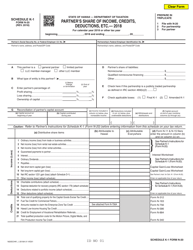

Instructions for IRS Form 1065-B Schedule K-1 Partner's Share of Income (Loss) From an Electing Large Partnership (For Partner's Use Only)

This document contains official instructions for IRS Form 1065-B Schedule K-1, Partner's Share of Income (Loss) From an Electing Large Partnership (For Partner's Use Only) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1065-B?

A: IRS Form 1065-B is used to report a partner's share of income or loss from an electing large partnership.

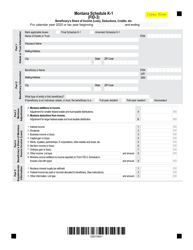

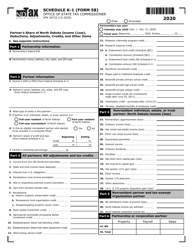

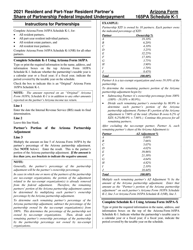

Q: What is Schedule K-1?

A: Schedule K-1 is a part of IRS Form 1065-B that reports the partner's share of income, deductions, and other tax items.

Q: What is an electing large partnership?

A: An electing large partnership is a partnership with 100 or more partners that elects to be treated as an electing large partnership.

Q: Who uses IRS Form 1065-B Schedule K-1?

A: Partners of an electing large partnership use Form 1065-B Schedule K-1 to report their share of income or loss.

Q: Is IRS Form 1065-B Schedule K-1 for individuals or businesses?

A: It is for individuals who are partners in electing large partnerships.

Q: What should I do with IRS Form 1065-B Schedule K-1?

A: You should use the information on Schedule K-1 to report your share of income or loss on your individual tax return.

Q: Is there a deadline for filing IRS Form 1065-B Schedule K-1?

A: Yes, the deadline for filing Form 1065-B Schedule K-1 is usually the same as the deadline for filing your individual tax return (April 15th).

Q: What if I don't receive IRS Form 1065-B Schedule K-1?

A: If you don't receive Schedule K-1 from the partnership, you should contact the partnership and request a copy.

Q: Can I e-file IRS Form 1065-B Schedule K-1?

A: No, you cannot e-file Form 1065-B Schedule K-1. It should be attached to your paper tax return.

Instruction Details:

- This 13-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.