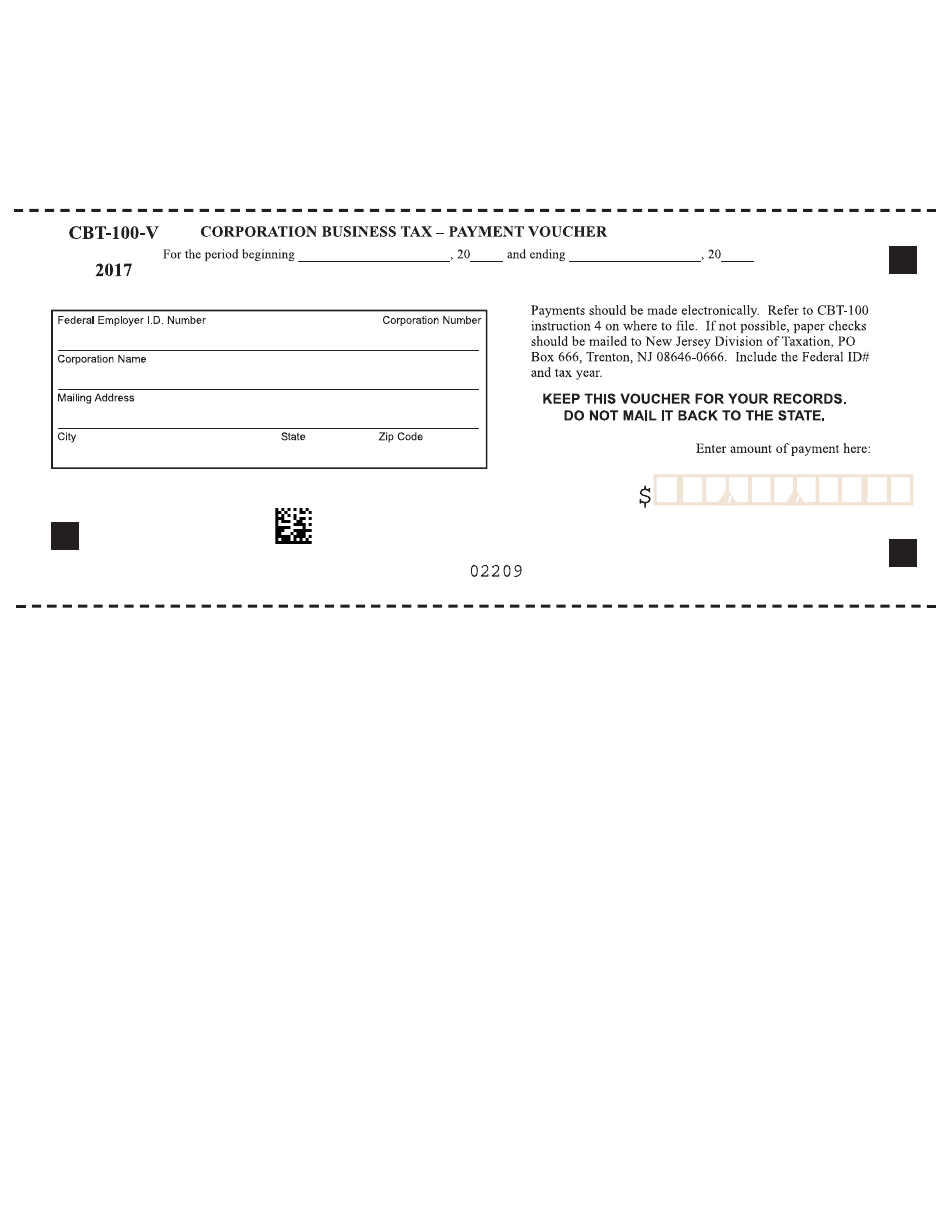

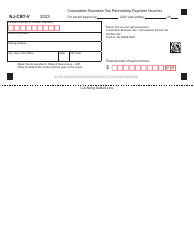

Form CBT-100-V Corporation Business Tax - Payment Voucher - New Jersey

What Is Form CBT-100-V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-100-V?

A: Form CBT-100-V is a payment voucher used for submitting Corporation Business Tax payments in the state of New Jersey.

Q: Who needs to use Form CBT-100-V?

A: Corporations that are required to pay business taxes in New Jersey need to use Form CBT-100-V.

Q: What is the purpose of Form CBT-100-V?

A: The purpose of Form CBT-100-V is to provide a voucher for corporations to submit their tax payments to the State of New Jersey.

Q: When is Form CBT-100-V due?

A: Form CBT-100-V is due on or before the 15th day of the fourth month following the close of the fiscal or calendar year, depending on the taxpayer's filing status.

Q: What information do I need to provide on Form CBT-100-V?

A: You need to provide your corporation's name, address, taxpayer identification number, payment amount, and other relevant information requested on the form.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBT-100-V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.