This version of the form is not currently in use and is provided for reference only. Download this version of

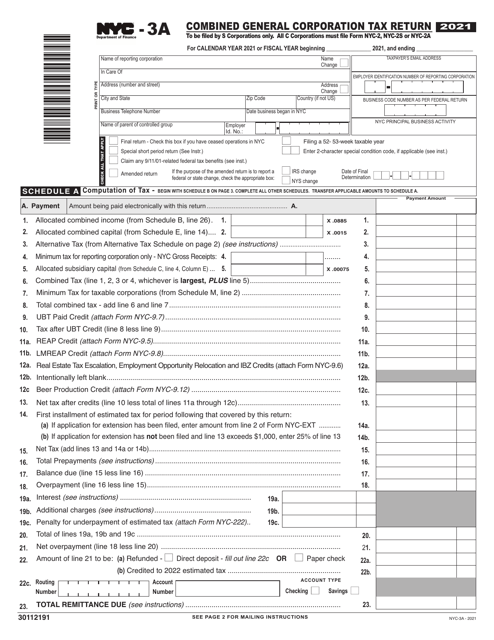

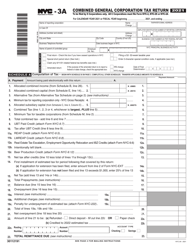

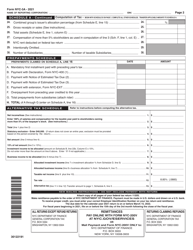

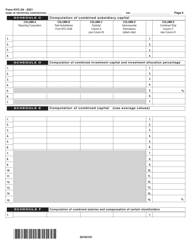

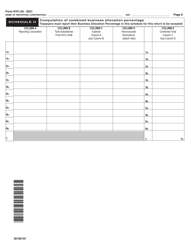

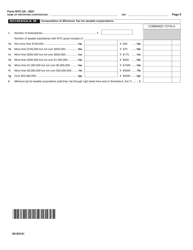

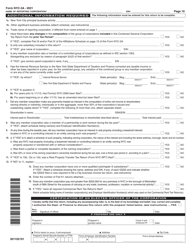

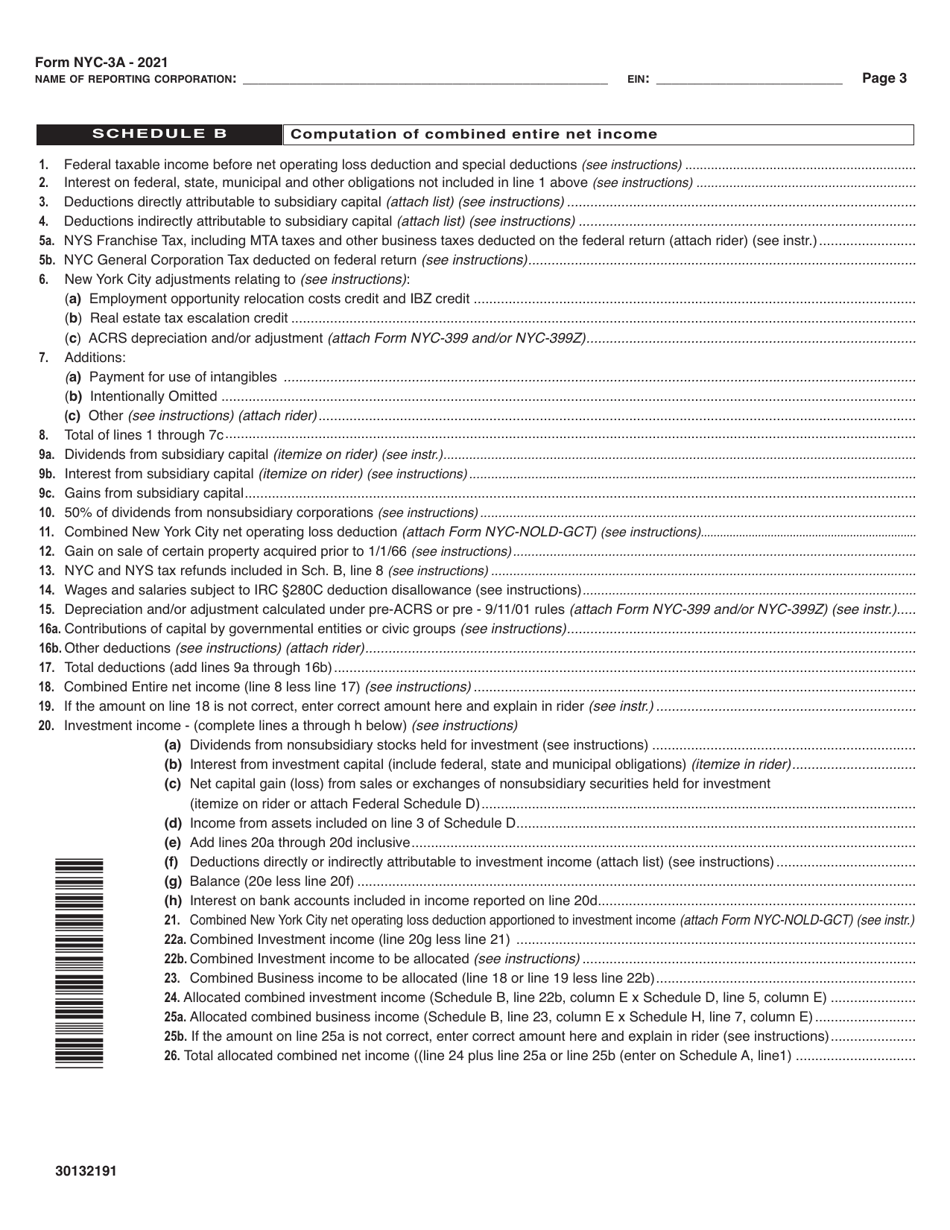

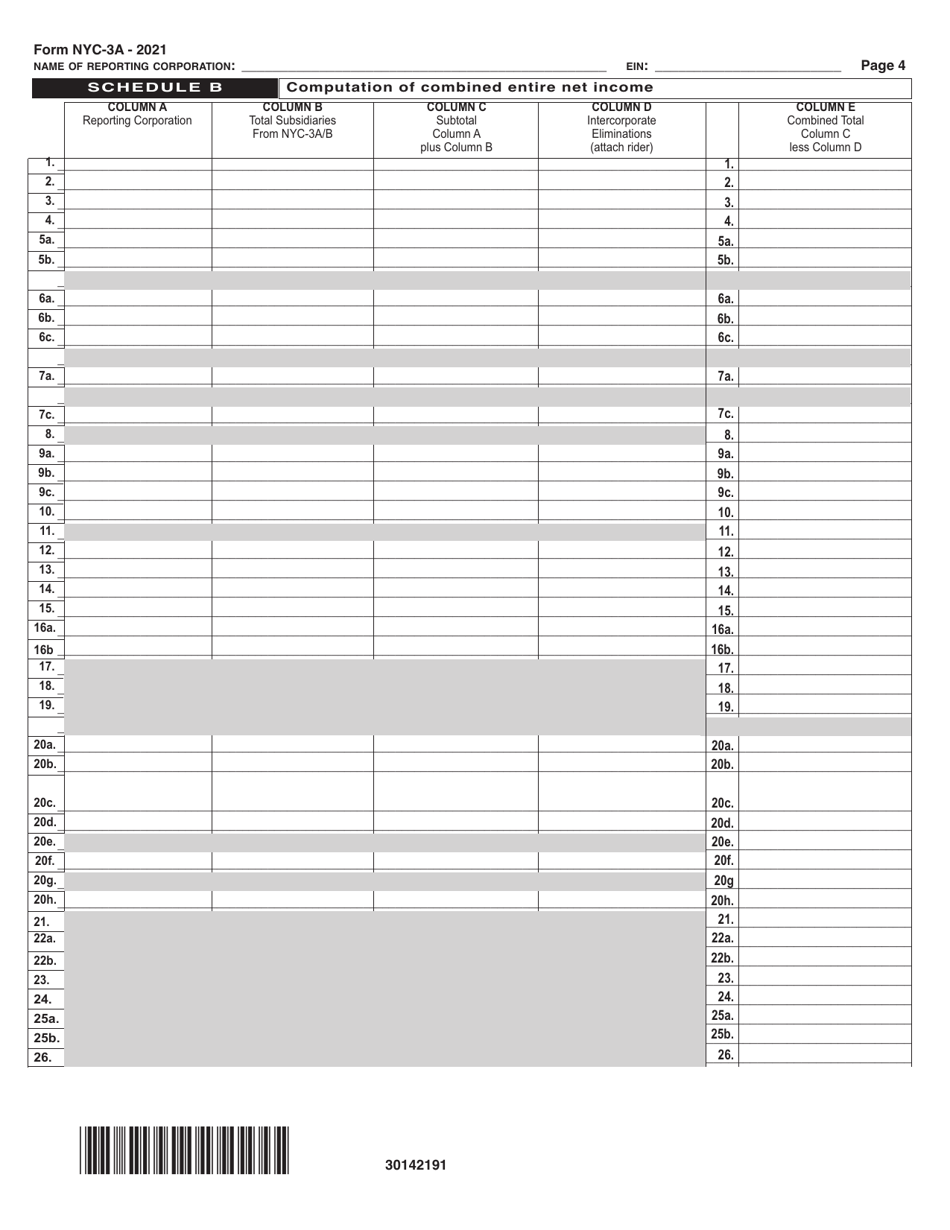

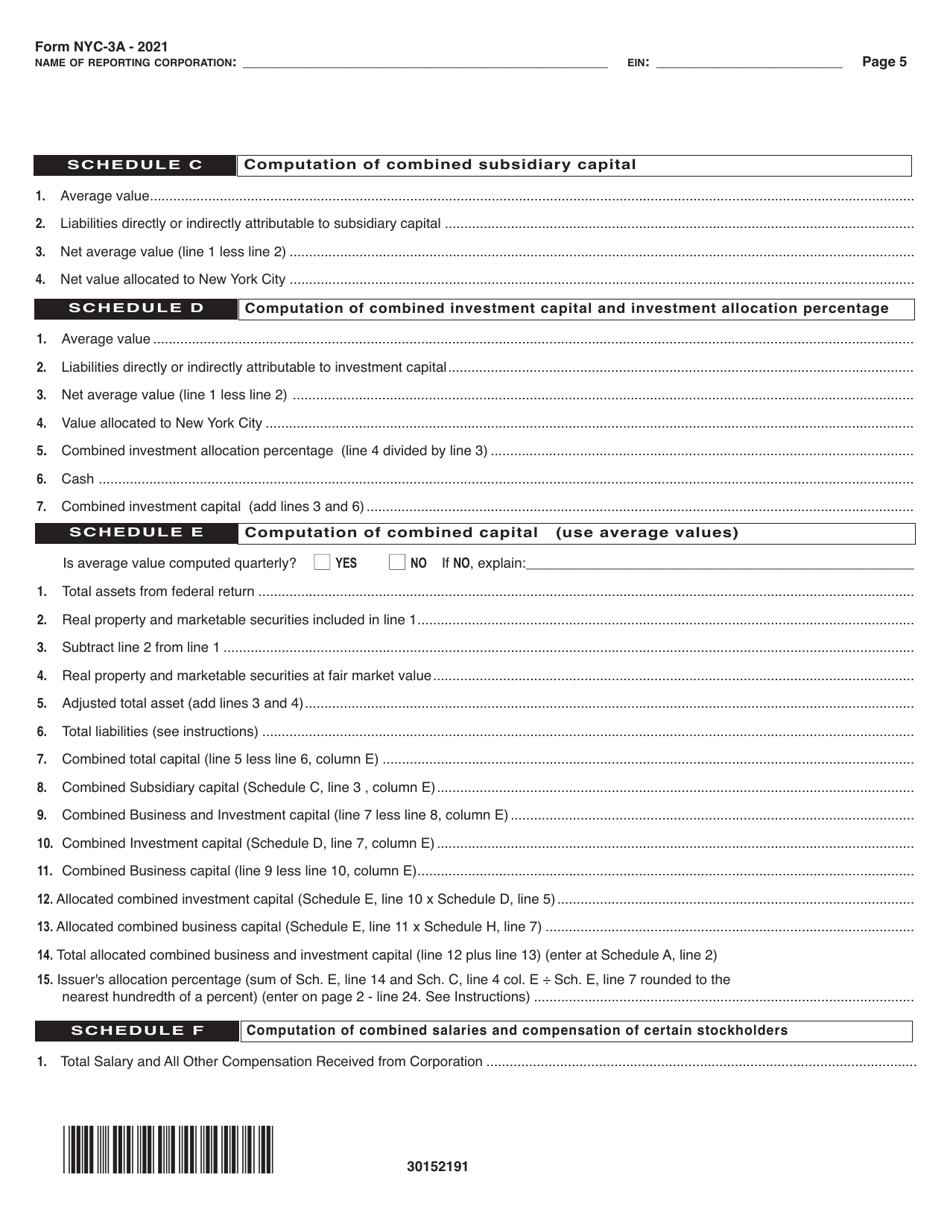

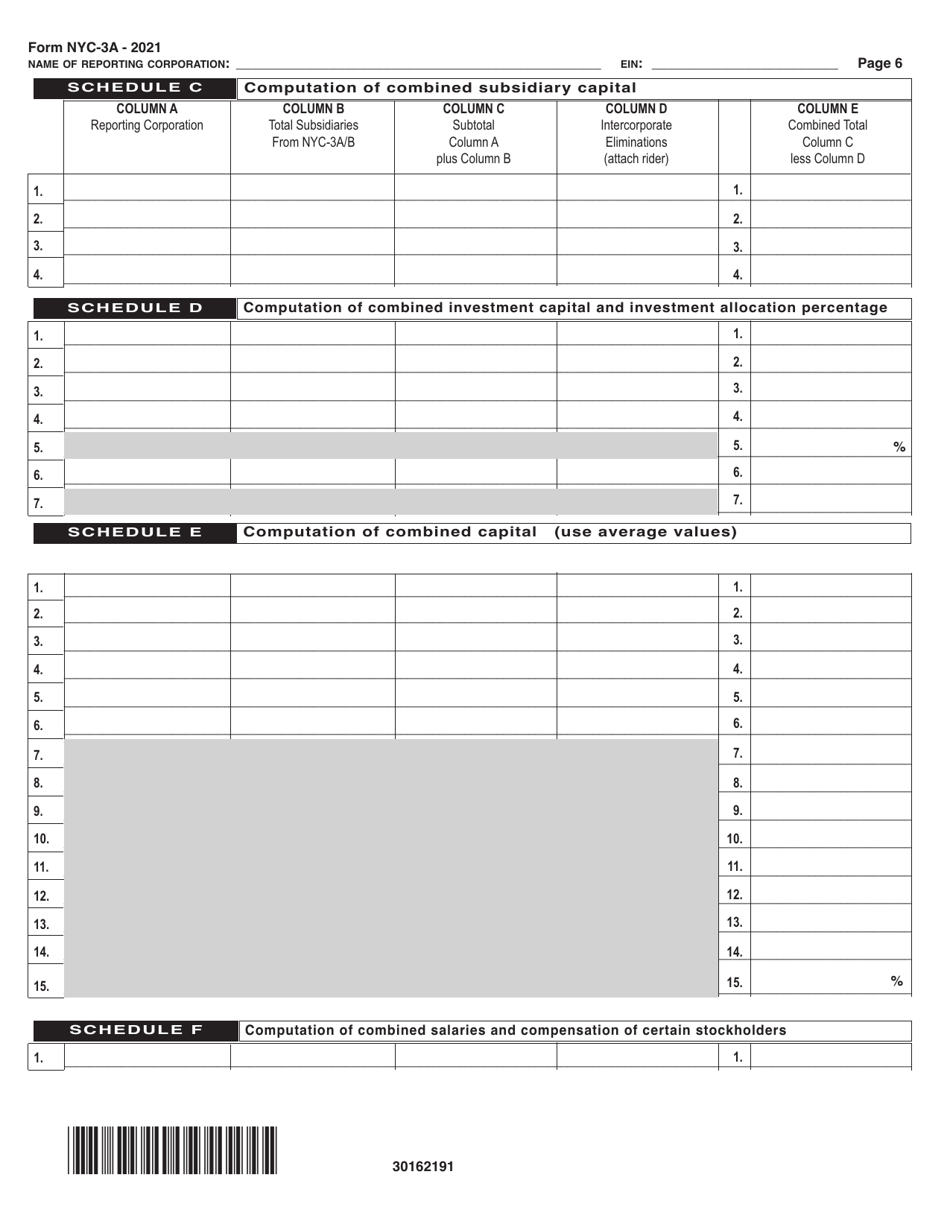

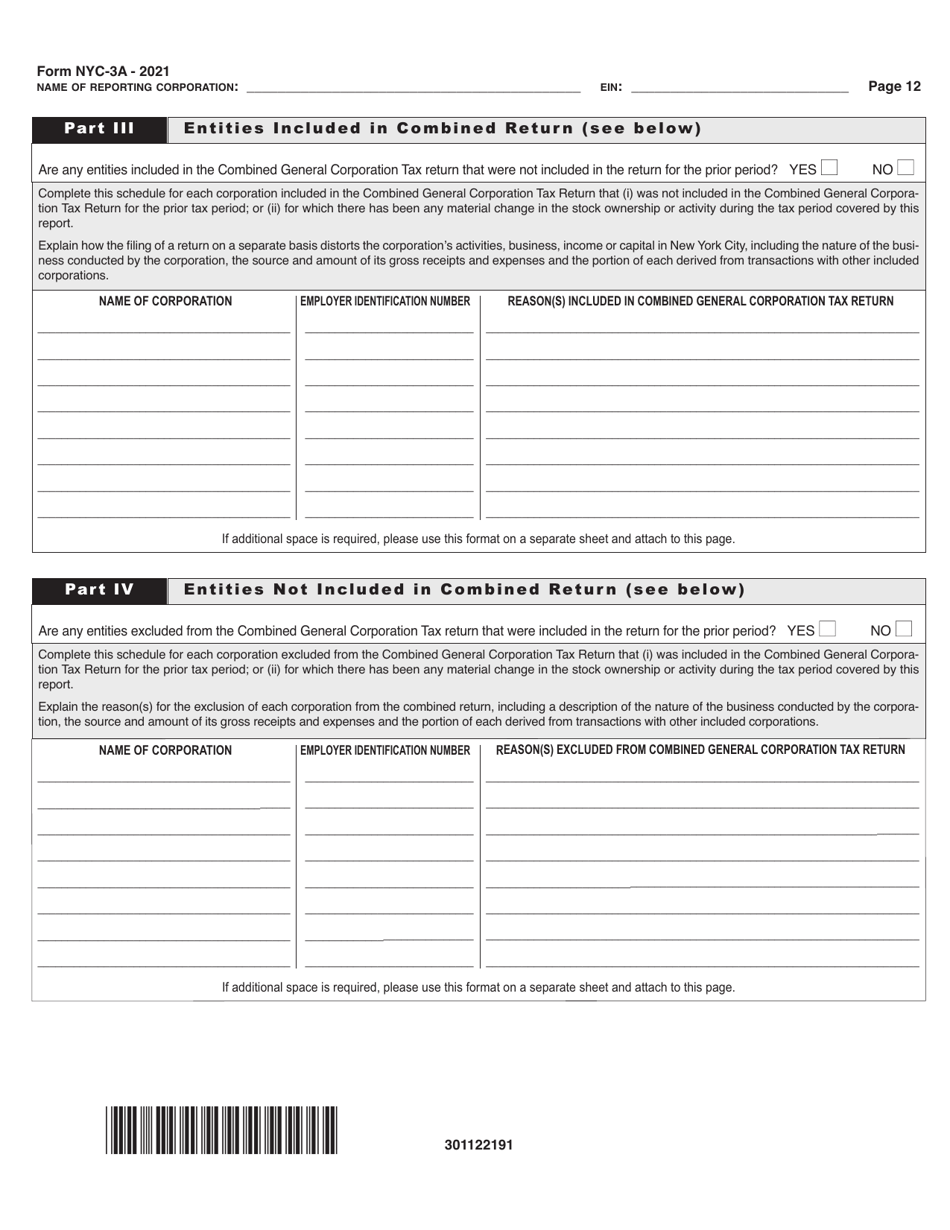

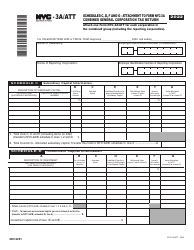

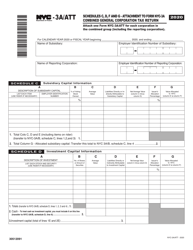

Form NYC-3A

for the current year.

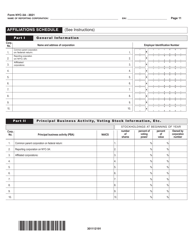

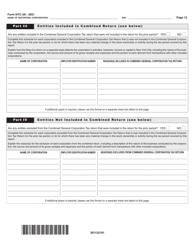

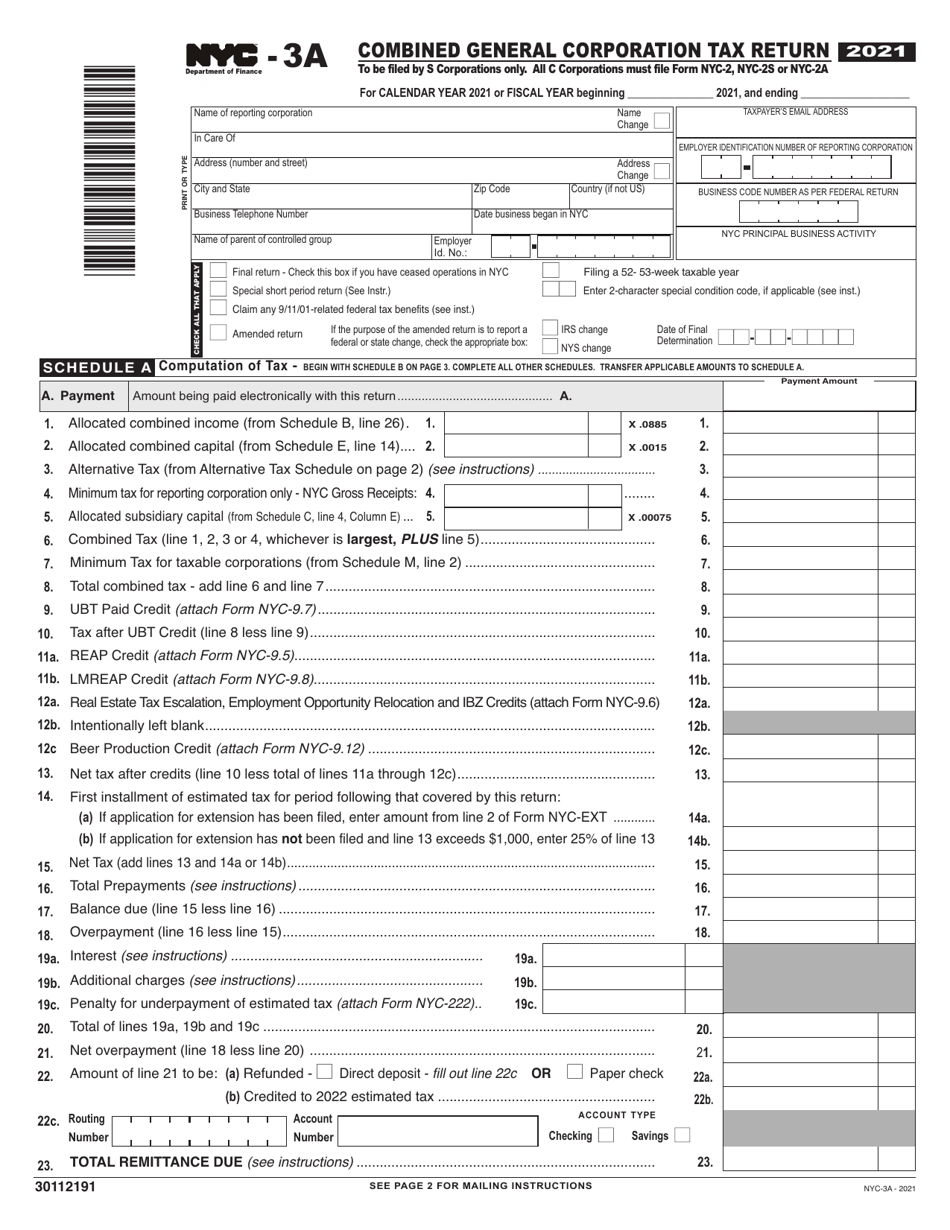

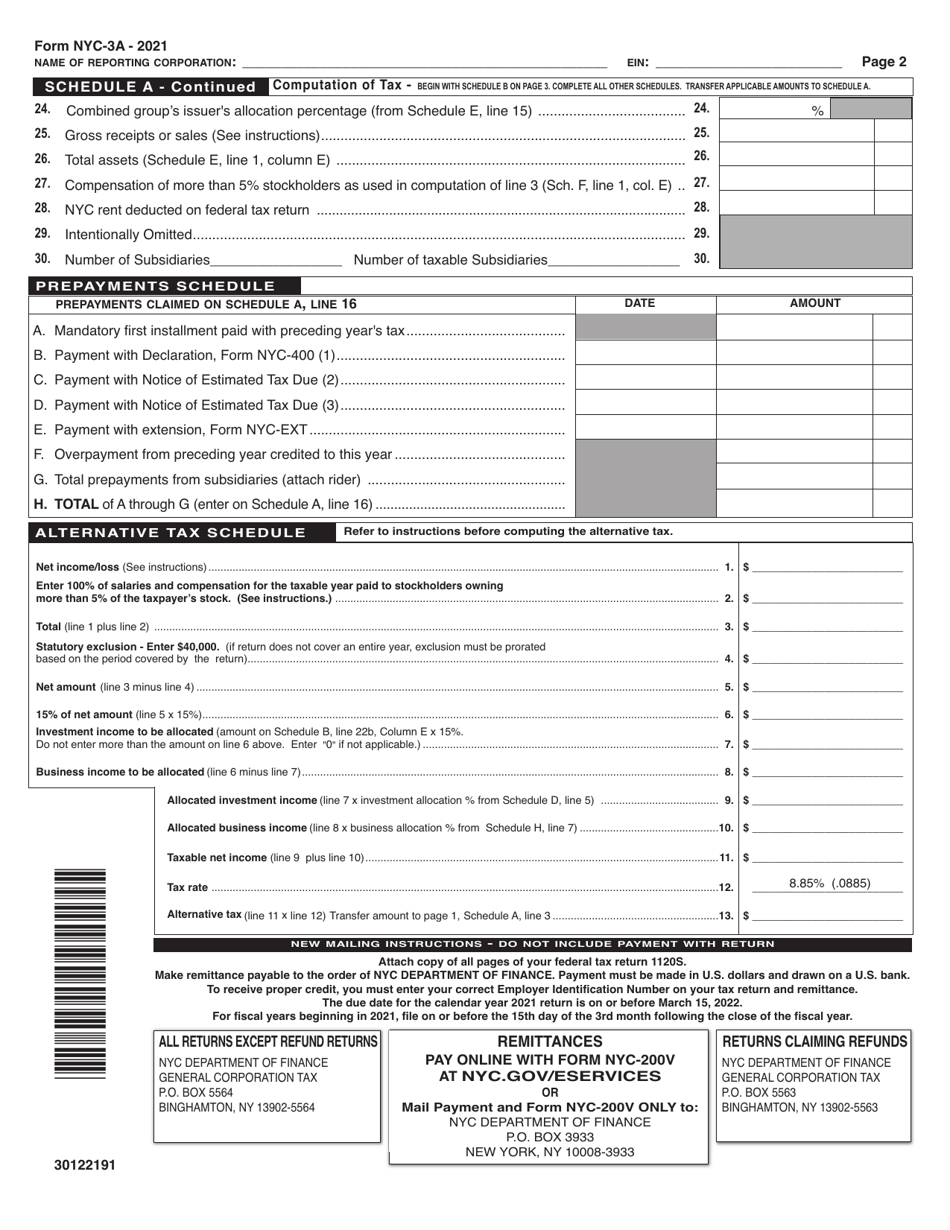

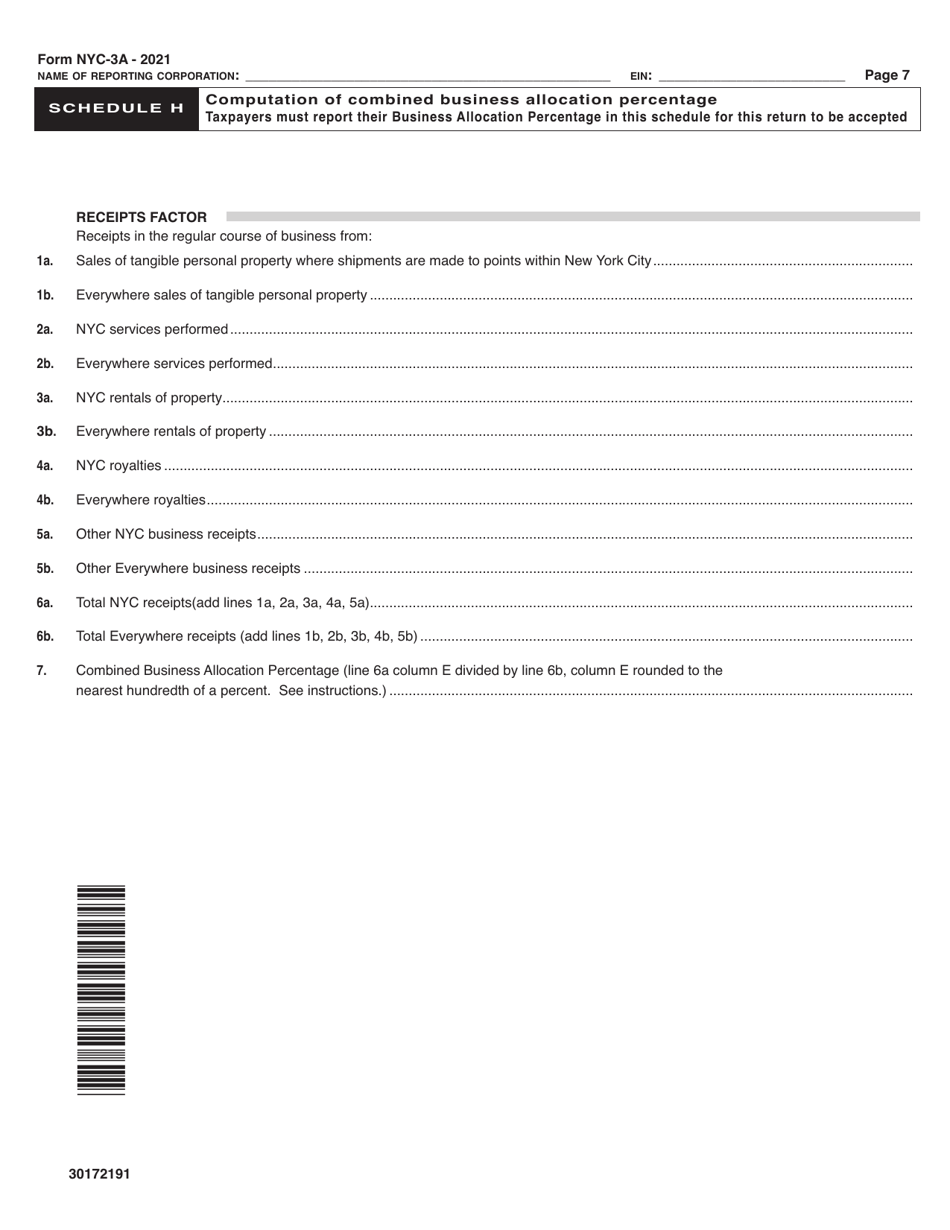

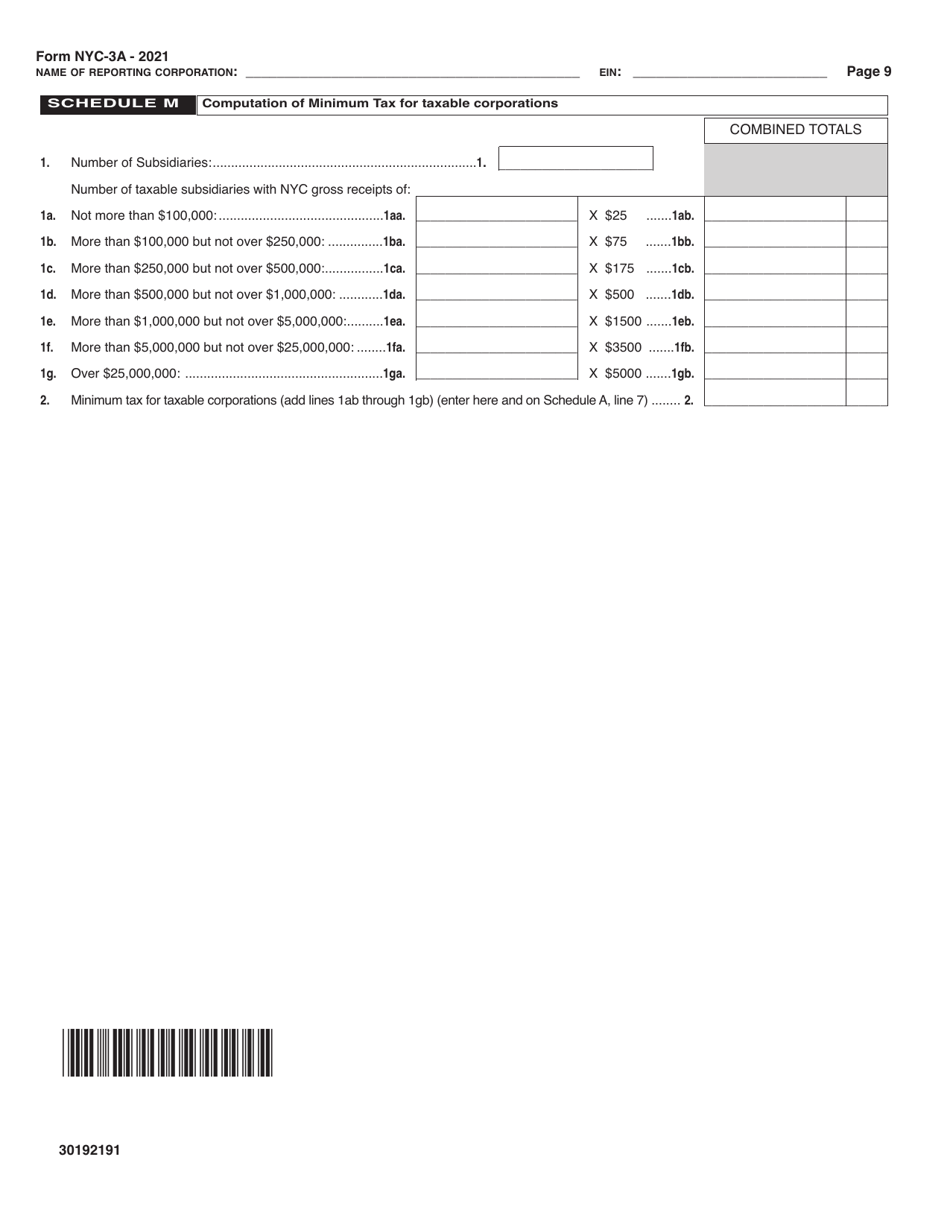

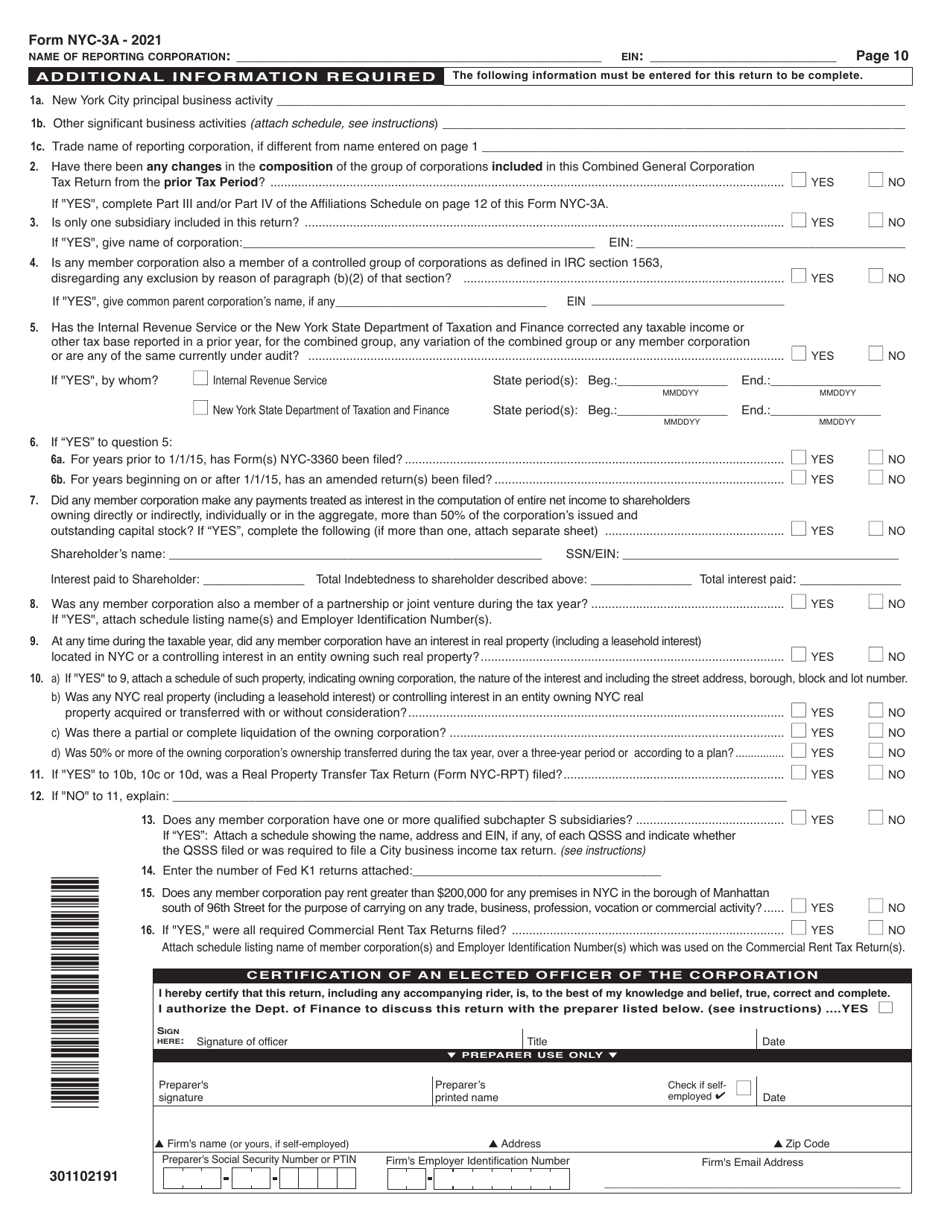

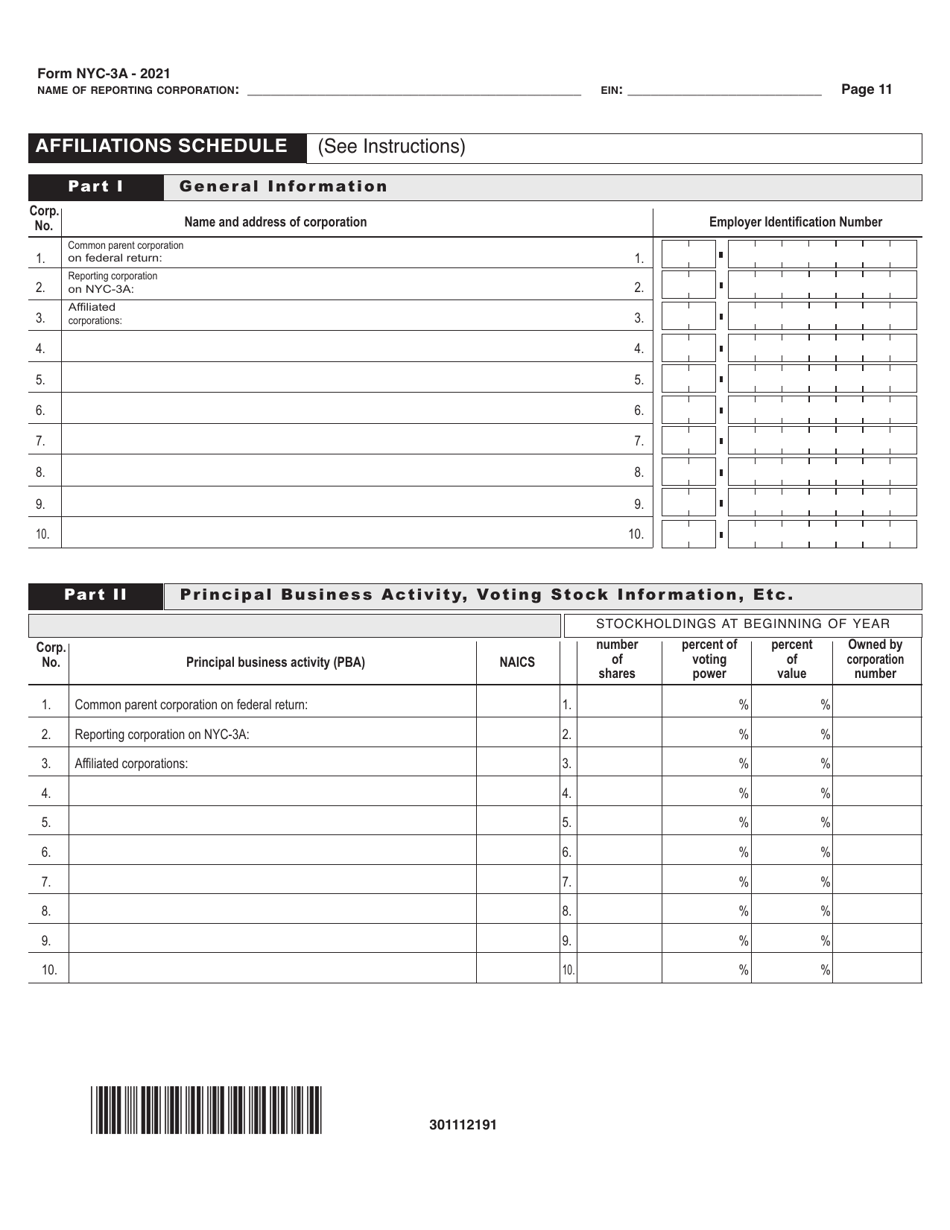

Form NYC-3A Combined General Corporation Tax Return - New York City

What Is Form NYC-3A?

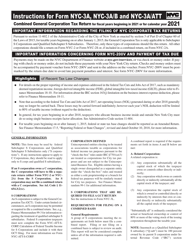

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the NYC-3A Combined General Corporation Tax Return?

A: The NYC-3A Combined General Corporation Tax Return is a tax form that certain corporations in New York City must file to report their income and calculate their tax liability.

Q: Who needs to file the NYC-3A Combined General Corporation Tax Return?

A: Corporations doing business in New York City are generally required to file the NYC-3A Combined General Corporation Tax Return if they meet certain criteria, such as having a certain amount of gross income or doing business in specific industries.

Q: When is the deadline to file the NYC-3A Combined General Corporation Tax Return?

A: The deadline to file the NYC-3A Combined General Corporation Tax Return is usually March 15th of the year following the tax year, unless an extension has been granted.

Q: What should I include when filing the NYC-3A Combined General Corporation Tax Return?

A: When filing the NYC-3A Combined General Corporation Tax Return, you should include all relevant income, deductions, and other information necessary to calculate your tax liability.

Q: Are there any penalties for late filing or non-compliance with the NYC-3A Combined General Corporation Tax Return?

A: Yes, there are penalties for late filing or non-compliance with the NYC-3A Combined General Corporation Tax Return, including interest charges and potential legal action.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-3A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.