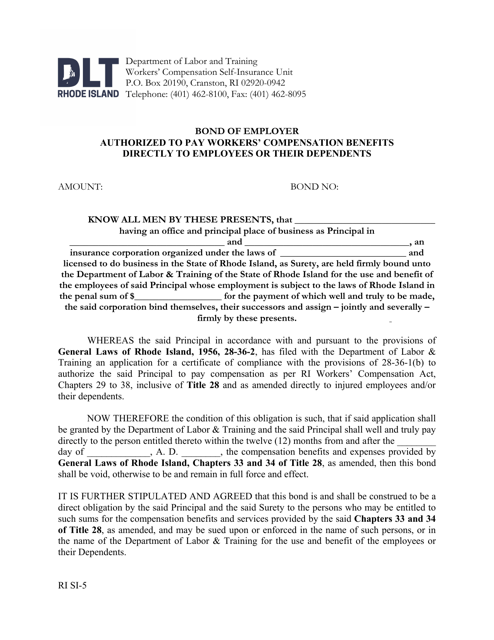

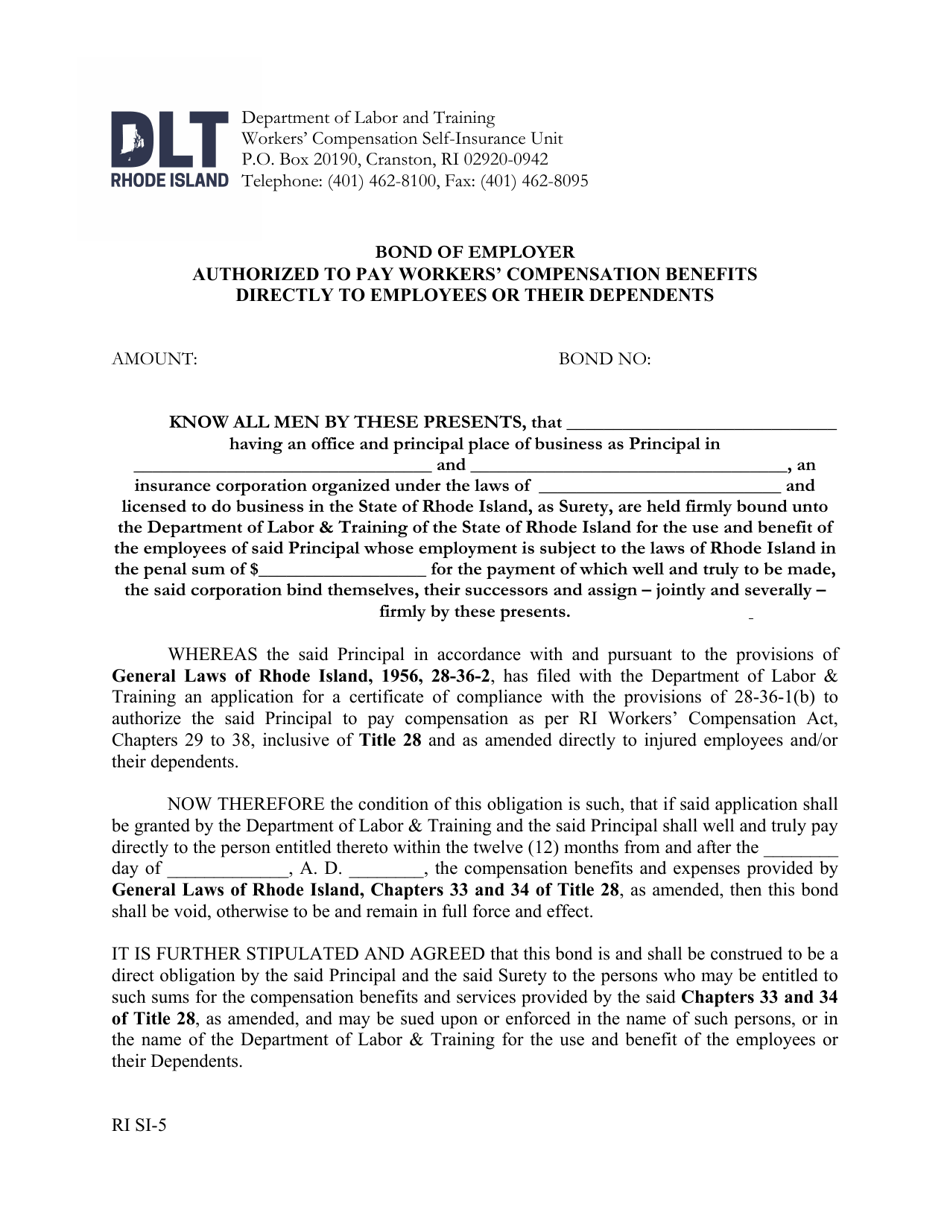

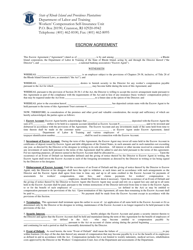

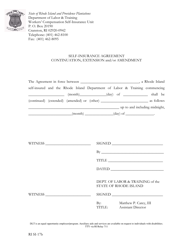

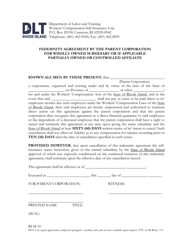

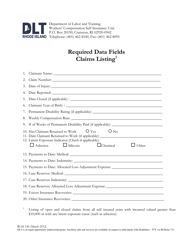

Form RI SI-5 Bond of Employer Authorized to Pay Workers' Compensation Benefits Directly to Employees or Their Dependents - Rhode Island

What Is Form RI SI-5?

This is a legal form that was released by the Rhode Island Department of Labor and Training - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

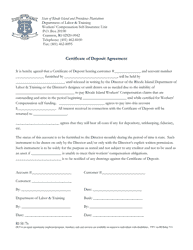

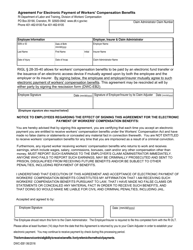

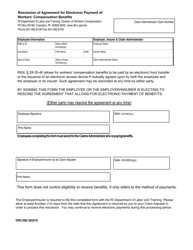

Q: What is the SI-5 Bond?

A: The SI-5 Bond is a bond for employers authorized to pay workers' compensation benefits directly to employees or their dependents in Rhode Island.

Q: Who needs to file the SI-5 Bond?

A: Employers who have been authorized by the Rhode Island Department of Business Regulation to self-insure their workers' compensation benefits.

Q: What does the SI-5 Bond do?

A: The SI-5 Bond ensures that employers will have sufficient funds to fulfill their obligation to pay workers' compensation benefits directly to employees or their dependents.

Q: How much is the SI-5 Bond?

A: The amount of the bond is determined by the Rhode Island Department of Business Regulation and varies depending on the size and financial stability of the employer.

Q: Who issues the SI-5 Bond?

A: The SI-5 Bond is typically issued by a surety company licensed to conduct business in Rhode Island.

Q: How long is the SI-5 Bond valid for?

A: The SI-5 Bond is typically valid for one year and must be renewed annually to maintain compliance with Rhode Island's self-insurance requirements.

Q: Is the SI-5 Bond required in other states?

A: No, the SI-5 Bond is specific to Rhode Island's self-insurance requirements for workers' compensation benefits.

Form Details:

- The latest edition provided by the Rhode Island Department of Labor and Training;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI SI-5 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Labor and Training.