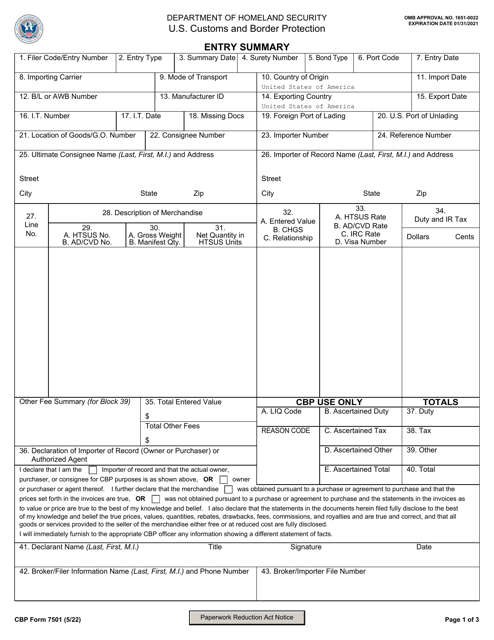

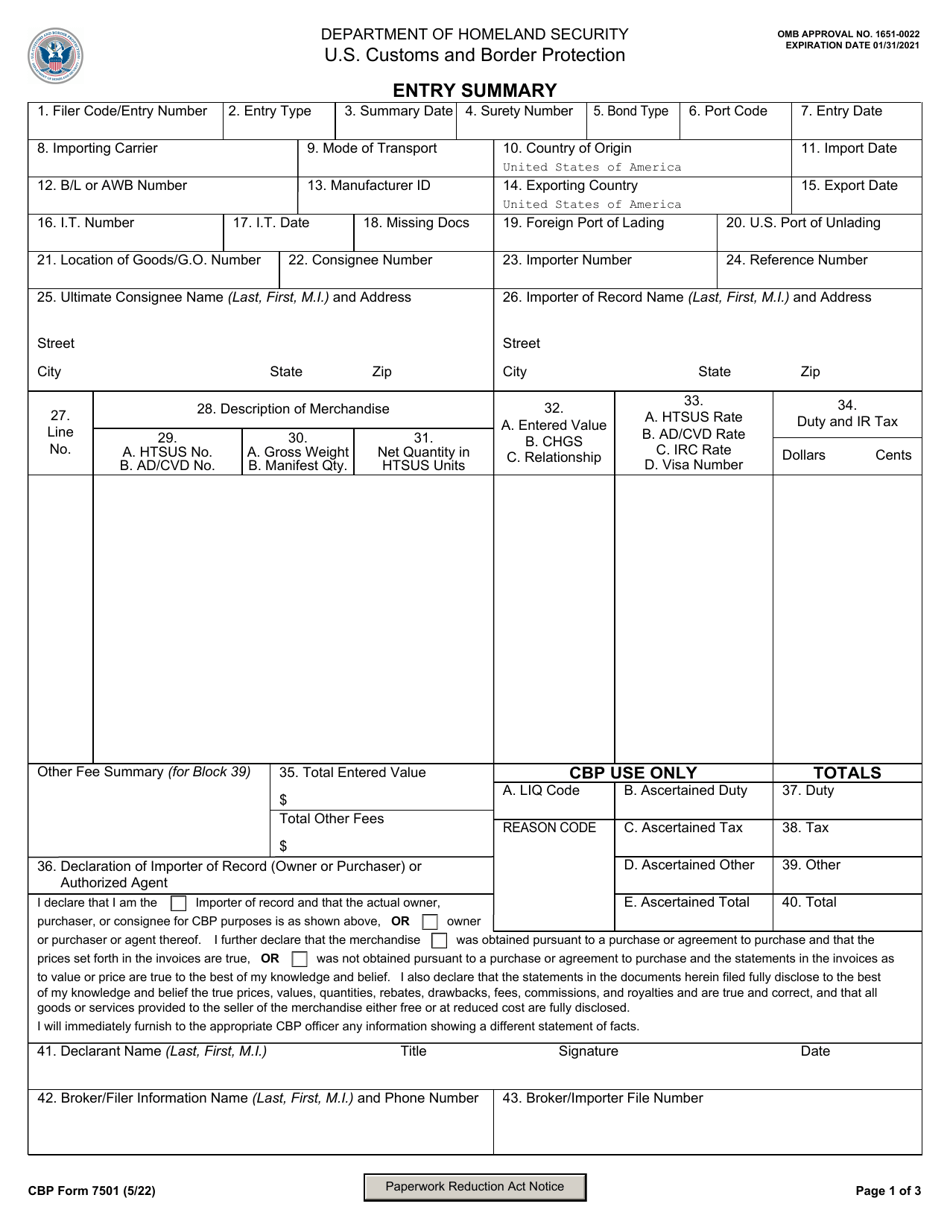

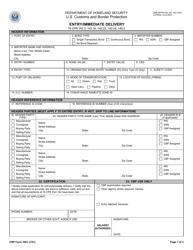

CBP Form 7501 Entry Summary

What Is CBP Form 7501?

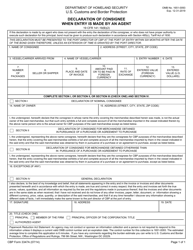

CBP Form 7501, Entry Summary , is a form used by Customs and Border Protection (CBP) to discover relevant information (origin, classification, appraisement) regarding the imported commodity. It describes merchandise entering the trade of the United States and records the amount of tax and/or duty paid.

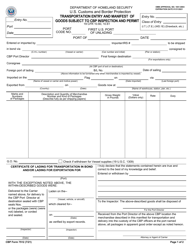

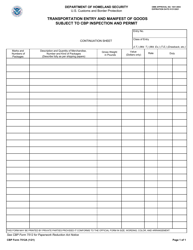

The latest version of the form was released by the CBP on May 1, 2022 , with all previous editions obsolete. A CBP Form 7501 fillable version can be downloaded through the link below. CBP Form 7501A, Document/Payment Transmittal, is an auxiliary form used to link a supplemental payment after an original automated clearing house (electronic network for financial transactions) payment with the relevant entry. It verifies the respondent's account.

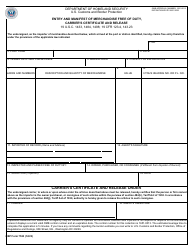

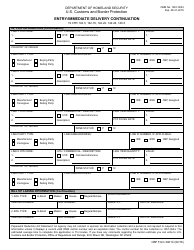

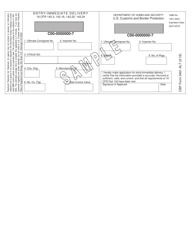

CBP Form 3461, Entry/Immediate Delivery for ACE, is another form closely related to CBP Form 7501. This form is initially submitted to the CBP electronically unless they request a hard copy. Its purpose is to speed up the release of your merchandise. After that, you have ten days to file the comprehensive and detailed Form CBP 7501.

CBP Form 7501 Instructions

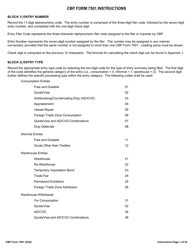

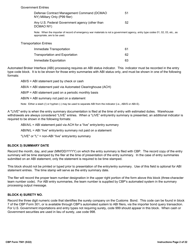

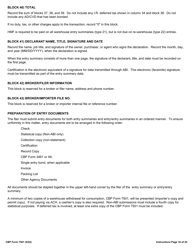

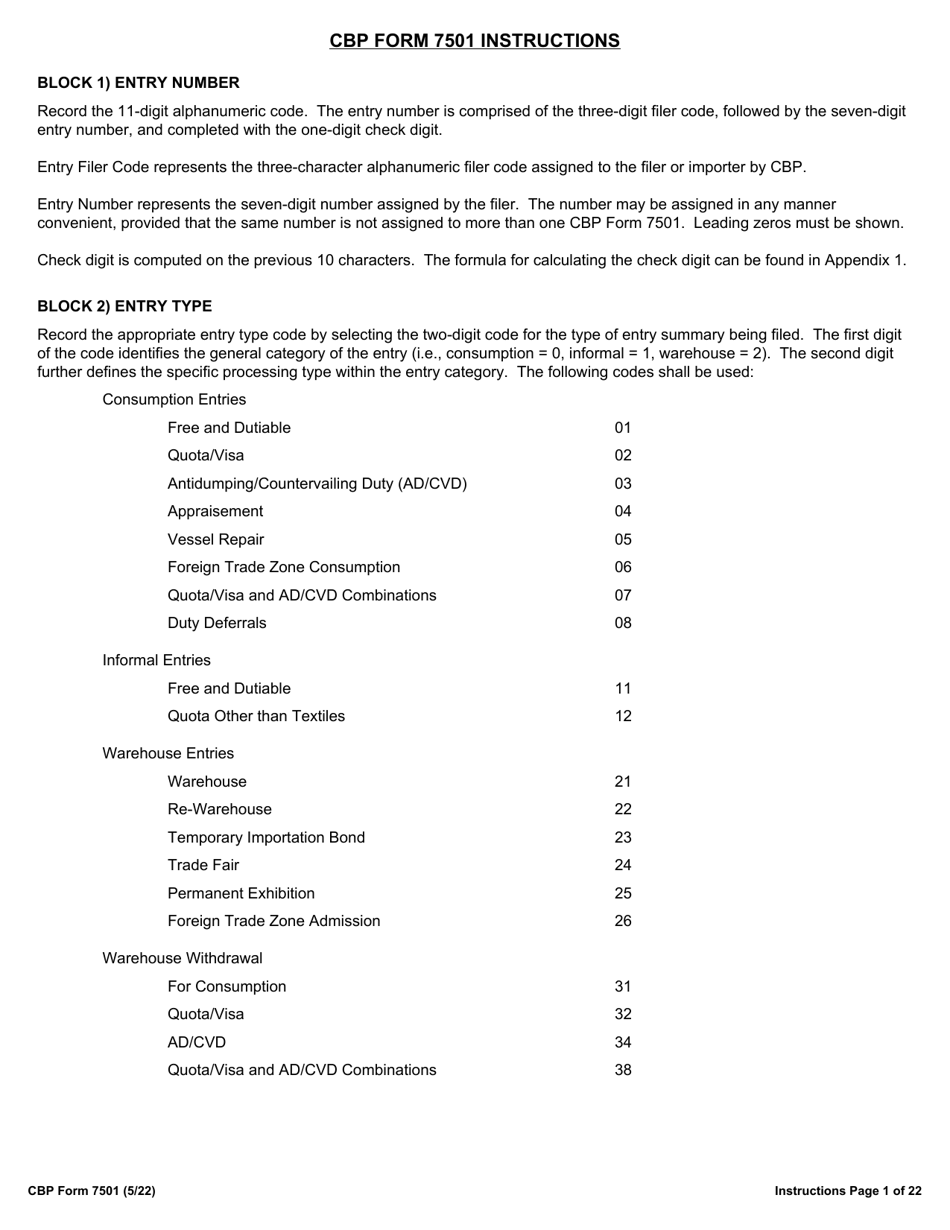

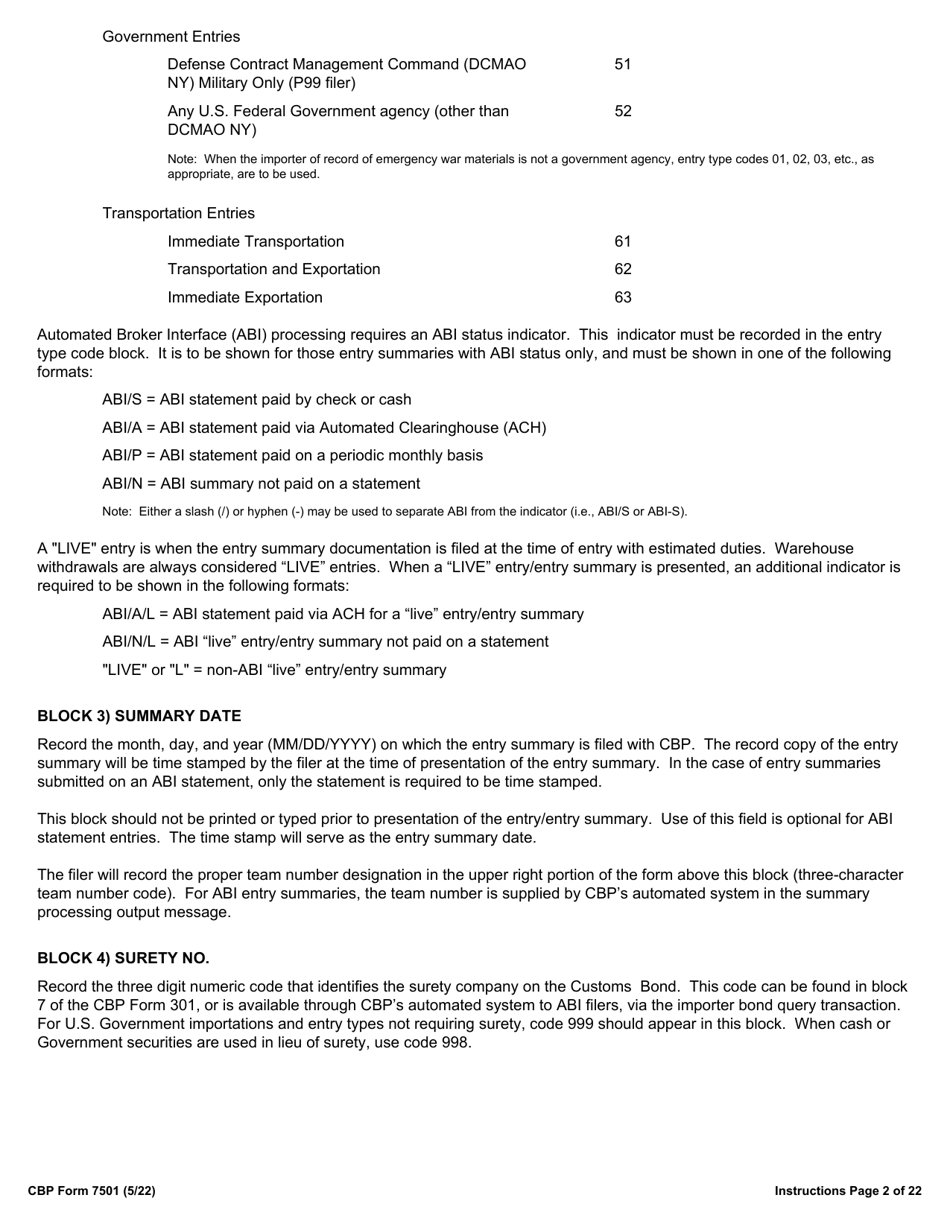

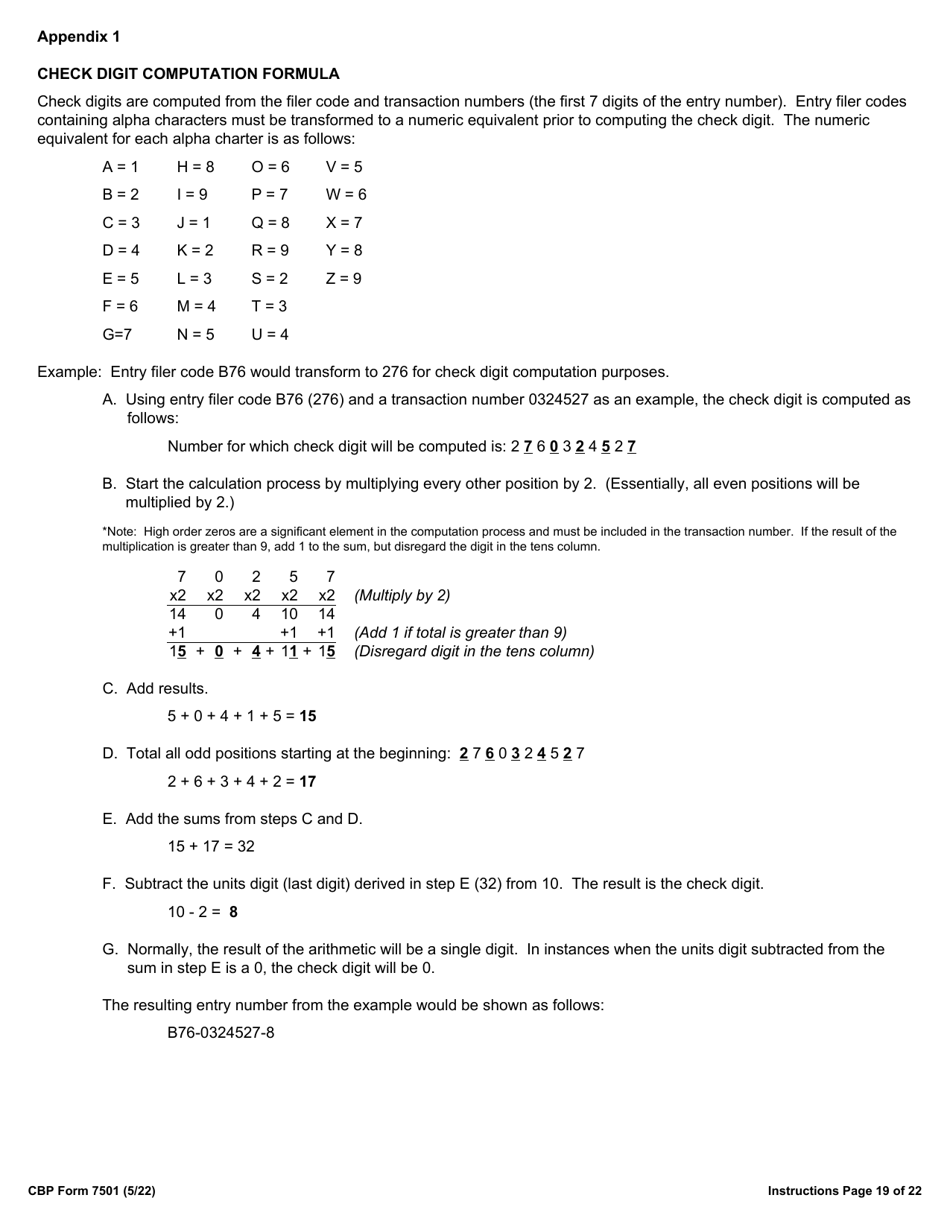

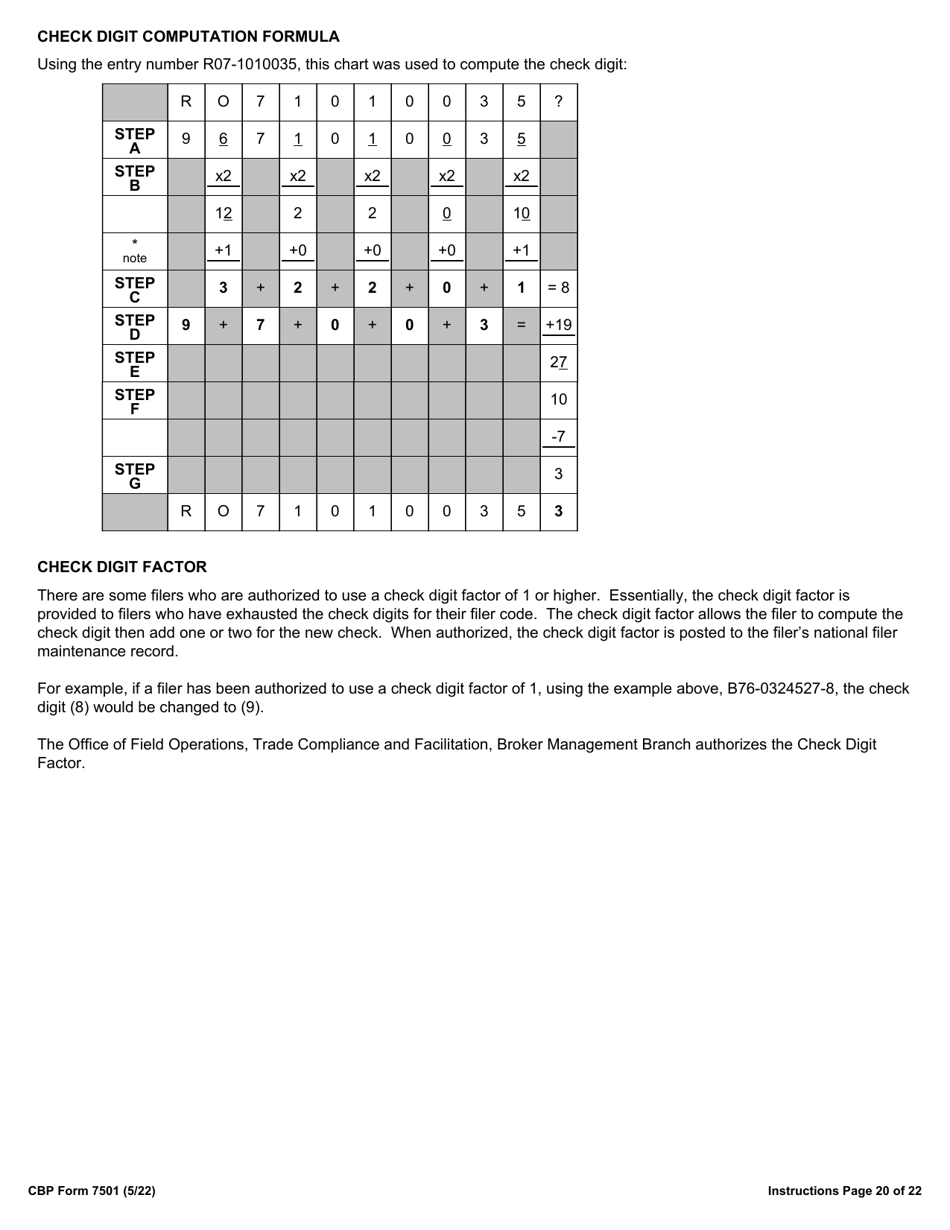

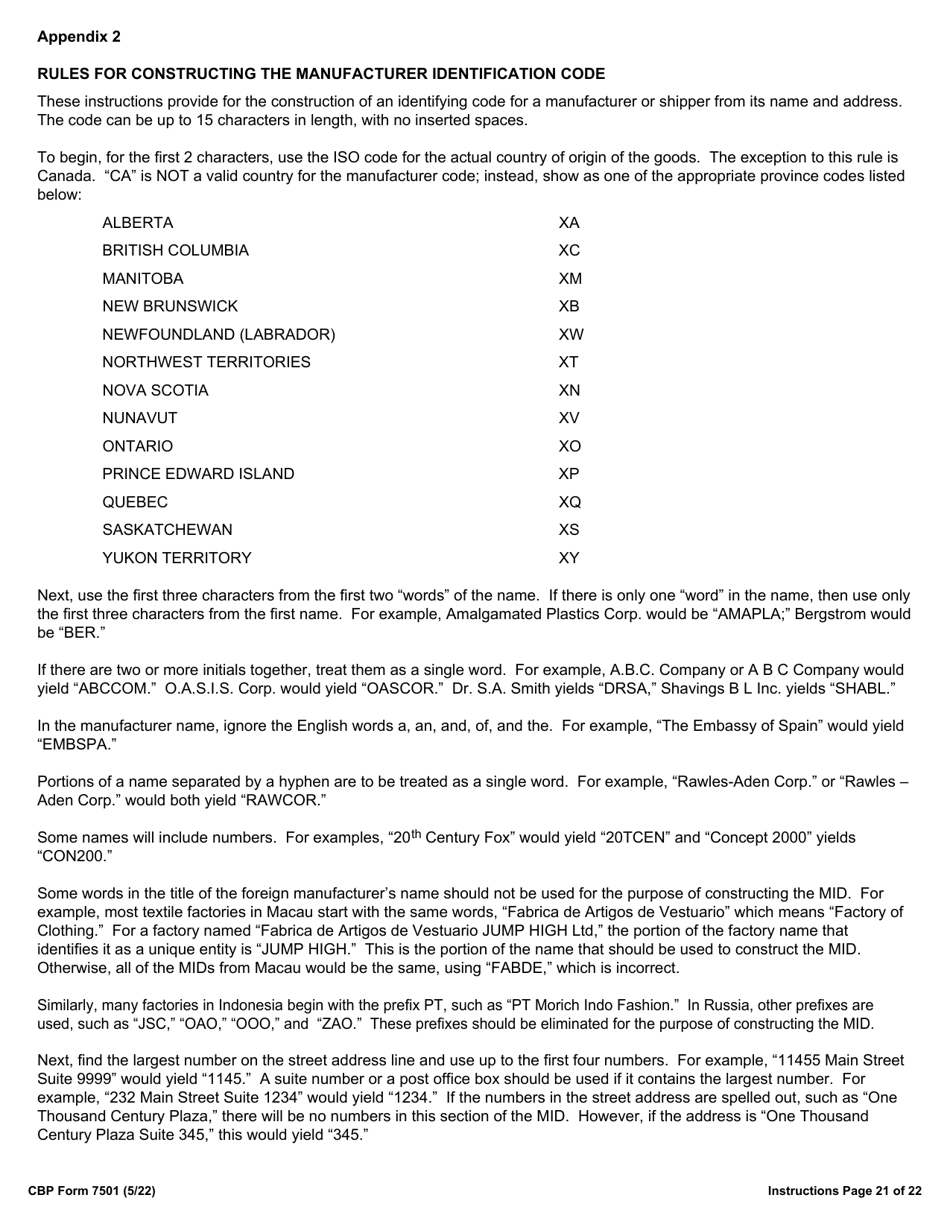

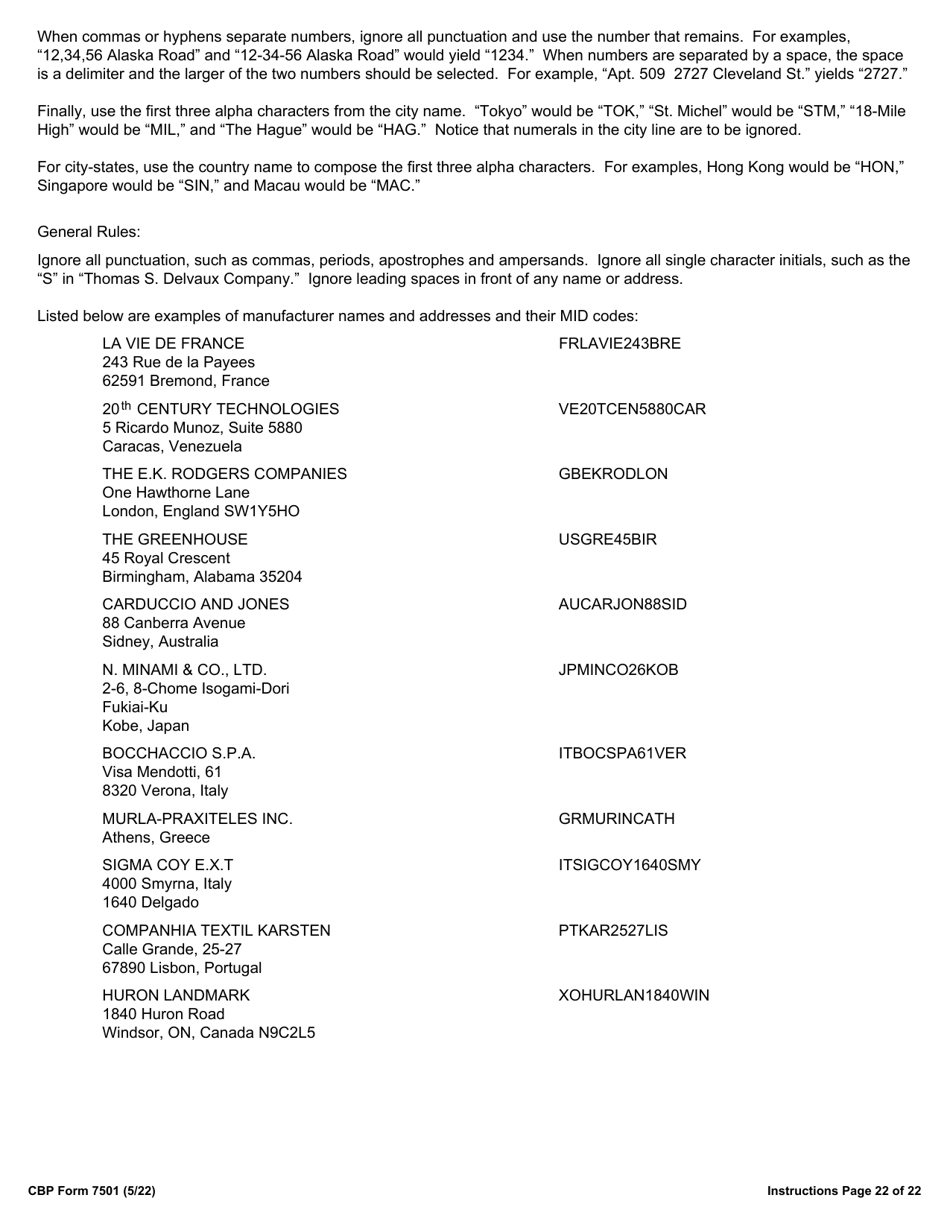

This form has to be filed within 10 business days from the time of the entry of merchandise. To prepare the form correctly, you need to consult with CBP Form 7501, Entry Summary instructions. They include appropriate entry type codes, mode of transport codes, country codes, missing documents codes, and rules for constructing manufacturer identification codes for every block, and different requirements for different categories of goods, countries, duties, and taxes needed to be paid.

Arrange all entry documents and staple them all together. Prepare a minimum of two copies of a warehouse withdrawal. You need to have two copies of the form - importer's copy and permit copy. Consult with the instructions to know where informal entries are applicable.

How to Fill out CBP Form 7501?

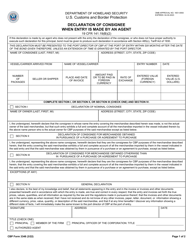

- Write down the entry filer number (the three-character code assigned to the importer or filer by the CBP) or the entry filer code (a seven-digit number assigned by the filer).

- Record the entry type code identifying the general category of the entry and the specific processing type within each category.

- State the date on which the entry summary is filed with the CBP.

- Write down the three-digit code identifying the surety company on the customs bond.

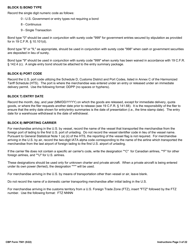

- Choose the bond type. There are three alternatives: entries not requiring a bond, continuous, or single entry.

- Indicate the U.S. port code.

- State the date on which the goods are released.

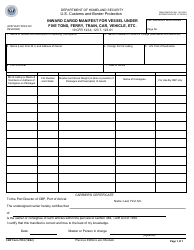

- Record the name of the vessel transporting the merchandise and write down the mode of transportation by which the merchandise entered the port of arrival.

- State the country of origin.

- Write down the date on which the merchandise arrived with the intent to unload.

- Record the bill of lading or air waybill (a receipt providing detailed information about the international shipment for it to be tracked) number.

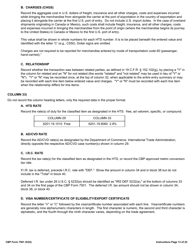

- Identify the manufacturer.

- State the exporting country and the date on which the carrier departed from it.

- Write down the immediate transportation number and the date of its attainment.

- Indicate documents not available at the time of filing.

- State the foreign port of lading.

- Record the U.S. port code where the merchandise was unladen.

- State the site or pier where the goods are available for examination.

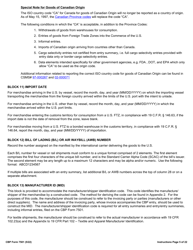

- Provide a valid identification number of the consignee, the importer of record, and the individual or firm to whom documentation is to be sent.

- Write down the names and addresses of the ultimate consignee and the importer of record.

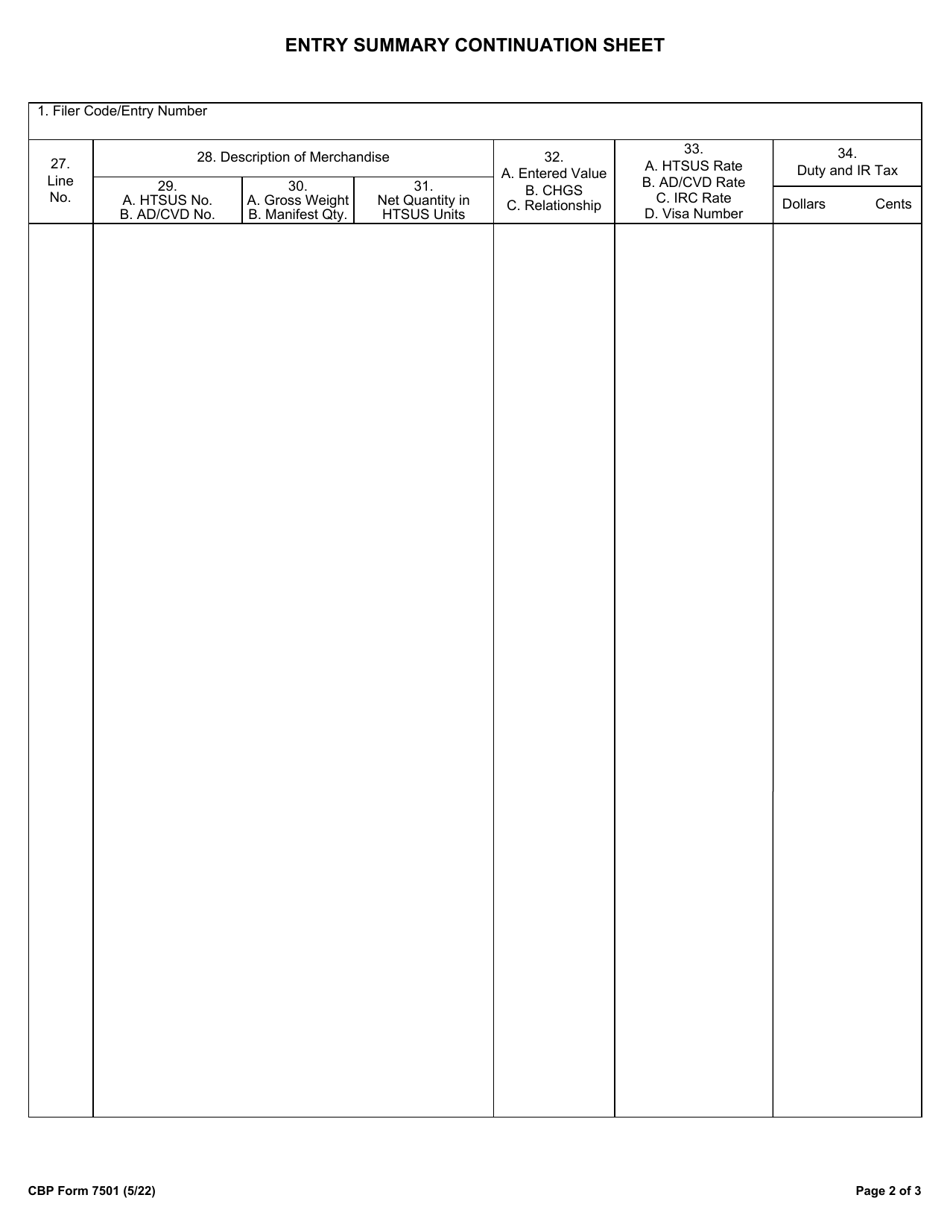

- State a line number of the commodity from one country.

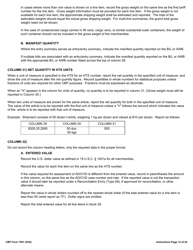

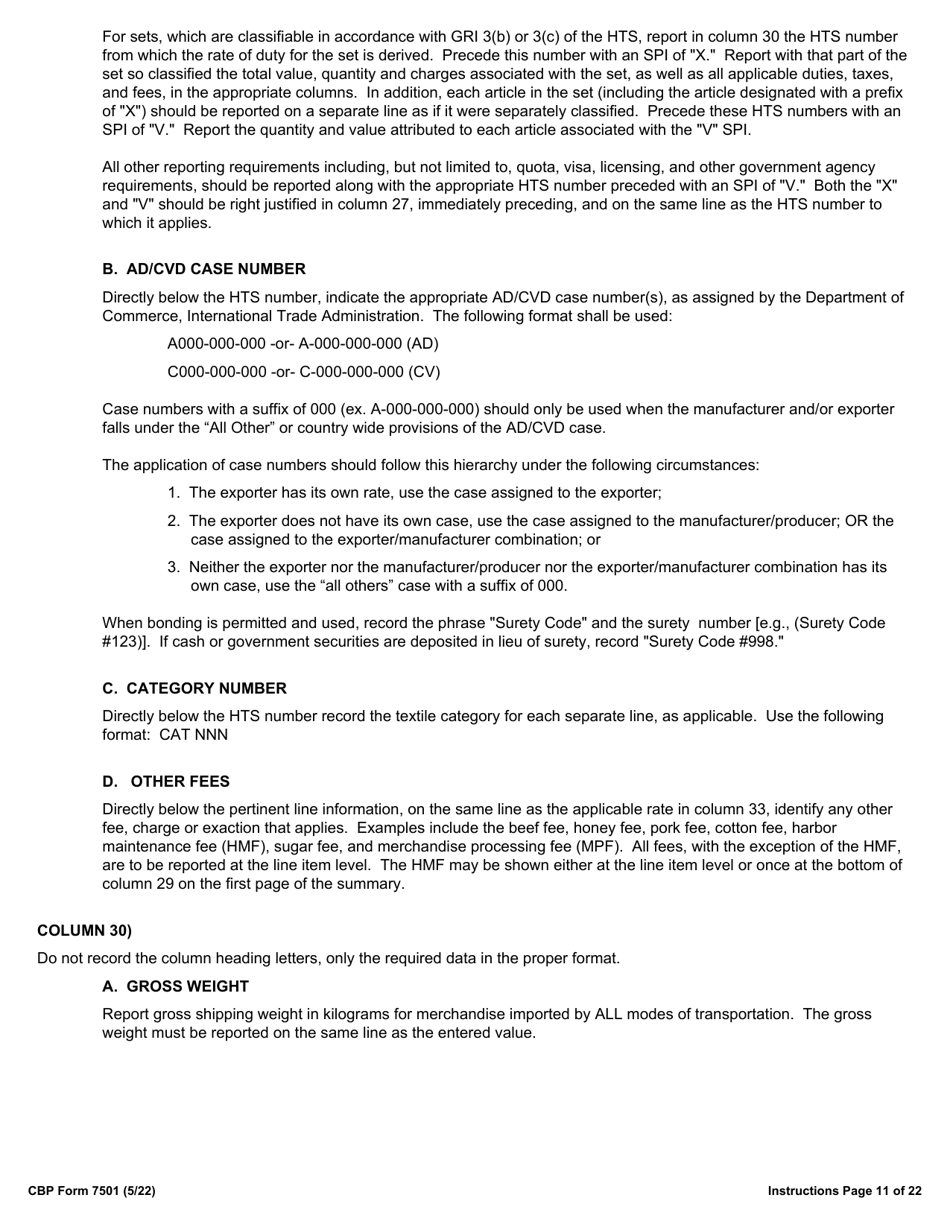

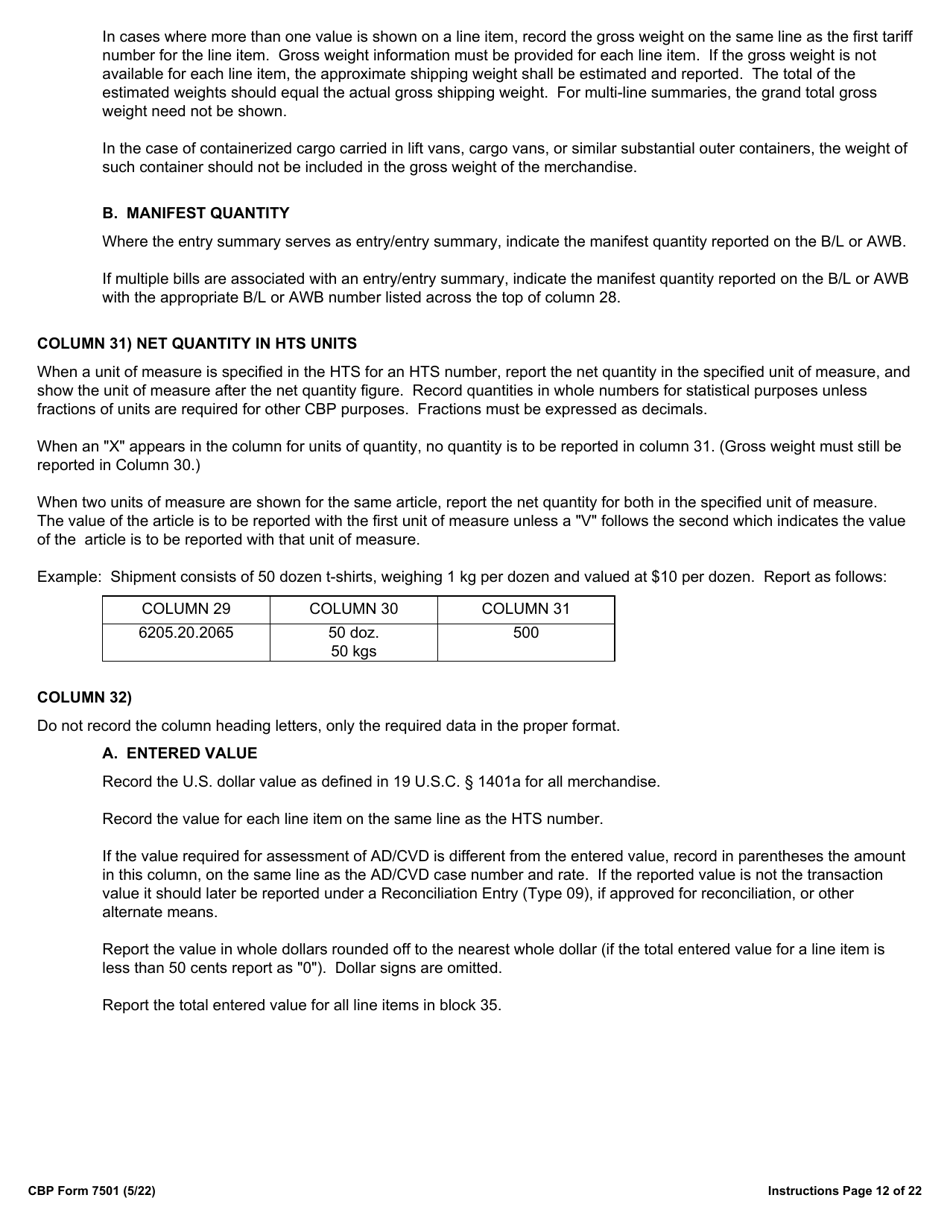

- Describe the articles in sufficient detail to permit the classification. State the Harmonized Tariff Schedule (HTS) number, Anti-dumping (AD)/Countervailing duties (CVD) number, the gross shipping weight, manifest quantity, and net quantity.

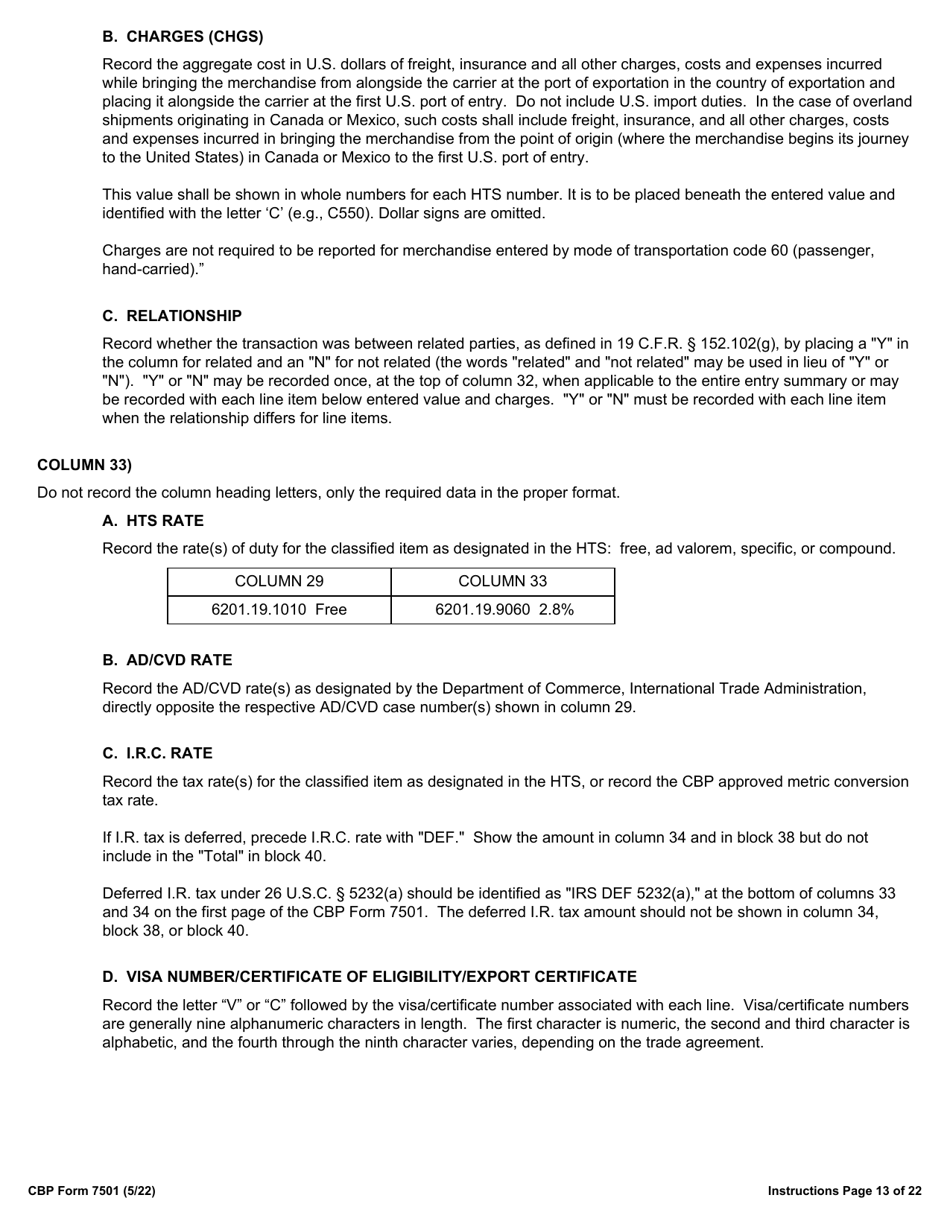

- Write down the value of the merchandise, the aggregate cost of all charges and expenses, and record the relationship for line items.

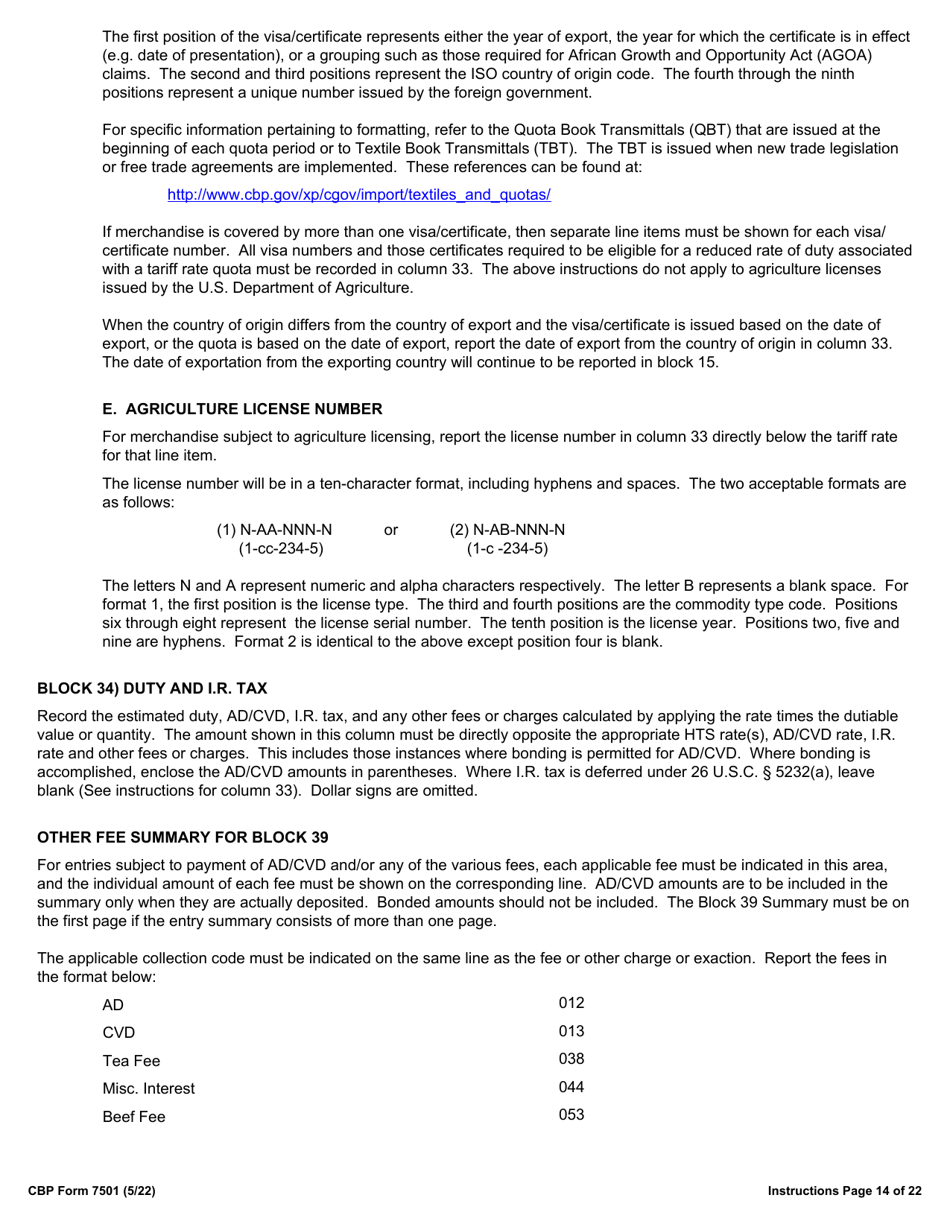

- State the rate of duty from the HTS, the AD/CVD rate, the tax rate, and the visa number for each line.

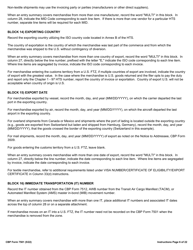

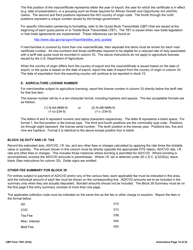

- Record the estimated duty and internal revenue tax.

- Indicate the total entered value for all line items, and fill out the declaration as an agent or importer.

- State the total duty and tax paid, include other fees and charges.

- Write down your full name and job title. Sign and date the form.

- The broker or filer is also required to state the name, address, phone number, and file number.