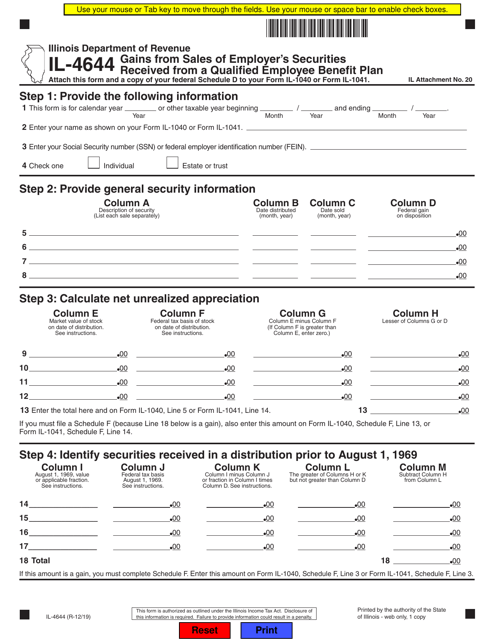

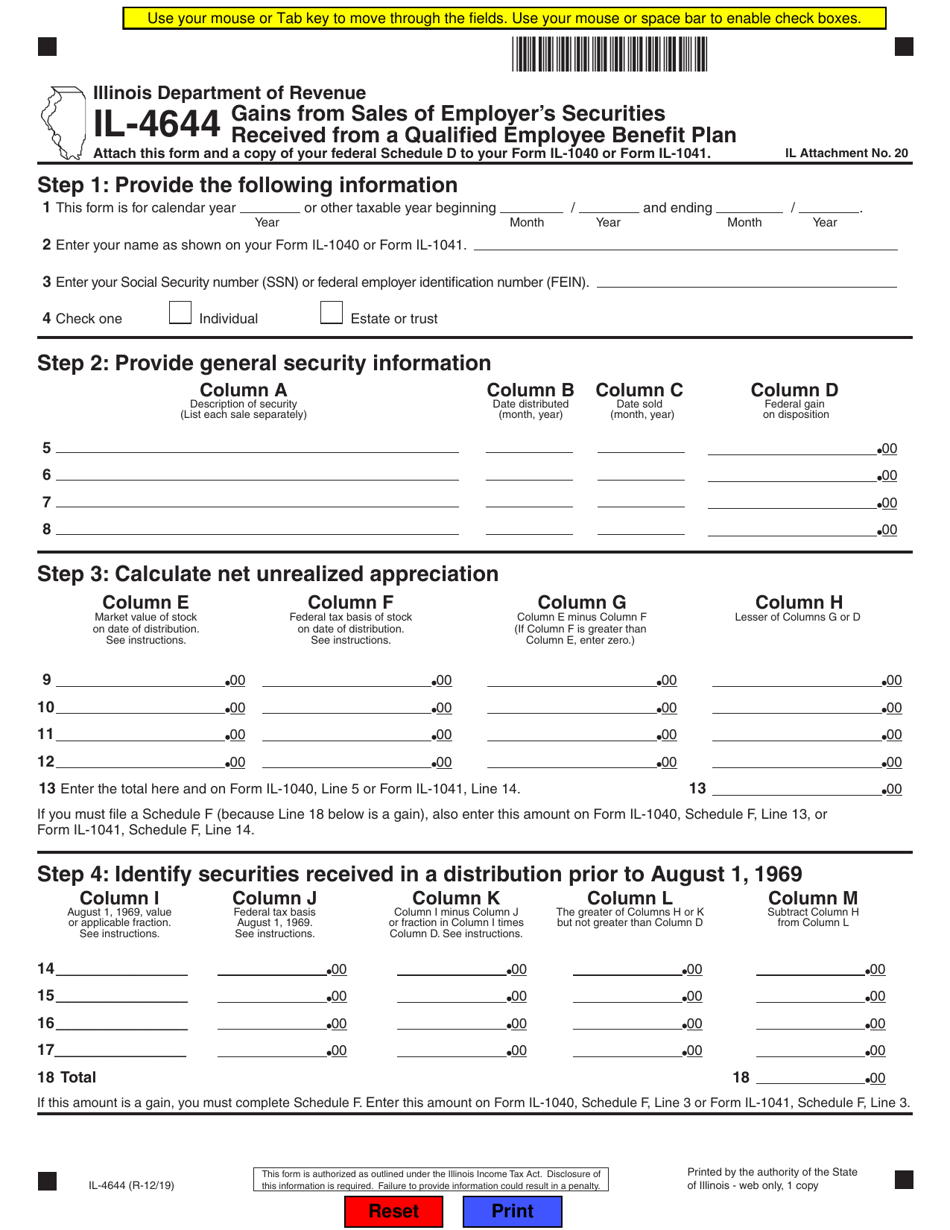

Form IL-4644 Gains From Sales of Employer's Securities Received From a Qualified Employee Benefit Plan - Illinois

What Is Form IL-4644?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-4644?

A: Form IL-4644 is a tax form used in Illinois to report gains from sales of employer's securities received from a qualified employee benefit plan.

Q: What is a qualified employee benefit plan?

A: A qualified employee benefit plan is a plan that meets certain requirements set by the Internal Revenue Code.

Q: Who needs to file Form IL-4644?

A: Anyone who has realized gains from sales of employer's securities received from a qualified employee benefit plan in Illinois needs to file Form IL-4644.

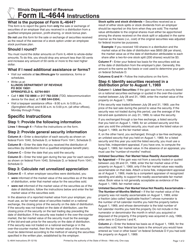

Q: What information is required on Form IL-4644?

A: Form IL-4644 requires information such as the taxpayer's name, social security number, the amount of gains from sales of employer's securities, and details about the qualified employee benefit plan.

Q: When is the deadline to file Form IL-4644?

A: The deadline to file Form IL-4644 is the same as the deadline for filing your Illinois income tax return, which is typically April 15th.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-4644 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.