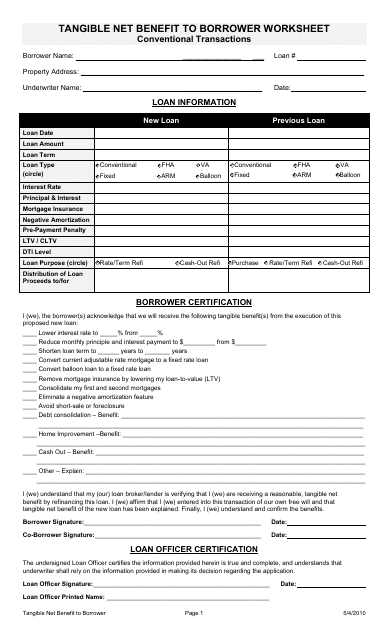

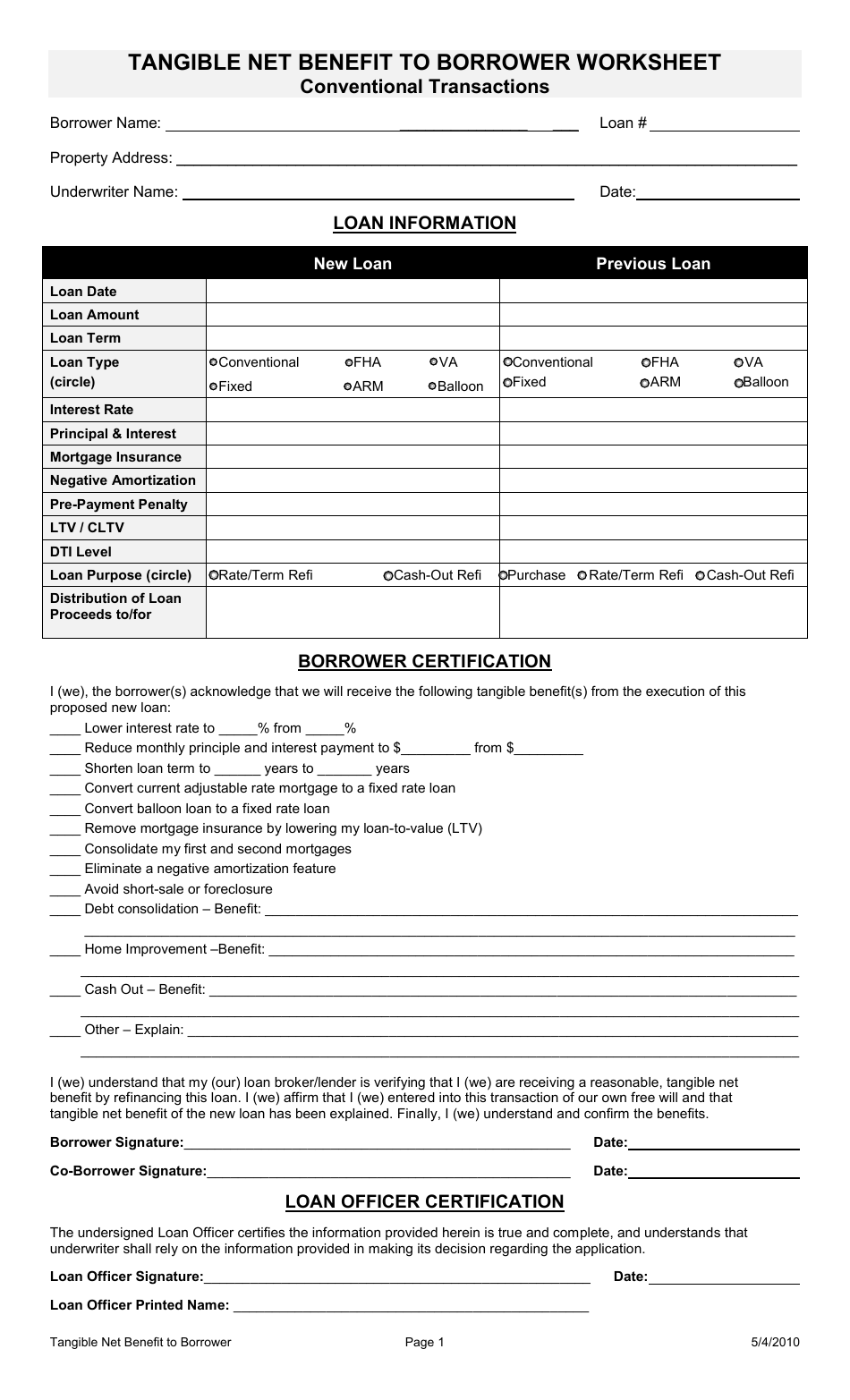

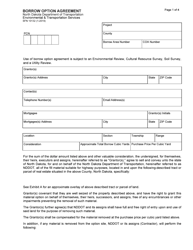

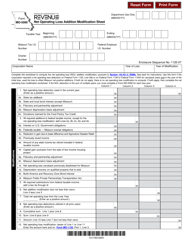

Tangible Net Benefit Form to Borrower Worksheet

The Tangible Net Benefit Form to Borrower Worksheet is used in the mortgage loan process to assess and document the financial advantages that the borrower will receive by refinancing their mortgage. It helps to ensure that the borrower is benefiting from the new loan terms.

The lender files the Tangible Net Benefit Form to Borrower Worksheet.

FAQ

Q: What is the Tangible Net Benefit Form to Borrower Worksheet?

A: The Tangible Net Benefit Form to Borrower Worksheet is a document used in the mortgage application process.

Q: What is the purpose of the Tangible Net Benefit Form to Borrower Worksheet?

A: The purpose of the Tangible Net Benefit Form to Borrower Worksheet is to evaluate the financial benefit to the borrower when refinancing a mortgage.

Q: What information does the Tangible Net Benefit Form to Borrower Worksheet include?

A: The Tangible Net Benefit Form to Borrower Worksheet includes information about the borrower's current loan, proposed loan terms, and the potential savings or costs associated with the refinance.

Q: Why is the Tangible Net Benefit Form to Borrower Worksheet important?

A: The Tangible Net Benefit Form to Borrower Worksheet is important because it helps both the borrower and lender assess whether refinancing a mortgage is financially beneficial for the borrower.

Q: Who fills out the Tangible Net Benefit Form to Borrower Worksheet?

A: The Tangible Net Benefit Form to Borrower Worksheet is typically filled out by the lender and presented to the borrower for review.

Q: Are there any specific requirements for the Tangible Net Benefit Form to Borrower Worksheet?

A: Specific requirements may vary depending on the lender, but in general, the Tangible Net Benefit Form to Borrower Worksheet should include accurate and detailed information to assess the financial impact of the refinancing.