This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

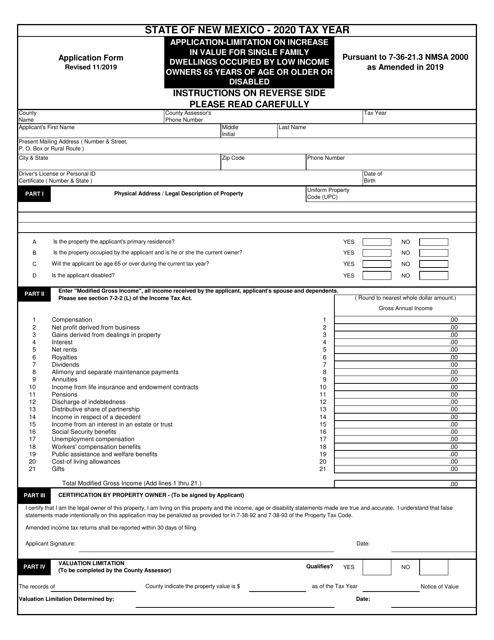

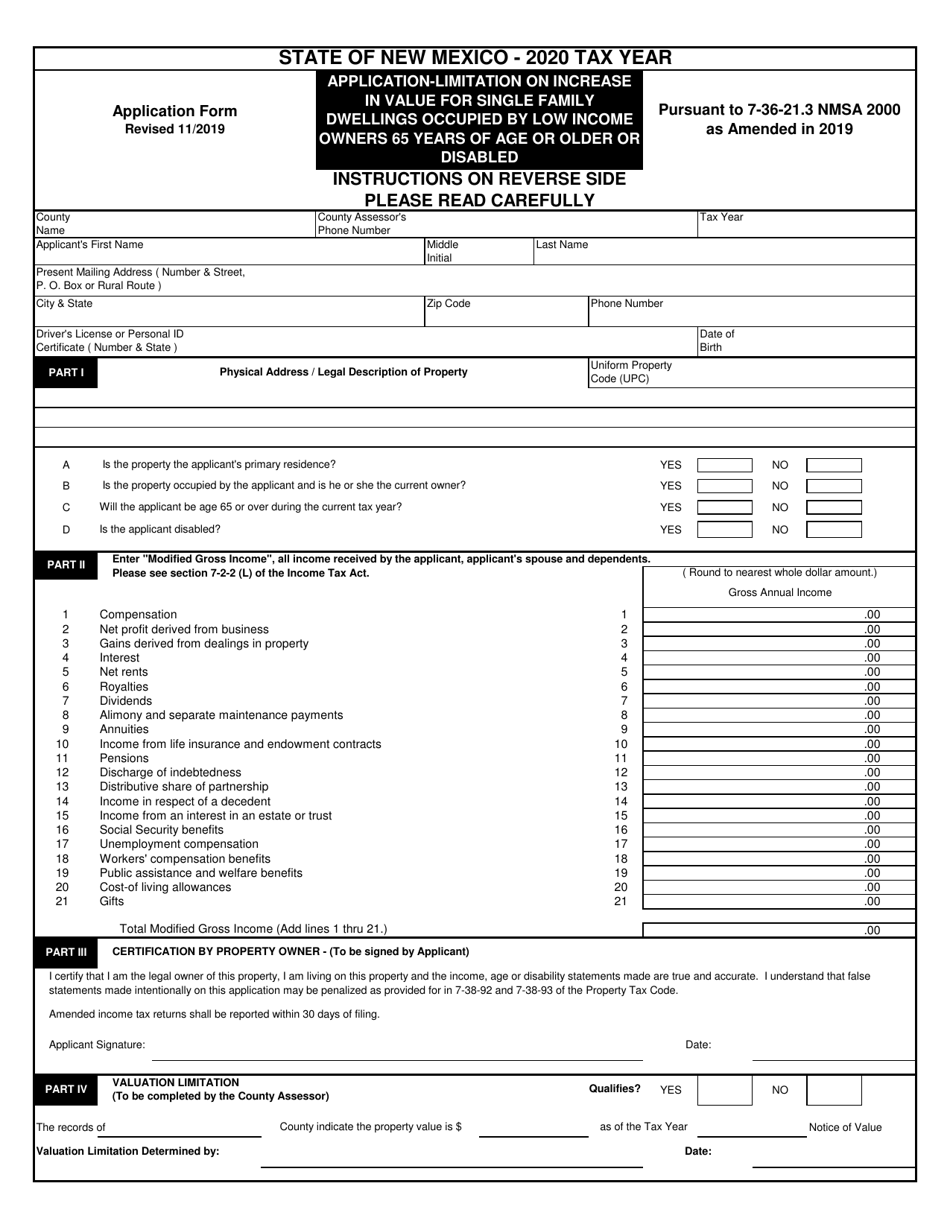

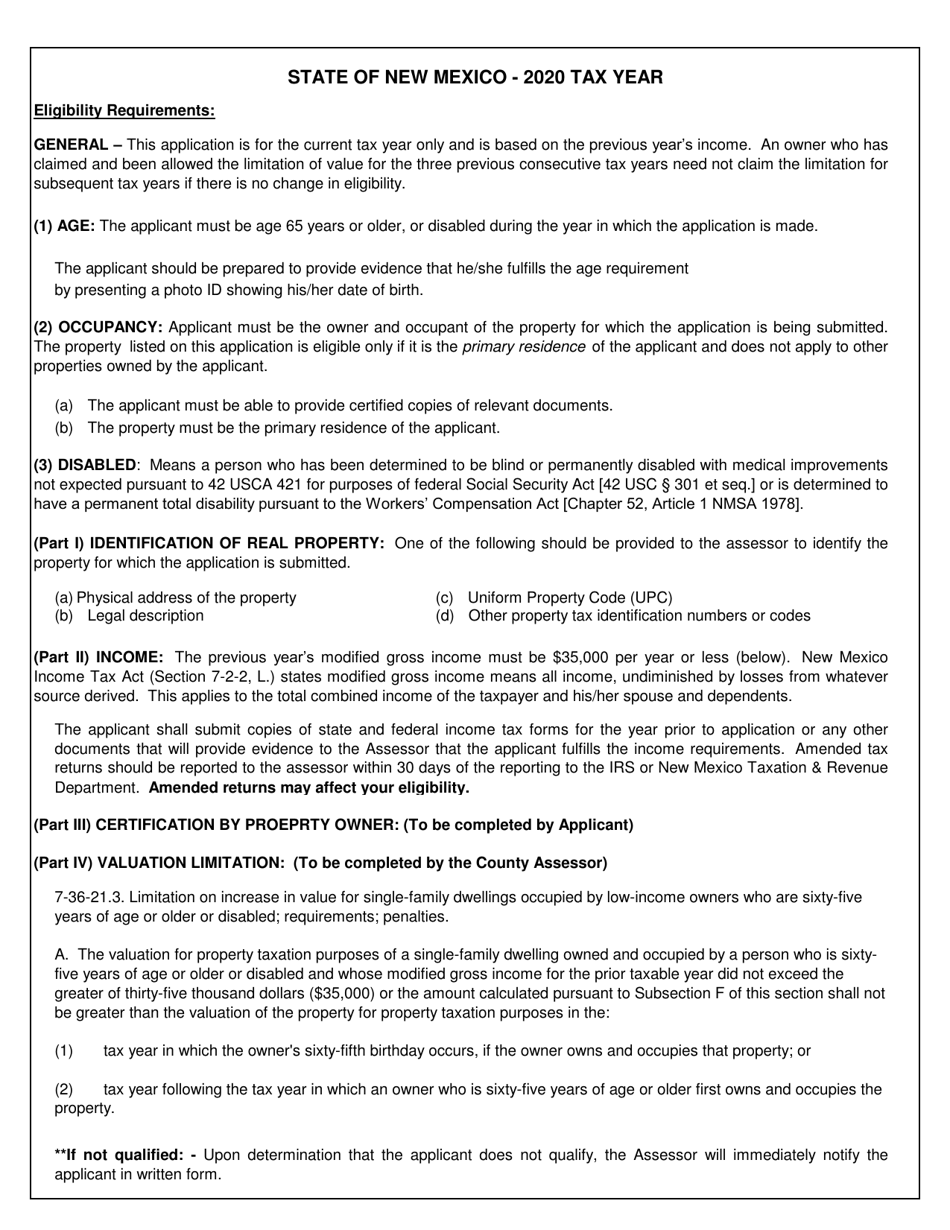

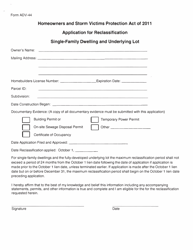

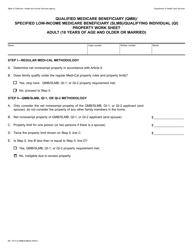

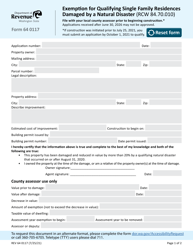

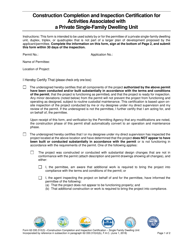

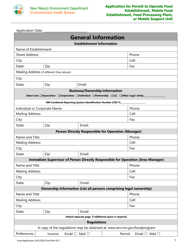

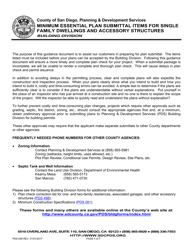

Application-Limitation on Increase in Value for Single Family Dwellings Occupied by Low Income Owners 65 Years of Age or Older or Disabled - New Mexico

Application-Limitation on Increase in Value for Low Income Owners 65 Years of Age or Older or Disabled is a legal document that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico.

FAQ

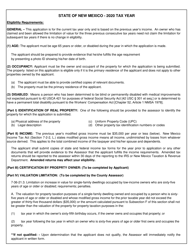

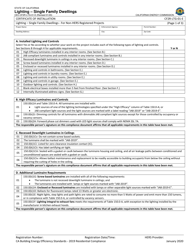

Q: What is the application-limitation on increase in value for single family dwellings?

A: It is a restriction on how much a single-family dwelling's value can increase.

Q: Who does this limitation apply to?

A: It applies to low income owners who are 65 years of age or older or disabled.

Q: What is considered a low income owner?

A: A low income owner is someone who earns below a certain income threshold.

Q: What happens if the owner meets the criteria?

A: If the owner meets the criteria, the increase in value of their dwelling is limited.

Q: Why is this limitation in place?

A: This limitation is in place to protect low income owners from significant property value increases and higher property taxes.

Q: Is this limitation specific to New Mexico?

A: Yes, this limitation on increase in value for single-family dwellings is specific to New Mexico.

Form Details:

- The latest edition currently provided by the New Mexico Taxation and Revenue Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.