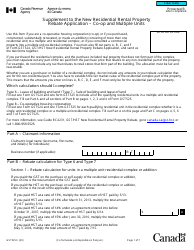

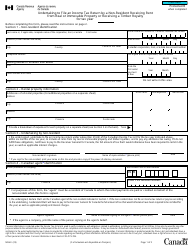

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T776

for the current year.

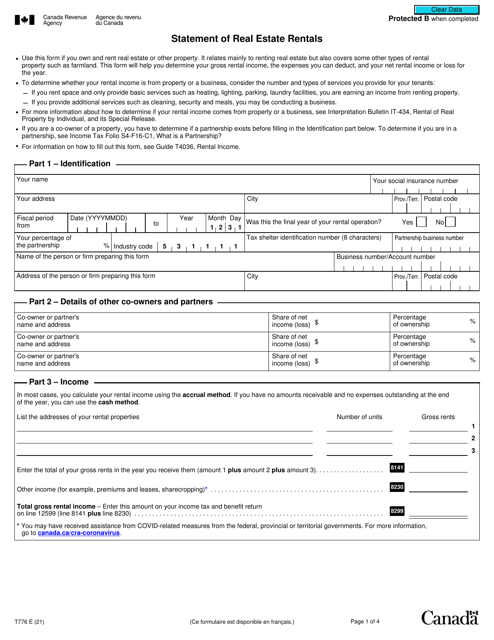

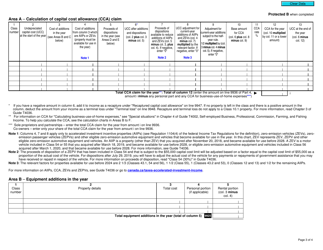

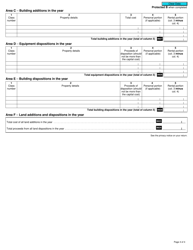

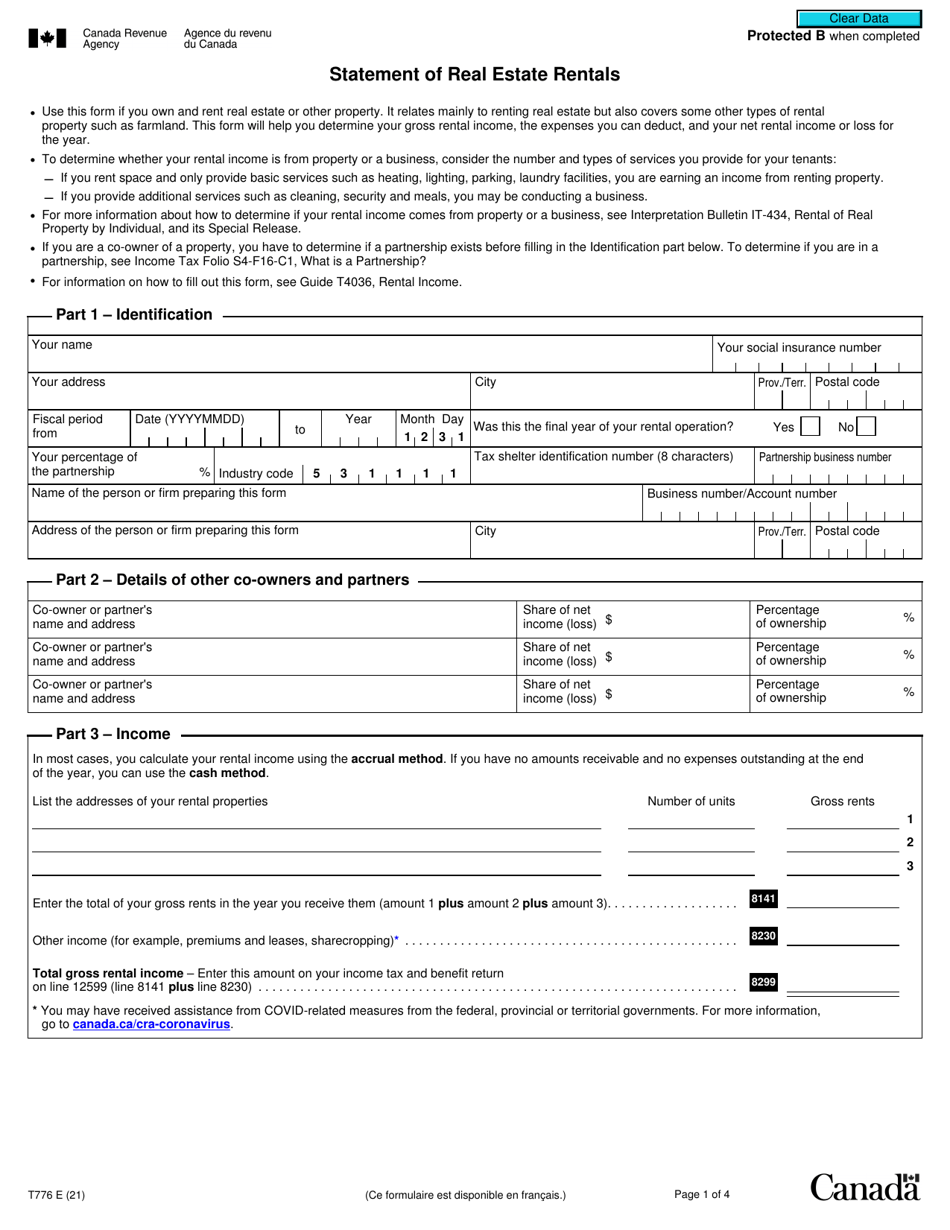

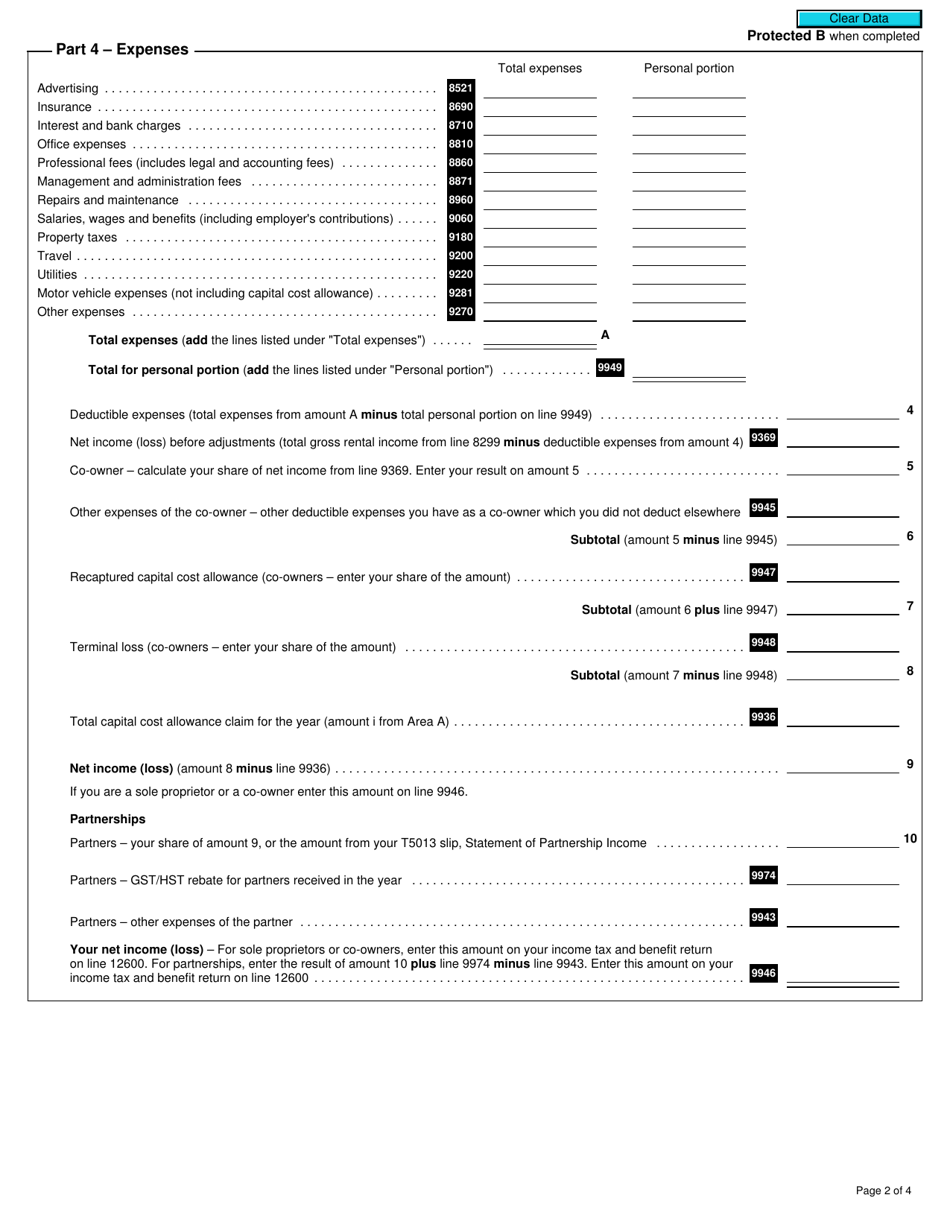

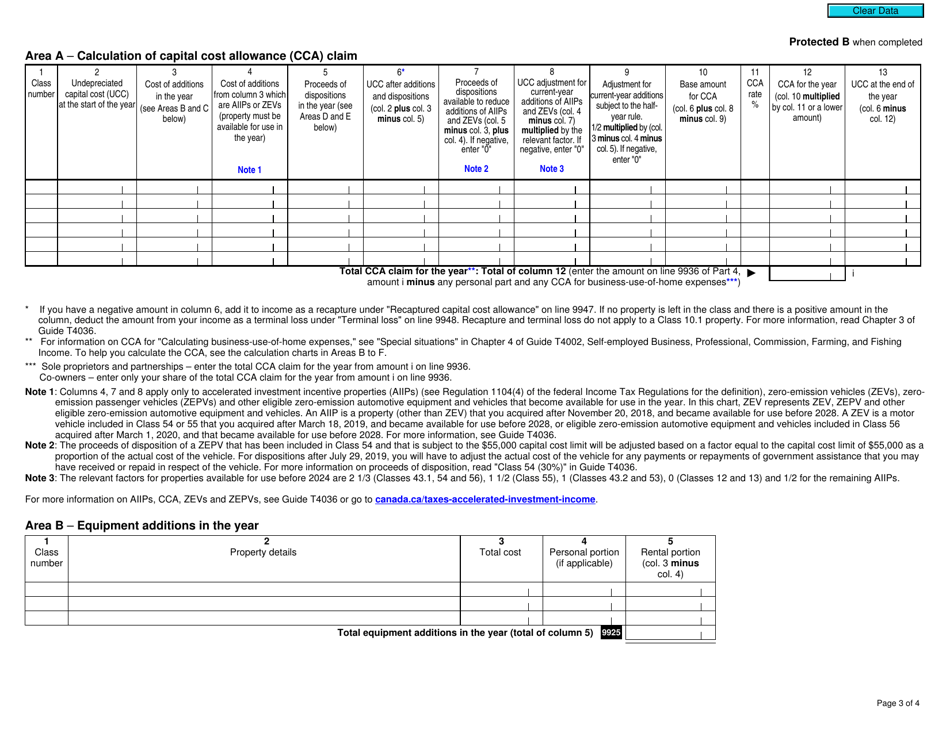

Form T776 Statement of Real Estate Rentals - Canada

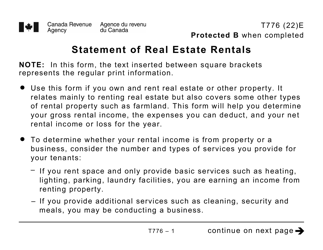

Form T776 Statement of Real Estate Rentals is used by individuals who earn rental income from properties in Canada. It is used to report the income, expenses, and net income or loss from rental activities. The form is submitted as part of the individual's Canadian income tax return to determine the tax liability based on the rental income earned.

The form T776 Statement of Real Estate Rentals in Canada is filed by individuals who earn rental income from real estate properties.

FAQ

Q: What is Form T776 Statement of Real Estate Rentals?

A: Form T776 Statement of Real Estate Rentals is a form used by residents of Canada to report income and expenses related to rental properties.

Q: Who needs to file Form T776 Statement of Real Estate Rentals?

A: Any Canadian resident who earns rental income from one or more properties needs to file Form T776.

Q: When is the deadline for filing Form T776 Statement of Real Estate Rentals?

A: The deadline for filing Form T776 is the same as the deadline for filing your annual income tax return, which is usually April 30th.

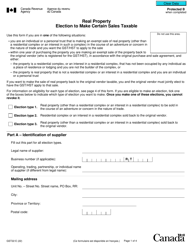

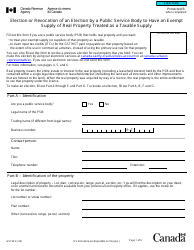

Q: What information is required to fill out Form T776 Statement of Real Estate Rentals?

A: You will need to provide details about your rental properties, including the property addresses, rental income received, and expenses incurred.

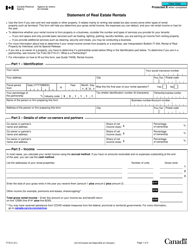

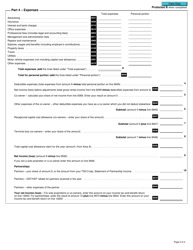

Q: What expenses can be claimed on Form T776 Statement of Real Estate Rentals?

A: You can claim a variety of expenses related to your rental properties, such as mortgage interest, property taxes, insurance, and maintenance costs.

Q: Can I claim a deduction for the cost of purchasing a rental property on Form T776?

A: No, the cost of purchasing a rental property is not deductible on Form T776. However, you may be able to claim depreciation expenses over time.

Q: Are there any penalties for not filing Form T776 Statement of Real Estate Rentals?

A: Yes, failure to file Form T776 or reporting incorrect information can result in penalties imposed by the Canada Revenue Agency.

Q: Can I file Form T776 electronically?

A: Yes, you can file Form T776 electronically using the CRA's NetFile service or through certified tax software.

Q: Is there a separate form for rental properties in the US?

A: Yes, in the US, individuals report rental income and expenses on Schedule E of their federal tax return. There is no specific form dedicated to rental properties like Form T776 in Canada.

Q: Do I need to keep records to support the information reported on Form T776?

A: Yes, it is important to keep records and receipts to support the rental income and expenses reported on Form T776 in case of an audit by the Canada Revenue Agency.