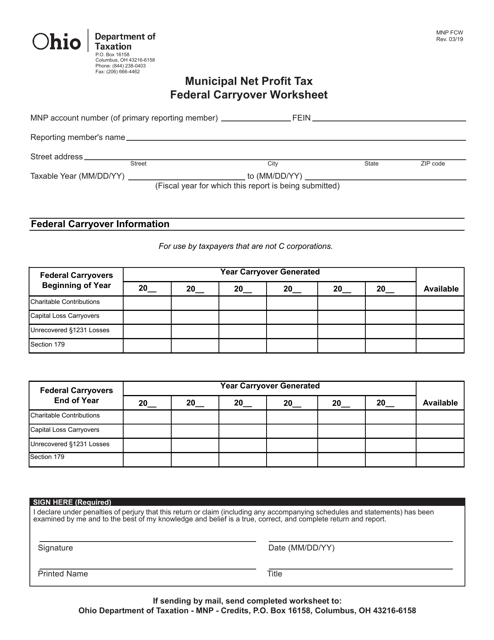

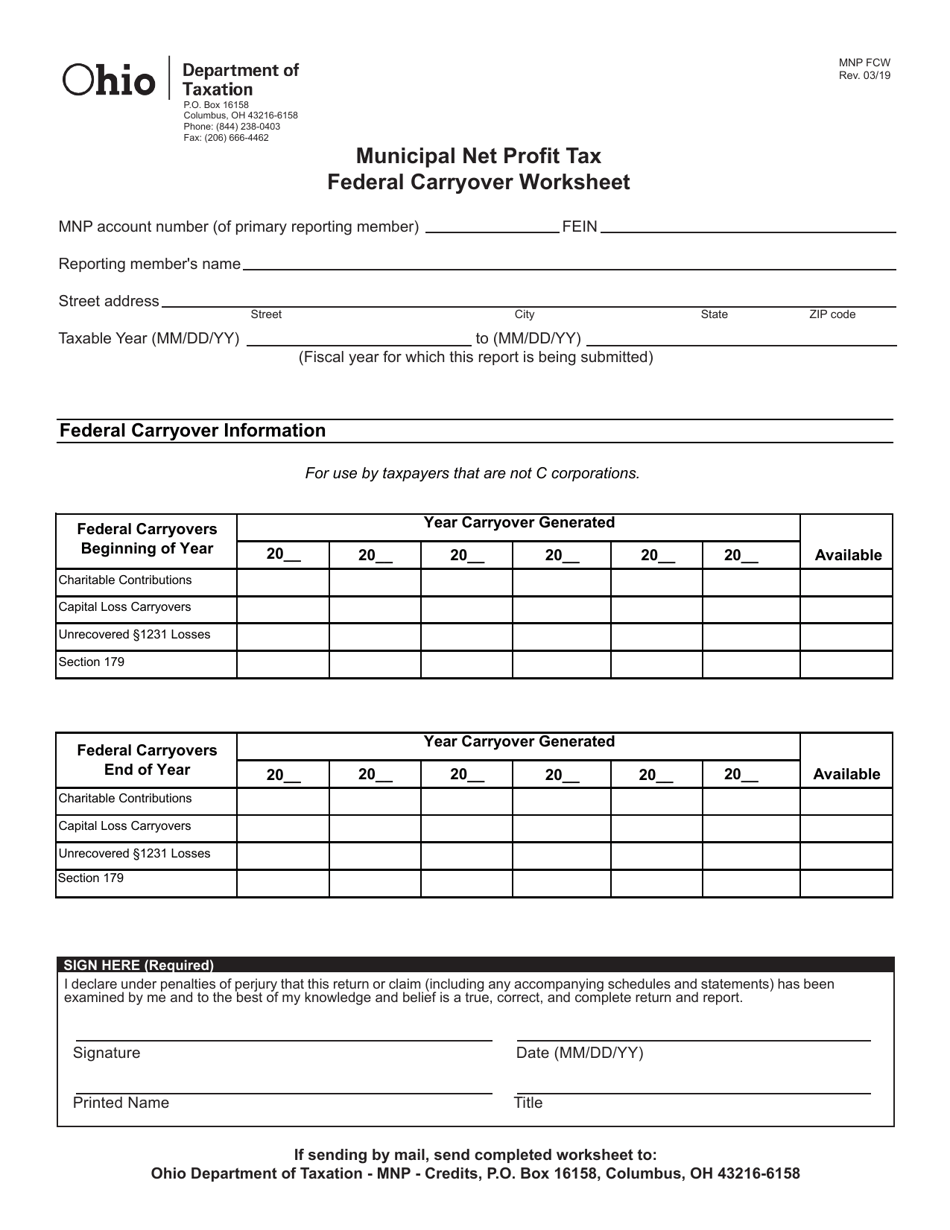

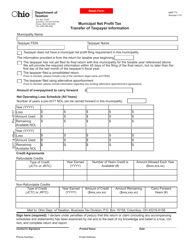

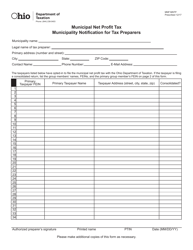

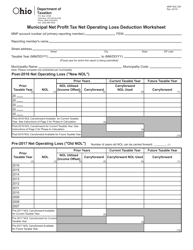

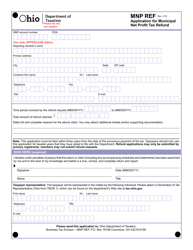

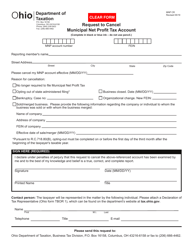

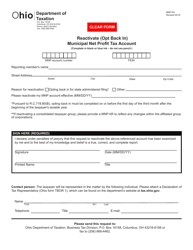

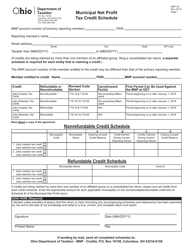

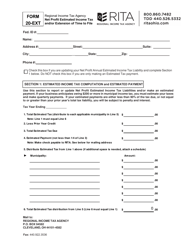

Form MNP FCW Municipal Net Profit Tax Federal Carryover Worksheet - Ohio

What Is Form MNP FCW?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MNP FCW?

A: MNP FCW stands for Municipal Net Profit Tax Federal Carryover Worksheet. It is a form used in Ohio for calculating carryover of net profit tax deductions.

Q: Who needs to use the MNP FCW form?

A: Businesses in Ohio that are subject to municipal net profit tax and have federal carryover deductions need to use the MNP FCW form.

Q: What does the MNP FCW form calculate?

A: The MNP FCW form calculates the amount of net profit tax deductions that can be carried over from a previous year to offset the tax liability in the current year.

Q: Is the MNP FCW form specific to Ohio?

A: Yes, the MNP FCW form is specific to Ohio. It is used for calculating municipal net profit tax deductions in the state.

Q: What information do I need to fill out the MNP FCW form?

A: To fill out the MNP FCW form, you will need information about your business's federal carryover deductions and net profit tax liability for the current and previous years.

Q: Are there any deadlines for submitting the MNP FCW form?

A: Yes, the deadlines for submitting the MNP FCW form may vary depending on the municipality. It is important to check with the local tax office or the Ohio Department of Taxation for specific deadlines.

Q: What should I do if I need help with the MNP FCW form?

A: If you need help with the MNP FCW form, you can contact the Ohio Department of Taxation or seek assistance from a tax professional.

Q: Can the MNP FCW form be filed electronically?

A: Yes, some municipalities in Ohio may allow electronic filing of the MNP FCW form. It is advisable to check with the local tax office for the available filing options.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MNP FCW by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.