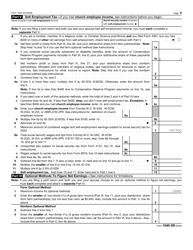

This version of the form is not currently in use and is provided for reference only. Download this version of

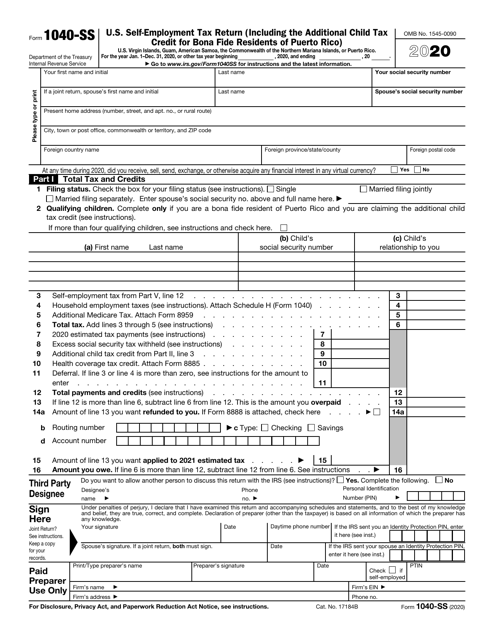

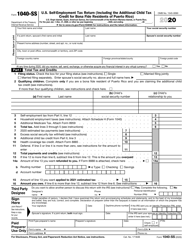

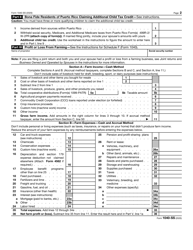

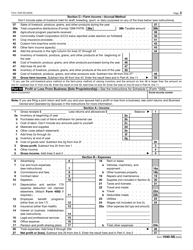

IRS Form 1040-SS

for the current year.

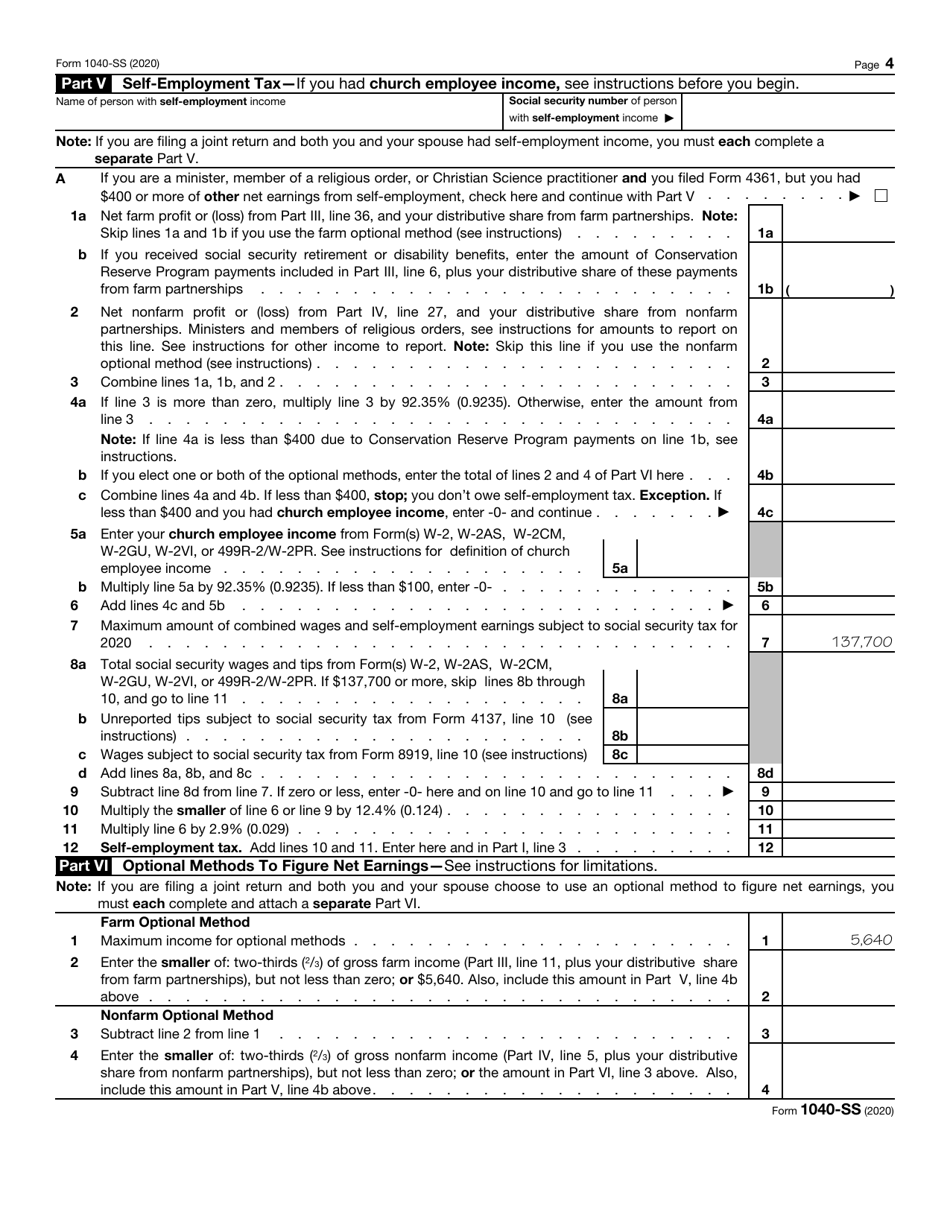

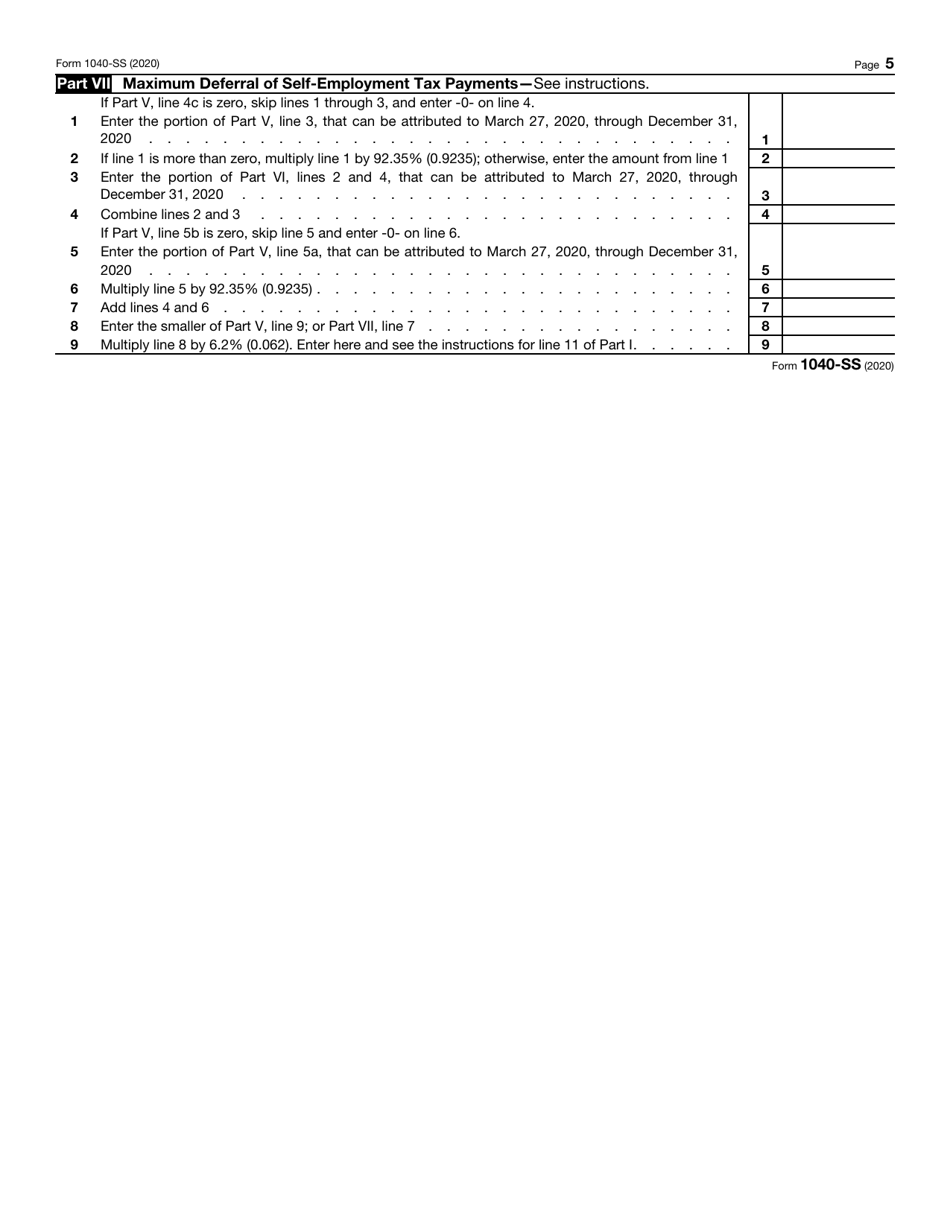

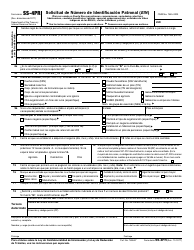

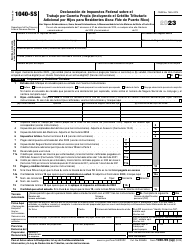

IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

What Is IRS Form 1040-SS?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

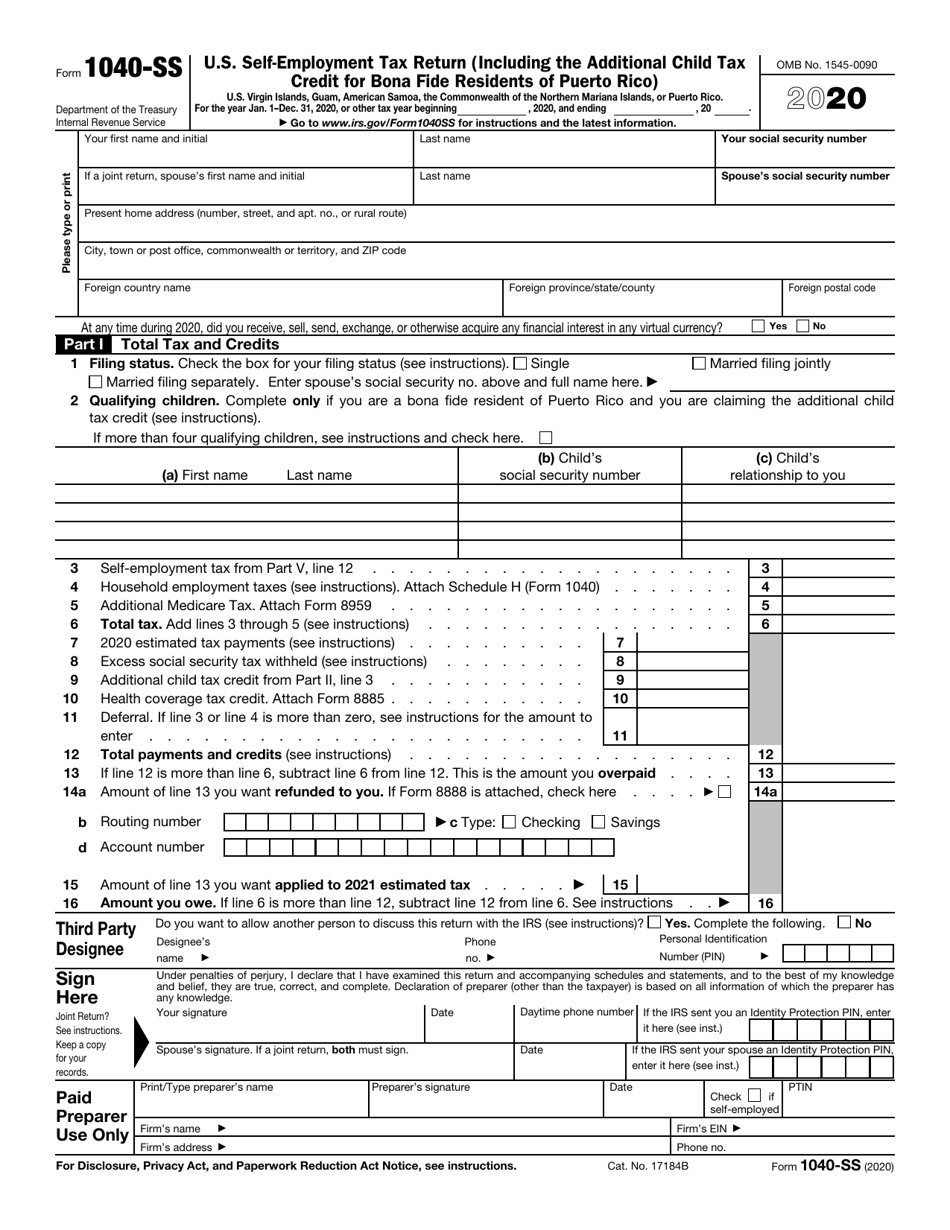

Q: What is IRS Form 1040-SS?

A: IRS Form 1040-SS is the U.S. Self-employment Tax Return for individuals who are self-employed and qualify for the Additional Child Tax Credit for bona fide residents of Puerto Rico.

Q: Who needs to file IRS Form 1040-SS?

A: Individuals who are self-employed and qualify for the Additional Child Tax Credit for bona fide residents of Puerto Rico need to file IRS Form 1040-SS.

Q: What is the purpose of IRS Form 1040-SS?

A: The purpose of IRS Form 1040-SS is to report self-employment income and calculate self-employment tax for individuals who qualify for the Additional Child Tax Credit for bona fide residents of Puerto Rico.

Q: What is the Additional Child Tax Credit?

A: The Additional Child Tax Credit is a refundable tax credit for taxpayers who have at least one child and meet certain income requirements.

Q: Who are considered bona fide residents of Puerto Rico?

A: Bona fide residents of Puerto Rico are individuals who have established their permanent residence in Puerto Rico and meet certain physical presence requirements.

Q: What if I have questions or need assistance with IRS Form 1040-SS?

A: If you have questions or need assistance with IRS Form 1040-SS, you can contact the IRS directly or seek help from a qualified tax professional.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-SS through the link below or browse more documents in our library of IRS Forms.