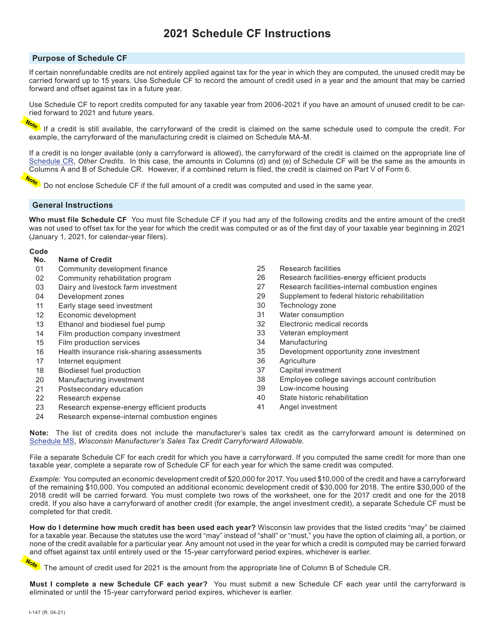

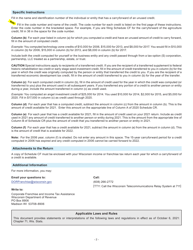

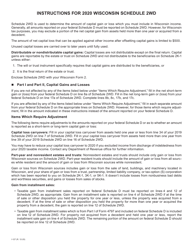

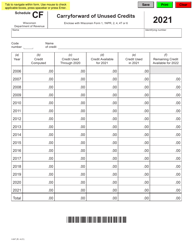

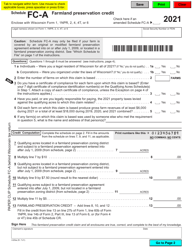

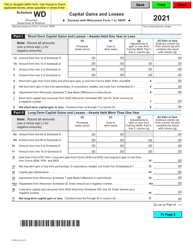

Instructions for Form I-147 Schedule CF Carryforward of Unused Credits - Wisconsin

This document contains official instructions for Form I-147 Schedule CF, Carryforward of Unused Credits - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form I-147 Schedule CF?

A: Form I-147 Schedule CF is a form used in Wisconsin to carryforward unused tax credits from previous years.

Q: What is the purpose of Form I-147 Schedule CF?

A: The purpose of Form I-147 Schedule CF is to allow individuals or businesses to carryforward tax credits that were not fully utilized in previous years.

Q: Who needs to fill out Form I-147 Schedule CF?

A: Anyone who has unused tax credits from previous years in Wisconsin needs to fill out Form I-147 Schedule CF.

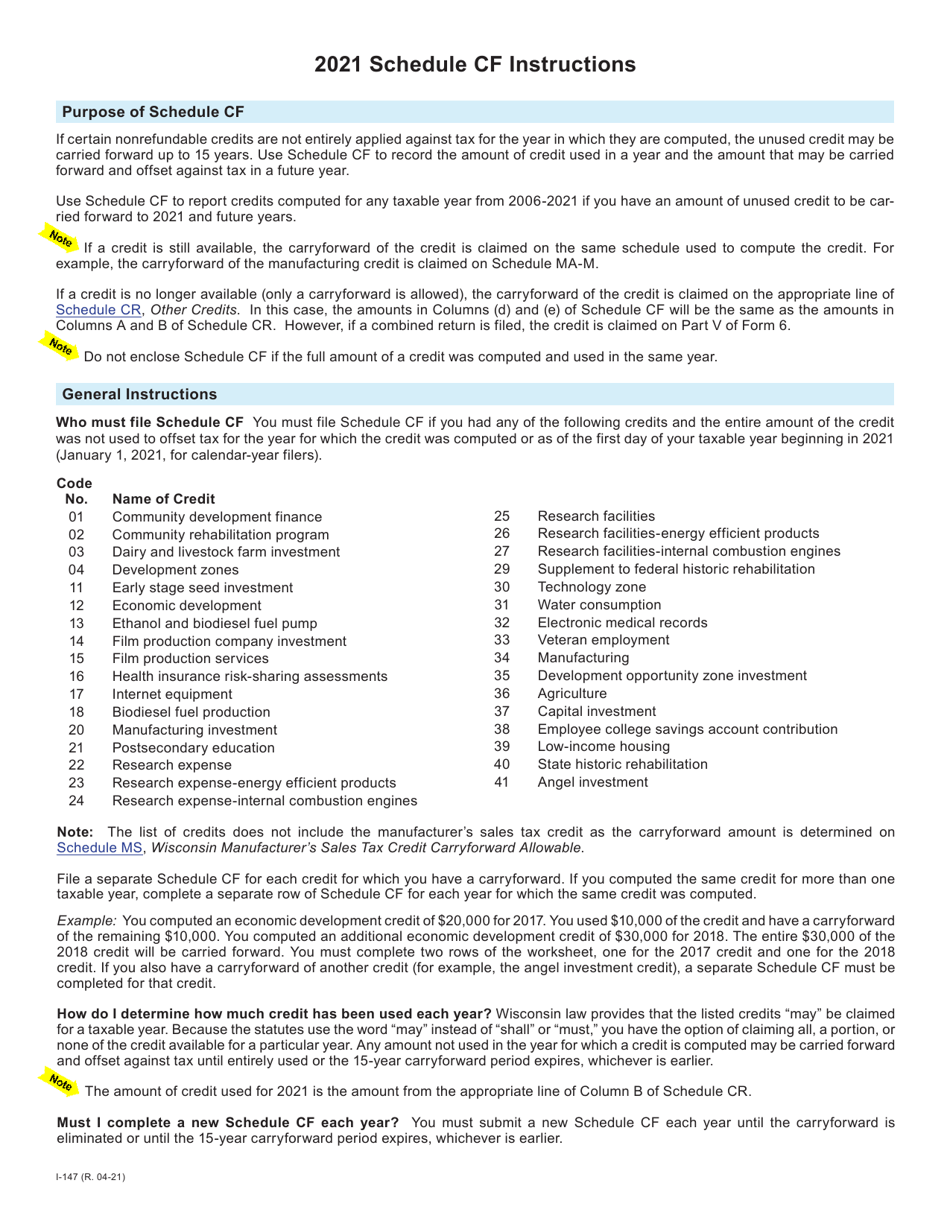

Q: What information is required on Form I-147 Schedule CF?

A: Form I-147 Schedule CF requires you to provide your personal information, details about the unused tax credits, and the amount you are carrying forward.

Q: When is the deadline to submit Form I-147 Schedule CF?

A: The deadline to submit Form I-147 Schedule CF is the same as the deadline to file your Wisconsin tax return, usually April 15th.

Q: Is there a fee to file Form I-147 Schedule CF?

A: No, there is no fee to file Form I-147 Schedule CF.

Q: Can I e-file Form I-147 Schedule CF?

A: Yes, you can e-file Form I-147 Schedule CF if you are filing your Wisconsin tax return electronically.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.