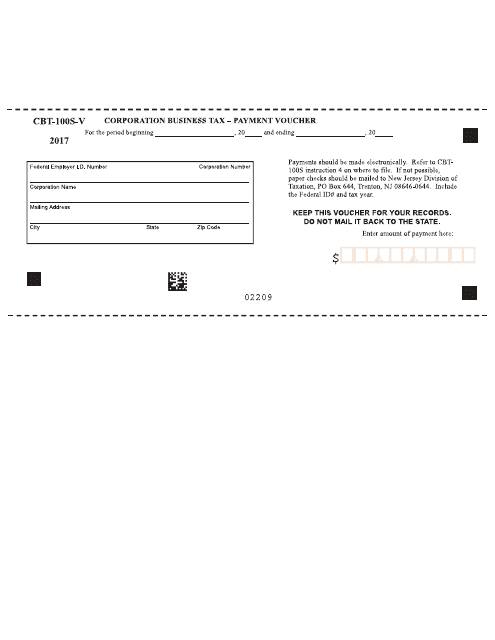

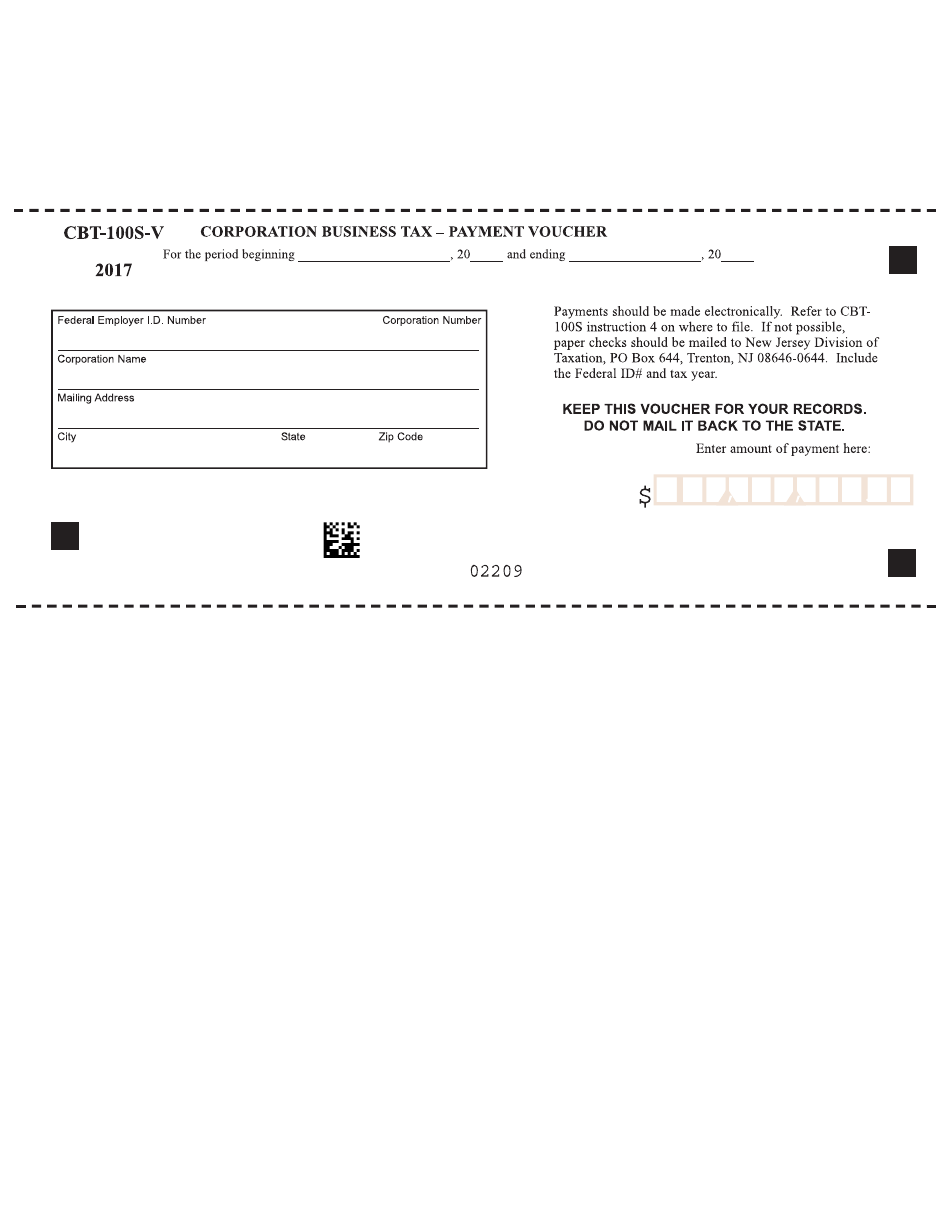

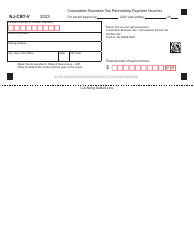

Form CBT-100S-V Corporation Business Tax - Payment Voucher - New Jersey

What Is Form CBT-100S-V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-100S-V?

A: Form CBT-100S-V is a payment voucher for the Corporation Business Tax in New Jersey.

Q: Who needs to file Form CBT-100S-V?

A: Businesses that are subject to the Corporation Business Tax in New Jersey need to file Form CBT-100S-V.

Q: What is the purpose of Form CBT-100S-V?

A: The purpose of Form CBT-100S-V is to make a payment towards the Corporation Business Tax in New Jersey.

Q: When is Form CBT-100S-V due?

A: The due date for Form CBT-100S-V is the same as the due date for filing the Corporation Business Tax return in New Jersey.

Q: What happens if I don't file Form CBT-100S-V?

A: If you don't file Form CBT-100S-V or make a payment by the due date, you may be subject to penalties and interest.

Q: Can I get an extension to file Form CBT-100S-V?

A: Yes, you can request an extension to file Form CBT-100S-V. However, the extension does not apply to the payment, so you need to make the payment by the original due date.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBT-100S-V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.