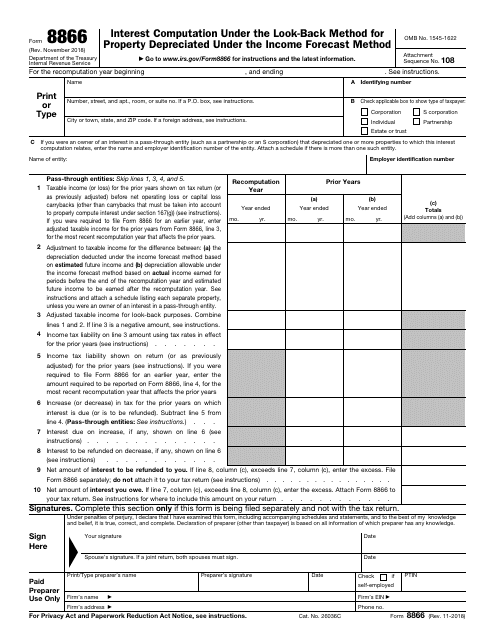

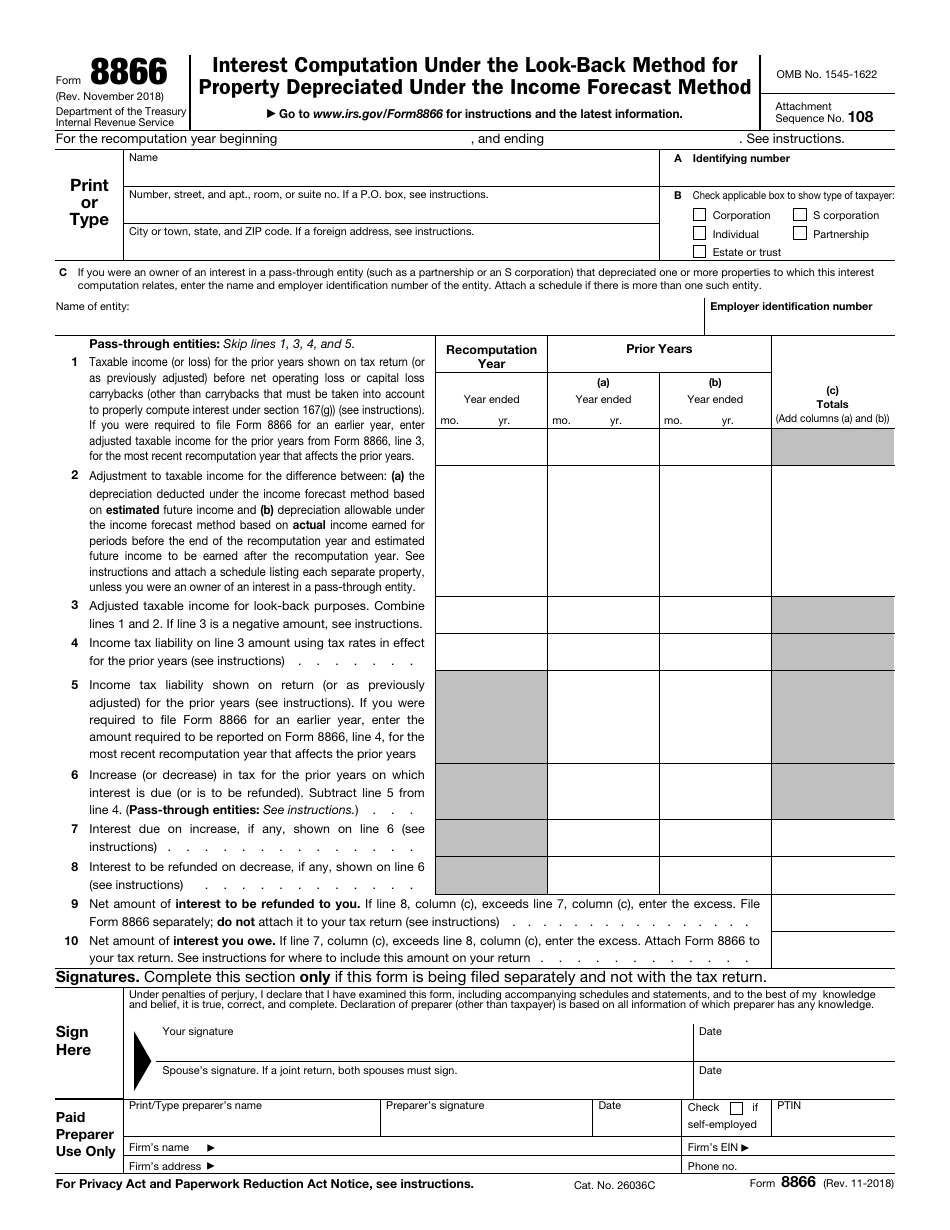

IRS Form 8866 Interest Computation Under the Look-Back Method for Property Depreciated Under the Income Forecast Method

What Is IRS Form 8866?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8866?

A: IRS Form 8866 is a form used for interest computation under the look-back method for property depreciated under the income forecast method.

Q: What is the look-back method?

A: The look-back method is a method used to calculate interest on property that has been depreciated under the income forecast method.

Q: What is the income forecast method?

A: The income forecast method is a method used to determine the depreciation of property based on projected income.

Q: When should I use IRS Form 8866?

A: You should use IRS Form 8866 when you need to calculate interest on property that has been depreciated under the income forecast method using the look-back method.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8866 through the link below or browse more documents in our library of IRS Forms.