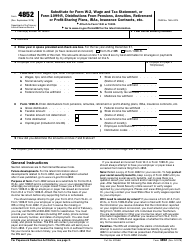

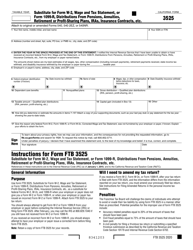

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-R

for the current year.

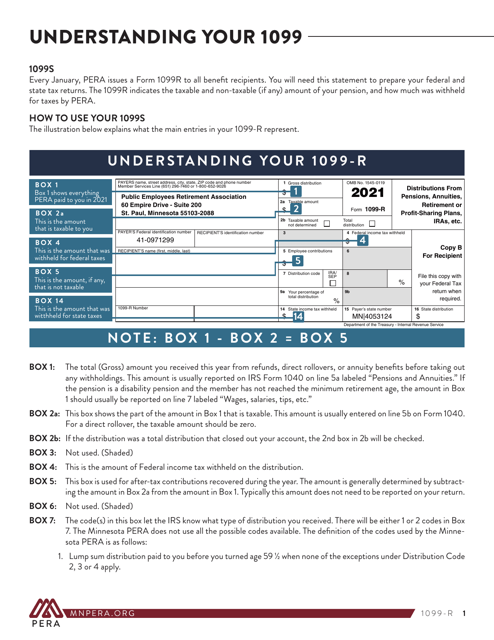

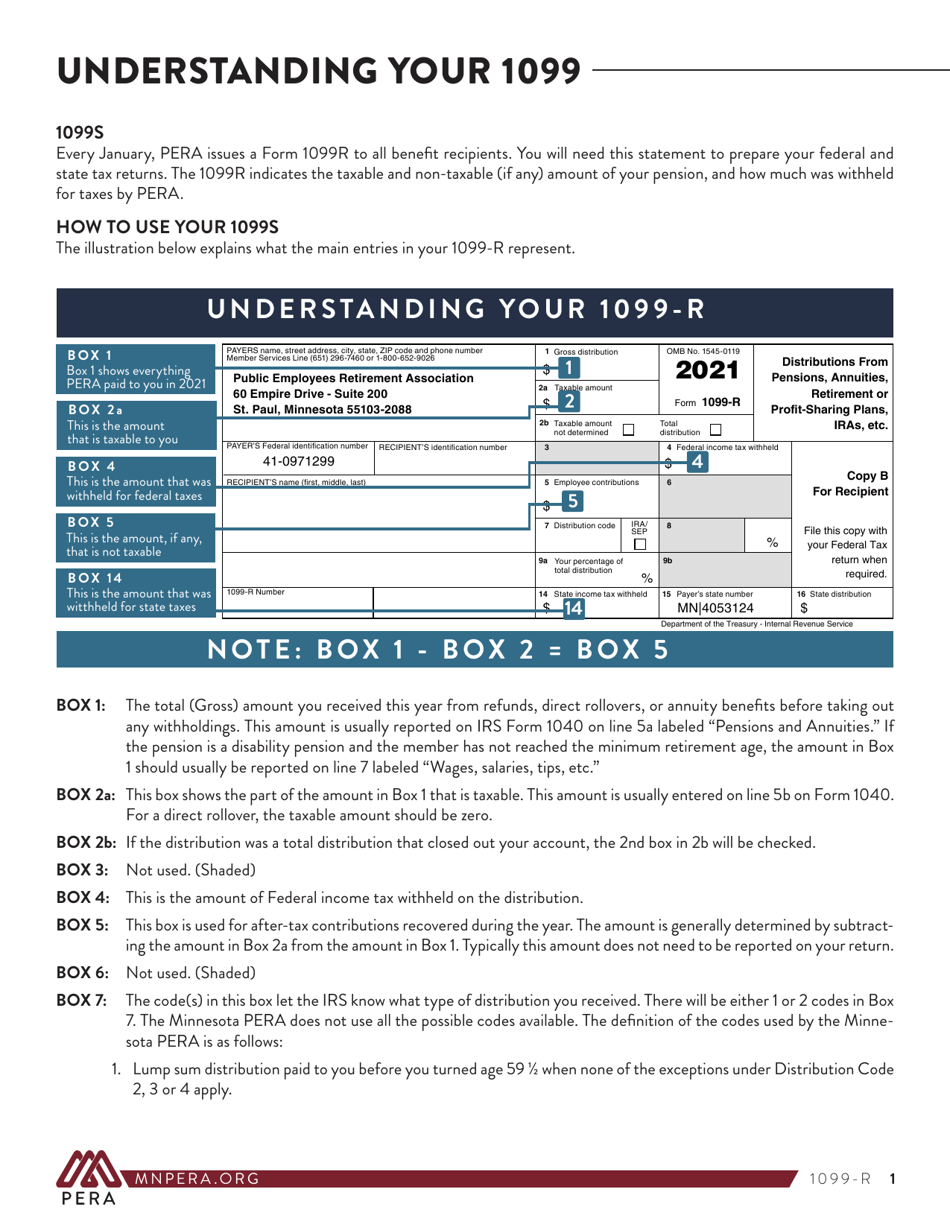

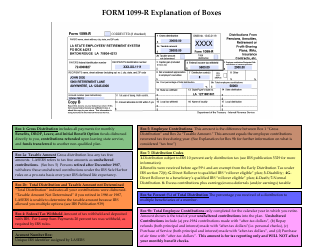

Instructions for IRS Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc. - Minnesota

This document contains official instructions for IRS Form 1099-R , Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc. - a form released and collected by the Minnesota Public Employees Retirement Association.

FAQ

Q: What is IRS Form 1099-R?

A: IRS Form 1099-R is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc.

Q: Who needs to file IRS Form 1099-R?

A: Payers of pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc., need to file IRS Form 1099-R to report the distributions.

Q: What information is required for IRS Form 1099-R?

A: IRS Form 1099-R requires information such as the recipient's name, address, taxpayer identification number, distribution amount, and distribution code.

Q: Can I e-file IRS Form 1099-R?

A: Yes, you can e-file IRS Form 1099-R using the IRS's Filing Information Returns Electronically (FIRE) system.

Q: When is the deadline to file IRS Form 1099-R?

A: The deadline to file IRS Form 1099-R is generally January 31st of the year following the calendar year in which the distribution was made.

Q: Do I need to send a copy of IRS Form 1099-R to the recipient?

A: Yes, you need to send a copy of IRS Form 1099-R to the recipient.

Q: Are there any penalties for not filing IRS Form 1099-R?

A: Yes, there are penalties for not filing IRS Form 1099-R, such as failure to timely file penalties and failure to furnish recipient statements penalties.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Minnesota Public Employees Retirement Association.