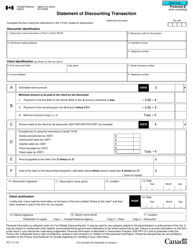

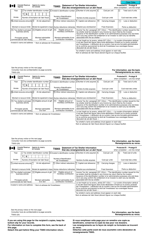

This version of the form is not currently in use and is provided for reference only. Download this version of

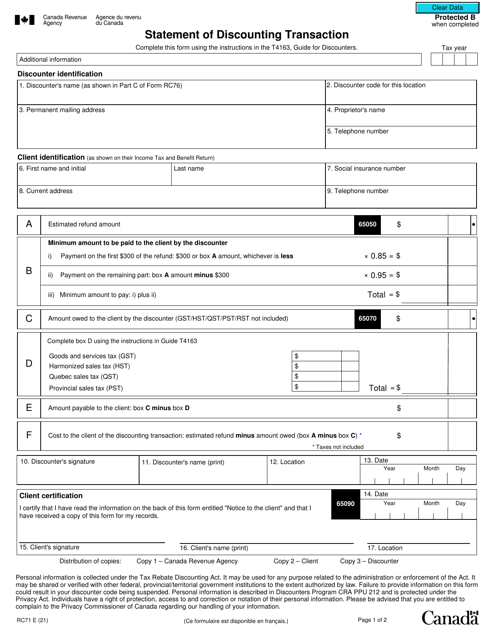

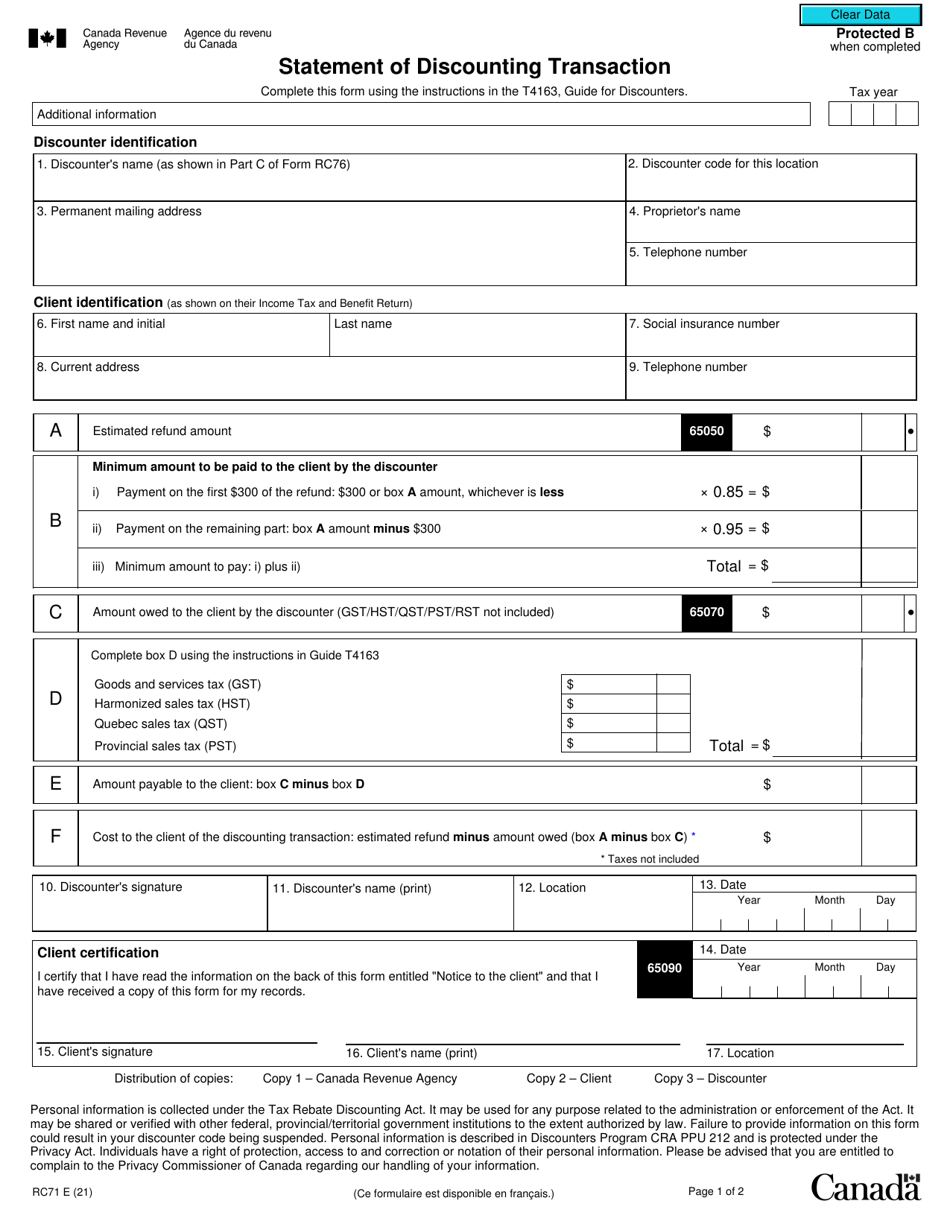

Form RC71

for the current year.

Form RC71 Statement of Discounting Transaction - Canada

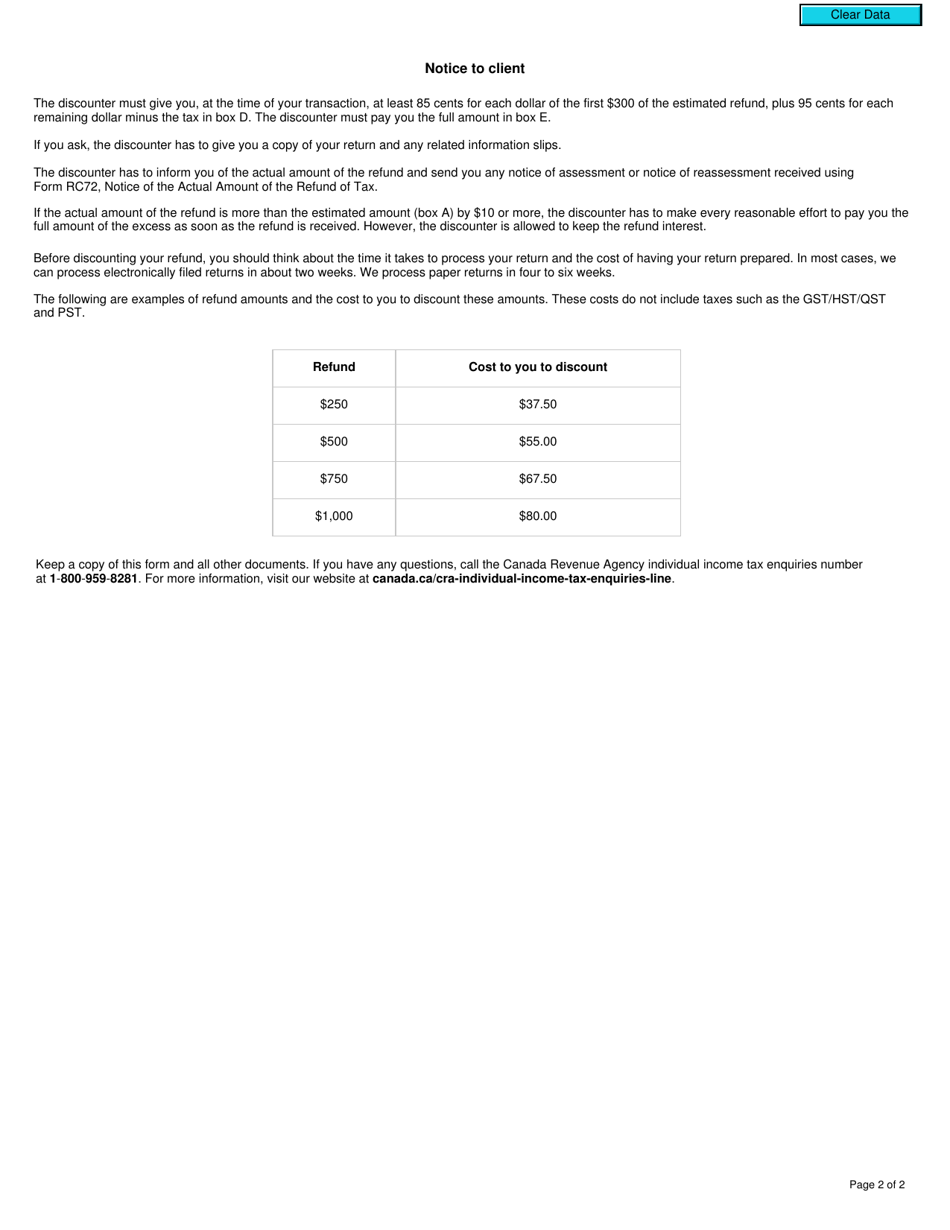

The Form RC71 Statement of Discounting Transaction in Canada is used to report transactions where a company sells its accounts receivable or other indebtedness to a financial institution at a discount. This form provides details of the discounted transactions for tax purposes.

The Form RC71 Statement of Discounting Transaction in Canada is filed by the person or company that receives the discounted amount.

FAQ

Q: What is the Form RC71?

A: Form RC71 is the Statement of Discounting Transaction.

Q: Who needs to complete Form RC71?

A: Any individual or corporation in Canada who has participated in a discounting transaction.

Q: What is a discounting transaction?

A: A discounting transaction involves the sale of accounts receivable or other financial assets at a price that is less than their face value.

Q: Why do I need to complete Form RC71?

A: Form RC71 is required by the Canada Revenue Agency to report discounting transactions and to account for any income or expense associated with the transaction.

Q: When is the deadline to file Form RC71?

A: The deadline to file Form RC71 is within 180 days after the end of the calendar year in which the discounting transaction occurred.

Q: Are there any penalties for not filing Form RC71?

A: Yes, there are penalties for not filing Form RC71, including potential fines and interest charges.

Q: Do I need to include supporting documents with Form RC71?

A: Yes, you may need to include supporting documents, such as contracts or invoices, depending on the specifics of your discounting transaction.

Q: What should I do if I made a mistake on Form RC71?

A: If you made a mistake on Form RC71, you should contact the Canada Revenue Agency as soon as possible to correct the error.