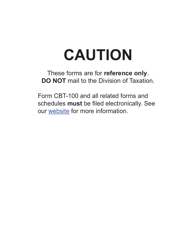

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CBT-100U

for the current year.

Instructions for Form CBT-100U New Jersey Corporation Business Tax Unitary Return - New Jersey

This document contains official instructions for Form CBT-100U , New Jersey Corporation Business Tax Unitary Return - a form released and collected by the New Jersey Department of the Treasury.

FAQ

Q: What is Form CBT-100U?

A: Form CBT-100U is the New Jersey Corporation Business Tax Unitary Return.

Q: Who needs to file Form CBT-100U?

A: Businesses registered as corporations in New Jersey that have a unitary business relationship with other entities may need to file Form CBT-100U.

Q: What is a unitary business?

A: A unitary business is a group of related entities that operate as a single integrated enterprise.

Q: What information is required on Form CBT-100U?

A: Form CBT-100U requires information about the unitary business relationship, apportionment factors, and related tax calculations.

Q: When is the deadline to file Form CBT-100U?

A: The deadline to file Form CBT-100U is generally the 15th day of the fourth month following the close of the taxable year.

Q: Are there any extensions available for filing Form CBT-100U?

A: Yes, New Jersey allows for an automatic extension of time to file Form CBT-100U if an extension is requested.

Instruction Details:

- This 21-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.