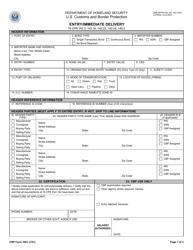

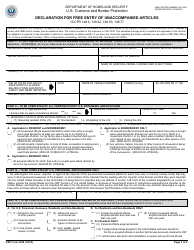

This version of the form is not currently in use and is provided for reference only. Download this version of

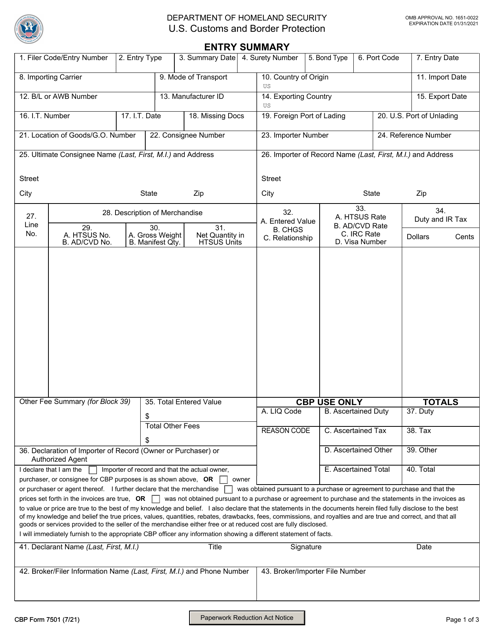

CBP Form 7501

for the current year.

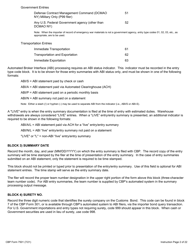

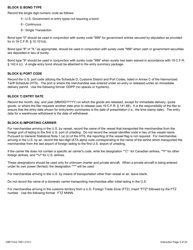

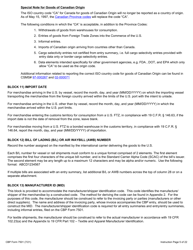

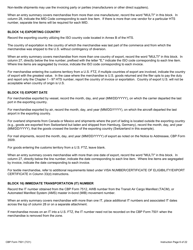

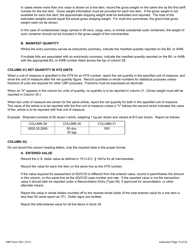

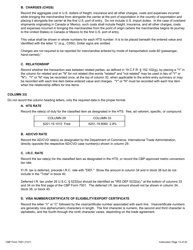

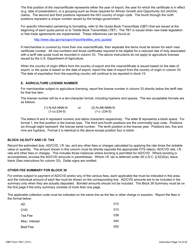

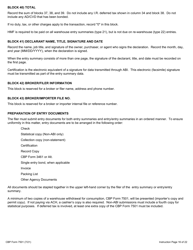

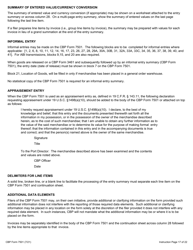

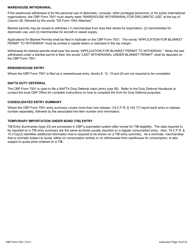

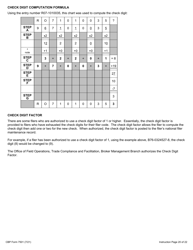

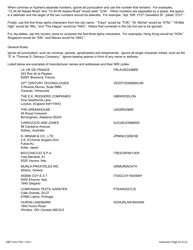

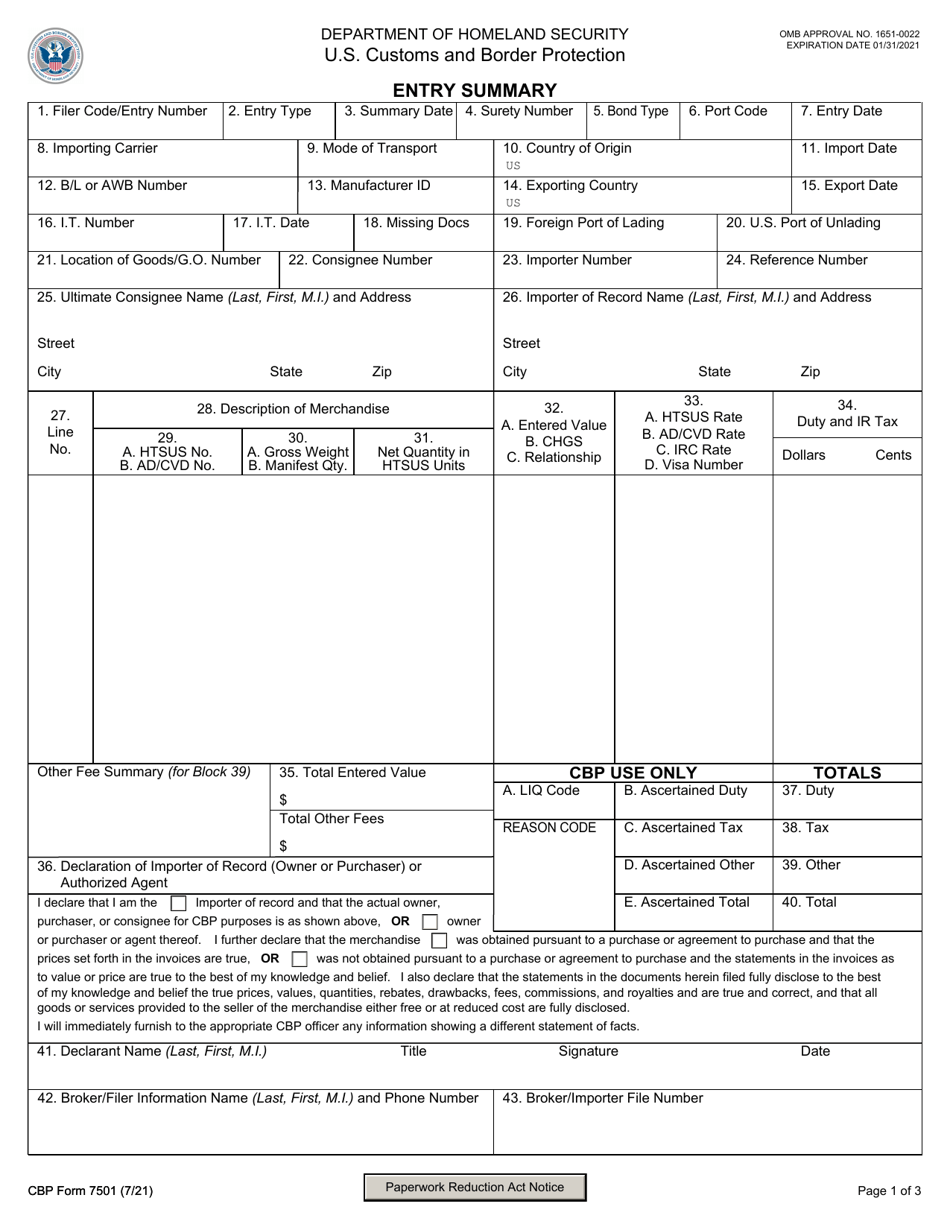

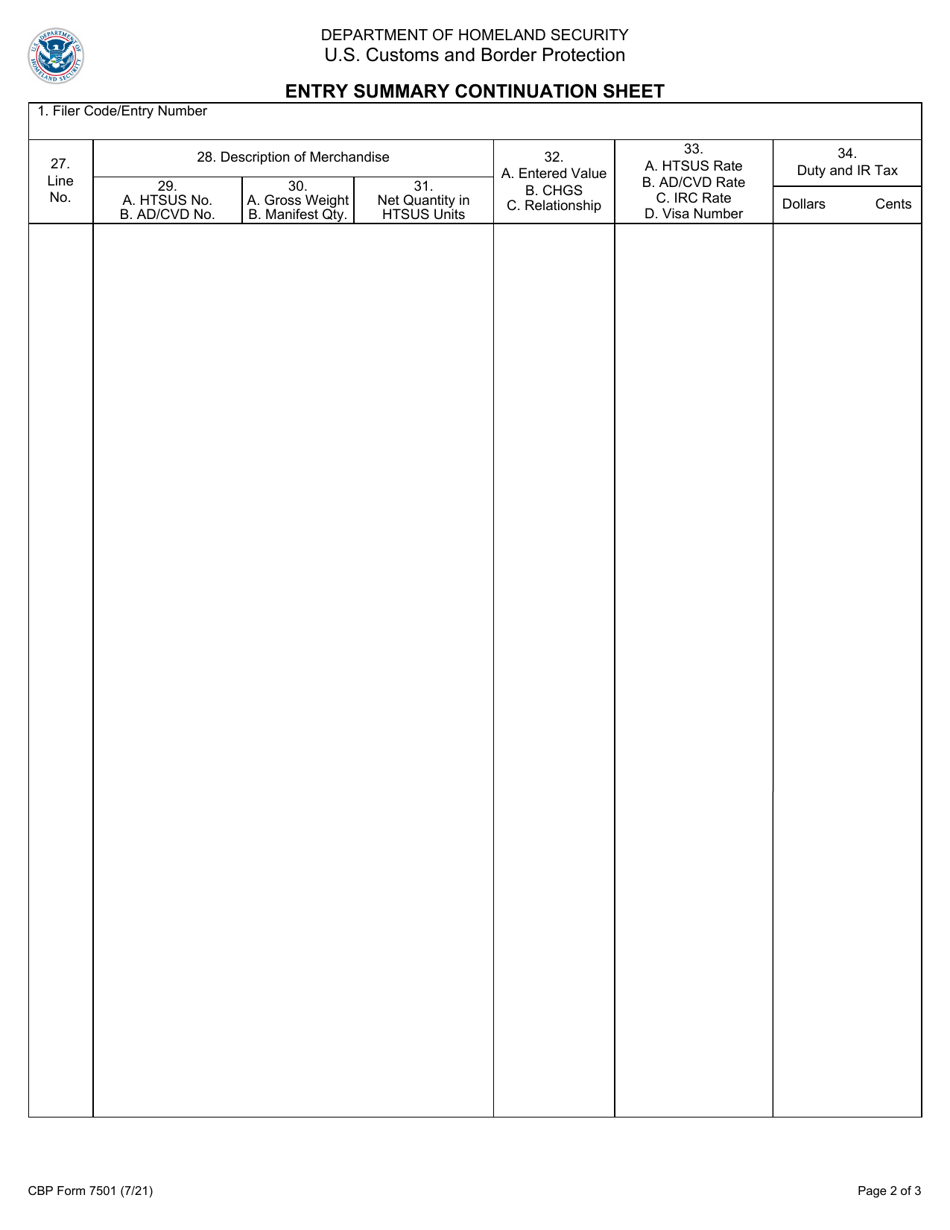

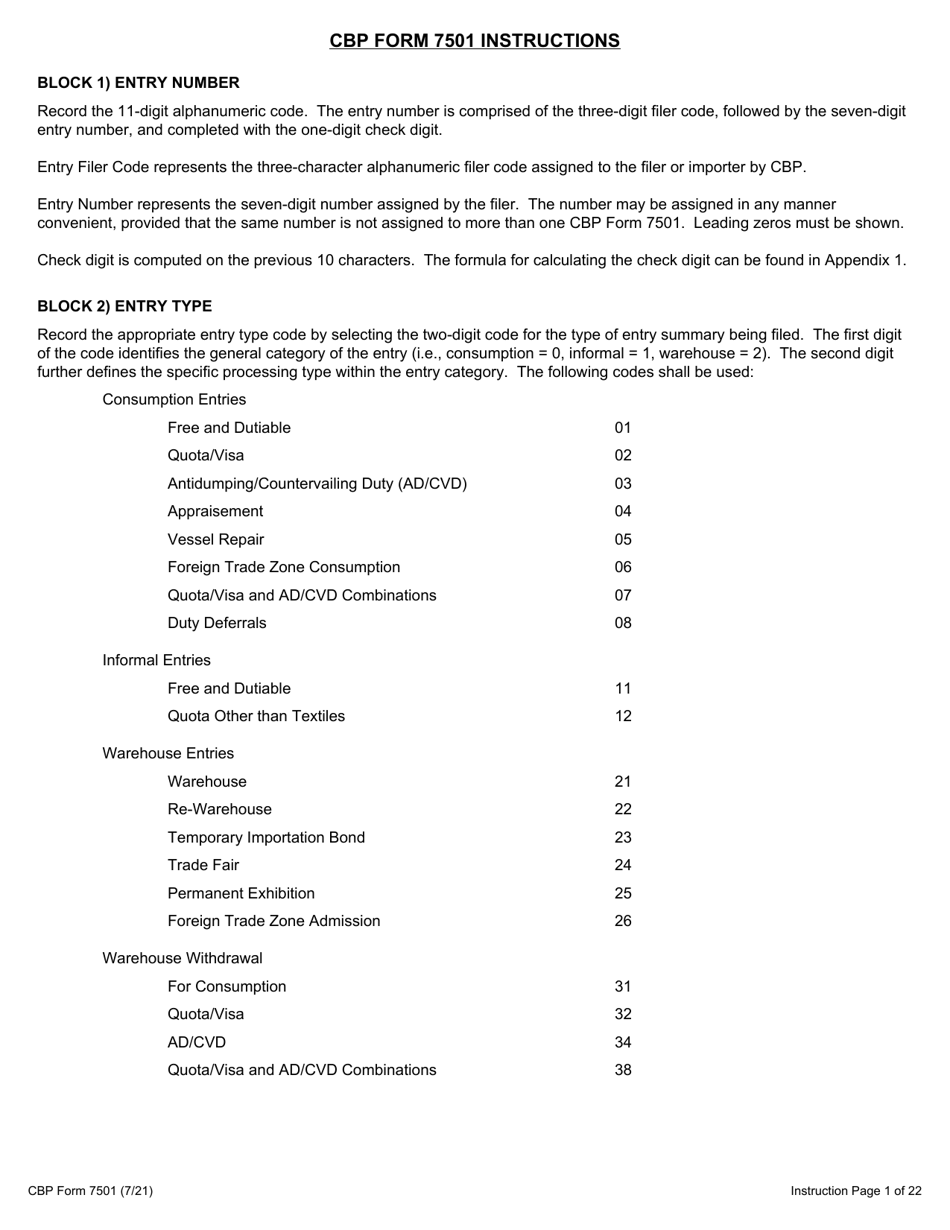

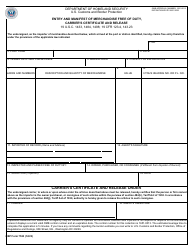

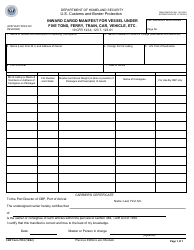

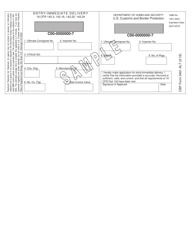

CBP Form 7501 Entry Summary

What Is CBP Form 7501?

This is a legal form that was released by the U.S. Department of Homeland Security - Customs and Border Protection on July 1, 2021 and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

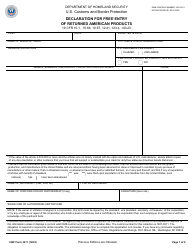

Q: What is CBP Form 7501?

A: CBP Form 7501 is an Entry Summary form used by U.S. Customs and Border Protection (CBP).

Q: What is the purpose of CBP Form 7501?

A: The purpose of CBP Form 7501 is to document the details of imported goods, including their value, origin, and classification, for customs purposes.

Q: Who needs to fill out CBP Form 7501?

A: Importers or their authorized agents are responsible for filling out CBP Form 7501.

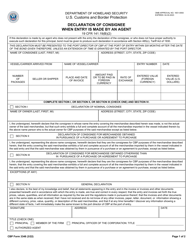

Q: When should CBP Form 7501 be filed?

A: CBP Form 7501 must generally be filed within 10 working days of the goods' arrival in the United States.

Q: Are there any fees associated with CBP Form 7501?

A: Yes, there may be fees associated with CBP Form 7501, such as processing fees or duties and taxes.

Q: What happens after CBP Form 7501 is filed?

A: After CBP Form 7501 is filed, CBP will review the form and assess any applicable duties and taxes.

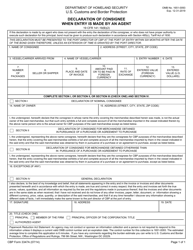

Q: Are there any penalties for incorrect or late filing of CBP Form 7501?

A: Yes, there may be penalties for incorrect or late filing of CBP Form 7501, including fines or additional duties.

Q: Can CBP Form 7501 be filed electronically?

A: Yes, CBP Form 7501 can be filed electronically through the Automated Commercial Environment (ACE) system.

Q: Is CBP Form 7501 used for imports into Canada as well?

A: No, CBP Form 7501 is specific to imports into the United States. Canada has its own customs forms and processes.

Form Details:

- Released on July 1, 2021;

- The latest available edition released by the U.S. Department of Homeland Security - Customs and Border Protection;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CBP Form 7501 by clicking the link below or browse more documents and templates provided by the U.S. Department of Homeland Security - Customs and Border Protection.