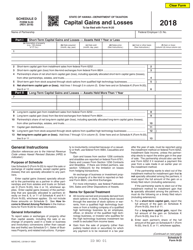

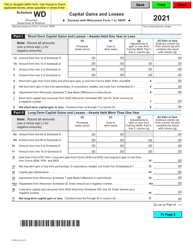

Instructions for Form I-170 Schedule WD Capital Gains and Losses - Wisconsin

This document contains official instructions for Form I-170 Schedule WD, Capital Gains and Losses - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form I-170 Schedule WD?

A: Form I-170 Schedule WD is a part of the Wisconsin state tax return which is used to report capital gains and losses.

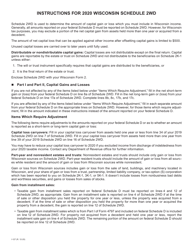

Q: Who needs to complete Form I-170 Schedule WD?

A: Individuals who have capital gains and losses in the state of Wisconsin need to complete this form.

Q: What is considered a capital gain or loss?

A: A capital gain is the profit made from the sale of an asset, while a capital loss is the loss incurred from the sale of an asset.

Q: What information is required on Form I-170 Schedule WD?

A: The form asks for details of each capital gain or loss, including the description of the asset, date acquired and sold, purchase and sale prices, and any adjustments.

Q: Is there a deadline to submit Form I-170 Schedule WD?

A: Form I-170 Schedule WD must be submitted along with the Wisconsin state tax return by the tax filing deadline, which is usually April 15th.

Q: Is there any special tax treatment for capital gains and losses in Wisconsin?

A: Wisconsin generally follows federal tax rules for the treatment of capital gains and losses, but there may be certain differences. It is recommended to consult a tax professional or refer to the Wisconsin Department of Revenue for more information.

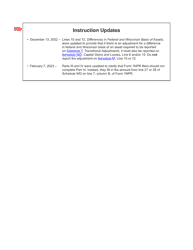

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.