This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 709

for the current year.

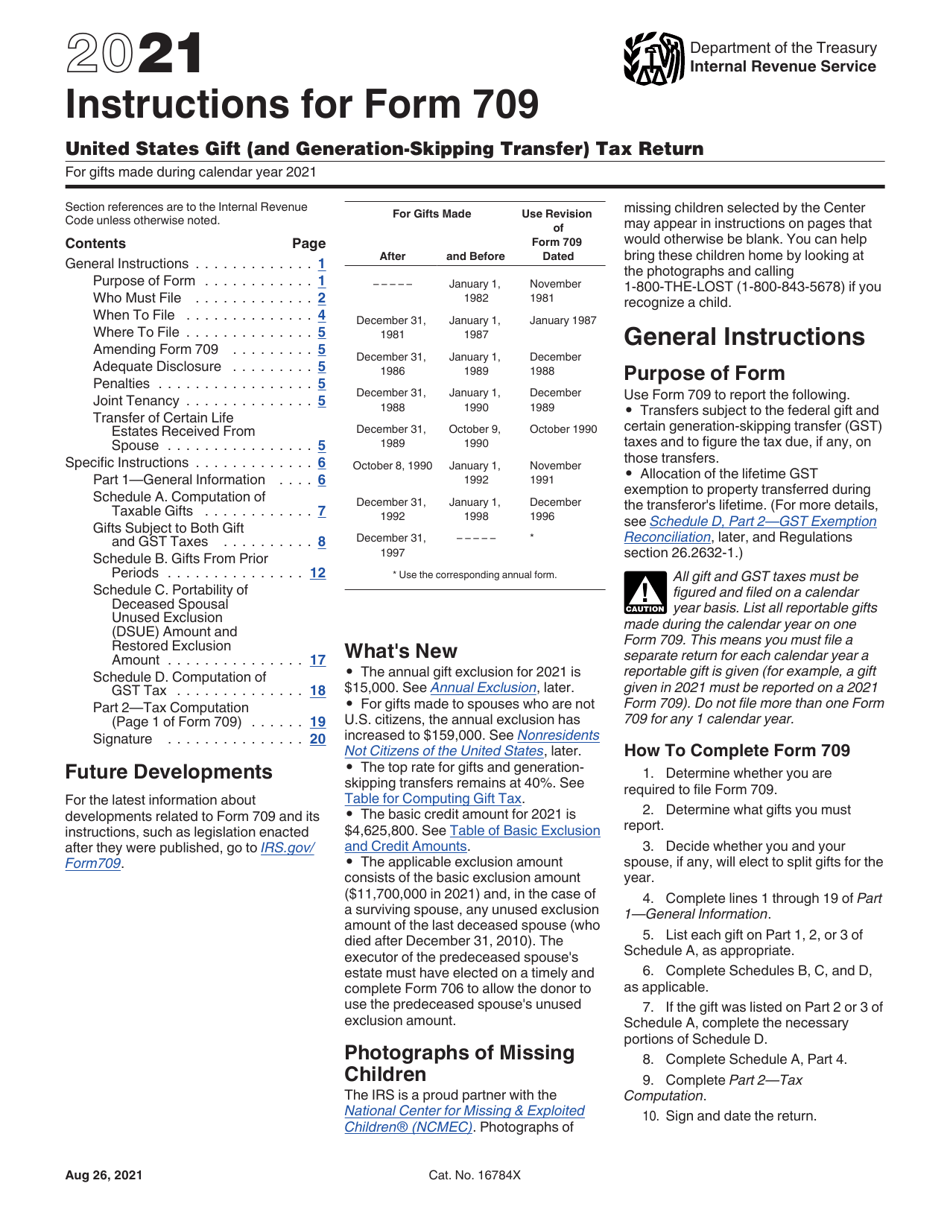

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return

This document contains official instructions for IRS Form 709 , United States Gift (And Generation-Skipping Transfer) Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is the IRS Form 709?

A: The IRS Form 709 is a United States Gift (And Generation-Skipping Transfer) Tax Return.

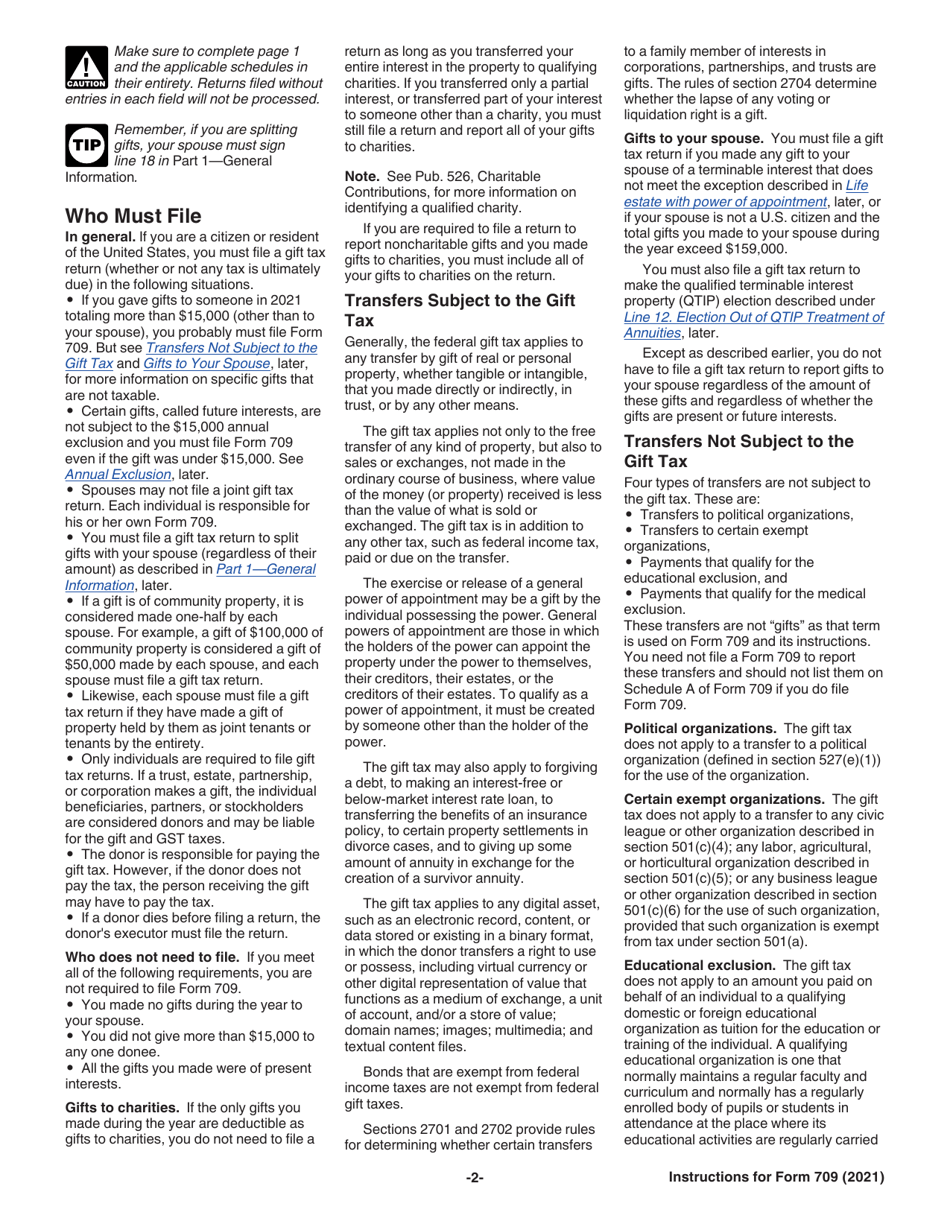

Q: Who needs to file the IRS Form 709?

A: Anyone who gives gifts that exceed the annual gift tax exclusion needs to file the IRS Form 709.

Q: What is the purpose of the IRS Form 709?

A: The purpose of the IRS Form 709 is to report gifts made during the tax year that exceed the annual gift tax exclusion.

Q: What is the annual gift tax exclusion?

A: The annual gift tax exclusion is the maximum amount of gifts an individual can give to another person each year without having to pay gift taxes.

Q: What is the gift tax rate?

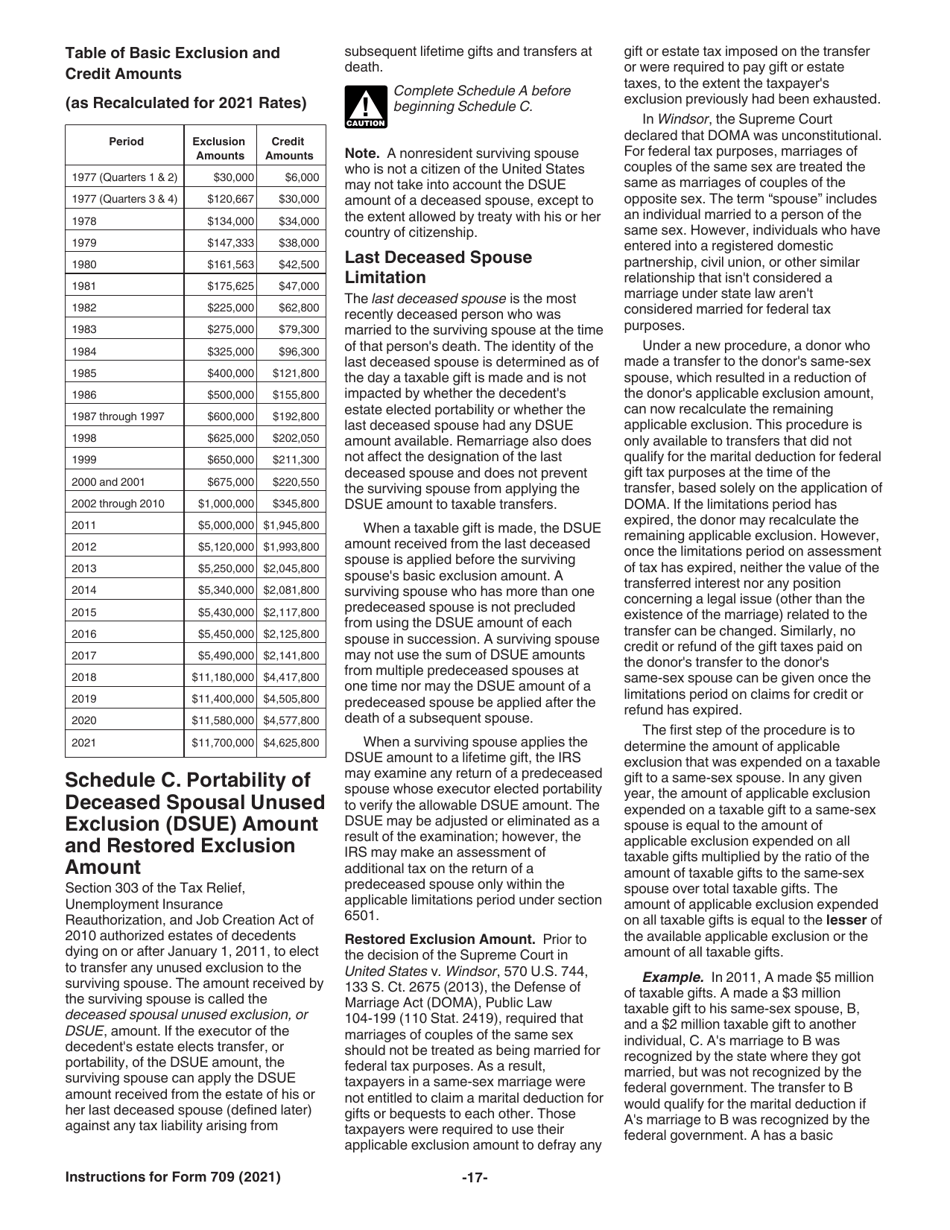

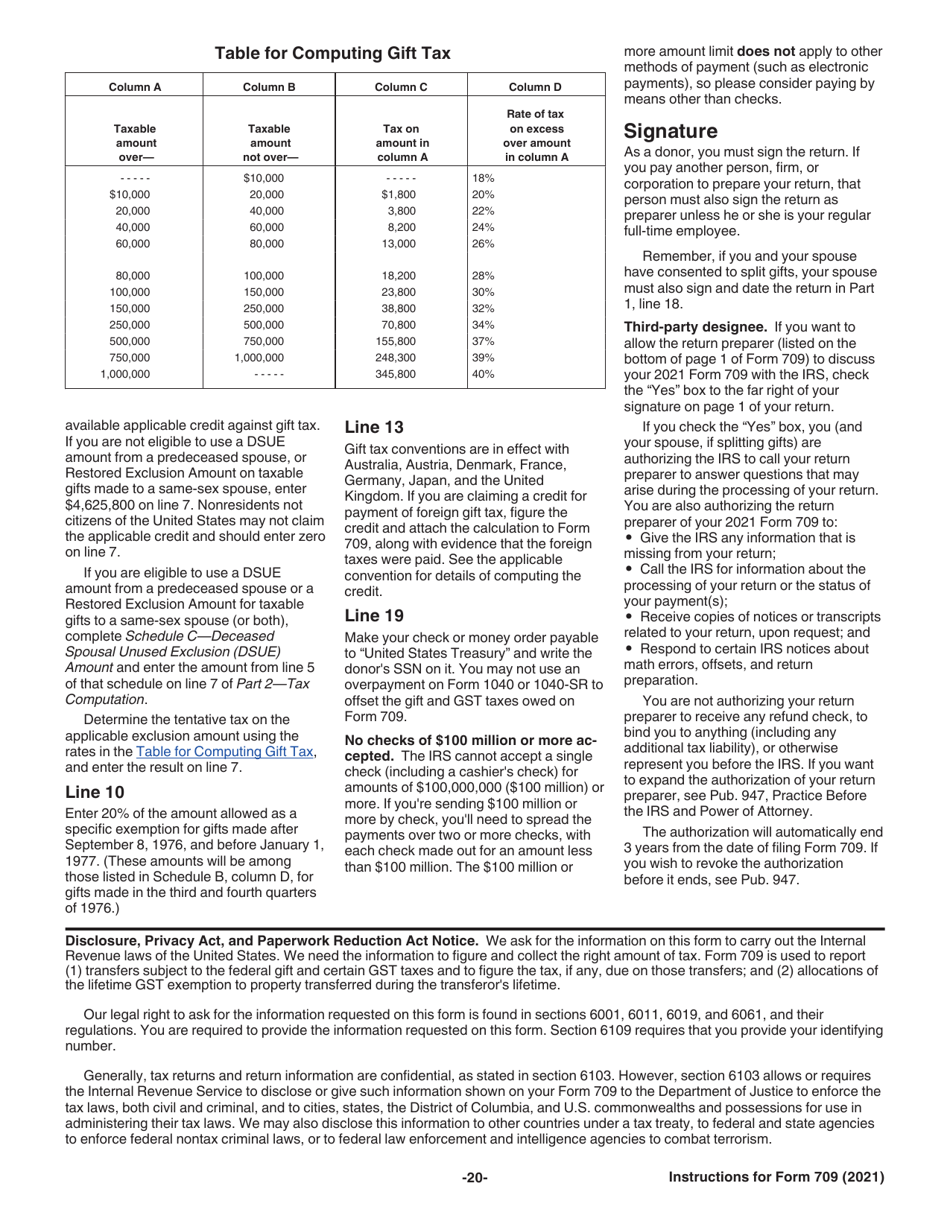

A: The gift tax rate can vary depending on the total value of the gifts given and ranges from 18% to 40%.

Q: Is there a deadline for filing the IRS Form 709?

A: Yes, the IRS Form 709 must be filed by April 15th of the year following the year in which the gift was made.

Q: Do I need to hire a tax professional to help me file the IRS Form 709?

A: While it is not required, hiring a tax professional can help ensure that the form is completed correctly and that you take advantage of any available deductions or exclusions.

Q: Are there any penalties for not filing the IRS Form 709?

A: Yes, failure to file the IRS Form 709 or understating the value of gifts can result in penalties, including monetary fines.

Instruction Details:

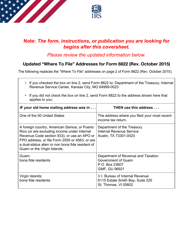

- This 21-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.