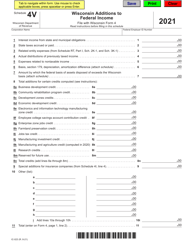

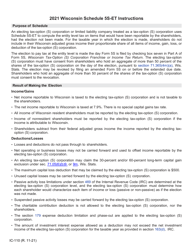

Instructions for Form IC-123 Schedule 4V Wisconsin Additions to Federal Income - Wisconsin

This document contains official instructions for Form IC-123 Schedule 4V, Wisconsin Additions to Federal Income - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form IC-123 Schedule 4V?

A: Form IC-123 Schedule 4V is a Wisconsin tax form used to report additions to federal income for Wisconsin income tax purposes.

Q: What are Wisconsin additions to federal income?

A: Wisconsin additions to federal income are certain types of income or adjustments that need to be reported separately on your Wisconsin tax return.

Q: Do I need to file Form IC-123 Schedule 4V?

A: You need to file Form IC-123 Schedule 4V if you have additions to federal income that are required to be reported for Wisconsin income tax purposes.

Q: When is the deadline to file Form IC-123 Schedule 4V?

A: The deadline to file Form IC-123 Schedule 4V is generally the same as the deadline for filing your Wisconsin income tax return, which is April 15th or the following business day if it falls on a weekend or holiday.

Q: What should I include when filing Form IC-123 Schedule 4V?

A: When filing Form IC-123 Schedule 4V, you should include any additions to federal income that are required to be reported for Wisconsin income tax purposes.

Q: Is there a penalty for not filing Form IC-123 Schedule 4V?

A: Yes, there may be penalties for not filing or filing Form IC-123 Schedule 4V late, so it's important to file it on time if you are required to do so.

Q: Can I e-file Form IC-123 Schedule 4V?

A: Yes, you can e-file Form IC-123 Schedule 4V if you are filing your Wisconsin income tax return electronically.

Q: What if I made a mistake on Form IC-123 Schedule 4V?

A: If you made a mistake on Form IC-123 Schedule 4V, you can file an amended return to correct the error. It's important to do so as soon as possible.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.