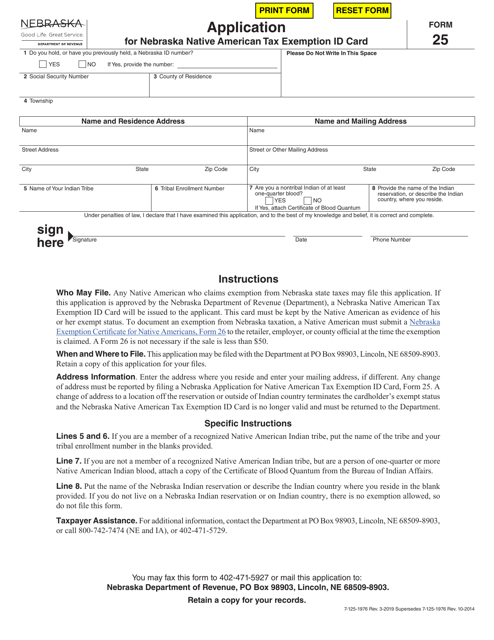

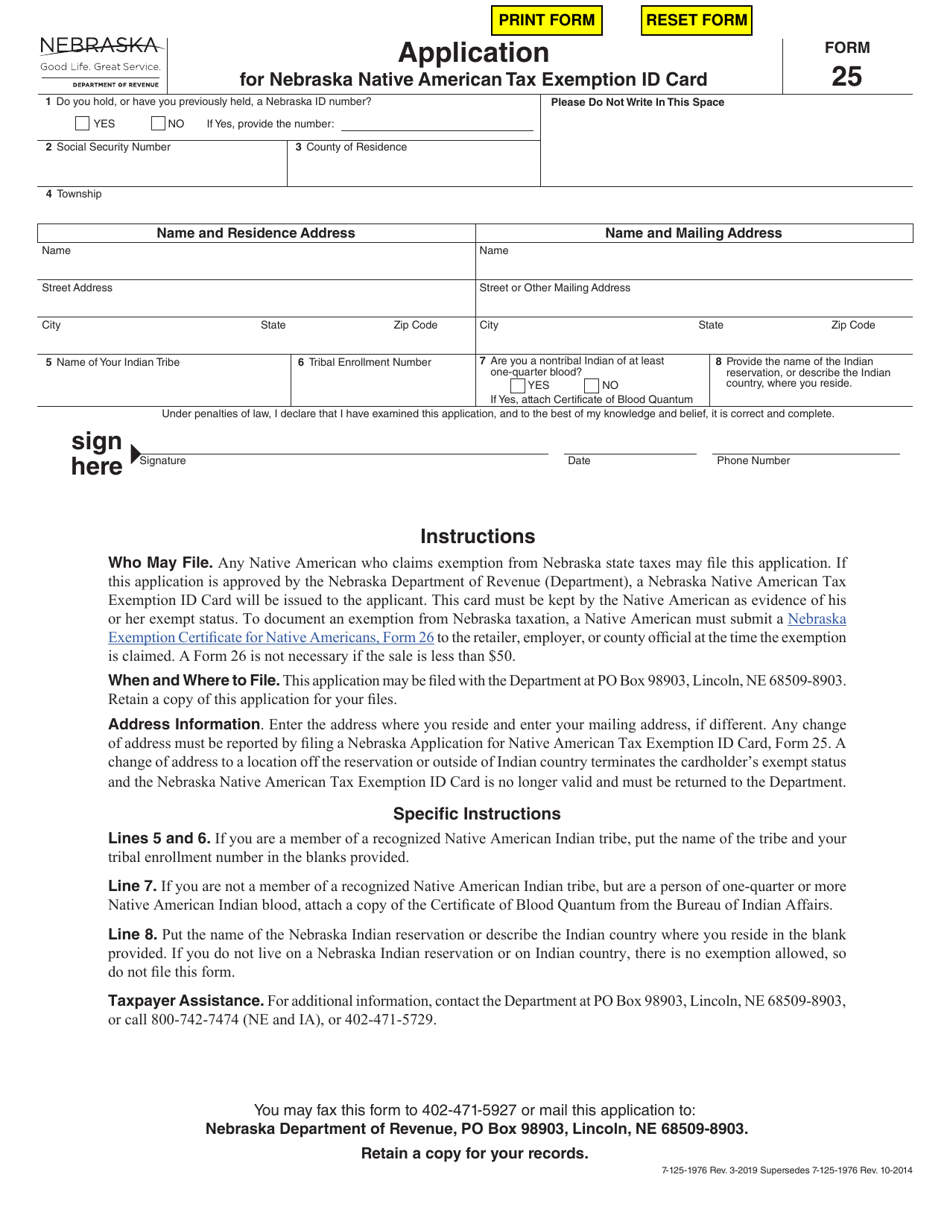

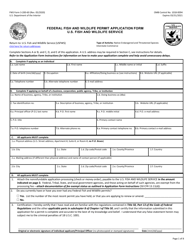

Form 25 Application for Nebraska Native American Tax Exemption Id Card - Nebraska

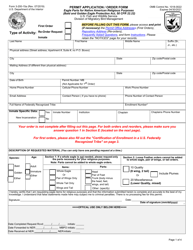

What Is Form 25?

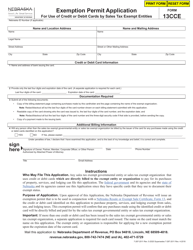

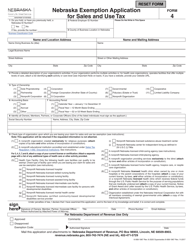

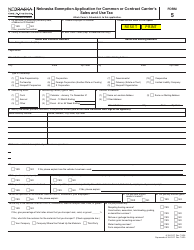

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25?

A: Form 25 is the Application for Nebraska Native American Tax Exemption ID Card.

Q: What is the purpose of Form 25?

A: The purpose of Form 25 is to apply for a Nebraska Native American Tax Exemption ID Card.

Q: What is a Nebraska Native American Tax Exemption ID Card?

A: A Nebraska Native American Tax Exemption ID Card provides Native American individuals with exemption from certain state and local taxes.

Q: Who is eligible to apply for a Nebraska Native American Tax Exemption ID Card?

A: Native American individuals who are enrolled members of a federally recognized tribe and reside in Nebraska are eligible to apply.

Q: How do I apply for a Nebraska Native American Tax Exemption ID Card?

A: You can apply for a Nebraska Native American Tax Exemption ID Card by completing and submitting Form 25 to the Nebraska Department of Revenue.

Q: Are there any fees associated with the application?

A: No, there are no fees to apply for a Nebraska Native American Tax Exemption ID Card.

Q: How long does it take to receive the ID card?

A: The processing time for the ID card is typically 4-6 weeks from the date the application is received.

Q: Is the ID card valid for a lifetime?

A: No, the Nebraska Native American Tax Exemption ID Card must be renewed every 5 years.

Q: What are the benefits of having a Nebraska Native American Tax Exemption ID Card?

A: The card provides exemption from certain state and local taxes, such as sales tax on purchases made on tribal lands.

Q: Can the ID card be used outside of Nebraska?

A: No, the ID card is only valid for tax exemption purposes within the state of Nebraska.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.