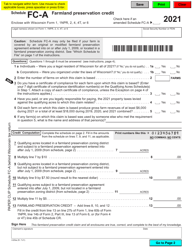

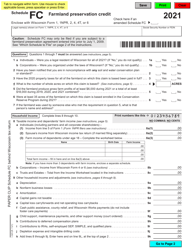

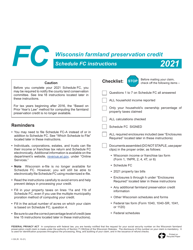

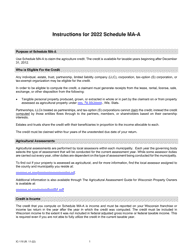

Instructions for Form IC-025AI Schedule FC-A Farmland Preservation Credit - Wisconsin

This document contains official instructions for Form IC-025AI Schedule FC-A, Farmland Preservation Credit - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form IC-025AI Schedule FC-A?

A: Form IC-025AI Schedule FC-A is a form used in Wisconsin to claim the Farmland Preservation Credit.

Q: What is the Farmland Preservation Credit?

A: The Farmland Preservation Credit is a credit available to Wisconsin residents who own farmland and meet certain eligibility criteria.

Q: Who is eligible for the Farmland Preservation Credit?

A: To be eligible for the Farmland Preservation Credit, you must be a Wisconsin resident and meet the ownership and usage requirements for farmland.

Q: What are the ownership requirements for farmland?

A: To meet the ownership requirements for farmland, you must own at least five acres of agricultural land and have owned it for at least three years.

Q: What are the usage requirements for farmland?

A: To meet the usage requirements for farmland, you must use the land for agricultural purposes and meet the minimum income threshold.

Q: How do I claim the Farmland Preservation Credit?

A: To claim the Farmland Preservation Credit, you must complete Form IC-025AI Schedule FC-A and include it with your Wisconsin income tax return.

Q: Are there any deadlines for claiming the Farmland Preservation Credit?

A: Yes, the Farmland Preservation Credit must be claimed by the due date of your Wisconsin income tax return, which is typically April 15th.

Q: What documentation do I need to include with Form IC-025AI Schedule FC-A?

A: You may be required to provide documentation such as property ownership records, income records, and other supporting documents to prove your eligibility for the Farmland Preservation Credit.

Q: Can I claim the Farmland Preservation Credit if I lease farmland?

A: No, the Farmland Preservation Credit can only be claimed by individuals who own the farmland and meet the ownership and usage requirements.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.