This version of the form is not currently in use and is provided for reference only. Download this version of

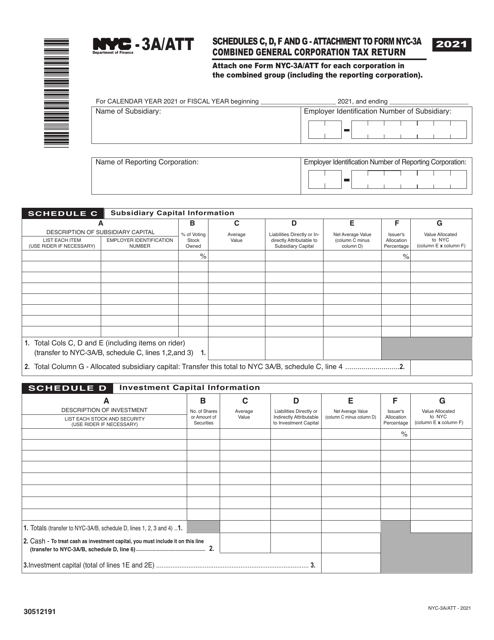

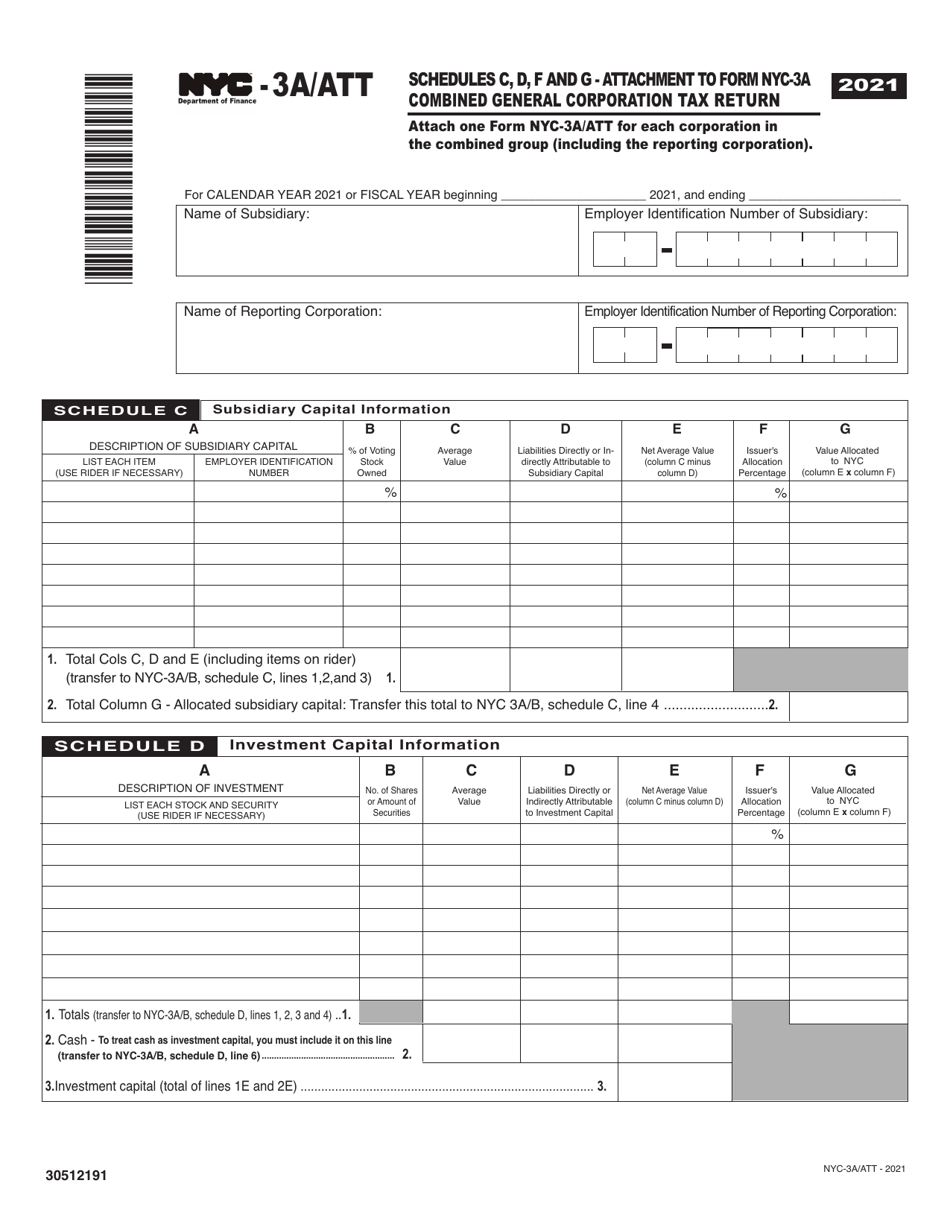

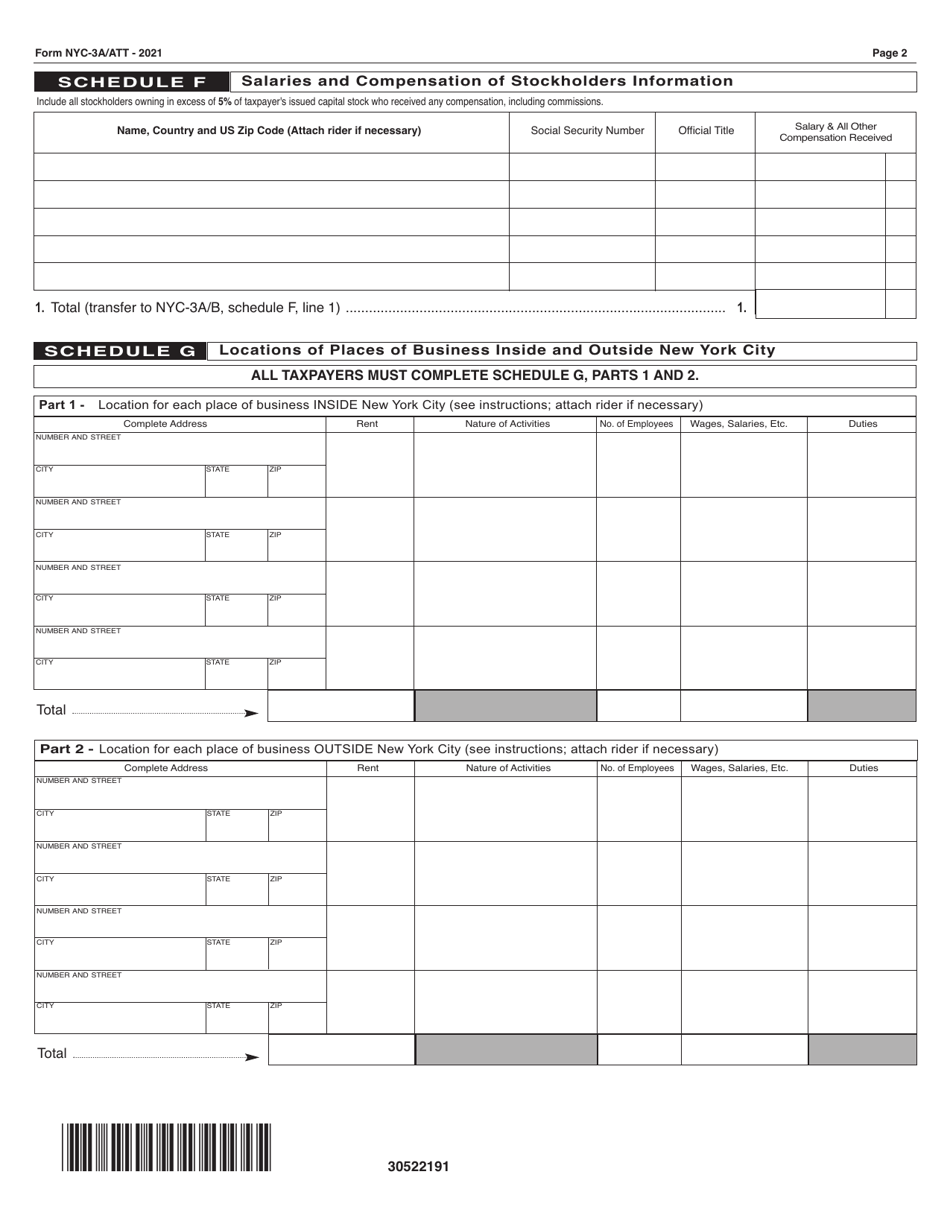

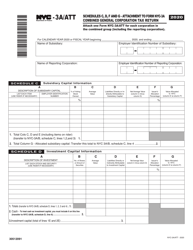

Form NYC-3A/ATT Schedule C, D, F, G

for the current year.

Form NYC-3A / ATT Schedule C, D, F, G Attachment to Combined General Corporation Tax Return - New York City

What Is Form NYC-3A/ATT Schedule C, D, F, G?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-3A/ATT Schedule C?

A: NYC-3A/ATT Schedule C is an attachment to the Combined General Corporation Tax Return for businesses in New York City.

Q: What is the purpose of NYC-3A/ATT Schedule C?

A: The purpose of NYC-3A/ATT Schedule C is to report information related to certain credits and incentives.

Q: What is NYC-3A/ATT Schedule D?

A: NYC-3A/ATT Schedule D is another attachment to the Combined General Corporation Tax Return that is used to report net income or loss for the tax year.

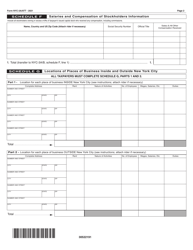

Q: What is NYC-3A/ATT Schedule F?

A: NYC-3A/ATT Schedule F is an attachment used to report net income or loss from rental or royalty income.

Q: What is NYC-3A/ATT Schedule G?

A: NYC-3A/ATT Schedule G is an attachment used to report information related to general corporation tax credits and incentives.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-3A/ATT Schedule C, D, F, G by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.