Instructions for CBP Form 7501 Entry Summary

The Customs and Border Protection (CBP) has released a set of official guidelines pertaining to the two forms required for importing any foreign goods or commodities into the United States:

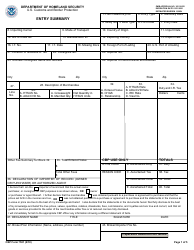

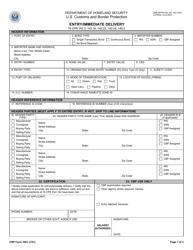

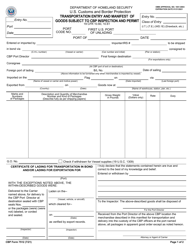

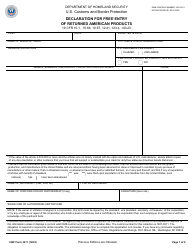

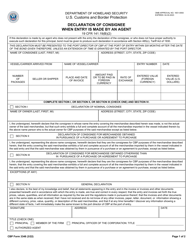

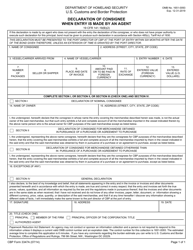

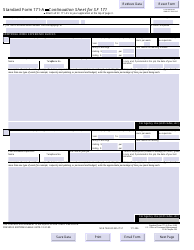

- CBP Form 7501, Entry Summary, is used to disclose the information regarding the origin, classification, and appraisement of the imported commodity.

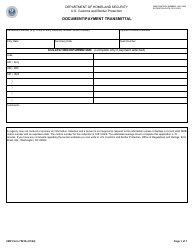

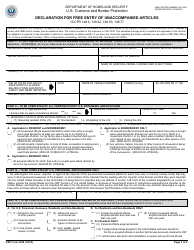

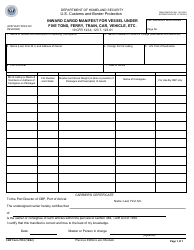

- CBP Form 7501A, Document/Payment Transmittal, is used to reconcile a payment after an initial automated clearing house payment with the associated entry.

The forms describe the items entering the trade of the United States, record the taxes paid, and give appropriate credit to the respondent's account. Printable instructions for CBP 7501 and CBP 7501A are available through the link below.

How to File CBP Form 7501?

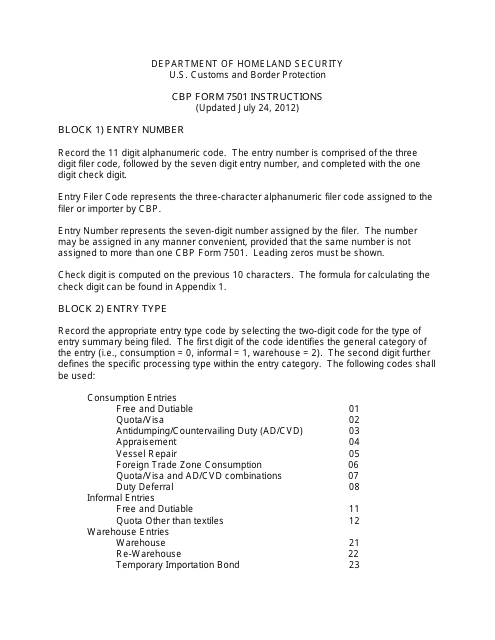

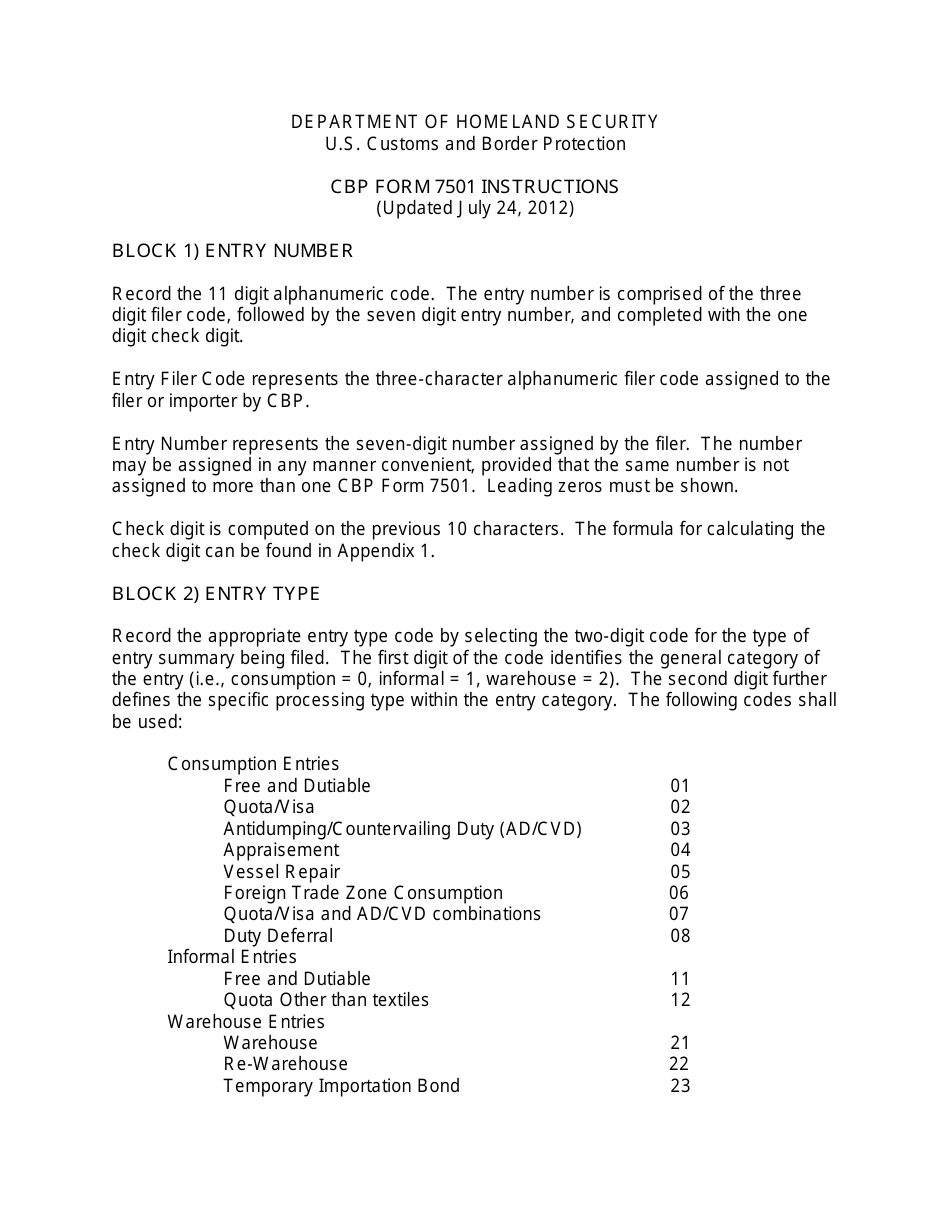

CBP Form 7501 (Entry Summary) Instructions are as follows:

- This form, essential for identifying merchandise entering the United States, has to be filed within 10 business days from the time of the entry of merchandise.

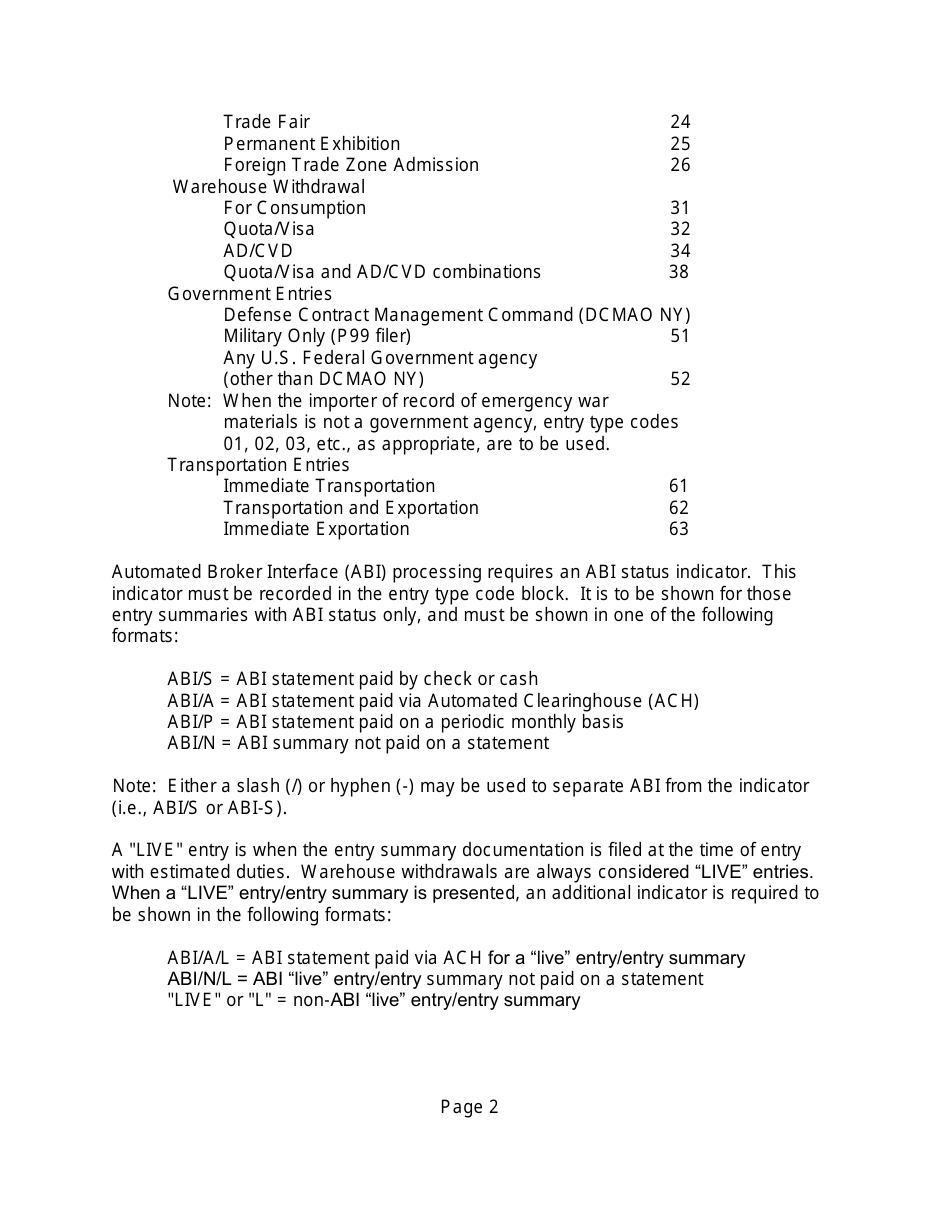

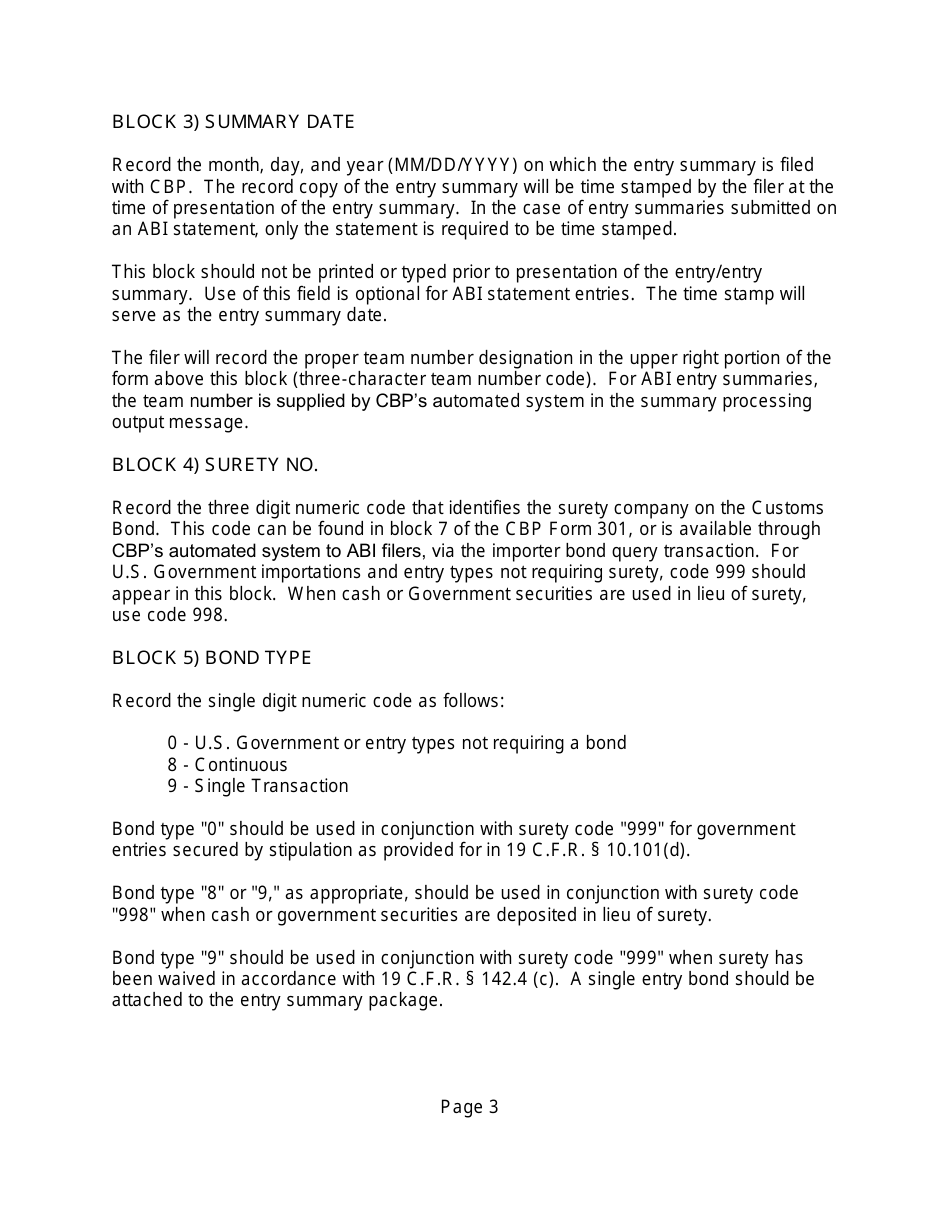

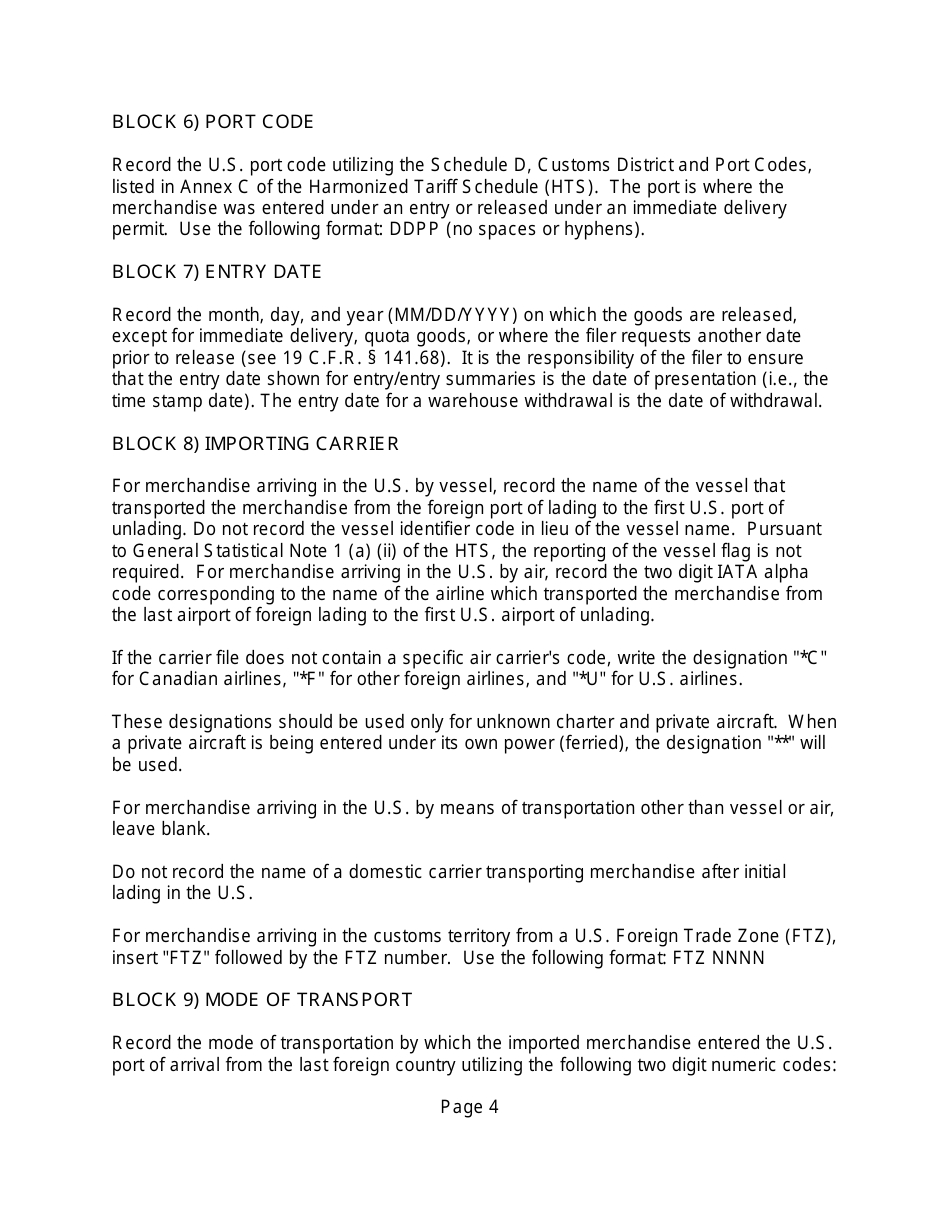

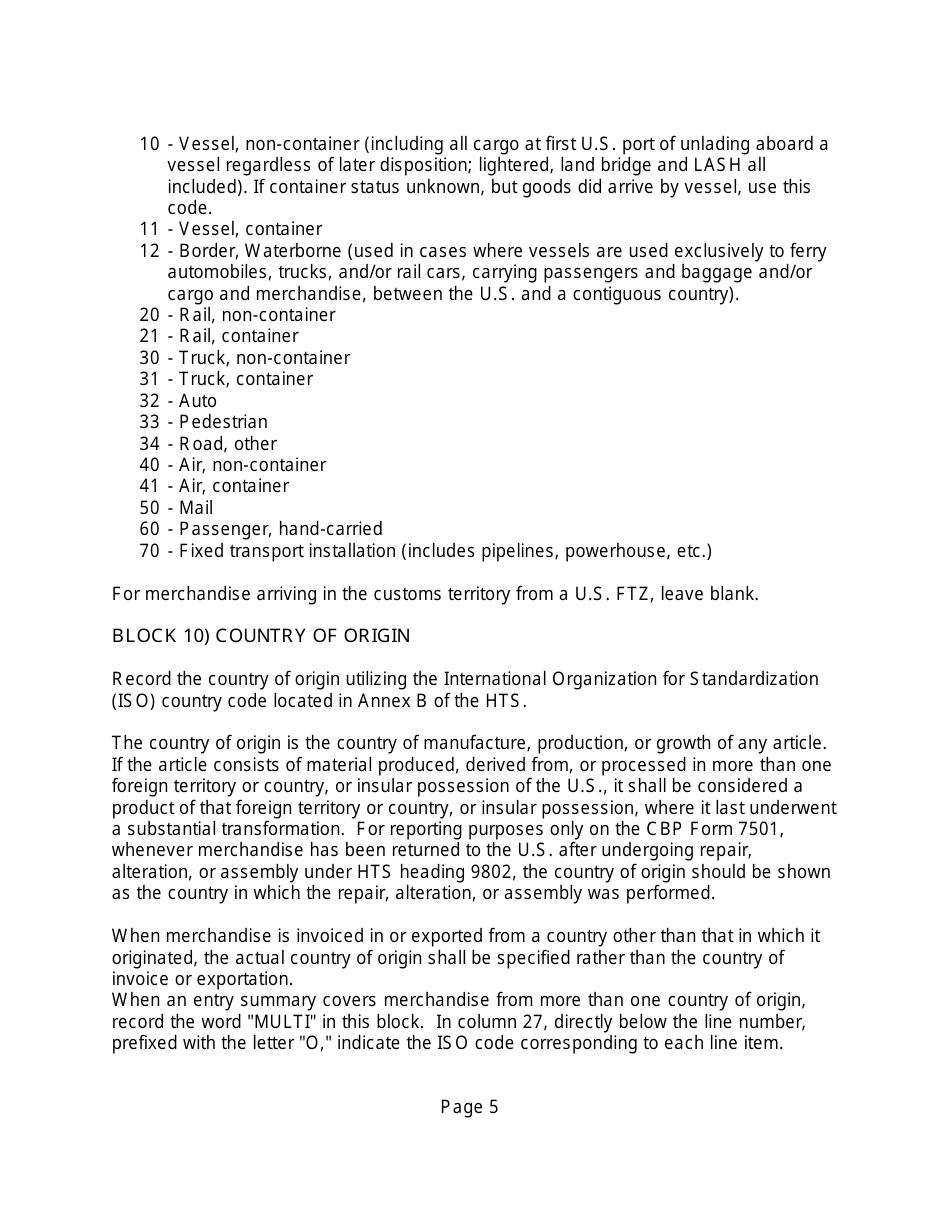

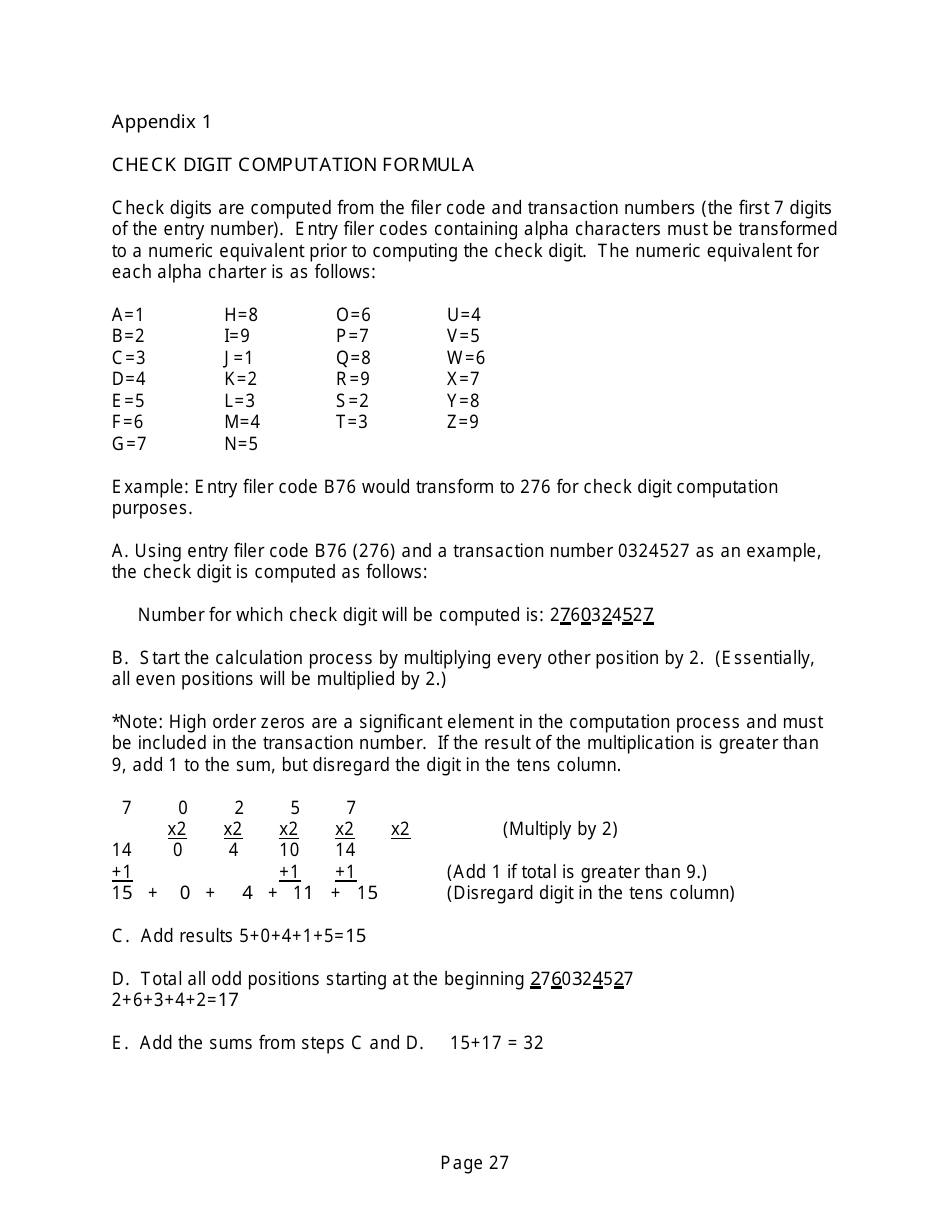

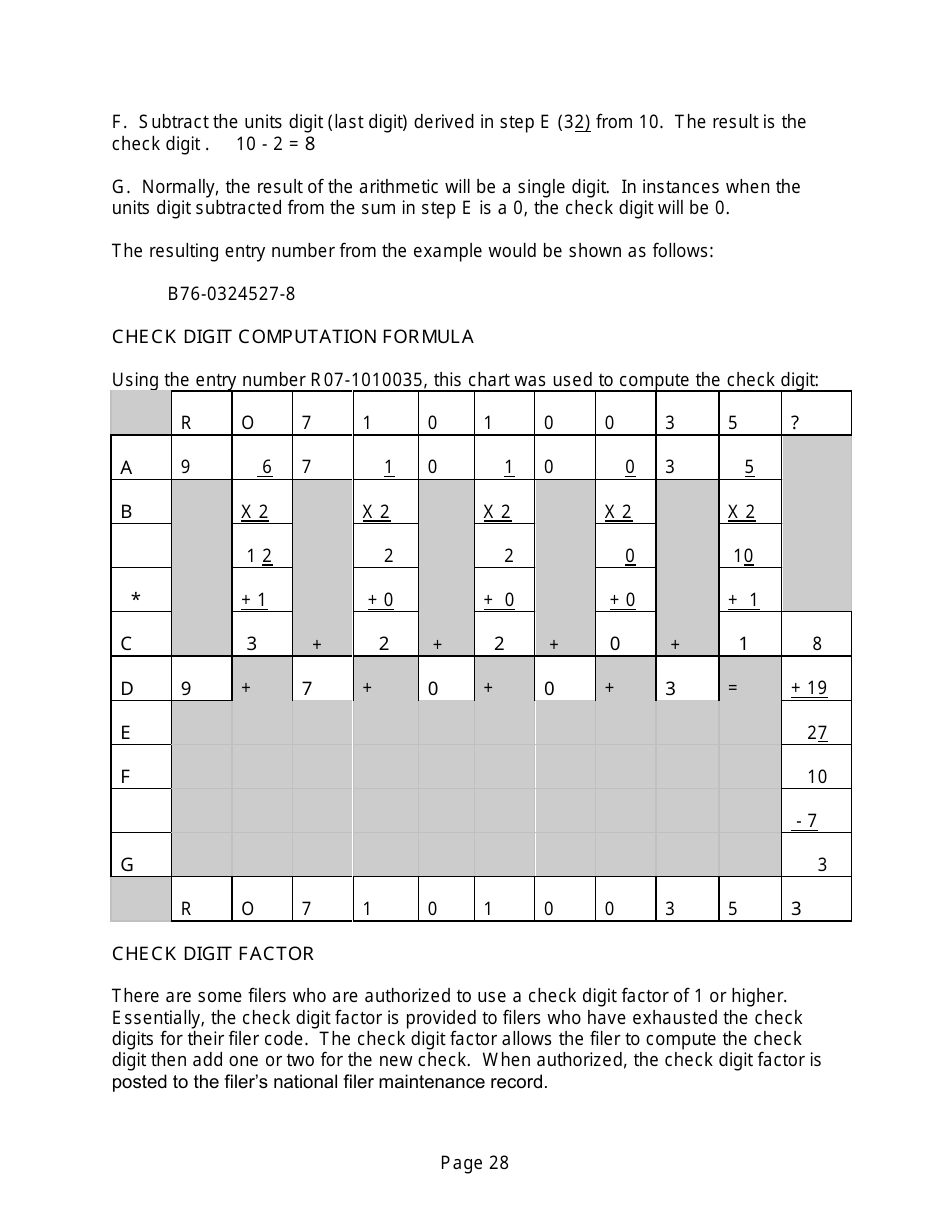

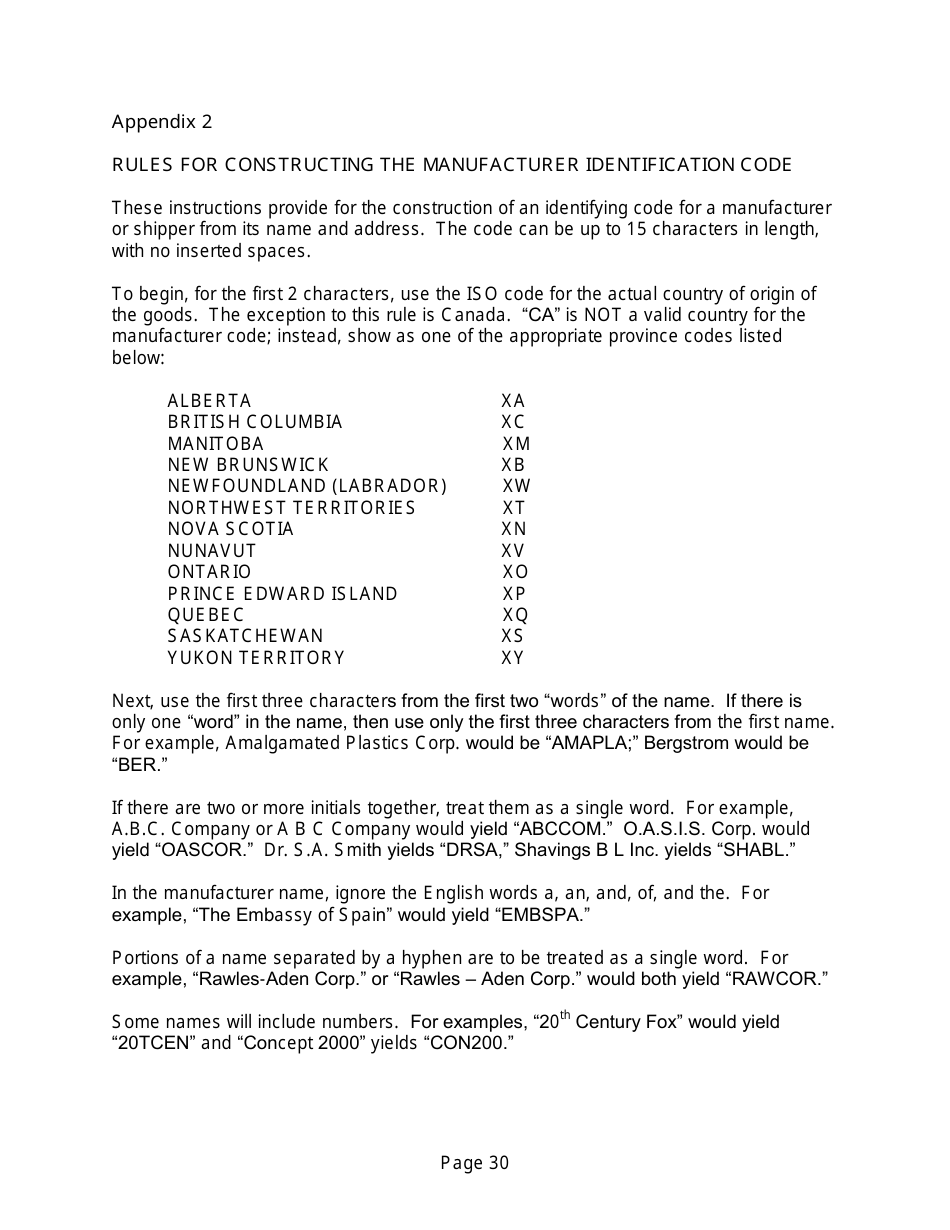

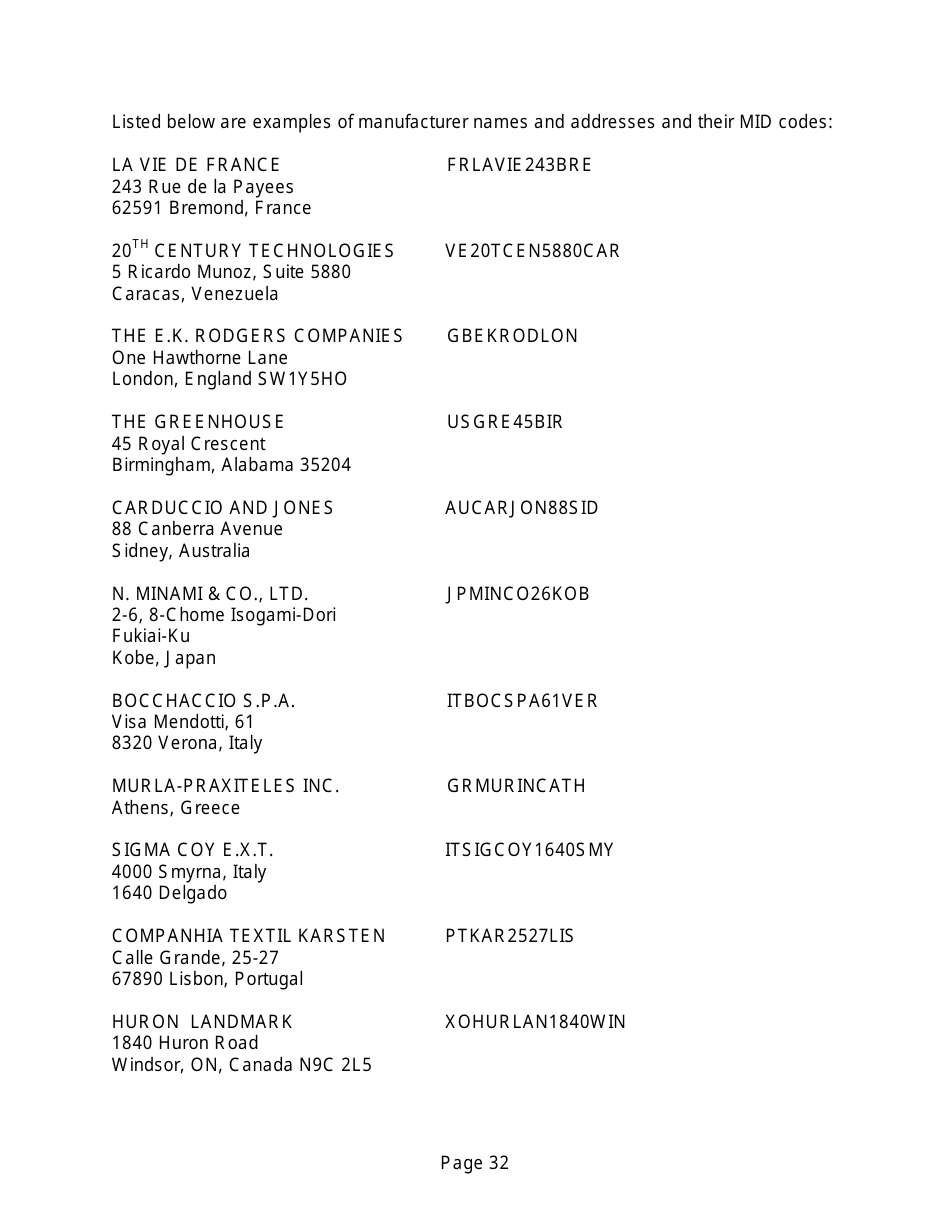

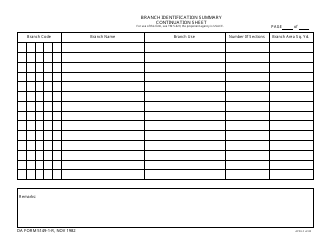

- To prepare the form correctly, you need to consult with CBP Form 7501 instructions for a full breakdown of each field. The instructions guide you on how to complete CBP Form 7501 and include appropriate entry type codes, mode of transport codes, country codes, missing documents codes, and rules for constructing manufacturer identification codes for every block, and different requirements for different categories of goods, countries, duties, and taxes needed to be paid.

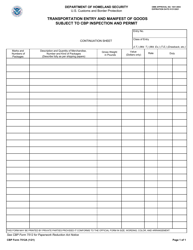

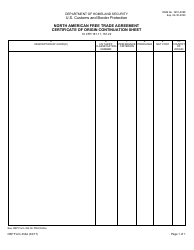

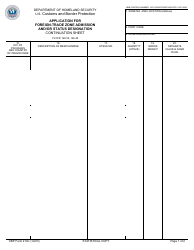

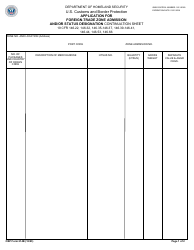

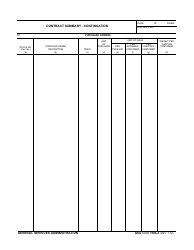

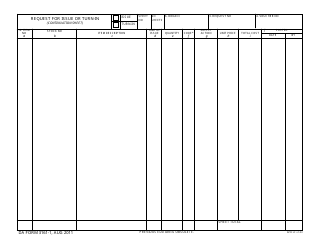

- The form consists of 5 pages, 4 of them are continuation sheets that you are allowed to use to state line numbers, describe the articles in sufficient detail, and write down the value of the goods along with the aggregate cost of all charges and expenses if you cannot fit the description on the first page.

- You have to arrange all entry documents stapling them together.

- Prepare a minimum of two copies of a warehouse withdrawal. You need to have two copies of the form - importer's copy and permit copy. If you are not paying via an automated clearing house (the electronic funds-transfer system that deals with tax refunds and payments, direct deposit, etc.), you also need to prepare a copy for a cashier. If a deferred tax is paid, include one extra copy of the form.

- Consult with the instructions to know which informal entries are applicable.

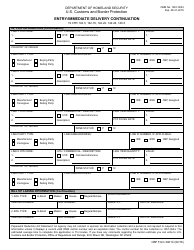

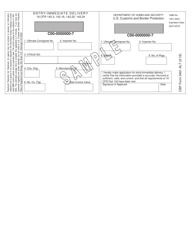

- To speed up the release of your merchandise, you need to file CBP Form 3461, Entry/Immediate Delivery, for ACE before you file the comprehensive and detailed description of the merchandise.

- If the entry summary takes more than one page, the instructions for preparation of CBP Form 7501 require you to show the summary of entered values on the last page after the last line item.

- Prepare all the related documents that prove statements disclosed in the documents to be ready to provide to the appropriate CBP officer with information.

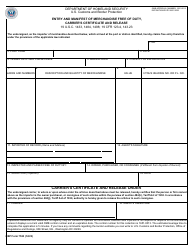

- If you are using this form to file a North American Free Trade Agreement (NAFTA) Duty Deferral Claim, you can refer to the Duty Deferral Handbook to find more information on how to complete the form for this purpose.