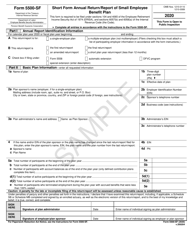

This version of the form is not currently in use and is provided for reference only. Download this version of

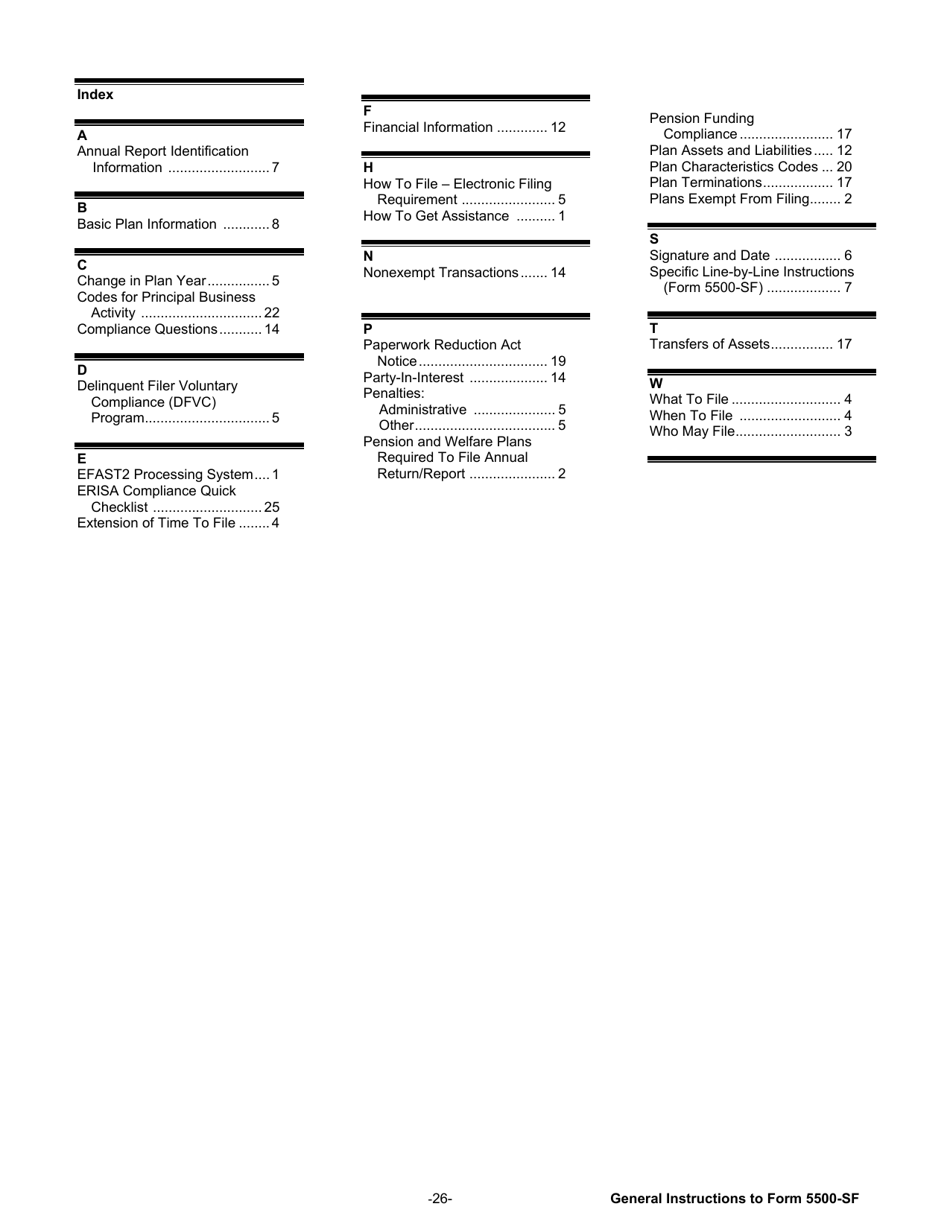

Instructions for Form 5500-SF

for the current year.

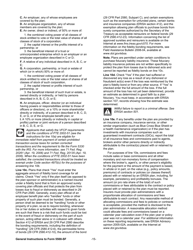

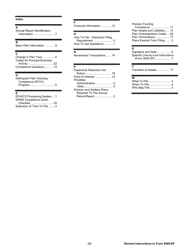

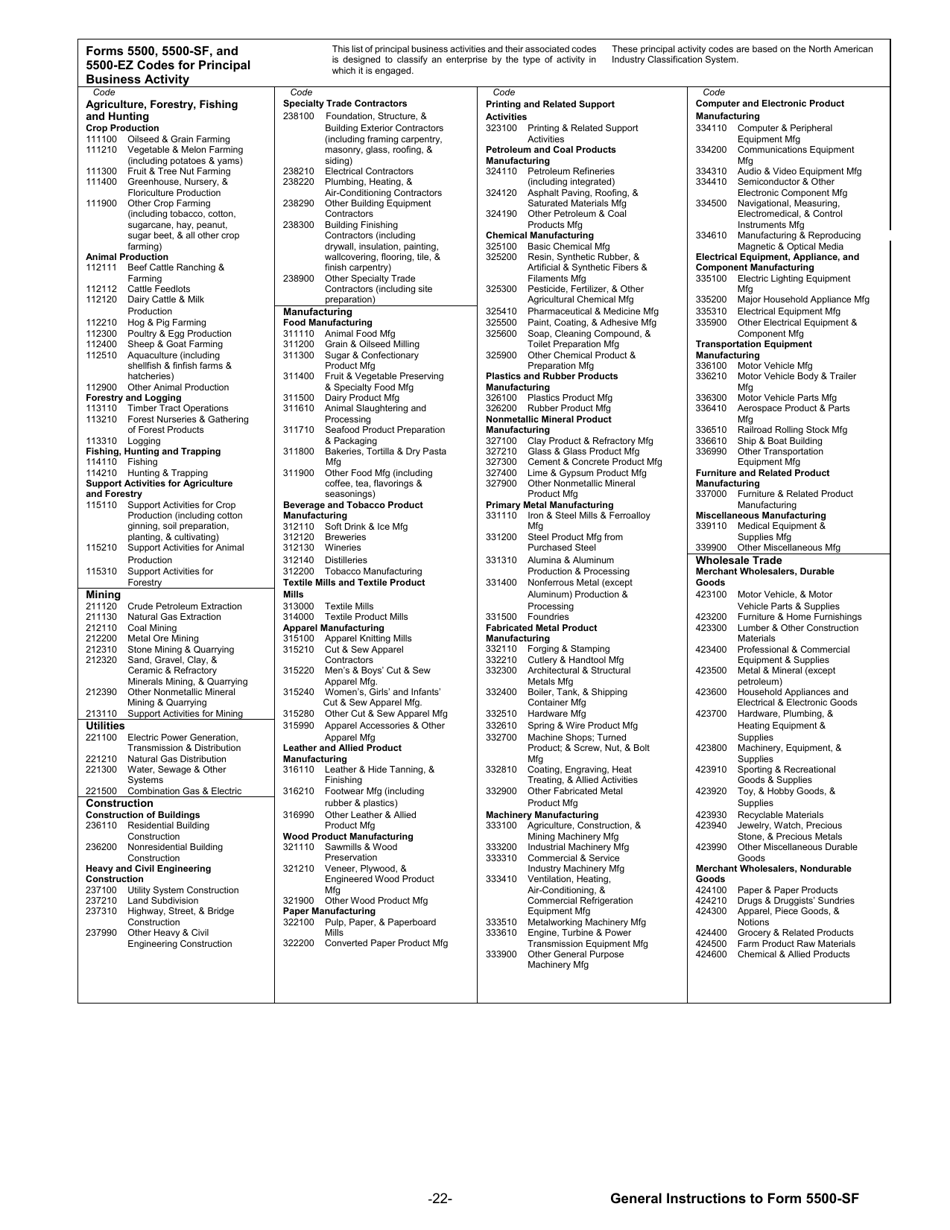

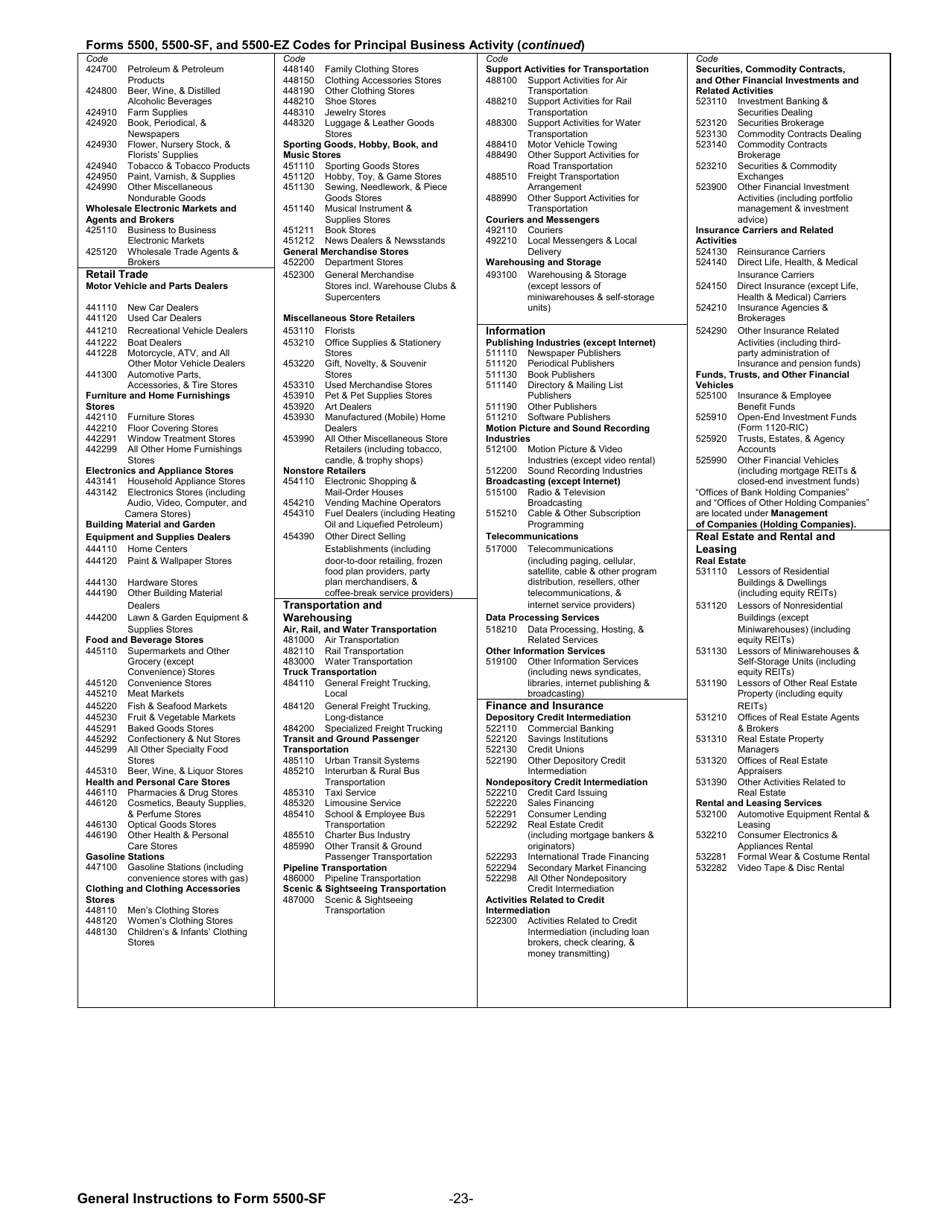

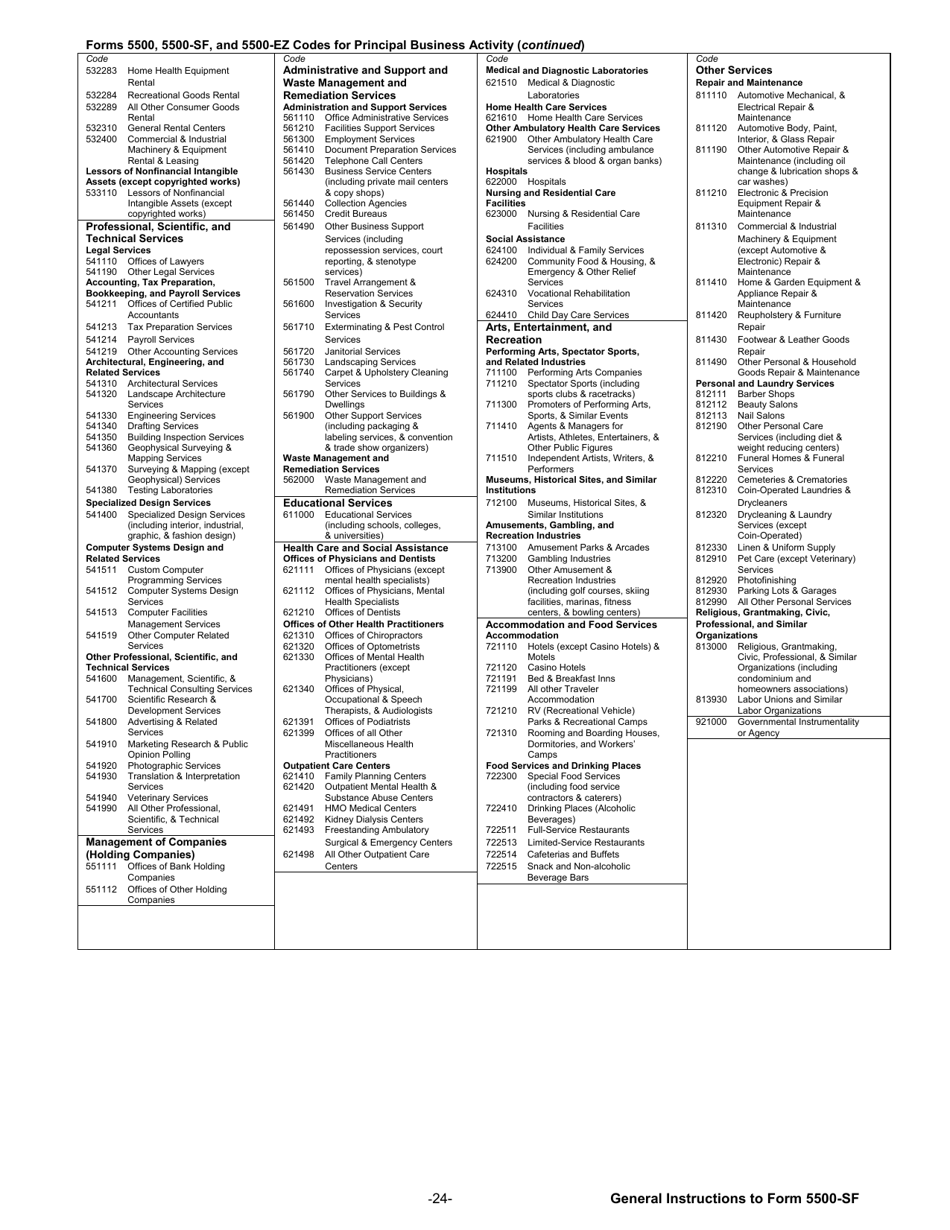

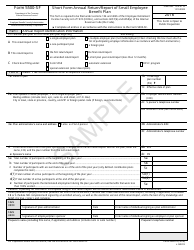

Instructions for Form 5500-SF Short Form Annual Return / Report of Small Employee Benefit Plan

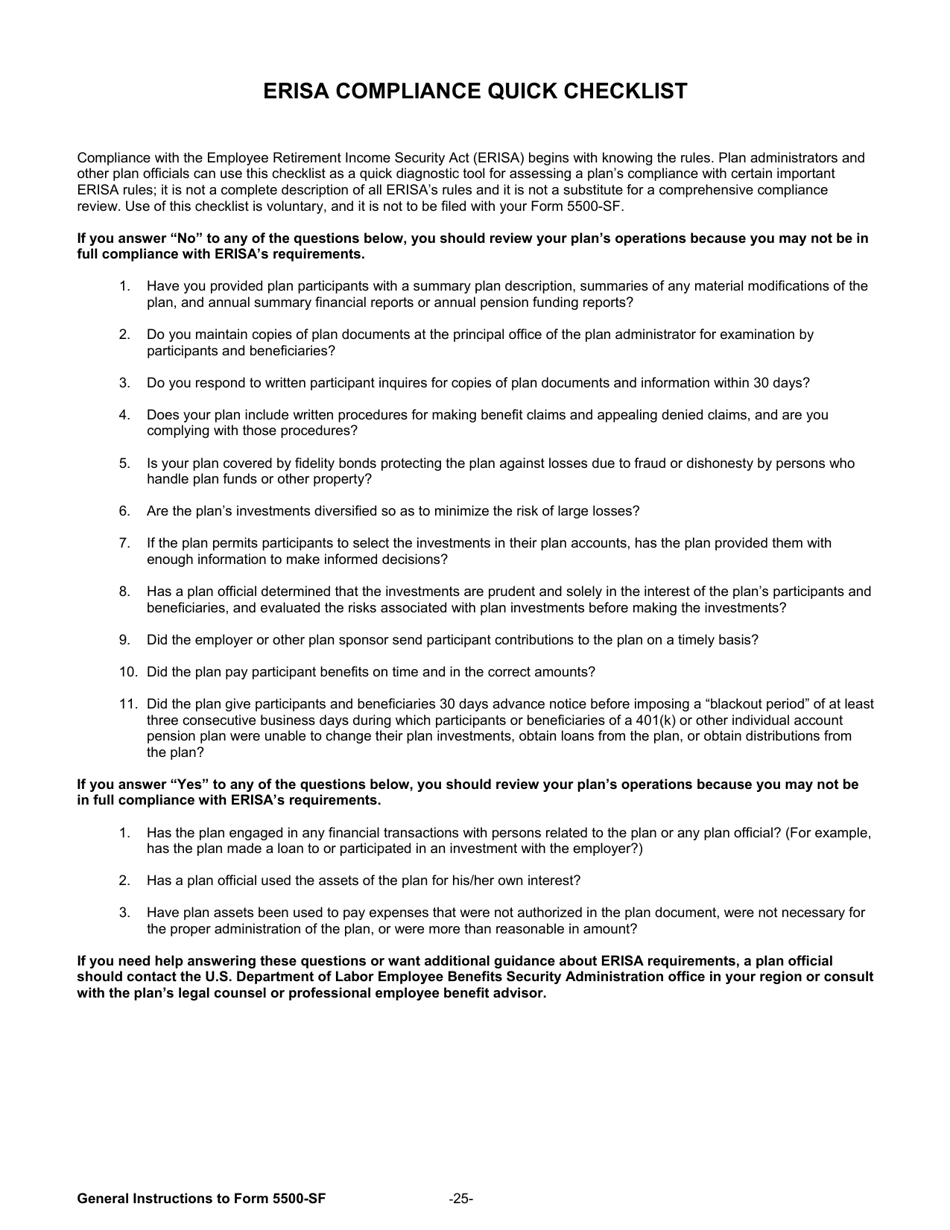

This document contains official instructions for Form 5500-SF , Short Form Annual Return/Report of Small Employee Benefit Plan - a form released and collected by the U.S. Department of Labor - Office of Labor-Management Standards.

FAQ

Q: What is Form 5500-SF?

A: Form 5500-SF is a short form used for filing the Annual Return/Report of Small Employee Benefit Plan.

Q: Who needs to file Form 5500-SF?

A: Small employee benefit plans are required to file Form 5500-SF if certain conditions are met.

Q: What is considered a small employee benefit plan?

A: A small employee benefit plan is a plan with less than 100 participants at the beginning of the plan year.

Q: What information is required on Form 5500-SF?

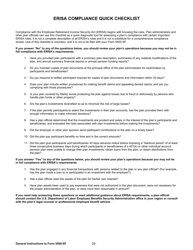

A: Form 5500-SF requires information about the plan sponsor, plan administrator, plan financials, and compliance with ERISA and the Internal Revenue Code.

Q: When is Form 5500-SF due?

A: Form 5500-SF is generally due by the last day of the seventh month after the plan year ends.

Q: Is there an extension available for filing Form 5500-SF?

A: Yes, a single 2.5-month extension can be requested.

Q: Are there any penalties for not filing Form 5500-SF?

A: Yes, failure to file Form 5500-SF may result in penalties imposed by the Department of Labor and the Internal Revenue Service.

Instruction Details:

- This 26-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Department of Labor - Office of Labor-Management Standards.