Form RC71 Statement of Discounting Transaction - Canada

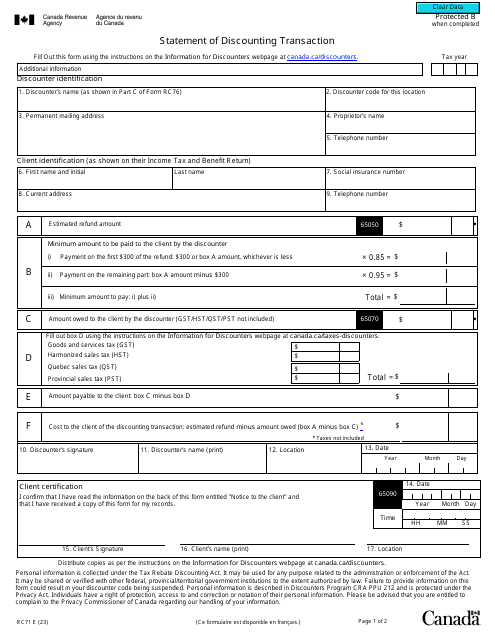

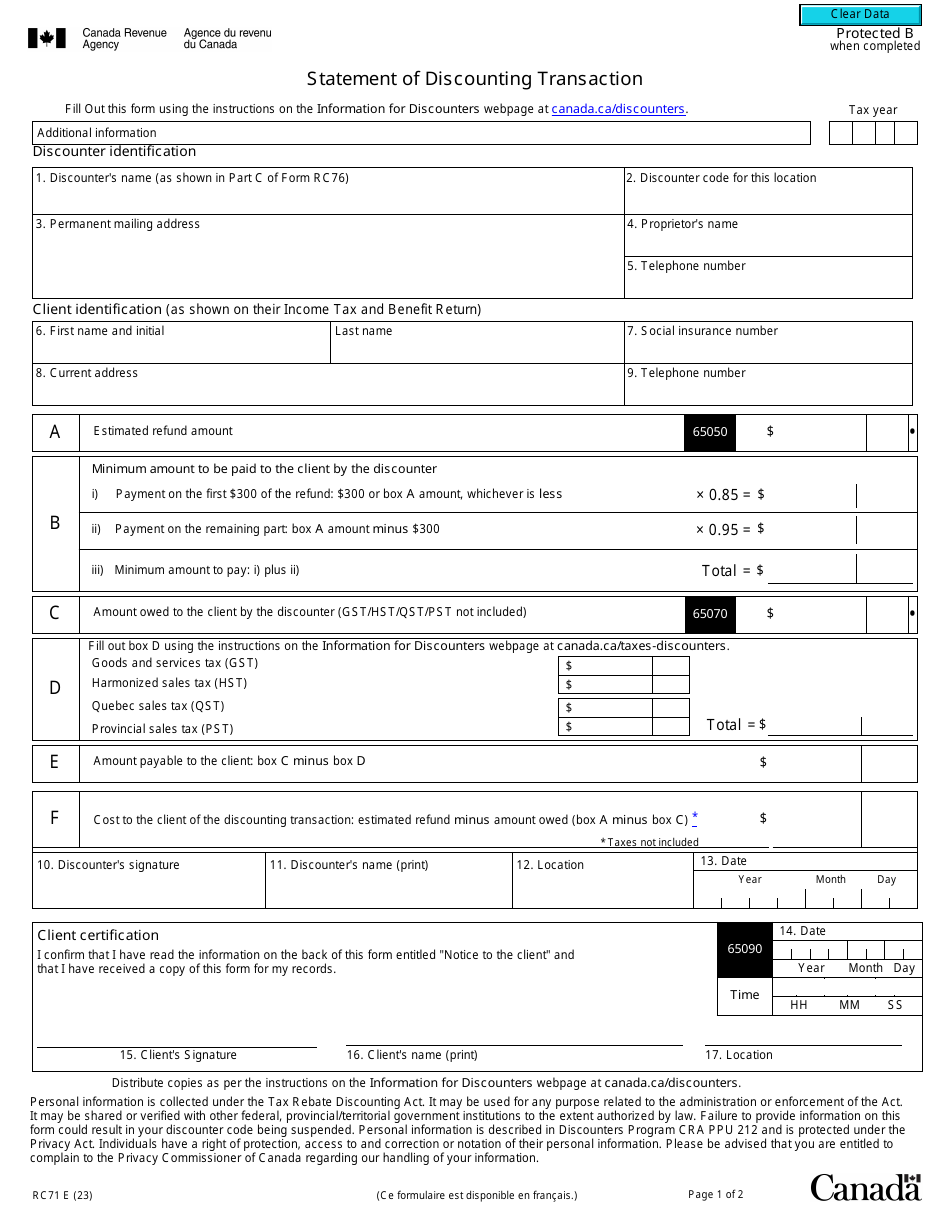

Form RC71 Statement of Discounting Transaction is used in Canada to report transactions where a taxpayer discounts a right or chose in action.

The Form RC71 Statement of Discounting Transaction in Canada is filed by financial institutions and other commercial lenders who engage in discounting transactions.

Form RC71 Statement of Discounting Transaction - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC71?

A: Form RC71 is the Statement of Discounting Transaction in Canada.

Q: Who needs to file Form RC71?

A: This form needs to be filed by a taxpayer who has entered into a discounting transaction with a financial institution in Canada.

Q: What is a discounting transaction?

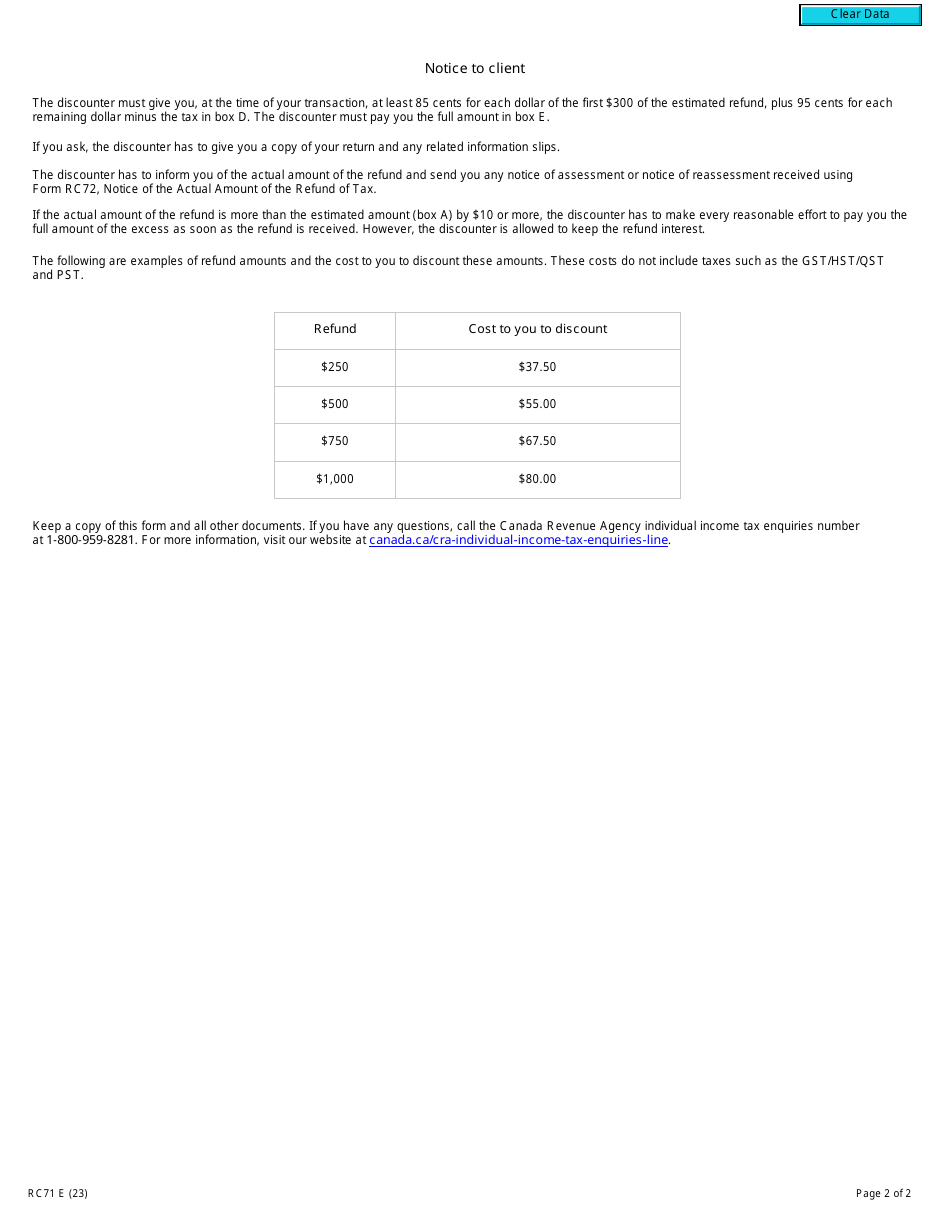

A: A discounting transaction is an arrangement where a taxpayer transfers their future income tax refund or other receivables to a financial institution in exchange for an immediate cash payment.

Q: What information is required in Form RC71?

A: The form requires information about the taxpayer, financial institution, details of the discounting transaction, and the amount of income tax refund or other receivables transferred.

Q: When is the deadline to submit Form RC71?

A: The deadline for filing Form RC71 is 90 days after the end of the tax year in which the discounting transaction occurred.

Q: Are there any penalties for not filing Form RC71?

A: Yes, failure to file Form RC71 or providing incorrect information may result in penalties and interest charges.

Q: Is Form RC71 only for individuals?

A: No, both individuals and corporations may need to file Form RC71 if they have entered into a discounting transaction.

Q: Do I need to include supporting documents with Form RC71?

A: In most cases, supporting documents such as agreements or contracts related to the discounting transaction need to be attached with Form RC71.