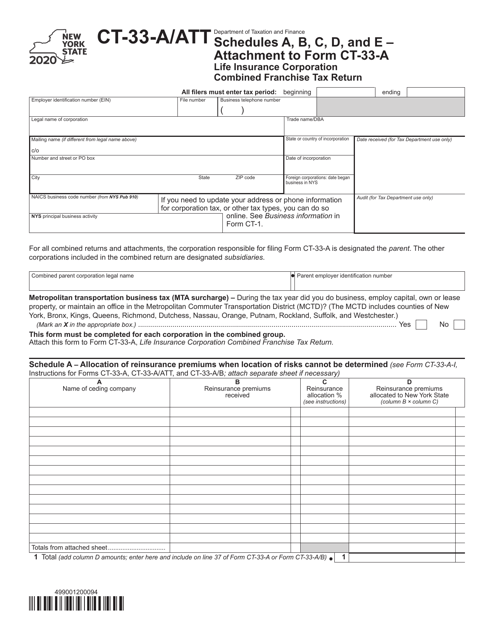

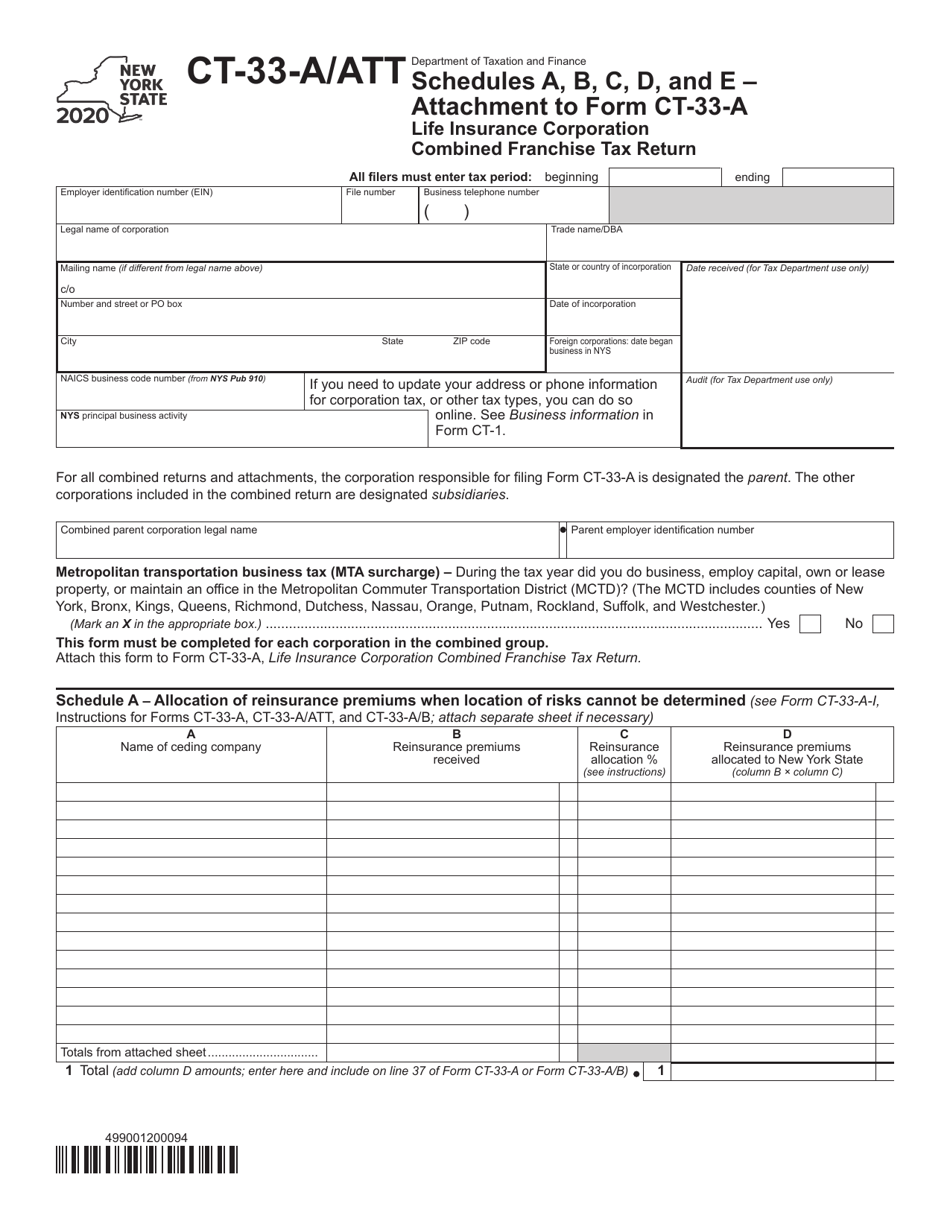

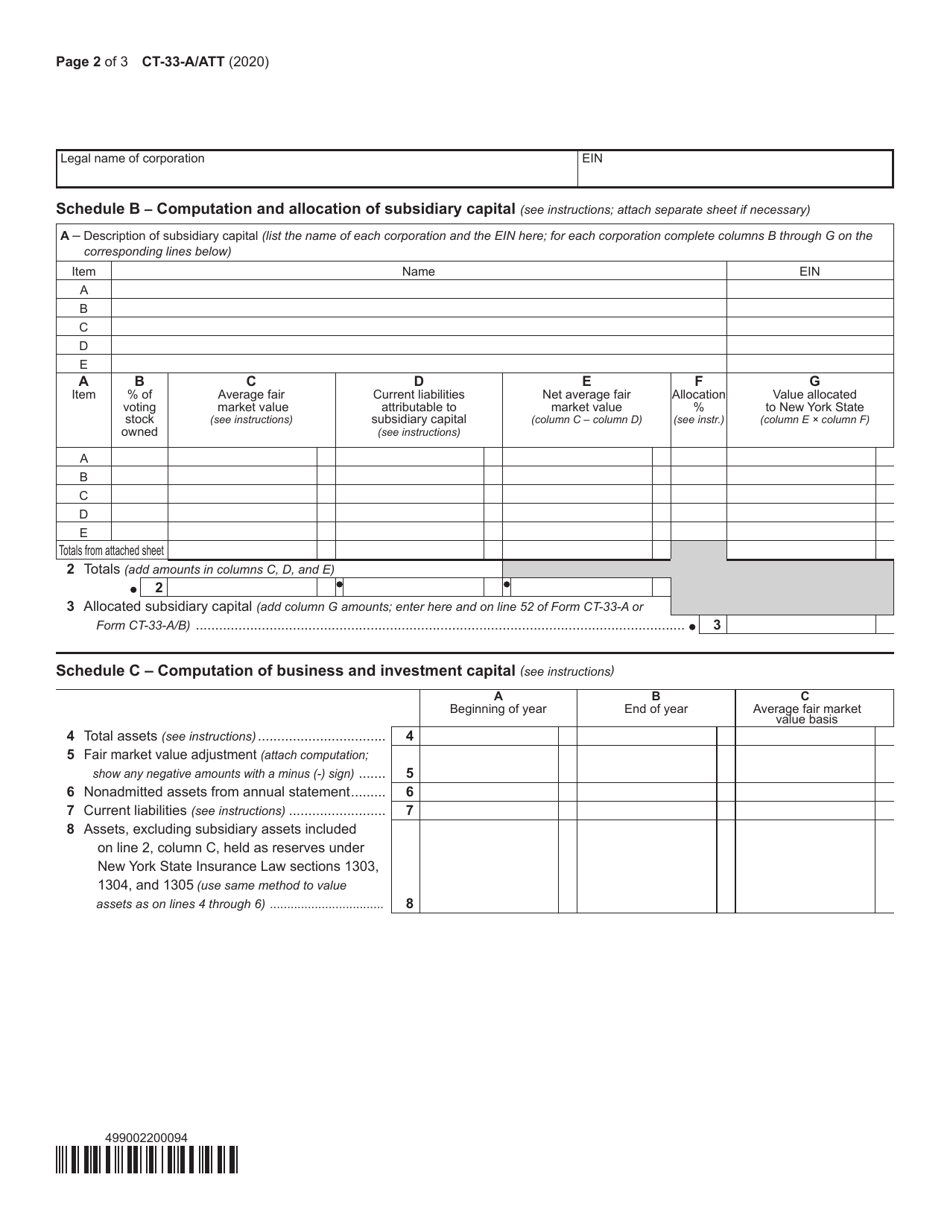

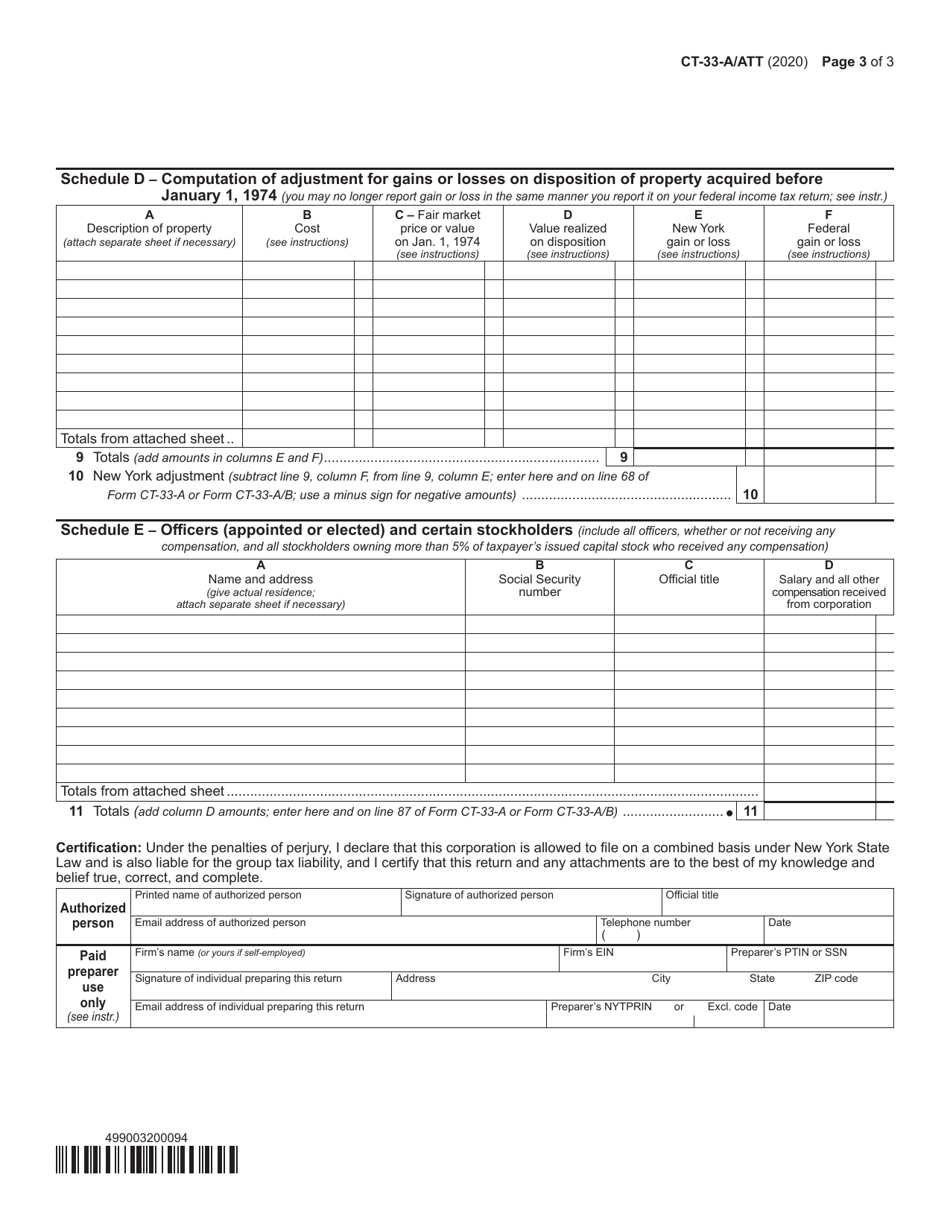

Form CT-3-A / ATT Schedule A, B, C, D, E Life Insurance Corporation Combined Franchise Tax Return - New York

What Is Form CT-3-A/ATT Schedule A, B, C, D, E?

This is a legal form that was released by the New York State Department of Financial Services - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-3-A/ATT Schedule A, B, C, D, E?

A: Form CT-3-A/ATT Schedule A, B, C, D, E is the Life Insurance Corporation Combined Franchise Tax Return for the state of New York.

Q: Who is required to file Form CT-3-A/ATT Schedule A, B, C, D, E?

A: Life insurance corporations in the state of New York are required to file Form CT-3-A/ATT Schedule A, B, C, D, E.

Q: What information does Form CT-3-A/ATT Schedule A, B, C, D, E require?

A: Form CT-3-A/ATT Schedule A, B, C, D, E requires information about the life insurance corporation's income, deductions, and credits.

Q: When is Form CT-3-A/ATT Schedule A, B, C, D, E due?

A: Form CT-3-A/ATT Schedule A, B, C, D, E is due on the same date as the corporation's franchise tax return, which is generally on or before March 15th.

Form Details:

- The latest edition provided by the New York State Department of Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3-A/ATT Schedule A, B, C, D, E by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.