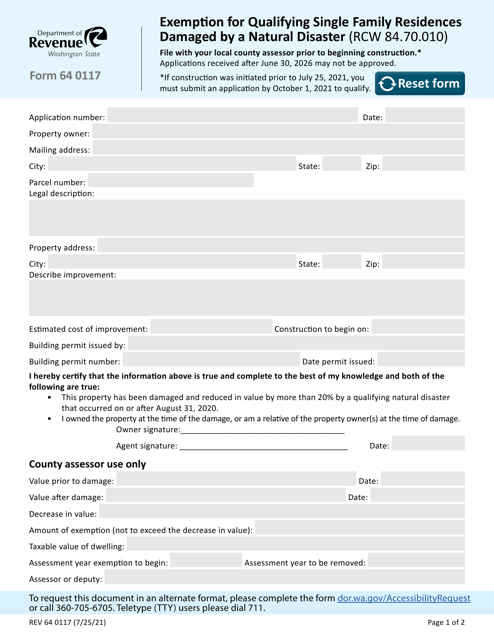

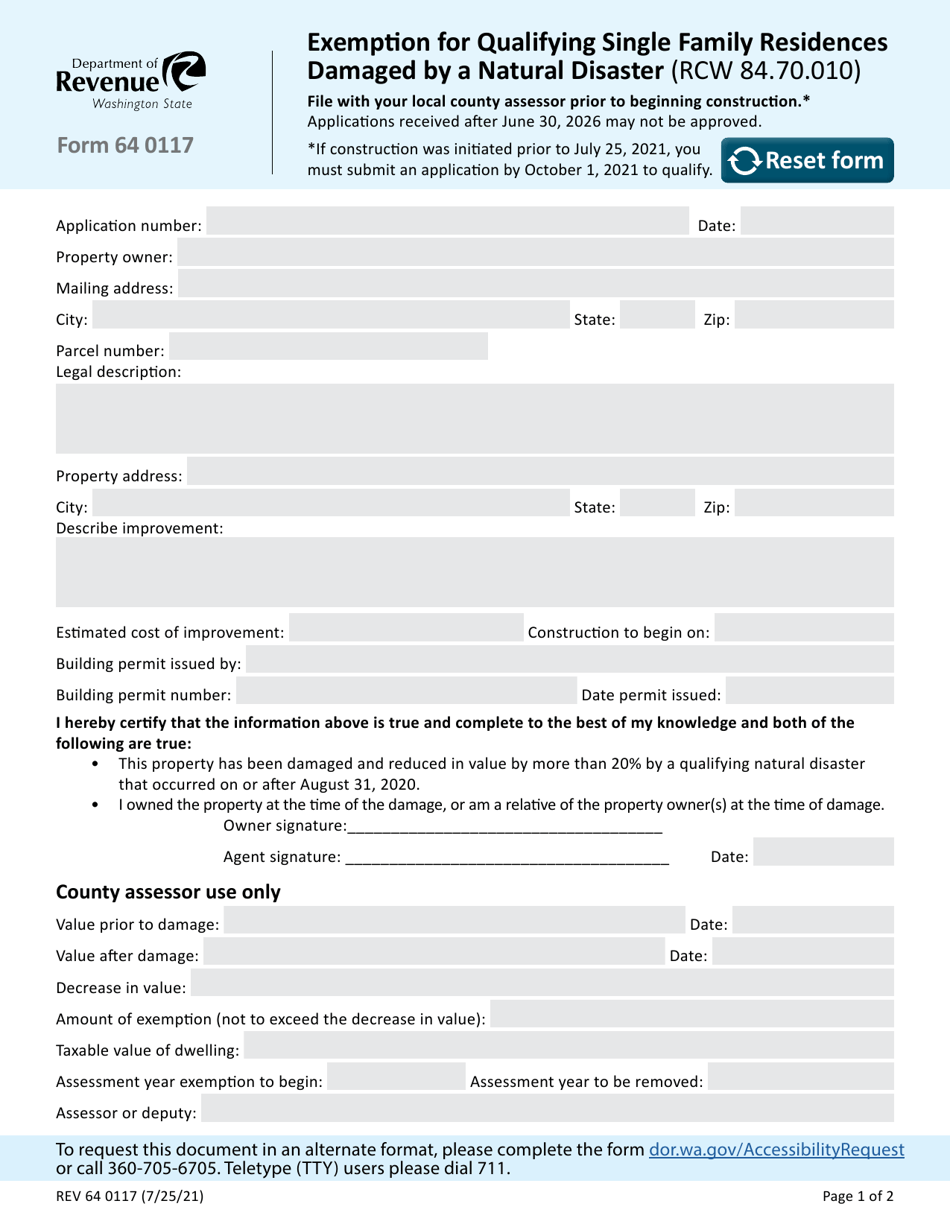

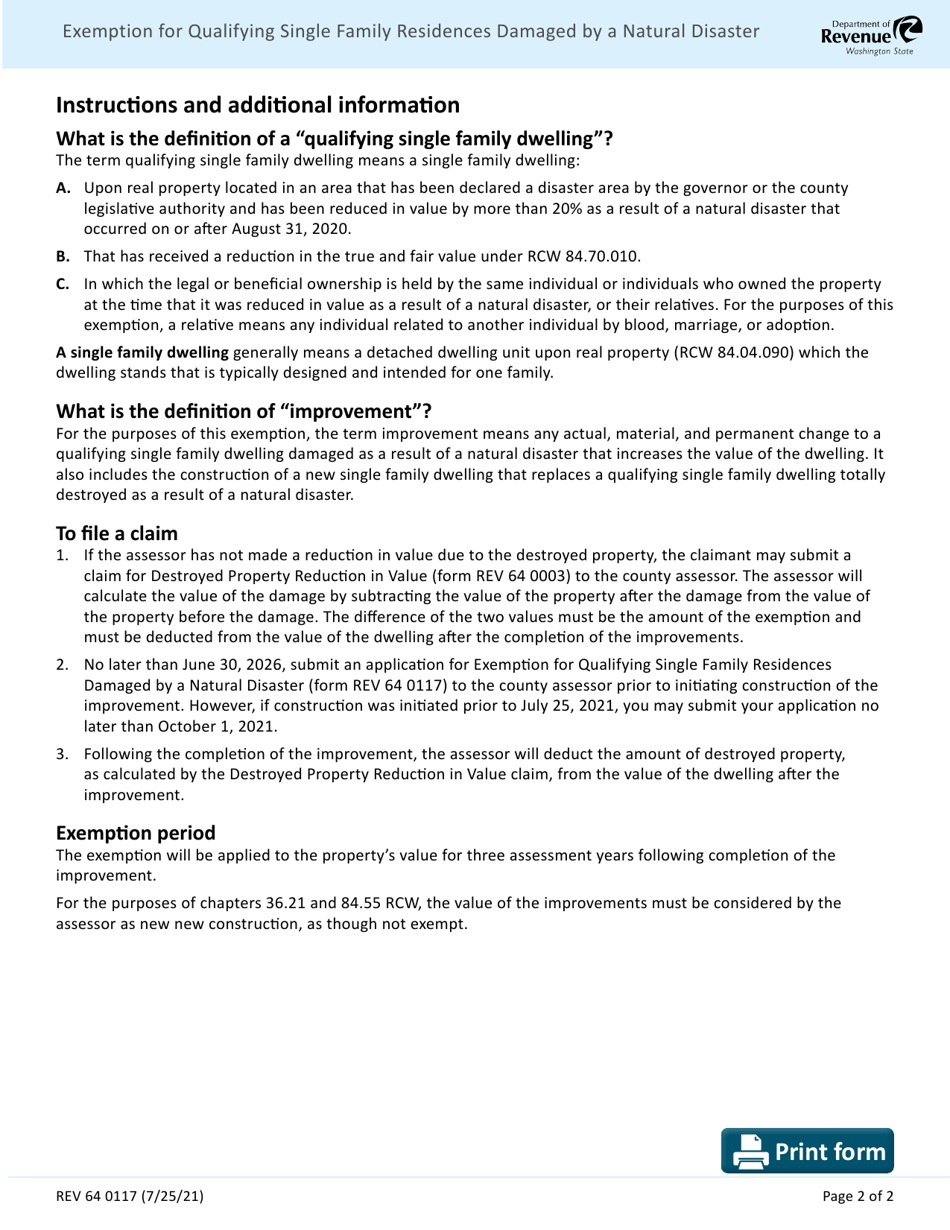

Form REV64 0117 Exemption for Qualifying Single Family Residences Damaged by a Natural Disaster - Washington

What Is Form REV64 0117?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV64 0117?

A: Form REV64 0117 is a form used in Washington to claim exemption for qualifying single family residences that have been damaged by a natural disaster.

Q: What does Form REV64 0117 exempt?

A: Form REV64 0117 exempts qualifying single family residences that have been damaged by a natural disaster from certain property taxes.

Q: Who is eligible to claim exemption using Form REV64 0117?

A: Owners of qualifying single family residences that have been damaged by a natural disaster in Washington are eligible to claim exemption using Form REV64 0117.

Q: What is a qualifying single family residence?

A: A qualifying single family residence is a residential property that meets certain criteria set by the state of Washington.

Q: Are there any deadlines for filing Form REV64 0117?

A: Yes, there are deadlines for filing Form REV64 0117. It is recommended to file the form within 30 days of the occurrence of the natural disaster.

Q: What documentation do I need to submit with Form REV64 0117?

A: You will need to submit supporting documentation such as photographs, repair estimates, or insurance claims to substantiate the damage caused by the natural disaster.

Form Details:

- Released on July 25, 2021;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV64 0117 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.