Basic Forex Forecast Methods: Technical Analysis and Fundamental Analysis

Basic Forex Forecast Methods: Technical Analysis and Fundamental Analysis are used for predicting the future movements and trends in the foreign exchange market. Technical analysis involves studying historical price data and using various indicators and chart patterns to make predictions. Fundamental analysis, on the other hand, involves analyzing economic factors, such as interest rates, employment data, and geopolitical events, to understand the broader market trends. These methods help traders and investors make informed decisions while trading currencies.

FAQ

Q: What is Forex?

A: Forex stands for foreign exchange, which refers to the global market for trading currencies.

Q: What is a Forex forecast?

A: A Forex forecast is an estimation of future currency price movements.

Q: What is technical analysis?

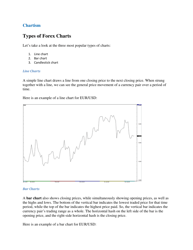

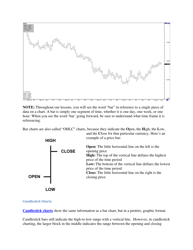

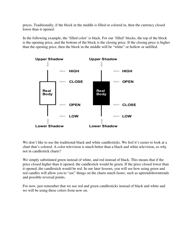

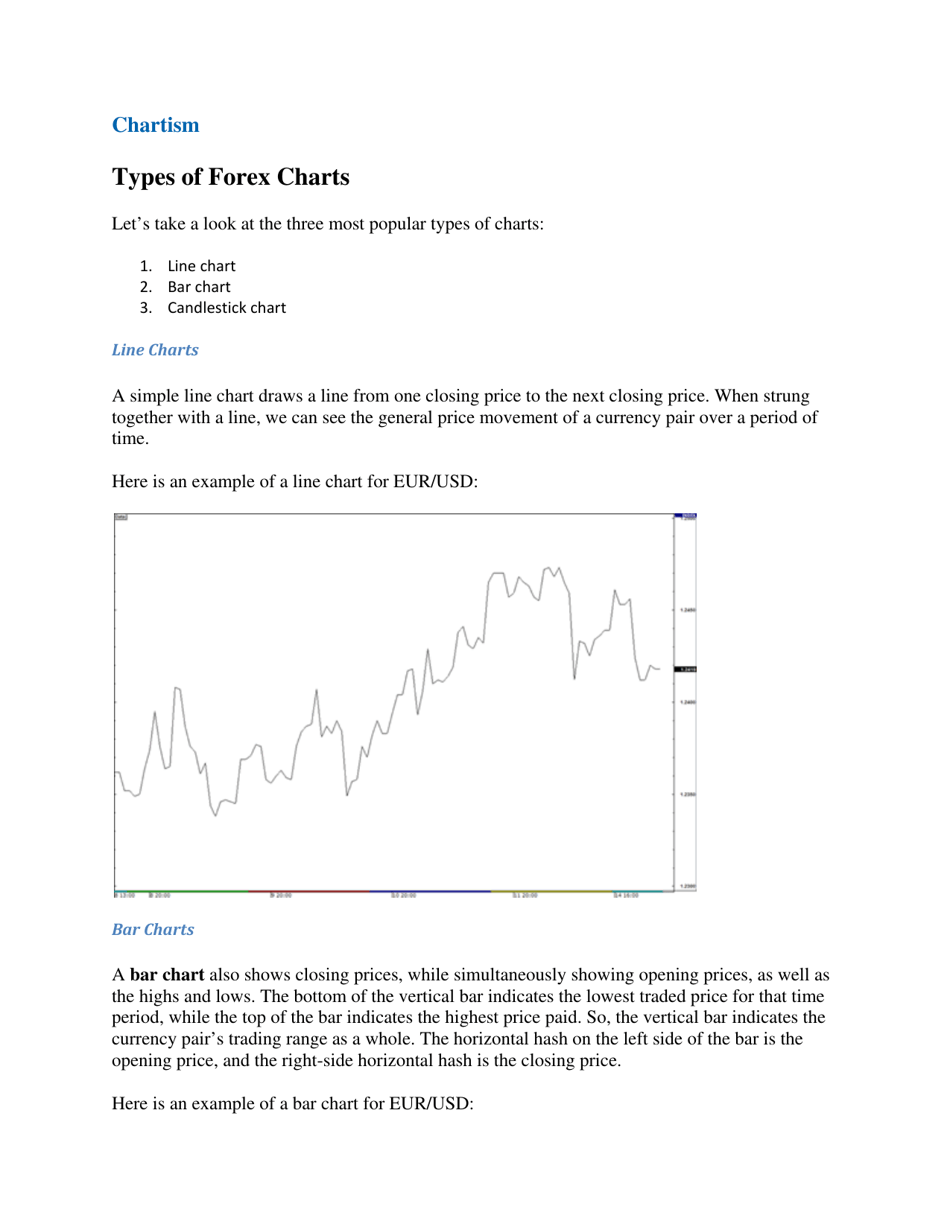

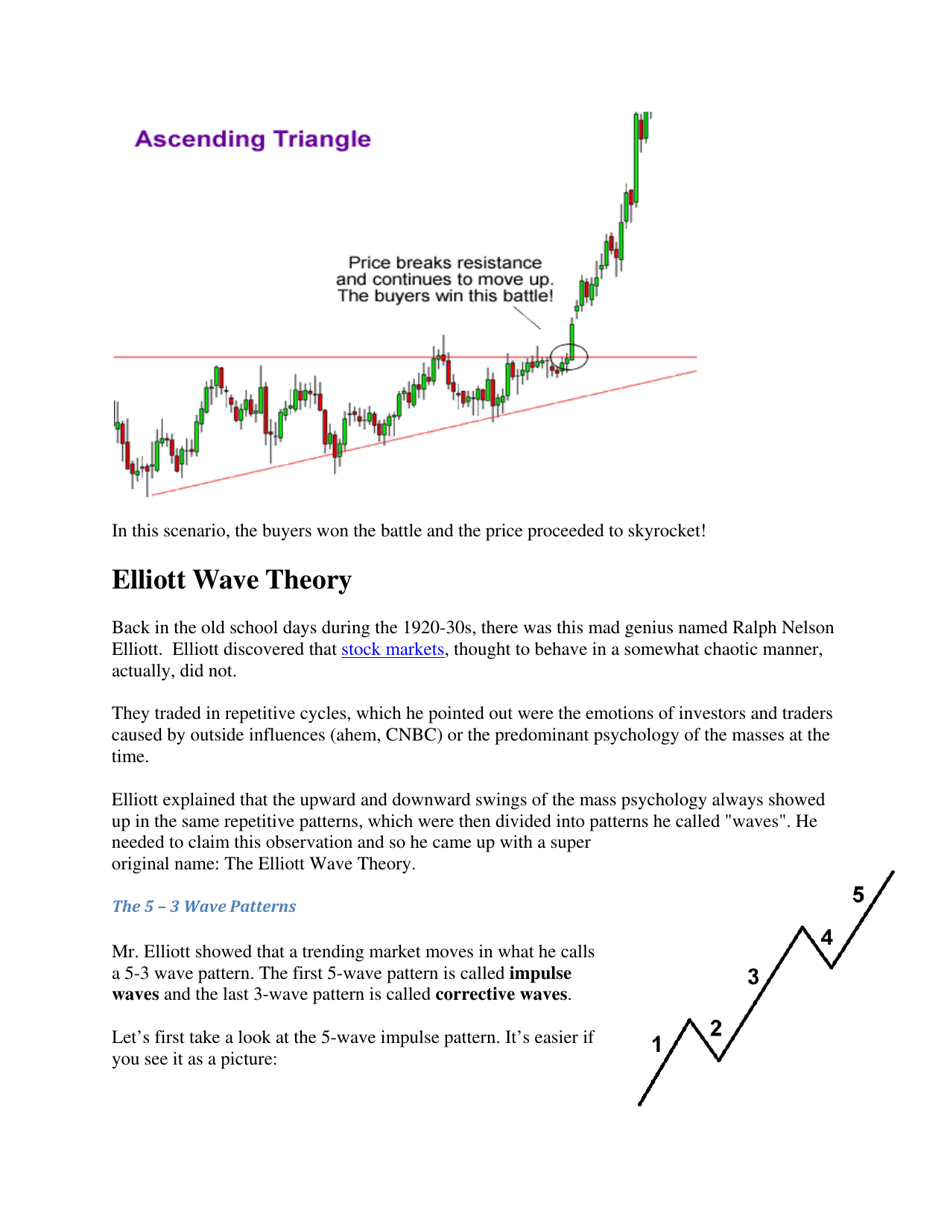

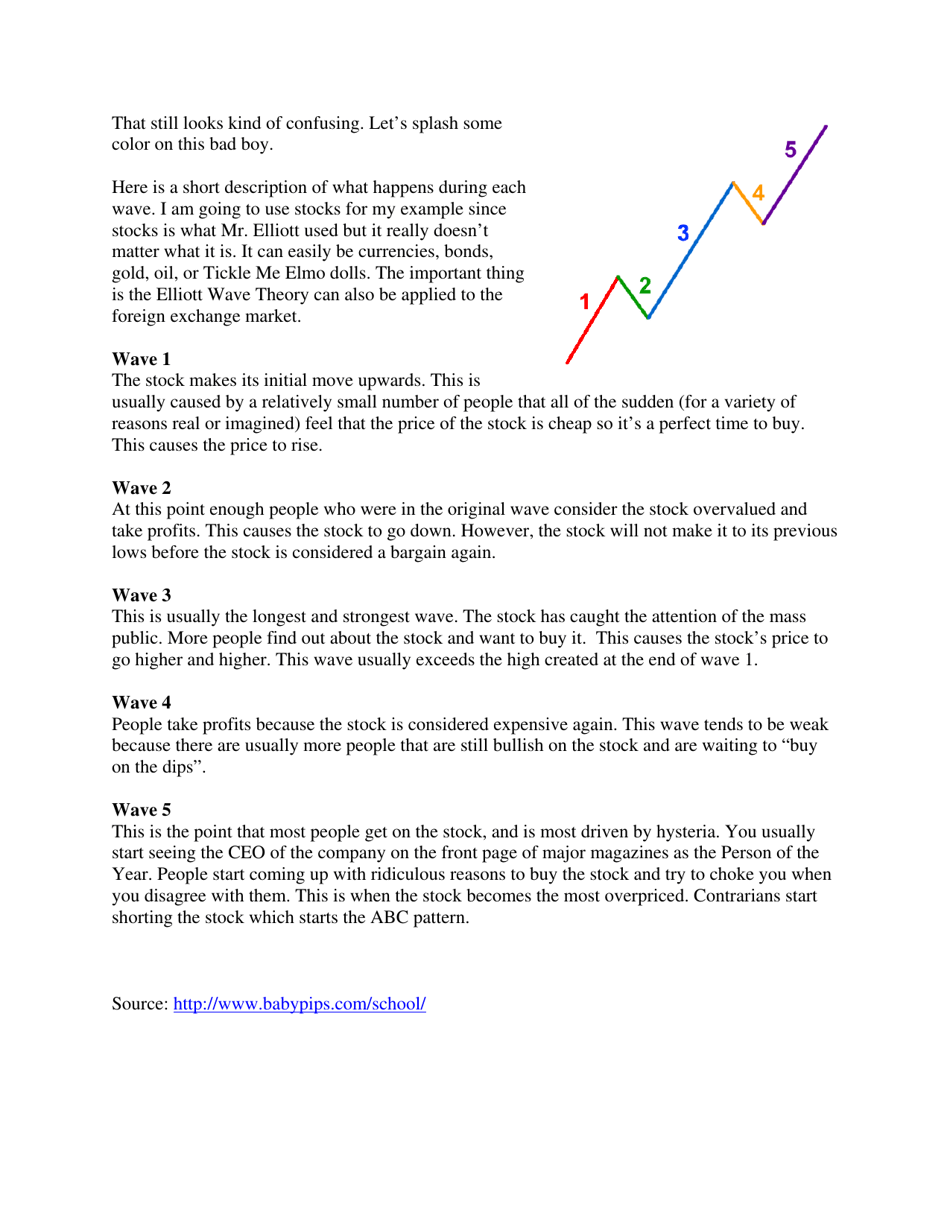

A: Technical analysis is a method of forecasting future price movements in Forex using chart patterns, indicators, and historical data.

Q: What is fundamental analysis?

A: Fundamental analysis is a method of forecasting future price movements in Forex by analyzing economic, social, and political factors that may impact currency values.

Q: Which analysis method is better?

A: There is no definite answer, as both methods have their advantages and disadvantages. Some traders use a combination of both methods for better accuracy.

Q: What are the key factors considered in fundamental analysis?

A: Key factors in fundamental analysis include interest rates, economic indicators, political stability, and central bank policies.

Q: What are the key factors considered in technical analysis?

A: Key factors in technical analysis include chart patterns, support and resistance levels, and various technical indicators like moving averages and oscillators.

Q: Can Forex forecasts guarantee accurate predictions?

A: No, Forex forecasts are not guaranteed to be accurate. They are predictions based on certain methods and indicators, but the market can be unpredictable.

Q: Are there any other methods to forecast Forex?

A: Yes, other methods include sentiment analysis, which involves analyzing market sentiment and trader behavior, and quantitative analysis, which uses mathematical models and algorithms to make predictions.