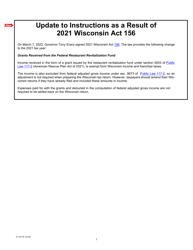

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IC-024 Schedule 4W

for the current year.

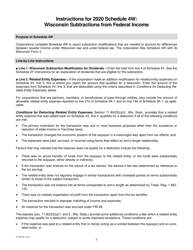

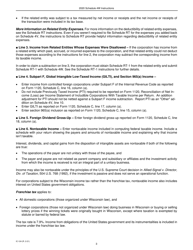

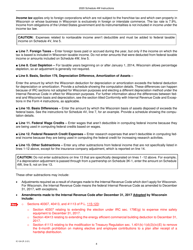

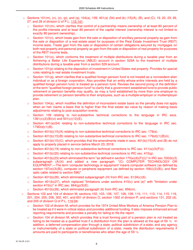

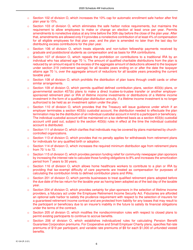

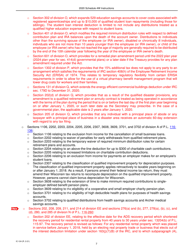

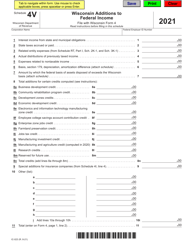

Instructions for Form IC-024 Schedule 4W Wisconsin Subtractions From Federal Income - Wisconsin

This document contains official instructions for Form IC-024 Schedule 4W, Wisconsin Subtractions From Federal Income - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form IC-024 Schedule 4W?

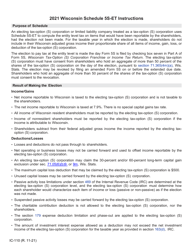

A: Form IC-024 Schedule 4W is a tax form used in Wisconsin to report subtractions from federal income.

Q: What are Wisconsin subtractions from federal income?

A: Wisconsin subtractions from federal income are deductions or exemptions allowed by the state of Wisconsin that can be subtracted from your federal income.

Q: Why do I need to fill out Form IC-024 Schedule 4W?

A: You need to fill out Form IC-024 Schedule 4W to accurately report and calculate your Wisconsin income tax liability.

Q: What information do I need to fill out Form IC-024 Schedule 4W?

A: You will need information about your federal income and any deductions or exemptions that you qualify for in Wisconsin.

Q: Do I need to include Form IC-024 Schedule 4W with my federal tax return?

A: No, Form IC-024 Schedule 4W is specific to Wisconsin state taxes and should not be included with your federal tax return.

Q: When is the deadline for filing Form IC-024 Schedule 4W?

A: The deadline for filing Form IC-024 Schedule 4W is usually the same as the deadline for filing your Wisconsin state tax return, which is April 15th.

Q: What should I do if I have questions or need assistance with Form IC-024 Schedule 4W?

A: If you have questions or need assistance with Form IC-024 Schedule 4W, you can contact the Wisconsin Department of Revenue for guidance.

Instruction Details:

- This 14-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.