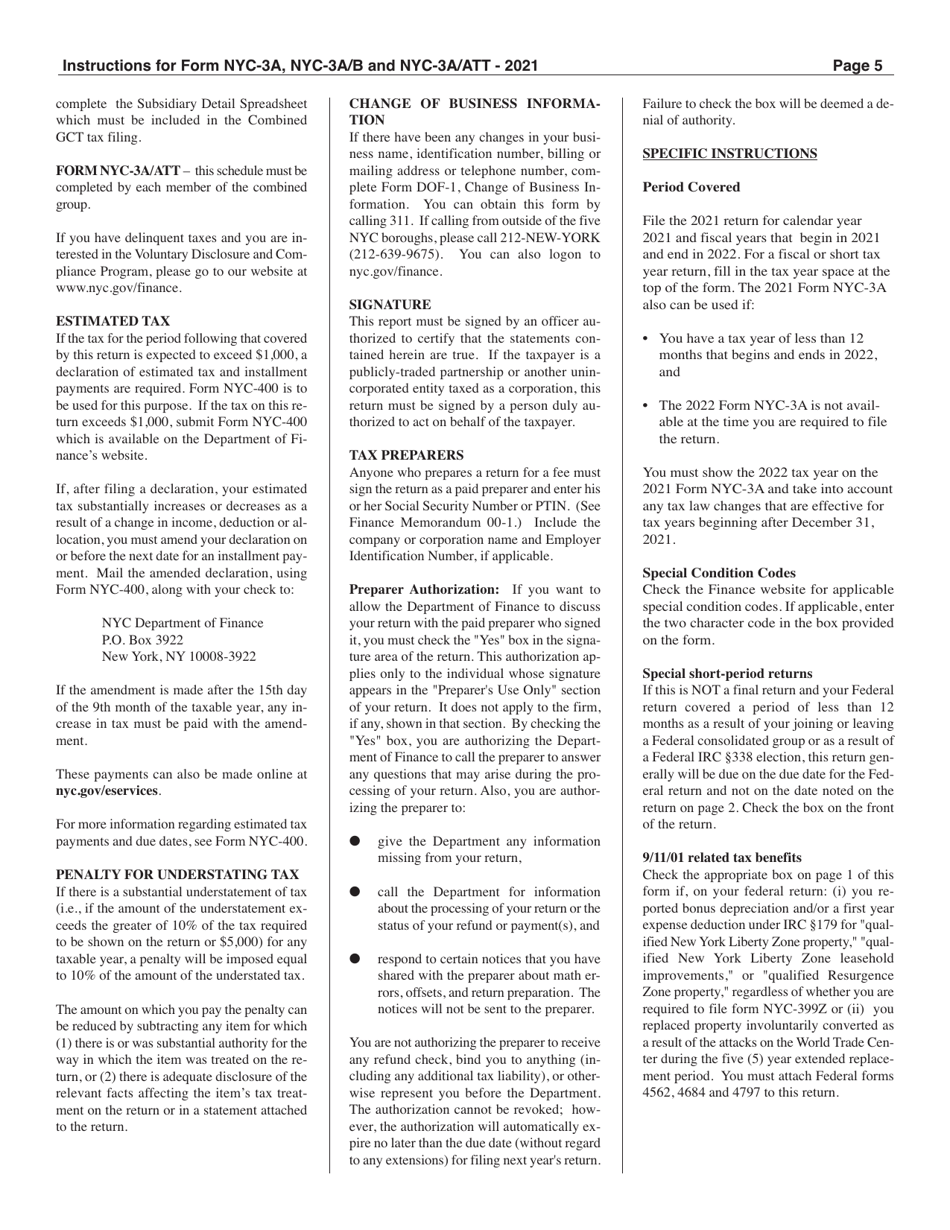

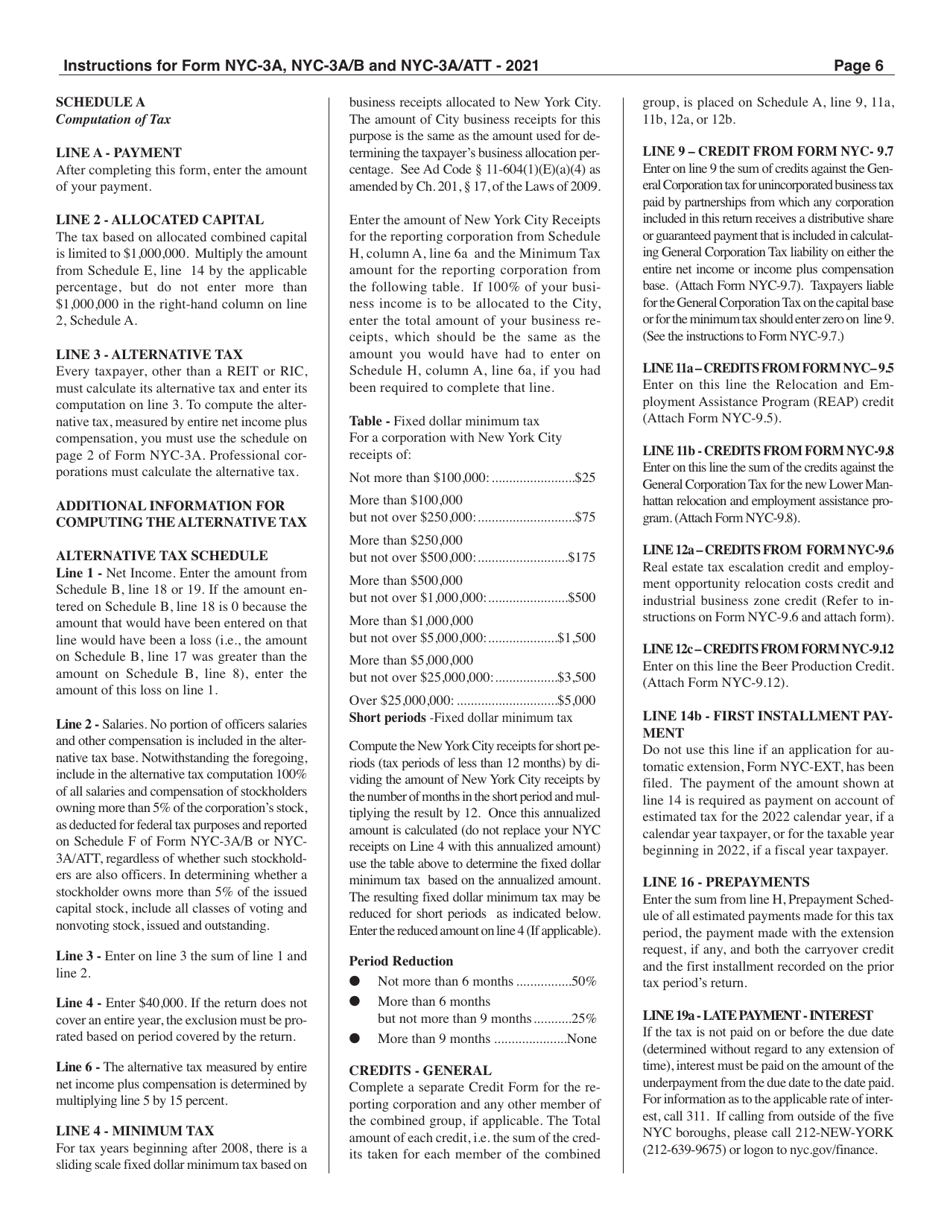

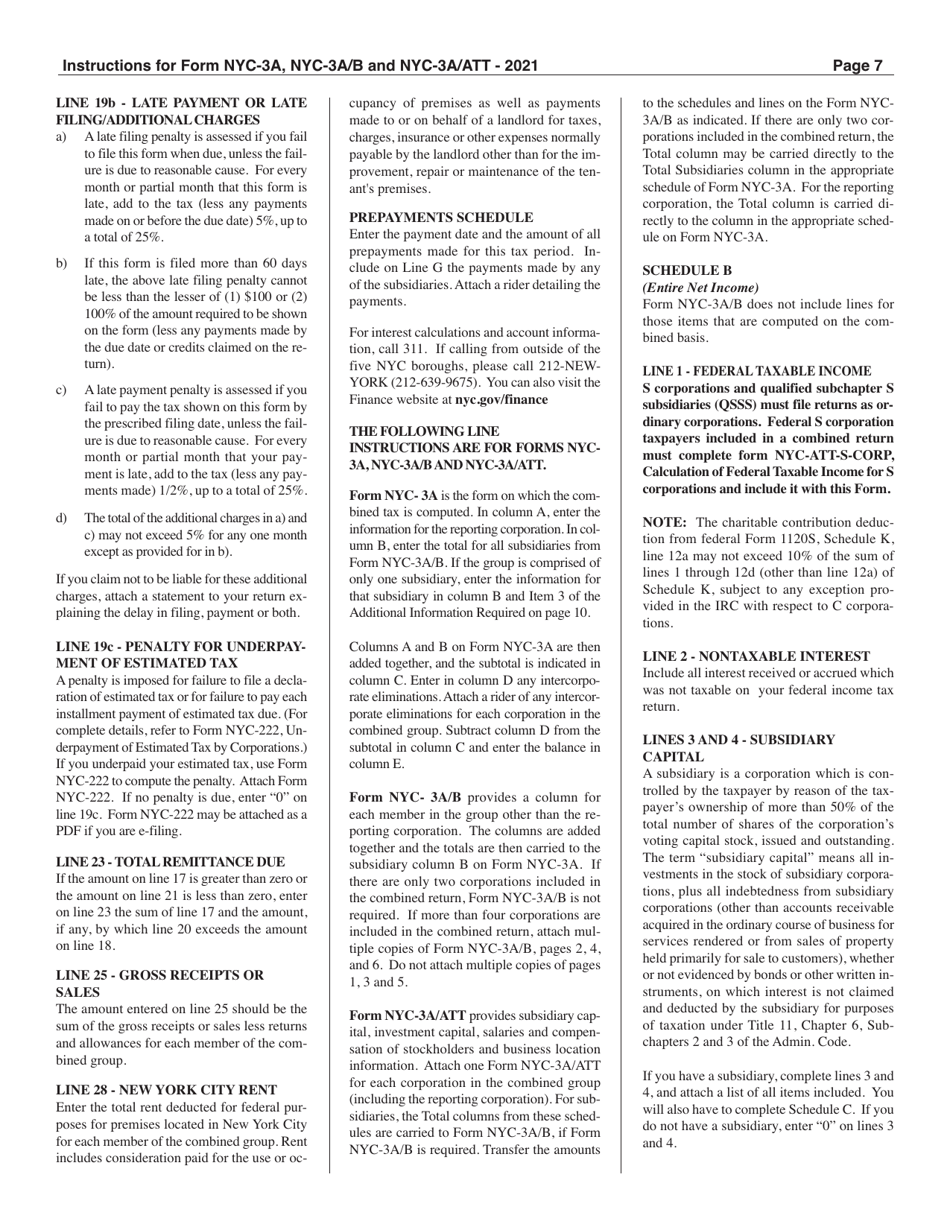

This document contains official instructions for Form NYC-3A , Form NYC-3A/B , and Form NYC-3A/ATT . All forms are released and collected by the New York City Department of Finance. An up-to-date fillable Form NYC-3A is available for download through this link. The latest available Form NYC-3A/B can be downloaded through this link. Form NYC-3A/ATT Schedule C, D, F, G can be found here.

FAQ

Q: What is Form NYC-3A?

A: Form NYC-3A is a tax form used in New York City.

Q: What are the other versions of Form NYC-3A?

A: The other versions of Form NYC-3A are NYC-3A/B and NYC-3A/ATT.

Q: What is Form NYC-3A used for?

A: Form NYC-3A is used to report business income and expenses for businesses in New York City.

Q: Who needs to file Form NYC-3A?

A: Businesses operating in New York City need to file Form NYC-3A.

Q: Is Form NYC-3A required for individuals?

A: No, Form NYC-3A is not required for individuals. It is only for businesses.

Q: When is the deadline for filing Form NYC-3A?

A: The deadline for filing Form NYC-3A is usually April 15th, but it may vary. Check the instructions for the specific year.

Q: Are there any filing fees for Form NYC-3A?

A: No, there are no filing fees for Form NYC-3A.

Q: What if I made a mistake on Form NYC-3A?

A: If you made a mistake on Form NYC-3A, you can file an amended return to correct it.

Q: Who can I contact for assistance with Form NYC-3A?

A: You can contact the New York City Department of Finance for assistance with Form NYC-3A.

Instruction Details:

- This 15-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York City Department of Finance.