This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-SS

for the current year.

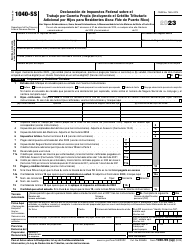

Instructions for IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

This document contains official instructions for IRS Form 1040-SS , U.S. Self-employment Tax Return (Including the Bona Fide Residents of Puerto Rico) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-SS is available for download through this link.

FAQ

Q: What is IRS Form 1040-SS?

A: IRS Form 1040-SS is the U.S. Self-employment Tax Return for individuals who are self-employed.

Q: Who should use IRS Form 1040-SS?

A: Individuals who are self-employed and meet the criteria specified by the IRS should use Form 1040-SS.

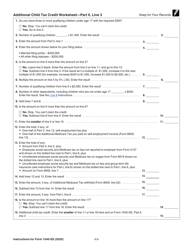

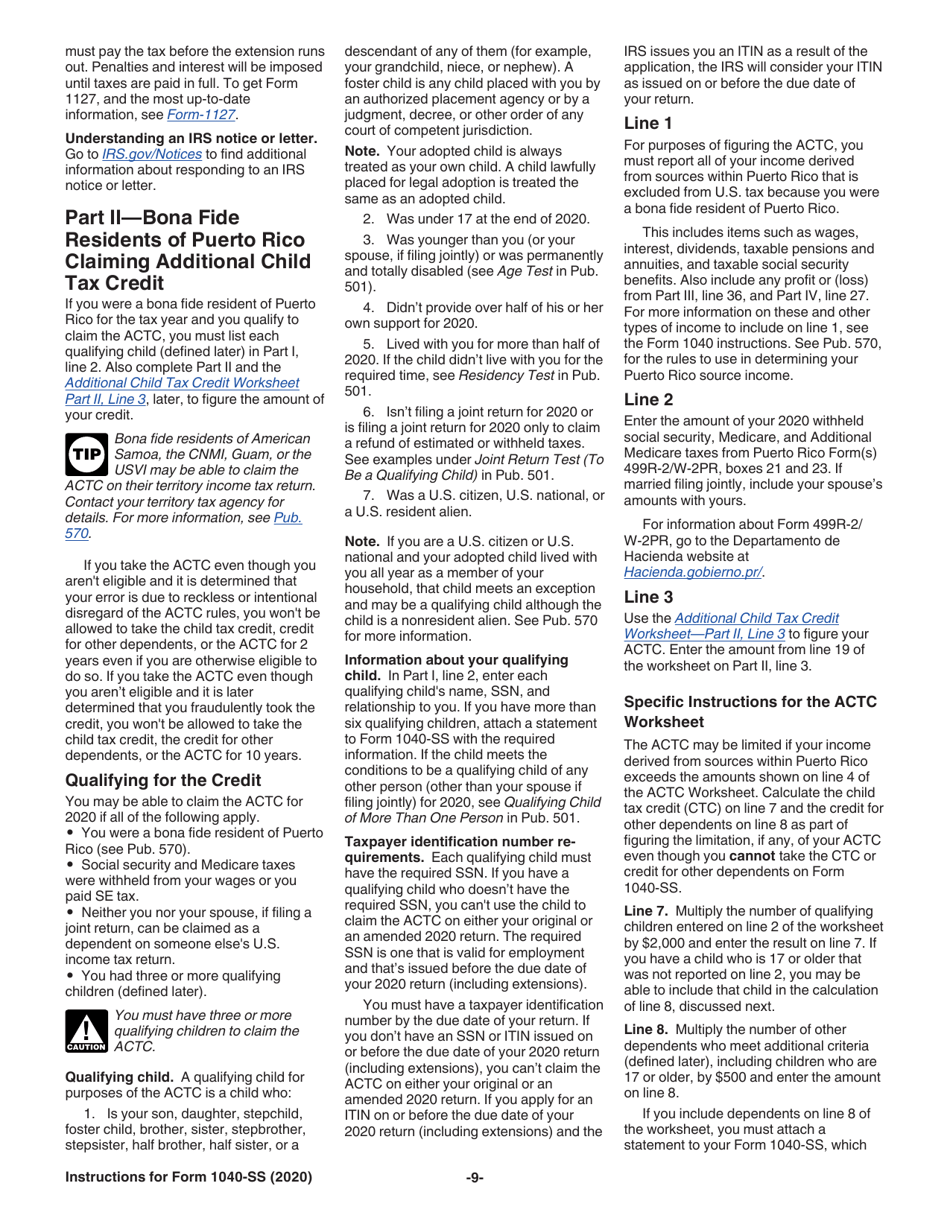

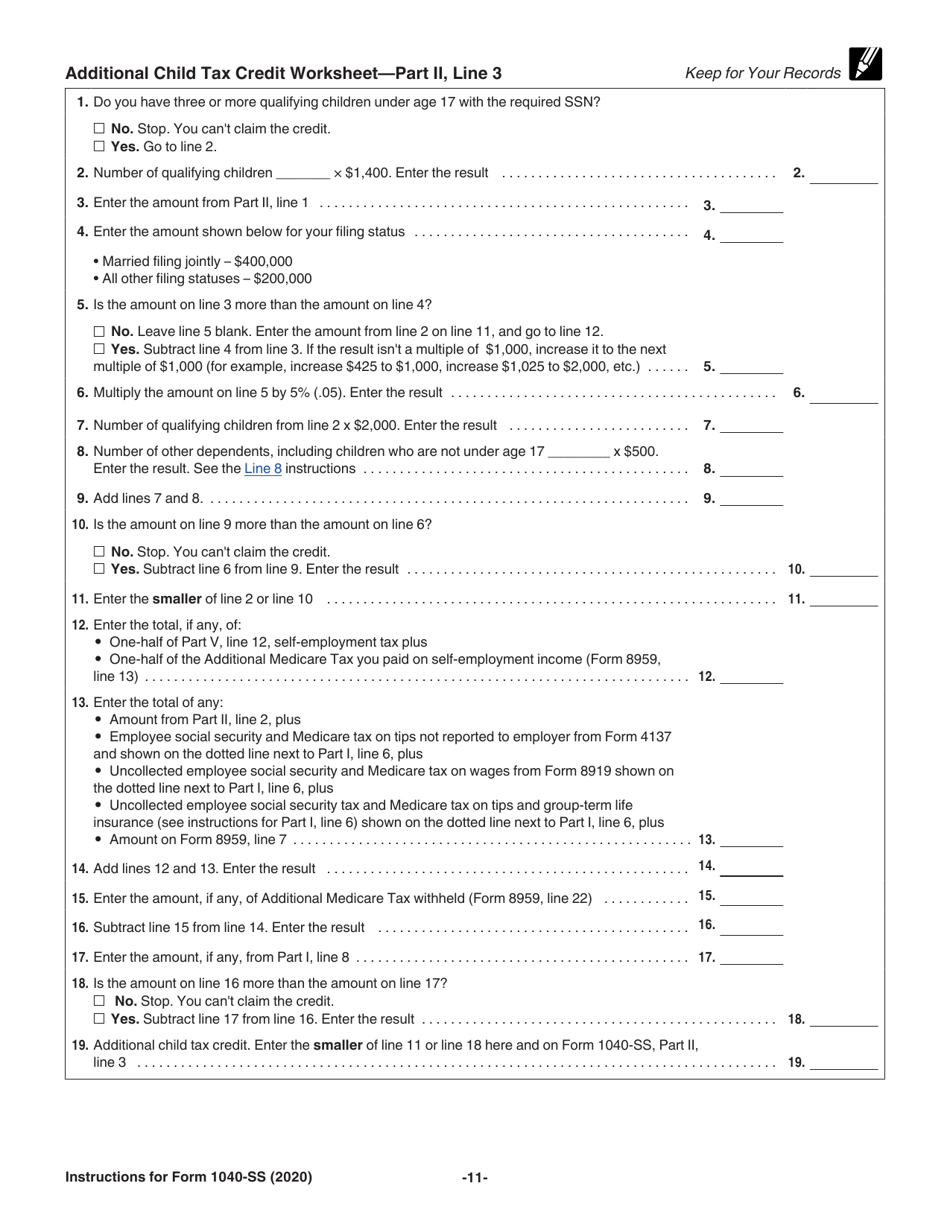

Q: What is the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico?

A: The Additional Child Tax Credit is a refundable tax credit available to eligible residents of Puerto Rico who have qualifying children.

Q: What is the purpose of IRS Form 1040-SS?

A: The purpose of Form 1040-SS is to report self-employment income and calculate the self-employment tax owed by individuals who are self-employed.

Q: When is the deadline to file IRS Form 1040-SS?

A: The deadline to file IRS Form 1040-SS is typically April 15th of each year. However, it may be extended in certain circumstances.

Q: Do I need to pay self-employment tax if I am self-employed?

A: Yes, individuals who are self-employed are generally required to pay self-employment tax, which is used to fund Social Security and Medicare.

Q: How do I calculate the self-employment tax?

A: The self-employment tax is calculated using Schedule SE, which is filed along with IRS Form 1040-SS. The tax rate is based on the individual's net self-employment income.

Q: Can I claim the Additional Child Tax Credit if I am a resident of Puerto Rico?

A: Yes, residents of Puerto Rico who meet the criteria for the Additional Child Tax Credit can claim it on their IRS Form 1040-SS.

Q: What information do I need to complete IRS Form 1040-SS?

A: You will need to gather information about your self-employment income, expenses, and any eligible credits or deductions to complete Form 1040-SS.

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.