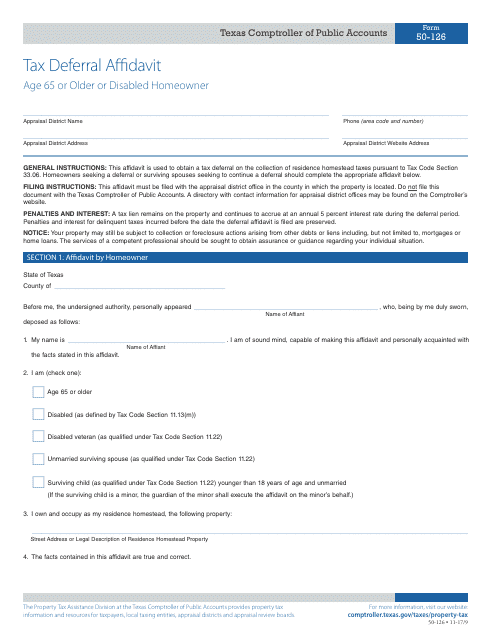

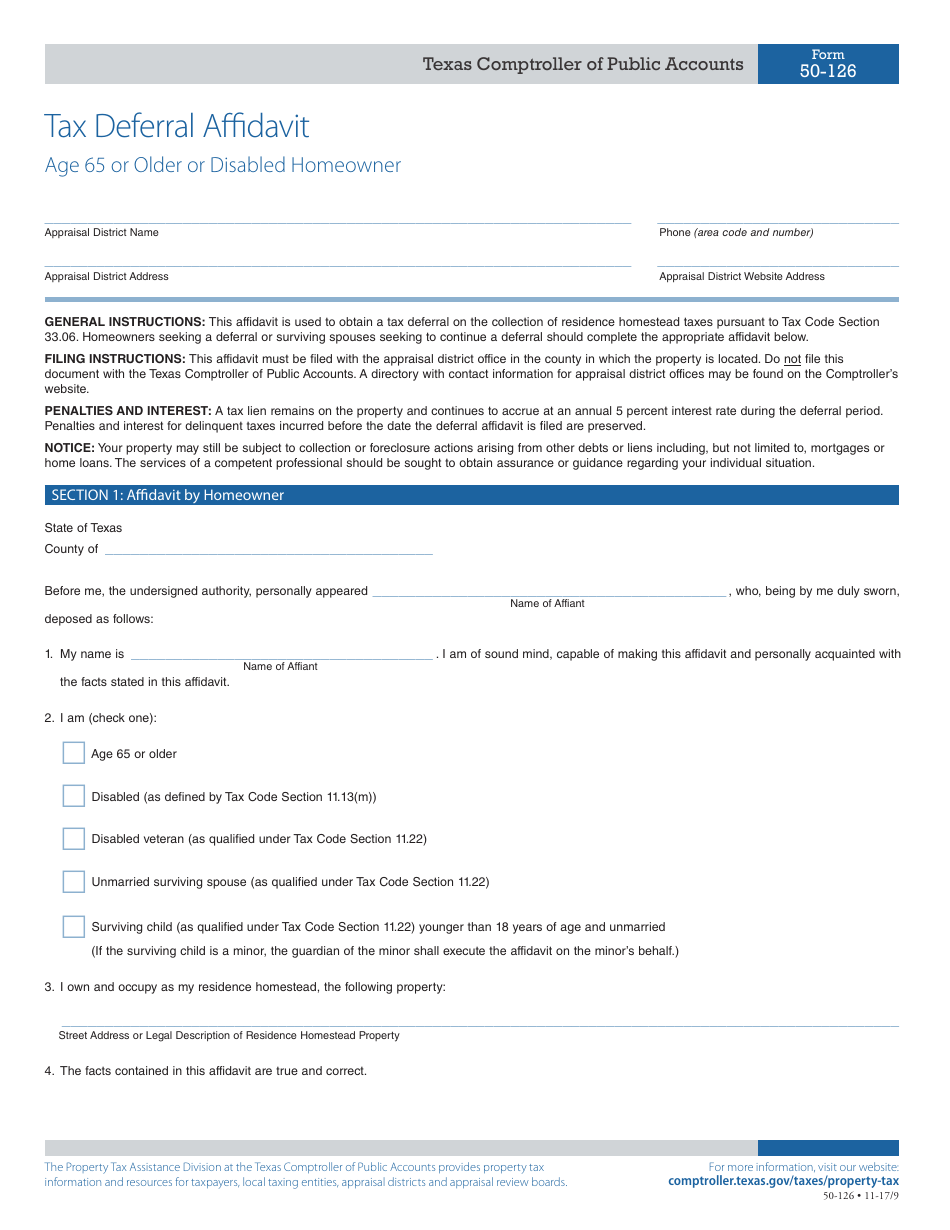

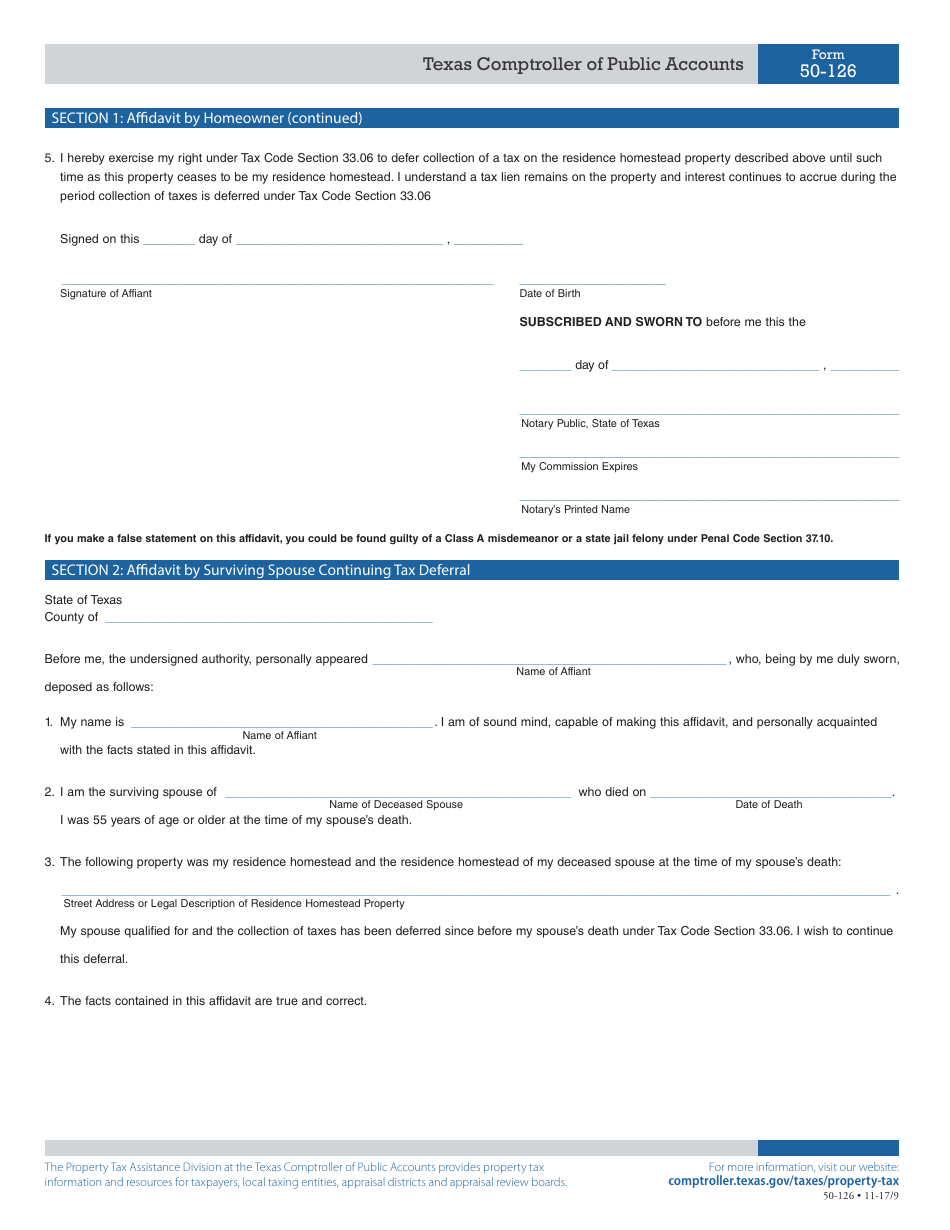

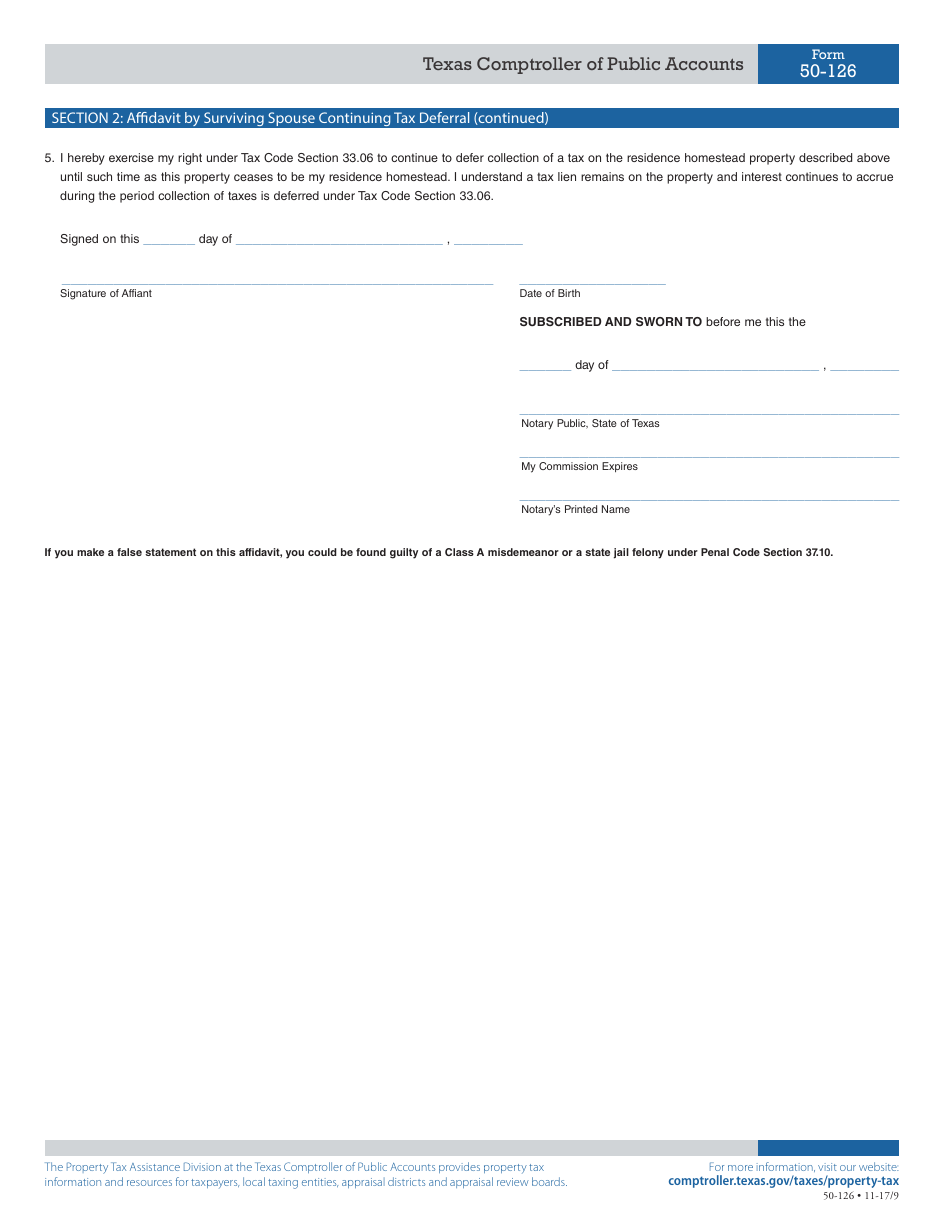

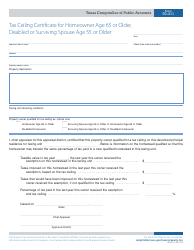

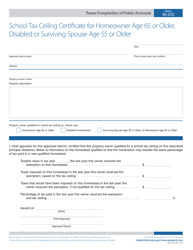

Form 50-126 Tax Deferral Affidavit - Age 65 or Older or Disabled Homeowner - Texas

What Is Form 50-126?

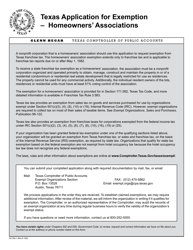

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

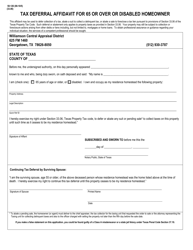

Q: What is the Form 50-126?

A: Form 50-126 is the Tax Deferral Affidavit for homeowners in Texas who are 65 or older or disabled.

Q: Who is eligible to use Form 50-126?

A: Homeowners in Texas who are 65 years of age or older or disabled are eligible to use Form 50-126.

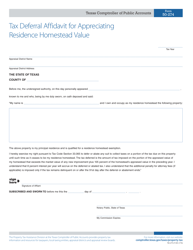

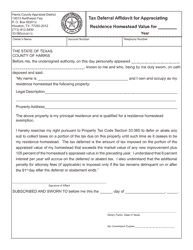

Q: What is the purpose of Form 50-126?

A: The purpose of Form 50-126 is to allow eligible homeowners in Texas to defer the payment of property taxes.

Q: How does Form 50-126 work?

A: By completing Form 50-126, eligible homeowners can defer the payment of property taxes until a later date.

Q: Is there a cost to use Form 50-126?

A: No, there is no cost to use Form 50-126.

Q: How often do I need to file Form 50-126?

A: Form 50-126 needs to be filed annually.

Q: Are there any income requirements to qualify for Form 50-126?

A: No, there are no income requirements to qualify for Form 50-126.

Q: What happens if I don't pay the deferred taxes?

A: If the deferred taxes are not paid, a lien may be placed on the property.

Q: Can I still apply for other property tax exemptions while using Form 50-126?

A: Yes, eligible homeowners can still apply for other property tax exemptions while using Form 50-126.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-126 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.